- Key tax free investment rules and limits in 2026?

- Individual Savings Accounts (ISAs)

- Lifetime ISA (LISA)

- Innovative Finance ISA (IFISA)

- Premium Bonds (NS&I)

- Enterprise Investment Scheme (EIS)

- Seed Enterprise Investment Scheme (SEIS)

- Venture Capital Trusts (VCTs)

- Government Bonds (Gilts)

- Pension Contributions

- Junior ISAs and Junior SIPPs

- Risks and Potential Pitfalls to Consider

- Tips to Maximise Tax-Free Investing in 2026

- FAQs: Frequently Asked Questions

- Conclusion

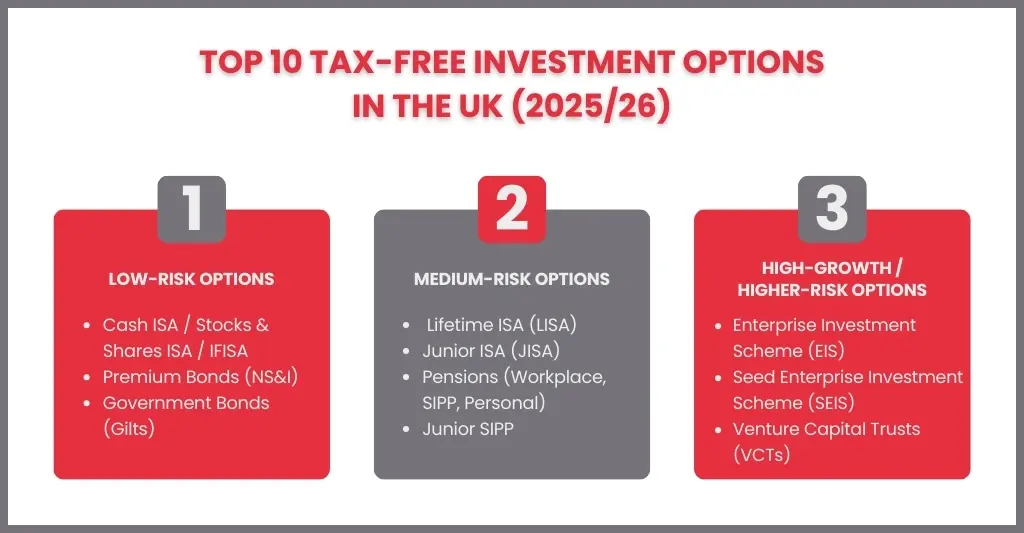

Many investors are looking for the finest tax free investment options to optimise their portfolios, and tax-efficient investing has been a key consideration for those looking to minimise risk and maximise returns. Making sure the best measures are being taken to do this is crucial now more than ever in the fight against tax increases and interest rate reductions.

UK investors can pick from a variety of tax wrappers to accomplish this, each with a unique focus and set of advantages that allow them to customise their strategy to their own investing goals and situation.

Key tax free investment rules and limits in 2026?

ISAs (Individual Savings Accounts):

- ISAs for cash, stocks and shares, and innovative finance.

- Tax-free: neither income tax nor capital gains tax is applied to returns or growth.

Lifetime ISA (LISA):

- For first-home purchase (max £450k) or retirement (age 60+).

- Government adds 25% bonus (on up to £4,000/year).

Junior ISA:

- For children under 18.

- Same tax-free growth/returns as adult ISAs.

Pensions (SIPP, Workplace, Personal)

- Tax relief on contributions (at marginal rate).

- Up to 25% can be taken as a tax-free lump sum at retirement.

Seed Enterprise Investment Scheme (SEIS)

- For seed-stage (very early) businesses.

- 50% income tax relief + reinvestment relief on gains.

Capital Gains Tax Allowance

- Gains up to the annual exempt amount are tax-free.

Personal Savings & Dividend Allowances

- Certain levels of savings interest & dividends are tax-free each year.

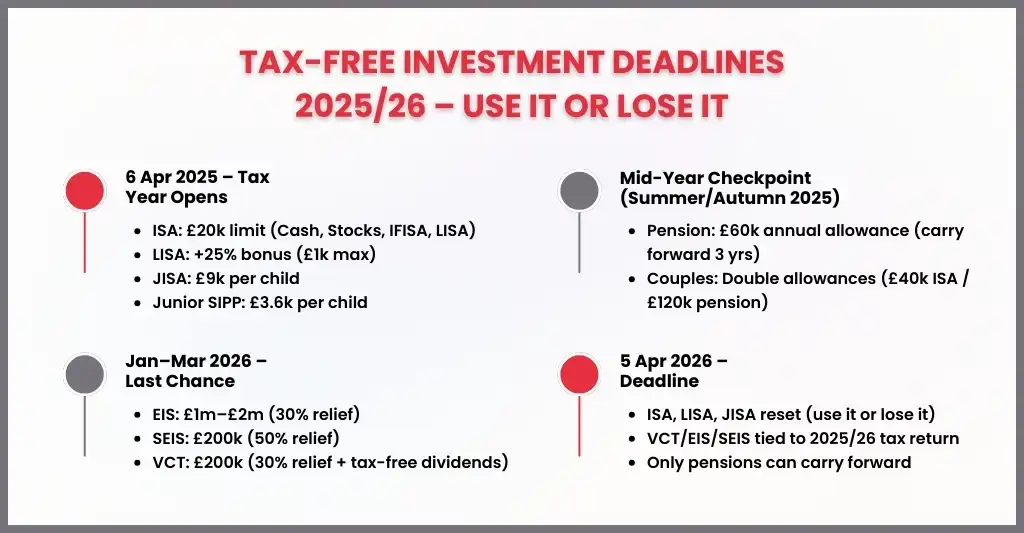

Key Rules & Limits (Tax Year 2025/26)

- ISA allowance → £20,000 per person.

- Lifetime ISA allowance → £4,000 (part of overall £20k).

- Junior ISA allowance → £9,000 per child.

- Pension annual allowance → £60,000 (or 100% of earnings if lower).

- Pension tax-free lump sum → Up to 25% of pot (capped at £268,275).

- EIS limit → £1m/year (or £2m if Knowledge-Intensive Companies).

- EIS relief → 30%.

- SEIS limit → £200k/year.

- SEIS relief → 50%.

- VCT limit → £200k/year.

- VCT relief → 30% (must hold 5+ years).

- ISA & Junior ISA allowances frozen → Until 2030.

Individual Savings Accounts (ISAs)

In the United Kingdom, one of the most well-liked and simple tax-free investment options is an Individual Savings Account (ISA). They serve as a “wrapper” to protect your investments or savings from capital gains tax, income tax, and additional withdrawal taxes.

Key Features of ISAs

Tax-free growth: Any capital gains, dividends, or interest received within an ISA are entirely exempt from taxes.

Annual allowance (2025/26): You can invest or save up to £20,000 per tax year.

Flexible use: You can divide this amount across other ISA kinds, provided that you don’t go over the annual limit.

Access: Unlike pensions, funds in ISAs can usually be withdrawn at any time without penalties (except Lifetime ISAs).

Lifetime ISA (LISA)

LISA is a government-backed savings and investment account that is created to assist individuals in preparing for retirement or purchasing their first house. It combines an additional government bonus with the tax-free benefits of a traditional ISA.

Key Features

- Eligibility: Available to individuals aged 18–39 at the time of opening.

- Contribution limit: Up to £4,000 per year (this forms part of your overall £20,000 ISA allowance).

- Government bonus: The government adds 25% to your contributions, up to a maximum of £1,000 per year.

- Tax-free growth: Interest, dividends, and capital gains earned within the LISA are tax-free.

Innovative Finance ISA (IFISA)

You can invest in debt-based securities like crowdfunding initiatives or lend money through peer-to-peer (P2P) lending platforms without paying taxes. It combines the well-known tax benefits of an ISA with access to alternative assets outside of stock markets and conventional institutions.

Key Features

- Annual allowance (2025/26): Up to £20,000, shared across all ISA types.

- Eligible investments:

- Peer-to-peer (P2P) loans.Debt-based crowdfunding projects.

- Certain innovative debt securities approved by the FCA.

- Tax-free returns: Interest and capital gains earned within the IFISA are completely free from tax.

Premium Bonds (NS&I)

National Savings & Investments (NS&I) offers premium bonds, a special type of government-backed savings instrument in which your money is placed into a monthly prize draw rather than collecting interest. They are a well-liked choice for savers who appreciate security and the possibility of winning because any profits are entirely tax-free.

Key Features

- Eligibility: Your age must be 16 or above, and you must be a UK resident. (Parents/guardians can buy for children under 16).

- Investment range: Minimum holding £25; maximum holding £50,000 per person.

- Prize fund: Monthly prize draw with winnings ranging from £25 to £1 million.

- Tax-free returns: All prizes are free from income tax, dividend tax, and capital gains tax.

Enterprise Investment Scheme (EIS)

The government-sponsored Enterprise Investment Scheme (EIS) was created to promote investment in smaller, riskier UK businesses. Investors who contribute this money are rewarded with substantial tax benefits that can drastically lower their tax obligations.

Key Features

- Annual Investment limit: The annual investment limit for 2025–2026 is £1 million each tax year, or £2 million provided at least £1 million is invested in knowledge-intensive companies.

- Rate of tax relief: 30% of eligible investments are exempt from income taxes.

- Exemption from Capital Gains Tax (CGT): If EIS shares are held for 3 years or longer, gains are tax-free.

- Loss relief: You can deduct losses from income taxes or CGT if the investment doesn’t work out.

- Relief from inheritance tax (IHT): If shares are kept for a minimum of 2 years, they may be eligible for 100% business relief.

Seed Enterprise Investment Scheme (SEIS)

One of the most generous tax relief schemes in the UK is the Seed Enterprise Investment Scheme (SEIS), which was created to promote investment in very early-stage businesses. Investing hard-earned money in a budding startup involves high risk, but this scheme provides greater tax benefits compared to EIS.

Key Features

- Annual investment limit (2025/26): Up to £200,000 per tax year.

- Income tax relief: 50% of the amount invested can be offset against your income tax bill.

- Capital Gains Tax (CGT) relief:

Gains on SEIS shares are tax-free if held for at least 3 years.50% CGT reinvestment relief – reinvest gains into SEIS shares to halve the CGT due. - Loss relief: If the company fails, you can offset losses against income tax or CGT.

Venture Capital Trusts (VCTs)

Venture Capital Trusts (VCTs) are publicly traded investment firms that combine investor funds to finance start-ups and small enterprises in the United Kingdom. Though they offer substantial tax incentives to promote assistance for early-stage businesses, they are comparable to investment trusts.

Key features

- Annual investment limit (2025/26): Up to £200,000 per tax year.

- Income tax relief: 30% upfront relief on investments, provided shares are held for at least 5 years.

- Dividends: Tax-free dividends paid out from VCT investments.

- Capital Gains Tax (CGT): No CGT on selling VCT shares.

- Market listing: VCTs are quoted on the London Stock Exchange, so shares are technically tradable (though liquidity is limited).

Government Bonds (Gilts)

The UK government issues gilts, or bonds, to raise funds. They are considered one of the safest investments available in the UK, because they are supported. Not all gilts are tax-free, but when held in the proper wrapper, some gilts and government-backed savings products can provide tax benefits.

Key Features

- Types of gilts:

- Conventional gilts – pay a fixed interest (coupon) until maturity.

- Index-linked gilts – interest and principal rise in line with inflation.

- Safety: Backed by the UK Government, making them low-risk compared to corporate bonds.

- Returns: Interest (coupon payments) plus repayment of the bond’s face value at maturity.

Pension Contributions

One of the most effective and tax-efficient strategies to save for retirement in the UK is through pension contributions. Pension contributions are increased by government tax breaks, and funds contributed grow free from capital gains and income taxes.

Key Features

- Tax relief on contributions: Basic-rate taxpayers: 20% relief at source (e.g., £80 contribution = £100 invested).

Higher-rate taxpayers: Can claim up to 40% or 45% via self-assessment. - Annual allowance (2025/26): Up to £60,000 per year or 100% of relevant UK earnings (whichever is lower).

- Carry forward: Unused allowances from the previous 3 years can be used, subject to eligibility.

- Tax-free growth: Investments inside pensions (e.g., funds, shares, bonds) grow free from income tax and CGT.

Junior ISAs and Junior SIPPs

Junior Self-Invested Personal Pensions (SIPPs) and Junior ISAs (JISAs) offer a highly tax-efficient way to save for children’s futures. Although both options offer tax-free growth, their functions differ: Junior SIPPs concentrate on very long-term retirement savings, whereas JISAs give access at adulthood.

Key Features

- Eligibility: Available for children under 18 who are UK residents.

- Annual allowance (2025/26): Up to £9,000 per year.

- Types:

Cash JISA – tax-free interest.

Stocks & Shares JISA – tax-free growth and dividends. - Access: Child gains control at age 16, but can only withdraw at age 18.

- Tax treatment: Completely free from income tax, dividend tax, and capital gains tax.

Risks and Potential Pitfalls to Consider

Tax-free investments have many benefits but here are some key risks and limitations to consider:

- Tax-free investments have many benefits but here are some key risks and limitations to consider:

- LISA penalties: Early withdrawal for anything other than buying your first home or retirement means 25% government bonus clawback plus a penalty, effectively losing more than your bonus.

- VCT liquidity: VCT shares can be hard to sell quickly as they are not liquid and not traded on the main stock exchange like regular shares.

- EIS/SEIS risks: These invest in early stage companies which have a higher failure rate; tax reliefs will mitigate losses but don’t guarantee returns.

- Premium Bonds: Tax free but returns are unpredictable as prizes are drawn monthly and there’s no guaranteed income.

- Pensions: Funds are generally locked in until age 55 (rising to 57 in 2028) so not very flexible for early access.

Tips to Maximise Tax-Free Investing in 2026

Making the most of your investing options and allowances can help you increase your wealth and drastically lower your tax liability. These are some possible strategies to maximise tax-free investments in 2026:

Use Your Full ISA Allowance

- The yearly ISA limit (Cash, Stocks & Shares, IFISA, Lifetime ISA) cannot exceed £20,000.

- Couples are exempt from taxes on up to £40,000 annually.

- Give ISAs priority for assets that yield interest, dividends, or regular capital gains.

Take Advantage of the Lifetime ISA Bonus

- To be eligible for the 25% government incentive (£1,000 annually), you must contribute up to £4,000 annually.

- Ideal as an addition to pension funds or for first-time homebuyers.

Save Early for Children

- Use Junior ISAs, which offer tax-free savings starting at age 18, for £9,000 annually.

- Take into account a Junior SIPP (£3,600/year) for tax benefit and long-term compounding.

Optimise Pension Contributions

- Get a 100% tax refund on contributions up to £60,000 annually, which is equivalent to 100% of earnings.

- Higher-rate taxpayers ought to use self-assessment to recover further relief.

- Remember that a 25% tax-free lump amount is available upon retirement.

Explore Venture and Start-Up Reliefs

- EIS (30% relief, £1m–£2m maximum) and SEIS (50 percent relief, £200k limit) offer lower taxes and help enterprises in the UK.

- In addition to tax-free profits, VCTs provide 30% relief.

- Make sure you keep your assets for at least 3 to 5 years.

Diversify Across Wrappers

- Distribute your investments among government-backed securities, pensions, and ISAs (such as Premium Bonds).

- Assists in achieving a balance between tax efficiency, risk, and access needs.

Transfer Assets Between Spouses

Married couples can share allowances and transfer assets to optimise the use of each partner’s tax bands.

Review Annually

- Check government updates frequently because tax laws and allowances are subject to change.

- To maximise your allowances before they reset on April 6th, rebalance your portfolio every tax year.

Combining Tax-Free Investments for Your Financial Goals

- Use ISAs for flexible, accessible tax-free growth for most people.

- Max pension contributions for long term retirement benefits, especially if you can carry forward unused allowances.

- If buying your first home or supplementing retirement savings use LISAs.

- High earners or those who want higher risk can use EIS, SEIS, and VCTs for extra tax relief but be careful as they are high risk and have lock in periods.

- Use Junior ISAs or Junior SIPPs to build tax efficient savings for your children’s futures.

- Diversify across these wrappers to balance tax efficiency, liquidity and risk

FAQs: Frequently Asked Questions

Can I open more than one ISA?

You can have multiple ISAs but in each tax year you can only put new money into one of each type (e.g. one Cash ISA, one Stocks & Shares ISA, one IFISA and one Lifetime ISA).

What’s the difference between EIS and SEIS?

EIS is for established, early-stage companies (up to £1m).

SEIS is for start-ups in their very early stages (up to £200,000).

How do VCTs differ from EIS/SEIS?

● Listed investment trusts known as VCTs provide tax-free profits and 30% tax relief on pooled exposure to small companies.

● Direct investments in businesses, EIS/SEIS, carry more risk but may provide loss and CGT relief.

What’s the best tax-free investment option?

There’s no “one-size-fits-all.”

ISAs suit most savers and investors.

Pensions are best for long-term retirement saving with generous relief.

EIS/SEIS/VCTs suit higher earners willing to take more risk.

Conclusion

A great way to increase your wealth and lessen the burden of taxes is through tax-free investment in the UK. ISAs, pensions, Premium Bonds, and more sophisticated schemes like EIS, SEIS, and VCTs offer investors and savers a variety of options in 2026 to accommodate varying risk tolerances and ambitions. The first move for most people ought to be maxing out their ISA and pension perks; top earners or those wanting more variety should check out start-up relief and venture capital. Junior ISAs and SIPPs work best for families who want to set up long-term security for their children.

Make your money work harder for you and keep more of the returns in your own pocket by reviewing your approach every tax year and knowing the benefits, limitations, and regulations of each alternative.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.