- Understanding the UK Tax System in 2026: Key Changes and Rates

- How to Reduce Corporation Tax in the UK?

- How to Reduce Tax on Salary in the UK?

- How to Reduce Capital Gains Tax (CGT) in the UK?

- How to Reduce Inheritance Tax (IHT) in the UK

- How High Earners Can Legally Reduce Their Tax Bills?

- Essential Tax Planning Tips and Tools for Every Taxpayer

- Frequently Asked Questions

- Conclusion

Tax season doesn’t have to be costly or stressful. In the UK, you can legally reduce your tax bill and keep more of your hard-earned money with careful planning. Each year, tax rules change, and 2025 brings new opportunities and challenges for businesses, contractors, and individuals. This guide covers how to maximise allowances, use HMRC-approved tax reliefs, and organise your finances effectively. All while keeping the right business records, handling employee details, and staying compliant with HMRC reporting, which is legally required for every taxpayer.

In The Ultimate Guide to Legally Reduce Your Taxes in the UK in 2025, we will outline the best practices, point out significant changes to tax legislation, and provide you with practical steps you can take right now to save money and remain in compliance.

Understanding the UK Tax System in 2026: Key Changes and Rates

You need to study how the UK tax system operates and what changes are made in 2026. After that, you can take the step of attempting to lower your tax liability. Tax rules are constantly changing over time. HMRC makes some adjustments to allowances, tax thresholds, and reliefs every year. These changes can have an immediate effect on your outstanding balance.

Key Changes for 2026

Income Tax Thresholds

Although the higher-rate and additional-rate thresholds have shifted somewhat, the personal allowance remains frozen, which could attract more income to higher tax bands.

Dividend Allowance

Investors and business owners who use dividends to pay themselves have been impacted by the recent reduction in the tax-free dividend allowance.

Capital Gains Tax (CGT)

More gains are now taxable due to a reduction in the annual exempt levels.

National Insurance Contributions (NICs)

Both self-employed people and employees are still impacted by changes to rates and thresholds. Every taxpayer must keep their National Insurance number updated for accurate filings.

Pension Contributions

Pension planning continues to be one of the most tax-efficient options due to changes to the lifetime and annual allowance limitations.

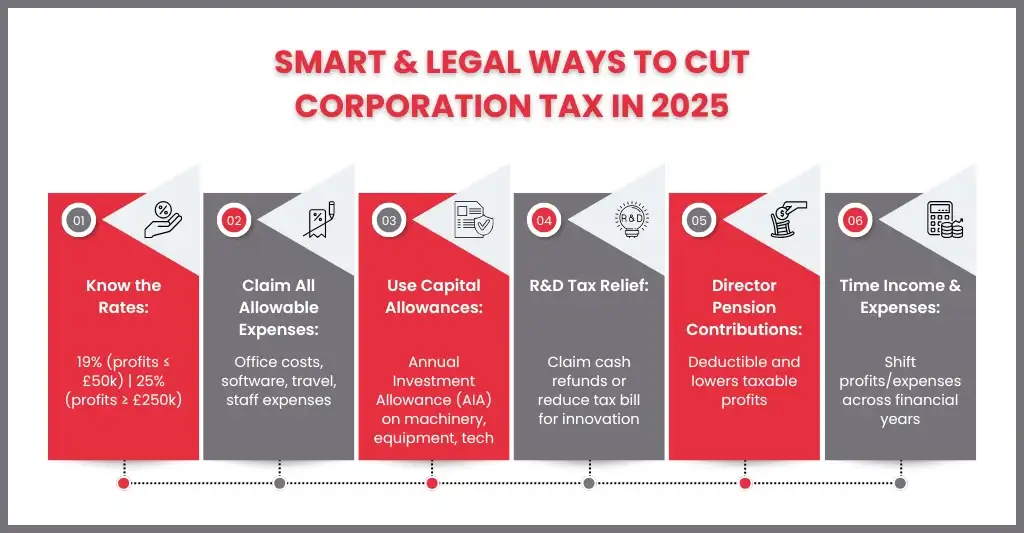

How to Reduce Corporation Tax in the UK?

Corporation tax is a major burden for limited firms. In 2025, the small profits rate is 19% for profits up to £50,000, the main rate is still 25% for profits exceeding £250,000, and there is a marginal relief mechanism in between. Thankfully, there are a number of legally permitted methods to lower your corporation tax bill without breaking the law.

Claim All Allowable Business Expenses

Make sure all allowable expenses are subtracted from earnings prior to calculating taxes. Software subscriptions, travel, office expenditures, professional fees, and some employee costs can all be included in this. Always maintain clean business records for compliance.

Make the Most of Capital Allowances

Investments in machinery, technology, or equipment may be eligible for capital allowances, such as the Annual Investment Allowance (AIA), which may significantly decrease taxable profits.

R&D (Research & Development) Tax Relief

If your company creates new goods, services, or procedures, you might be eligible for R&D reimbursement. For businesses that are losing money, this may result in a cash reimbursement from HMRC or a decrease in corporation tax.

Pension Contributions for Directors

Contributions to an employer’s pension plan are deductible business expenses. Contributions to a pension help directors save money over the long run while lowering taxable profits.

Consider Timing of Income and Expenses

Effectively managing taxable gains can be achieved by purposefully postponing revenue or accelerating expenses within the same financial year.

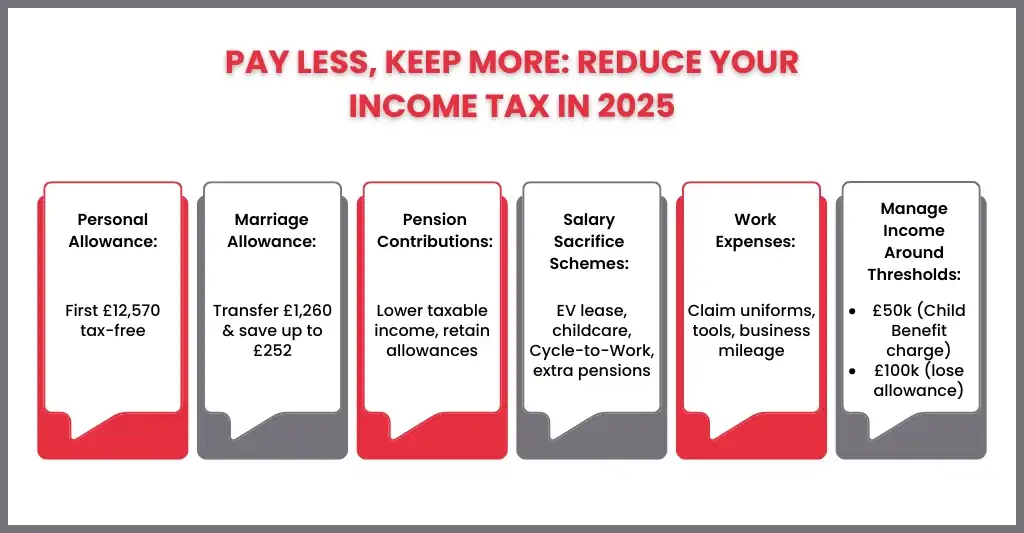

How to Reduce Tax on Salary in the UK?

Maximise Tax-Free Allowances

Personal Allowance: The first portion of your salary is exempt from taxes (£12,570 in 2025–2026). This allowance decreases if your income exceeds £100,000; however, there are strategies available to mitigate this (see pension contributions below).

Marriage Allowance: The lower earner may transfer up to £1,260 of their allowance to the higher earner, saving up to £252 per year, if they or their spouse earns less than the personal allowance.

Contribute More to Your Pension

Salary Sacrifice/Pension Contributions: Your taxable income is decreased by pension contributions.

For instance, if you make £60,000 and contribute £10,000 to your pension, you will only pay £50,000 in taxes.

Keeping your income below certain thresholds, such as £100,000, where you begin to lose your Personal Allowance, can also be facilitated by this.

Employer pension plans: Salary sacrifice plans are provided by certain employers, which prevent both you and your employer from having to pay NICs.

Use Salary Sacrifice Schemes: Some employers allow you to “sacrifice” a portion of your cash pay for non-cash benefits, which are either tax-free or NIC-efficient, instead of receiving your entire wage. Among the examples are:

- Cycle to Work scheme

- Electric car lease scheme (Benefit-in-Kind is very low on EVs)

- Additional pension contributions

- Childcare vouchers (if still in the old scheme)

Claim Work-Related Expenses

- If you spend your own money on job-related expenses (tools, uniforms, business mileage in your own car, etc.), you can claim tax relief.

- Flat-rate expense allowances exist for certain jobs (e.g., nurses, mechanics, police).

- Use HMRC’s online portal to make claims.

Optimise Investments & Savings: ISA Allowance: You can save or invest up to £20,000 annually without paying taxes.

Dividend Allowance & Capital Gains Allowance: If you make money from investments as well, arrange your income to benefit from tax-free allowances.

Manage Income Around Key Tax Thresholds

- £50,000: The High-Income Child Benefit Charge may apply if you make more than this and apply for child benefits. Contributions to a pension can assist lower-income individuals below this threshold.

- £100,000: Above this, for every £2 earned, you lose £1 of your personal allowance. Donations to charities or pension plans may lower your adjusted net income

- £125,140: All Personal Allowance is gone.

Make Charitable Donations (Gift Aid)

Gift Aid donations raise your basic-rate tax band, resulting in a higher percentage of your income being taxed at 20% rather than 40%.

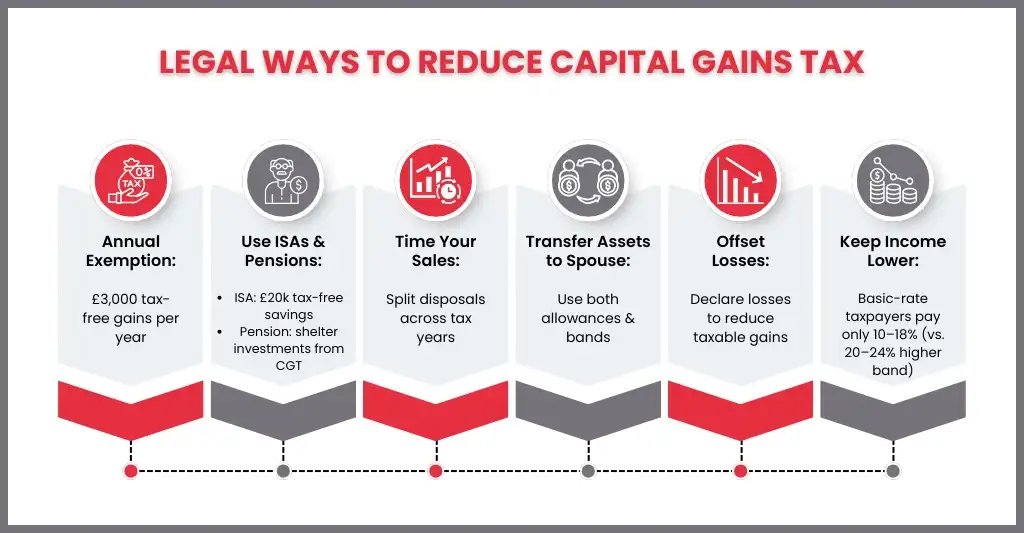

How to Reduce Capital Gains Tax (CGT) in the UK?

Capital Gains Tax (CGT) is due when you sell or give away assets such as shares, valuable objects, or real estate (typically not your primary residence), and your profit surpasses the yearly cap. It is legal to lower or avoid CGT with appropriate planning:

Use Your Annual CGT Allowance

- A tax-free amount known as the Annual Exempt Amount is given to each individual.

- For 2025/26, it is £3,000.

- You lose it if you don’t use it throughout a tax year, so make sure to arrange your disposals appropriately.

Time Your Asset Sales

- Use several annual allowances by spreading out disposals over several tax years.

- For instance, if you sell a portion of your shares in March and the remainder in April, you will be using your allowances in two different tax years.

Consider Main Residence Relief (Property)

Under Private Residence Relief, you are often excluded from CGT when you sell your primary residence. You can be eligible for Lettings Relief if you have rented it out or utilised it for business purposes.

Reduce Tax Rate with Income Planning: Your tax band determines the CGT rates

- Depending on the type of asset, basic rate taxpayers pay between 10% and 18%.

- 20% or 24% for taxpayers with higher or additional rates.

- Gains can be moved into the lower CGT band by lowering your taxable income (via salary sacrifice, gift aid, or pension contributions).

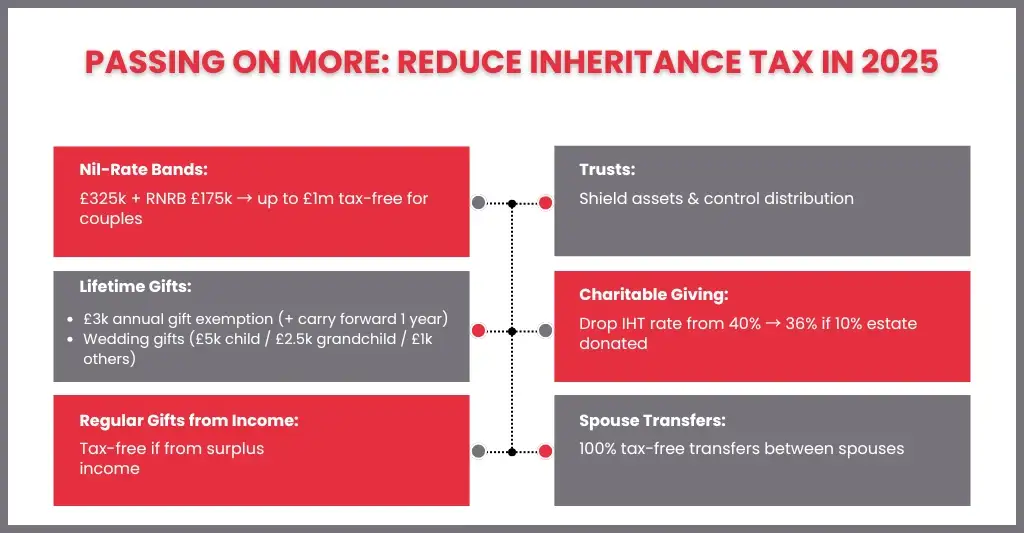

How to Reduce Inheritance Tax (IHT) in the UK

Inheritance Tax (IHT) is usually charged at 40% on estates above the nil-rate band (£325,000 per person, 2025/26). With planning, you can legally reduce or avoid IHT and pass on more wealth to your family.

Use Your Nil-Rate Band & Residence Nil-Rate Band

Each individual has a tax-free allowance of £325,000. You also receive the Residence Nil-Rate Band (RNRB) (up to £175,000) if you leave your primary residence to your direct family members. When selling a family property, married couples or civil partners can combine allowances up to £1 million tax-free.

Make Gifts During Your Lifetime

- Small Gifts: Up to £250 per person per tax year is exempt.

- Annual Exemption: You can give away £3,000 per year tax-free (can carry forward 1 year).

- Wedding Gifts: Up to £5,000 to a child, £2,500 to a grandchild, £1,000 to others.

- Regular Gifts from Income: If you can show gifts are from surplus income (not savings), they are exempt.

Use Trusts for Estate Planning

Your taxable estate may decrease in value if you place assets into specific trusts.

Trusts can also dictate when and how assets are distributed to beneficiaries.

Complex area → ask for guidance on the appropriate structure.

Leave Assets to a Spouse or Charity

- IHT does not apply to anything given to a spouse or civil partner.

- Charity gifts are likewise exempt.

- The IHT rate on the remainder of your estate may drop from 40% to 36% if at least 10% of it is donated to charity.

Reduce the Estate Value Before Death

- Naturally, the taxable estate decreases when you spend your fortune on lifestyle, vacations, and other personal expenses.

- After two years, investments in assets that qualify for Business Relief (specific shares, firms listed on AIM, or businesses) may not be subject to IHT.

How High Earners Can Legally Reduce Their Tax Bills?

Pension Contributions: Reduce taxable income and maintain it below the £100k Personal Allowance and £50,000 Child Benefit levels.

Salary Sacrifice: To save taxes and NICs, exchange your pay for perks like a pension, an electric vehicle, or a bicycle to work.

ISAs: Make tax-free investments up to £20,000 annually.

Gift Aid: Charitable contributions increase the basic-rate band and lower taxable income.

Spousal Allowances: Distribute assets to a spouse who makes less money so they can use them.

Tax-Efficient Investments: EIS, SEIS, and VCTs provide CGT breaks and income tax relief.

Using Pensions for Estate Planning: Pensions develop tax-efficiently and are free from IHT.

Essential Tax Planning Tips and Tools for Every Taxpayer

Every taxpayer may save money with the correct tactics, so smart tax planning isn’t only for the wealthy. Here are the main pointers and resources:

Make Full Use of Allowances

- Personal Allowance (£12,570) – tax-free income.

- ISA Allowance (£20,000 per year) – tax-free savings and investments.

- Dividend & CGT Allowances – use them before they reset each tax year.

Claim Work-Related Expenses

- It is possible to deduct uniform, professional costs, tools, and business transportation.

- For information on flat-rate allowances at work, visit HMRC’s online portal.

Optimise Pension Contributions

- Contributions reduce taxable income and boost retirement savings.

- Salary sacrifice can also cut NICs.

Keep Good Records

- Maintain records of your earnings, expenditures, and investments.

- Apps or software for accounting that have been approved by HMRC, such as Xero, QuickBooks, or FreeAgent.

Get Professional Support When Needed

- A tax adviser or accountant can uncover reliefs you may miss.

- HMRC’s free tools: Tax Relief Checker and Personal Tax Account.

Frequently Asked Questions

Can I reduce Capital Gains Tax (CGT)?

Yes, through the use of your £3,000 yearly allowance, offsetting losses, transferring assets to a spouse, and holding assets in ISAs or pensions.

What is Inheritance Tax, and how can I cut it?

Estates over £325,000 are subject to 40% IHT. Through pensions, trusts, lifelong gifts, and spousal/charity exemptions, you can lower it.

Are there free tools to help with tax planning?

Yes, including tax calculators, software such as FreeAgent, Xero, or QuickBooks, and HMRC’s Personal Tax Account.

How can we help reduce your tax bill in the UK in 2025?

We provide expert advice and strategies to maximise your allowances, claim all eligible reliefs, optimise pension contributions, and manage income efficiently, helping you legally minimise your tax liability while staying compliant.

Conclusion

The goal of effective tax planning is to make use of the reliefs, allowances, and resources that the UK tax system already offers, not to avoid paying taxes. Little actions like maximising pension contributions, using ISAs, spreading profits, and giving thoughtfully can add up to substantial savings over time, regardless of your tax status, basic-rate taxpayer, a high-income taxpayer, or someone preparing for retirement and inheritance.

You can legally lower your tax burden, safeguard your wealth, and keep more of your hard-earned money working for you and your family by remaining organised, making plans in advance, and getting help when needed.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.