- What is a Tax Reference Number?

- What are the Types of Tax Reference Number in the UK?

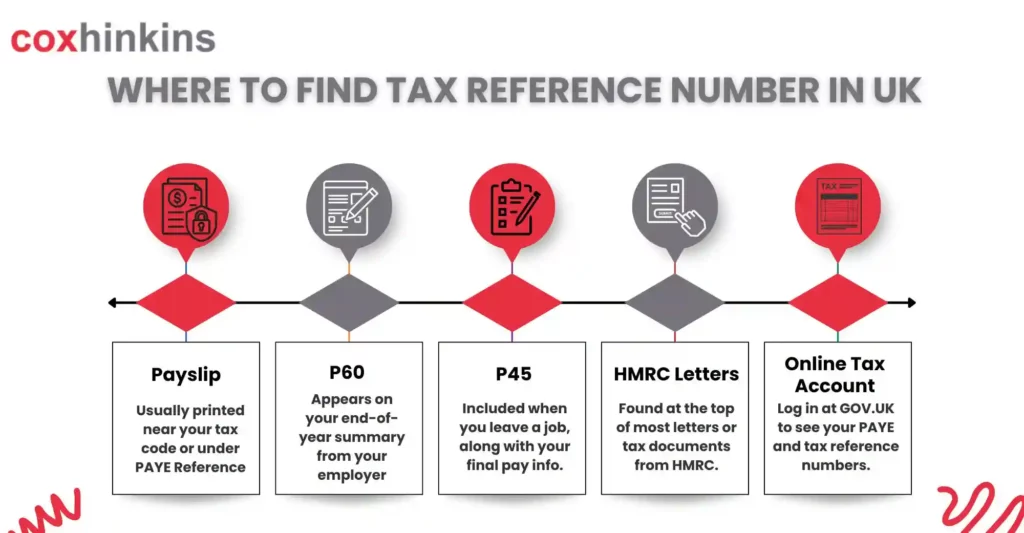

- Where to find your Tax Reference Number?

- Purpose and Uses of Tax Reference Number

- How to get a Tax Reference Number?

- Is Tax Reference Number Similar to Unique Taxpayer Reference (UTR)?

- Using the Correct HMRC Reference Number

- Frequently Asked Questions

- Conclusion

A tax reference number is a special identification number assigned by a country’s fiscal authorities to an individual, company, or other organisation for tax purposes. It’s essential to keep your tax records accurate and track all your income, deductions, and payments.

This number is often required to access government services, file a tax return, or receive employment income. Reporting corporate tax, VAT, payroll tax, and other financial obligations is essential for businesses. Knowing where to find this number and when you need it can save you time and trouble when filing a return or making an inquiry to HMRC. We will discuss everything, so you don’t have to search anymore!

What is a Tax Reference Number?

A Tax Reference Number is a unique identifier assigned by fiscal authorities to individuals or companies for tax purposes. All of your tax-related data, including income, payments, and tax filings, is tracked using it.

This number guarantees that all records are correctly linked and that the right individual or company is being taxed. It’s crucial when monitoring your tax account, filing taxes, and corresponding with the taxation authorities.

What are the Types of Tax Reference Number in the UK?

In the United Kingdom, HM Revenue & Customs (HMRC) issues a variety of Tax Reference Numbers, each with a distinct function. The most common ones are divided as follows:

PAYE Reference Number: Employers use it to handle National Insurance contributions and Pay As You Earn (PAYE) tax payments.

- Found on P60s, P45s, and pay slips.

- The usual format is 123/AB456.

Unique Taxpayer Reference Number (UTR): HMRC issues a UTR number for people and companies who must file a self-assessment tax return. Your UTR will appear in several HMRC documents, including the SA250 or welcome to Self Assessment letter, account statement, HMRC app, tax return notification, prior Self Assessment tax returns, and payment reminders, if you have already enrolled.

Value Added Tax Number (VAT): An identification number used for all VAT purposes in the nation is called a VAT number. It enables tax officials to keep an eye on the movement of goods and the taxes imposed on trade companies.

National Insurance Number (NINO): To guarantee that taxpayers’ taxes and National Insurance contributions are exclusively recorded in their names, the National Insurance Number is an additional unique identification number. Throughout a taxpayer’s lifetime, this six-digit, two-letter number stays constant. For example, RA123856S.

Where to find your Tax Reference Number?

There are various ways to find your Tax Reference Number, commonly known as an Employer PAYE Reference:

- Payslip: “Tax Ref” or “PAYE Reference” is frequently written around the top or bottom.

- P60 or P45: official documents from your employer that show your total pay and tax for the year.

- Letters from HMRC – any tax letter or notice will include it.

- Personal Tax Account (online) – log in to your HMRC account to view your details safely.

Purpose and Uses of Tax Reference Number

A Tax Reference Number (TRN) is a special number that is given to people, companies, or employers by tax authorities for tax-related reasons. Accurate reporting, compliance, and effective communication with tax authorities are all guaranteed.

Purpose of a Tax Reference Number

- Identification: It gives each taxpayer a distinct identity within the fiscal system.

- Tax Compliance: Used to ensure correct tax contributions, file tax filings, and make payments.

- Employer Payroll Processing: Assists companies in accurately reporting employee taxes.

- Government Communication: Useful while speaking with fiscal authorities in an official capacity.

- Verification and record-keeping: Make sure that financial transactions and tax history are properly tracked.

Common Uses of a Tax Reference Number:

- Filing Tax Returns: It is used by both individuals and corporations to file returns.

- PAYE (Pay As You Earn): Employers use TRNs to report employee earnings and deductions for payroll.

- VAT Registration & Payments: When it comes to Value-Added Tax, businesses utilise TRNs.

- Tax Benefit Claims: Required for government tax incentives, deductions, and refunds.

- Business transactions: It is necessary for financial transactions, particularly for CIS and corporation tax.

How to get a Tax Reference Number?

A Tax Reference Number (TRN) is a special identification number that tax authorities provide to employers, businesses, and individuals for tax-related reasons. Whether you’re an individual, a self-employed person, or a business determines the procedure for obtaining one.

For Individuals (Employees & Self-Employed):

- Register with the Tax Authority: Go to the official website of the tax authority (such as the IRS in the US or HMRC in the UK) and finish the registration process.

- Provide Personal Details: You might be required to provide your Social Security Number (SSN), National Insurance number (NI number), or other form of identification.

- Get Your TRN: After processing, you will receive the number through email, mail, or your online tax account.

For Businesses (Employers & Companies):

- Register Your Business: Visit the website of your nation’s tax authorities to register for tax services such as VAT, PAYE (Pay As You Earn), or Corporation Tax.

- Give Business Information: Include information like the company name, address, and legal structure.

- How to obtain the Reference Number? Following registration, the tax authority will provide your company with a special reference number, which is typically used in official tax records.

Is Tax Reference Number Similar to Unique Taxpayer Reference (UTR)?

A Unique Taxpayer Reference number (UTR) is not the same as a Tax Reference Number. Not everybody has a UTR number. Only if you register with HMRC for Self-Assessment of your taxes will you receive a UTR. People who work for themselves, own property, or earn money overseas typically file a UTR to pay their taxes. Each individual who registers for a UTR receives a 10-digit number that they can use for the duration of their lifetime.

The majority of people in the UK are employed and pay all of their taxes using PAYE (Pay As You Earn), which is the payroll system used by their employer. Payslips and other tax documents you get from your company will display your tax reference number if you are an employee.

Using the Correct HMRC Reference Number

What is an HMRC Reference Number?

Employers, organisations, and individuals can all keep track of their tax obligations with the help of an HMRC reference number. Certain reference numbers are needed for different kinds of taxes.

Common HMRC Reference Numbers & Their Uses

Unique Taxpayer Reference (UTR): Companies and self-employed individuals use the Unique Taxpayer Reference (UTR) on their self-assessment tax forms.

Employer PAYE Reference: Required for Pay As You Earn (PAYE) submissions and payroll tax reporting.

Value Added Tax (VAT): Reporting and payments are made using the VAT registration number.

The Corporation Tax Reference (CT UTR): Assigned to companies for Corporation Tax filings.

National Insurance (NI) Number: Used for transactions about employment, benefits, and individual taxes.

Why Using the Correct HMRC Reference Matters?

- Prevents delays or fines resulting from inaccurate references.

- Guarantees that tax payments are credited to the appropriate account.

- Helps HMRC in effectively processing tax returns and refunds.

- It keeps unnecessary audits and compliance problems away.

Frequently Asked Questions

Can I Use the Same TRN for Different Taxes?

No, reference numbers differ for various taxes. VAT, PAYE, and Corporation Tax, for instance, all need their tax reference numbers. Use the right number every time you file or pay.

How Do I Proceed If My Tax Reference Number Is Lost?

You can:

Check previous returns or emails from the tax authority.

Access your online tax portal.

Get help from your nation’s fiscal authority.

Is It Possible to Modify My Tax Reference Number?

No, the fiscal authority assigns tax reference numbers, which are permanent. However, companies that re-register or alter their legal structure could be given a new reference.

What Happens if I Use the Wrong TRN?

Tax payments may be misallocated if the wrong tax reference number is used.

Refunds or returns are processed slowly.

Possible fines or problems with compliance.

Conclusion

Maintaining compliance with tax laws and facilitating easy communication with tax authorities requires that you be aware of your Tax Reference Number. Whether you are an individual, freelancer, or business owner, having this number safe and close at hand can make anything from filing taxes to answering tax-related questions easier. To be sure you’re using the right reference, always double-check official paperwork. If you’re not sure, don’t be afraid to get in touch with your local tax office. The first step to keeping on top of your tax obligations is to be educated about them.

If you require any assistance regarding corporation tax services or VAT services, you can freely reach out to Coxhinkins. Our expert accountants will provide the best solutions to your queries.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.