- Key Takeaways

- What is Self-Assessment Return?

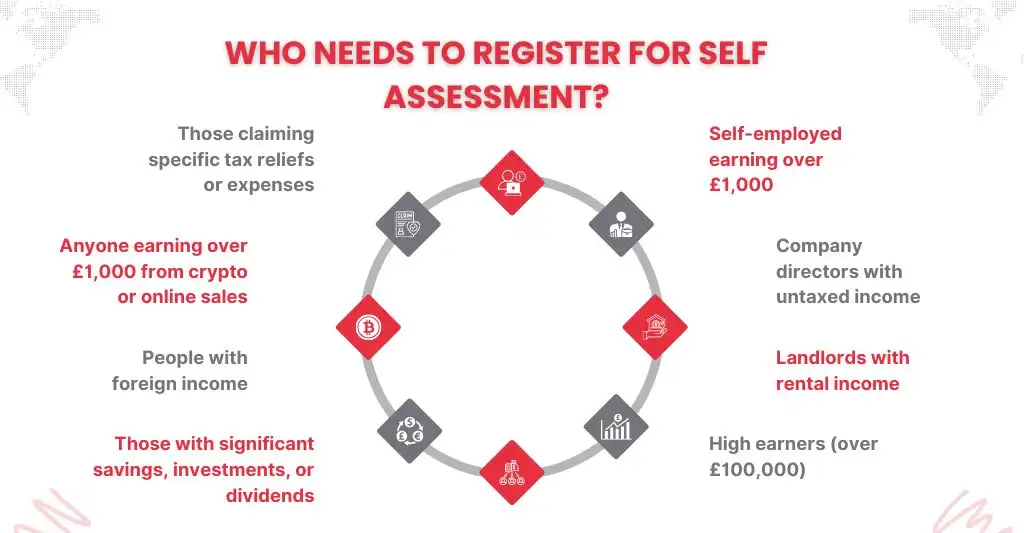

- Who Needs to Register for Self-Assessment?

- When Do You Need to Register for Self Assessment Return?

- Step-by-Step Guide to Registering for Self-Assessment

- Registering as a Sole Trader or Freelancer

- Registering as a Company Director or Shareholder

- Registering for Self Assessment Via post?

- What to Do After Registering for Self-Assessment Return?

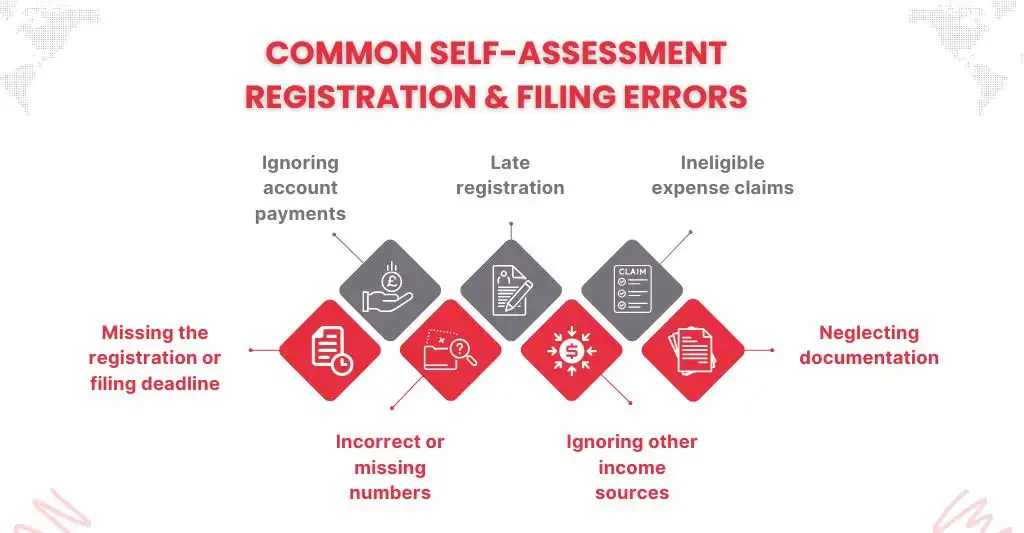

- Common Mistakes to Avoid for Self-Assessment Return

- Frequently Asked Questions

- Conclusion

A Self-Assessment tax return must be filed with HMRC if you are self-employed, receive untaxed income, or manage other sources of income outside of PAYE. To make the procedure as easy and stress-free as possible, this comprehensive guide will walk you through every stage of the process, from deadlines to digital registration, whether you’re new to it or need a refresher in 2026.

Key Takeaways

- Register for Self-Assessment by October 5, 2025 to avoid penalties.

- Set up your secure online account at HMRC.gov.uk. For a detailed step-by-step guide, see How to Create Your Government Gateway Account.

- Keep your Unique Taxpayer Reference (UTR) safe for future use.

- File your tax return and pay any tax owed by January 31, 2026.

- Maintain accurate records and avoid common mistakes.

What is Self-Assessment Return?

Self-employed individuals in the UK are required to submit a self-assessment tax return to HM Revenue and Customs (HMRC) each year to disclose their taxable income. Accurately calculating and paying your income tax and National Insurance contributions for the tax year is ensured by this procedure.

Who Needs to Register for Self-Assessment?

If this is your first time filing a tax return, you must register for Self Assessment because you:

- Self-employed individuals (sole traders) earning more than £1,000 per tax year

- Partners in a business partnership

- Company directors (unless income is taxed through PAYE and you have no other untaxed income)

- Individuals with rental income

- Those earning income from savings, investments, or dividends above the annual allowance

- People with foreign income

- High earners (usually earning over £100,000)

- Anyone needing to claim certain tax reliefs or expenses

- Those receiving income from crypto assets, freelance work, or online sales exceeding the £1,000 trading allowance.

When Do You Need to Register for Self Assessment Return?

- After the tax year that you earned taxable income ended on April 5th, you have until October 5th to register for Self Assessment.

- This allows you to finish and submit a self-assessment tax return before the online filing deadline of midnight on January 31.

- Self-assessment registration should be done as soon as possible because it will allow you more time to finish your first Self-Assessment tax return, which could take longer the first time due to your inexperience and lack of expertise.

Step-by-Step Guide to Registering for Self-Assessment

In 2025, registering for Self-Assessment with HMRC is simple if you do the following:

Check If You Need to Register

Ensure you meet the Self-Assessment requirements before you begin. If you’re not sure, use the eligibility checking provided by HMRC.

Create a Government Gateway Account

If you don’t already have one, you’ll need to set up a Government Gateway account:

- Visit HMRC’s login page

- Choose “Create sign-in details.”

- Follow the prompts to create your account

Register for Self-Assessment

- If you work for yourself or are a sole proprietor, use form CWF1 on the HMRC website or through your online account.

- Not working for themselves (landlord, investor, etc.): To register, fill out form SA1.

- Forms SA400 and SA401 should be used for the partnership and each member when joining one.

Wait for Your Unique Taxpayer Reference (UTR)

You will receive a 10-digit UTR number via postal mail from HMRC within 10 working days of registering (21 days if you are overseas). You must do this to send a tax return.

Note: You can also check our other guide on Understanding the Unique Taxpayer Reference (UTR) Number to learn more about what a UTR is, why it’s important, and how to manage it effectively.

Activate Your Online Services

You will also receive an activation code for HMRC’s online services along with your UTR.

- Open your Government Gateway account and log in.

- To activate your Self-Assessment service, enter the code.

File Your Tax Return by the Deadline

After registration, you’re responsible for completing your return and paying any tax owed by the deadlines:

- Register by: 5 October 2025

- Submit paper return by: 31 October 2025

- Submit online return and pay tax by 31 January 2026

Registering as a Sole Trader or Freelancer

You must register with HMRC as a freelancer or sole trader if you work for yourself to file a Self-Assessment tax return. Accordingly, it is your responsibility to declare your earnings and outlays and to pay any taxes or national insurance that may be owed.

When to Register?

In the second tax year of your company, you have to register by October 5th. For instance, if you began working for yourself in June 2024, you must register by October 5, 2025.

How to Register?

At gov.uk register-for-self-assessment, you can register online. You will have to provide:

- Your name, birth date, and address

- The number for National Insurance

- The day you began working for yourself

- The type of business you operate.

Following registration, HMRC will create your online account for filing and provide you with a Unique Taxpayer Reference (UTR).

What happens next?

Every year, you will be reminded to file your self-assessment tax return. Be sure to:

- Maintain thorough records of your earnings and expenses.

- Set up money for annual taxes.

- By January 31 of the year after the tax year ends, file your return and make any necessary tax payments.

Registering as a Company Director or Shareholder

You might have to register for Self Assessment to submit your earnings to HMRC if you make money as a shareholder or are a director of the firm.

Do you need to register?

You must register for Self Assessment if:

- As a director of a limited business, your income is not subject to PAYE at the source.

- You receive revenue from shares, such as dividends, that haven’t yet had taxes deducted.

- You get additional untaxed income from investments or rentals.

How to Register?

If your self-assessment tax return is pending, you need to register online via HMRC.

- To register for a self-assessment, visit gov.uk.

- Choose the one that best describes you (for example, “Not self-employed” if you are merely a director or shareholder).

- Give your National Insurance number, personal information, and business details.

After that, HMRC will create your online account and provide your Unique Taxpayer Reference (UTR).

Key Deadlines

- Register no later than October 5th after the tax year in which you received untaxed income.

- Please submit your self-assessment return by January 31st.

- To avoid fines and interest, pay any taxes due on the same day.

Registering for Self Assessment Via post?

Most people register for self-assessment online, but in case you are unable to register online, you can register by post.

When to use the postal option:

You can register via post if:

- You cannot verify your identity online

- You prefer not to use a Government Gateway account

- You’re registering a partner in a partnership, or

- There’s a technical issue preventing online registration

Which type of form is to be used?

The form you use depends on your situation.

- Self-employed (sole trader): Use Form CWF1

- Not self-employed (e.g., company director, landlord): Use Form SA1

- Partnerships: Use Form SA400 to register the partnership, and Form SA401 for each partner.

What to Do After Registering for Self-Assessment Return?

HMRC will create your online account and provide you with a Unique Taxpayer Reference (UTR) when you have registered for Self Assessment. Then you should definitely:

- Create an account with HMRC’s online services to manage your tax return.

- Maintain a record of all your earnings and expenditures.

- Keep in mind important due dates, particularly 31January for filing and payment.

- Set aside money for your taxes, which should include Class 2/4 National Insurance if you work for yourself.

- Even if you have no outstanding taxes, you should still file your return.

Common Mistakes to Avoid for Self-Assessment Return

It can be simple to file a Self-assessment return, but even minor errors can result in fines or overpayments. Here are some typical danger signs to be aware of:

- Missing the due date: To prevent penalties, file your return and pay any taxes due by 31 January.

- Missing or inaccurate numbers: Verify all earnings, outlays, and tax credits again.

- Ignoring other sources of income: List all sources, such as dividends, rental income, and freelancing.

- Neglecting documentation: Maintain invoices, statements, and receipts for a minimum of five years following the filing deadline.

- Ineligible expenditure claims: You may only submit claims for expenses that are solely and completely related to your business.

- Register on time: You must register by October 5th of your second tax year.

Ignoring account payments: If your tax bill exceeds £1000, you could have to pay in advance.

Frequently Asked Questions

What happens if I fail to file or register in time?

Even if there is no tax owed, there is a £100 fixed penalty for missing the 31 January deadline.

At 3, 6, and 12 months past due, there are further penalties. After three months, daily fines of £10 can also start to apply.

Any tax that is not paid is subject to interest.

What if I don’t register before the deadline of October 5th?

If your tax is paid in full by 31st January, HMRC could eliminate the late notification penalty.

Does Self-Assessment allow online registration?

Yes. Most people can register online with the gov.uk using their personal or business tax accounts. If you are unable to register online (for example, because of complicated income or technological difficulties), you can use the SA1 or CWF1 forms to register by mail.

Conclusion

Anyone who makes money outside of standard PAYE employment, whether they are self-employed, a landlord, or make money from side jobs, must register for Self Assessment in 2025. You may fulfill your legal requirements and stay clear of late fees by following the detailed instructions in this tutorial, which cover everything from creating your Government Gateway account to submitting your registration via HMRC’s online services.

Do not hesitate to register, as the deadline is October 5, 2025. By 31 January 2026, you will be able to file your Self-Assessment tax return after obtaining your Unique Taxpayer Reference (UTR) upon registration. Organising yourself and enrolling early will help you avoid penalties, stress, and wasted time.

Need help with your Self-Assessment registration or tax return? Visit Cox Hinkins or contact our expert team today for personalised support and guidance. We’re here to make the process simple and stress-free—get in touch now to ensure your tax affairs are in order well before the deadline!

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.