- Who Can Claim Tax Refund in the UK?

- Common Reasons You Might Be Owed a Tax Refund

- How can you check if HMRC owes you a tax refund?

- What Documents Do You Need To Claim A Tax Refund In The Uk?

- Step-by-Step Process to Claim Tax Refund from HMRC

- Can you claim a tax refund for previous tax years?

- How Long Does HMRC Take to Process Your Claim Tax Refund Request?

- What Are the Common Reasons for HMRC Tax Refund Delays?

- What Mistakes Should You Avoid When Claiming A Tax Refund In The Uk?

- What Should You Do If Hmrc Rejects Your Tax Refund Claim?

- Frequently Asked Questions

- Conclusion

If you need to claim tax refund from HMRC, understanding the correct process is essential. Every year, thousands of UK taxpayers overpay income tax due to incorrect tax codes, job changes, PAYE errors, or missed allowances. The good news is that you can claim tax refund online, by post, or through Self Assessment, but only if you follow HMRC’s official procedures.

In this guide, we’ll help you understand your rights and show you step-by-step how to claim back your overpaid tax legally and efficiently. Drawing on our extensive experience with clients facing these exact issues, we’ve designed this guide to simplify the refund process so you can get your money back quickly and without unnecessary hassle.

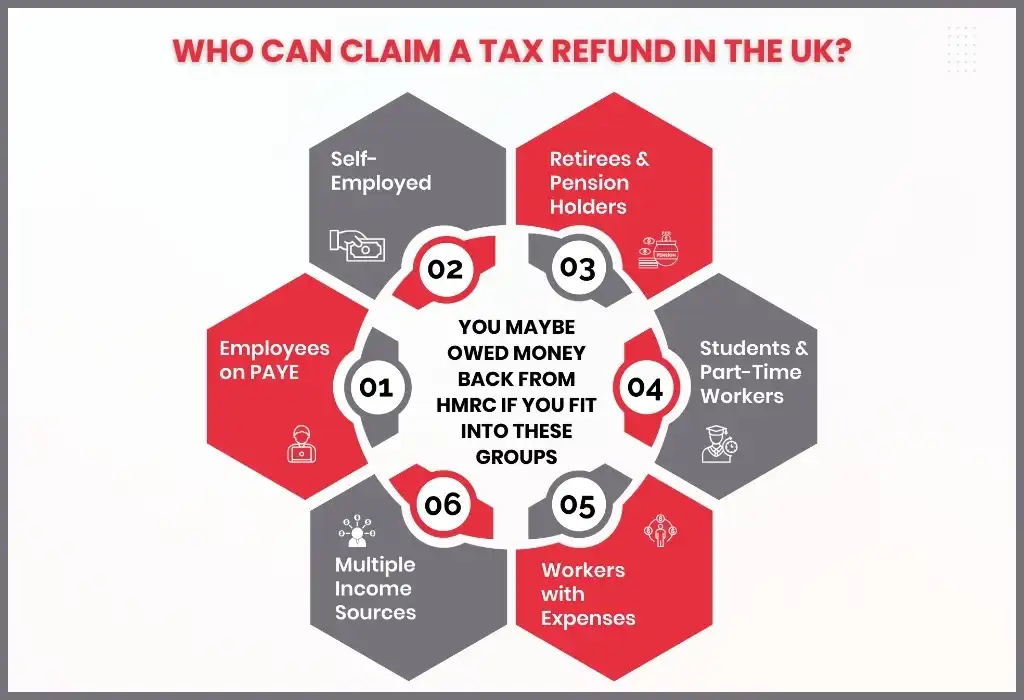

Who Can Claim Tax Refund in the UK?

While not everyone qualifies for a tax refund, many people lose out because they are unaware of their eligibility. You might be eligible for a refund if:

Employees on PAYE: If your company deducted an excessive amount of taxes from your cheque, pension, or bonus. This sometimes occurs when you switch jobs, work part-time for a portion of the year, or are assigned to the incorrect tax code.

Self-Employed Workers: When making account payments, you might have overestimated your income and paid more than your true tax obligation.

Retirees and Pension Holders: If too much tax was deducted from your pension income or lump sum withdrawals.

Students and Part-Time Workers: If you worked only part of the year (e.g., summer jobs) and your annual income fell below the tax-free Personal Allowance.

Individuals with Work-Related Expenses: If you spent your own money on tools, uniforms, travel, or professional subscriptions but didn’t claim tax relief.

People with Multiple Income Sources: If you had more than one job or pension, and your tax-free allowance wasn’t allocated correctly.

Note: Many taxpayers overlook important savings interest tax rules that can affect refunds. For detailed information, see our guide on HMRC Savings Tax Warning

Common Reasons You Might Be Owed a Tax Refund

In the UK, a lot of people pay more in taxes than they owe, frequently without even recognising it. If you qualify, you can get this back from HMRC. Among the most frequent reasons are:

Overpaid PAYE Tax: If you have a job, your employer uses PAYE (Pay As You Earn) to deduct taxes. You may have paid too much if your tax code was incorrect, your income changed, or you changed employment in the middle of the year.

Job Changes or Redundancy: If your PAYE code was based on annual income you didn’t get, you may have overpaid taxes if you quit your job before the end of the tax year or were laid off.

Work-Related Expenses: You can be eligible for tax relief if you pay for some expenses out of pocket, such as professional fees, uniforms, or business travel.

Student Loan Repayments: You might be eligible for a refund if your student loan installments were taken out of your pay cheque even after you had completed paying them off.

Pension Contributions and Benefits: Incorrect tax deductions can occasionally be made from contributions, lump amounts, or pension payments that can subsequently be recovered.

Marriage Allowance: If you’re married or in a civil partnership, you may be able to give your spouse a portion of your tax-free allowance, which could result in a return if you didn’t utilise it sooner.

Self-Assessment Overpayments: If you submit a Self-Assessment return, you might have overpaid because you overestimated your income or spending. This can be refunded by HMRC after your return is handled.

Note: For more on how savings interest can impact your taxes, see our guides on How to Avoid the Savings Interest Tax Trap.

How can you check if HMRC owes you a tax refund?

Finding out if you owe money back to HMRC is easier than you would imagine. The primary methods to check are as follows:

Use HMRC’s Online Service: Enter your Government Gateway ID to access your Personal Tax Account. Your tax code, income information, and whether you have overpaid are all displayed here.

Check Your P60 and P45 Forms: Compare the tax you paid with what HMRC claims you should have paid. Your tax payment is stated on your P60 at the end of the tax year, or your P45 if you quit your work in the middle of the year. You might be eligible for a refund if there is any discrepancy.

Look Out for a P800 or Simple Assessment: If HMRC thinks you have paid too much (or too little), they frequently send either a Simple Assessment or a P800 tax calculation letter. These will inform you directly if a refund is due.

Through Self-Assessment: HMRC will determine your ultimate liability following the filing of a tax return. Any excess amount will appear in your account, and you can ask for a refund.

Contact HMRC directly: You can request a review of your records by calling HMRC’s helpdesk if you have any questions or believe your situation hasn’t been accurately recorded.

What Documents Do You Need To Claim A Tax Refund In The Uk?

HMRC typically requests documentation to verify your income, the amount of tax you have paid, and any reclaimed expenditures when you file for a tax refund. Having the appropriate documentation on hand helps expedite the procedure.

Essential Documents:

P60 – This document shows your total pay and tax deducted for the tax year (issued by your employer in April).

P45 – If you left a job during the year, this form shows your pay and tax up to the leaving date.

Payslips – Useful to cross-check PAYE deductions throughout the year.

Self-Assessment Tax Return – If you’re self-employed or file returns, HMRC will need your completed return as the basis for refund calculations.

P800 or Simple Assessment Letter – If HMRC sends one, it explains whether you’re due a refund.

Note: You can check our full guide on What is a P60 to better understand this important document and how it relates to your tax refund.

Supporting Documents for Tax Relief Claims

- Receipts/Invoices – For allowable work expenses such as tools, uniforms, or travel.

- Mileage Logs or Travel Records – If you claim tax relief for business mileage or public transport.

- Professional Membership Fees – Proof of payment for trade unions or professional bodies approved by HMRC.

- Pension Statements – If you’ve made contributions that weren’t taxed correctly.

- Student Loan Statements – To confirm overpayments if repayments continued after clearing the balance.

Personal Identification:

- National Insurance (NI) Number – Essential for matching your records.

- Bank Account Details – HMRC pays refunds directly into your account.

Step-by-Step Process to Claim Tax Refund from HMRC

In the UK, claiming a tax refund is typically simple, though the procedure varies depending on your circumstances. To ensure you don’t miss anything, take the following actions:

Gather Your Documents

If you are claiming tax relief, gather your P60, P45, pay slips, P800/Simple Assessment, or Self-Assessment tax return, as well as receipts or evidence of expenses.

Check If You’re Due a Refund

- Open your online HMRC Personal Tax Account and log in.

- Examine your income, payments, and tax code to determine whether you have overpaid.

- Or wait for HMRC to tell you directly through a P800 or Simple Assessment.

Choose the Right Method to Claim

- Online: Using your own tax account is the quickest option.

- By Mail: You can accept the computation and ask for reimbursement by mail if you’ve received a P800 or Simple Assessment.

- Self-Assessment: HMRC will automatically pay any refunds if you file a tax return and include your bank information.

- By Phone: To discuss your refund, give HMRC a call if your situation is unique or if you are unable to use online services.

Submit Your Claim

Give your bank account information to HMRC so they can make the earliest possible payment directly. It will take longer to issue a cheque if you don’t.

Wait for Processing

Refunds usually take:

- 5 working days (online claims to a UK bank account).

- 2–4 weeks (postal claims or cheque payments).

- Longer if HMRC needs extra checks or your claim is complex.

Keep Records Safe

Forms, receipts, and confirmation emails should always be kept on hand in case HMRC later questions your claim.

Can you claim a tax refund for previous tax years?

Yes, there is a time limit on when you can still get a refund for past tax years if you overpaid. You can claim money you owe HMRC by going back up to four tax years. The right to a refund typically ends after that.

How Does It Work?

Deadline

- Your claim must be filed by April 5th, four years following the end of the applicable tax year.

- Example: You have until April 5, 2024, to make a claim for the 2019–20 tax year, which ended on April 5, 2020.

Method of Claim

- You will need your pay slips, P60, or P45 to prove that taxes were deducted if you were employed.

- If you work for yourself, you can apply for a repayment by making changes to your Self-Assessment return (within time constraints).

Refund Process

- Once HMRC processes your claim, they’ll issue a repayment either by bank transfer or cheque.

Claiming as a Non-Resident or After Leaving the UK?

Even if you worked in the UK but have since relocated overseas or are considered a non-resident, you can still be eligible for a tax refund. Even if you no longer reside in the nation, you can still claim back owed taxes from HMRC.

When You Might Be Due a Refund?

Leaving the UK part-way through the tax year: You can have overpaid taxes under PAYE if you didn’t make enough money for the entire year.

Working temporarily in the United Kingdom: Standard tax regulations might result in non-residents who work for a brief length of time overpaying taxes.

Double Taxation Agreements: If your nation and the UK have a tax treaty, you can be eligible for a rebate and be spared from paying taxes on the same income twice.

Pension or Investment Income: If you live in a nation with a tax treaty and UK tax was withheld from your income, you might be eligible to recover it.

How to Claim?

Form P85: If you have left the UK, you have to fill out Form P85, “Leaving the UK – getting your tax right,” and submit it to HMRC with portions of your P45.

Self-Assessment Return: You might be required to submit a final tax return and make a reimbursement request if you were registered for Self-Assessment.

Double Tax Relief Claim: To process claims about treaties, HMRC might need further forms (such as DT-Individual) that have been approved by your local tax office.

Refund Process: You can still receive your refunds straight into your UK bank account.

HMRC may issue a cheque if you no longer have a UK account, which you may need to cash at your foreign bank.

Tip: Always keep copies of your P45, payslips, and departure details. Non-resident claims can take longer, as HMRC may need extra verification.

How Long Does HMRC Take to Process Your Claim Tax Refund Request?

Whether HMRC needs to do additional checks and how you file your claim will determine how long it takes to get your tax refund. While it’s usually really rapid, there are several circumstances in which it might take longer.

Typical Timeframes:

Online claims (via Personal Tax Account): If paid into a UK bank account, online claims (via Personal Tax Account) often arrive within 5 working days.

Self-assessment refunds: If you have included your bank information, they will typically be issued 1-2 weeks after your return is processed.

Postal Claims: Approximately two to four weeks after HMRC gets your paperwork, you can submit postal claims (such as P800, Simple Assessment, or P85 for leavers).

Cheque payments: Due to postal delivery delays, cheque payments may take two to six weeks.

Factors That May Delay Your Refund

- Before releasing the payment, HMRC performs fraud or security checks.

- Your claim contains missing or inaccurate bank information.

- Complicated claims (such as backdated claims for several tax years or non-resident refunds).

- Busy times (for example, following the January Self-Assessment deadline, when HMRC handles a spike in claims).

What Are the Common Reasons for HMRC Tax Refund Delays?

Sometimes, your tax refund from HMRC takes longer than you were expecting to come through. Here are a few things that are probably causing the holdup:

Your Bank Details Just Aren’t Right

Take a close look at the details you submitted when you put in your claim – did you get the account number, sort code, or anything else wrong? HMRC can’t send your refund until everything is correct, so a quick double-check is a good idea.

Additional Security – They’re Doing Their Job

HMRC might be running some extra checks to make sure everything is alright. Now, we know this is all in the name of security, but it can still cause a bit of an annoying delay in the meantime.

Claims That Need a Bit More Work

If your claim is a bit more complicated, perhaps you’re claiming for the previous year or you’re not even based in the UK, it’s going to take HMRC a bit longer to sort out.

Busy Periods

Around times like just after the January Self-Assessment deadline, HMRC is going to be absolutely slammed with claims to get through, and delays are pretty much inevitable as a result.

Missing Documents – A Bit of a Problem

If you’re still missing some bits of paperwork, like your P60 or P45, HMRC can’t actually process your refund until they get everything they’re supposed to.

So, in short, to avoid delays, just make sure your details are all up to date, you’ve got all the right paperwork, and you file as early as you can if you can – that way, everything should go pretty smoothly.

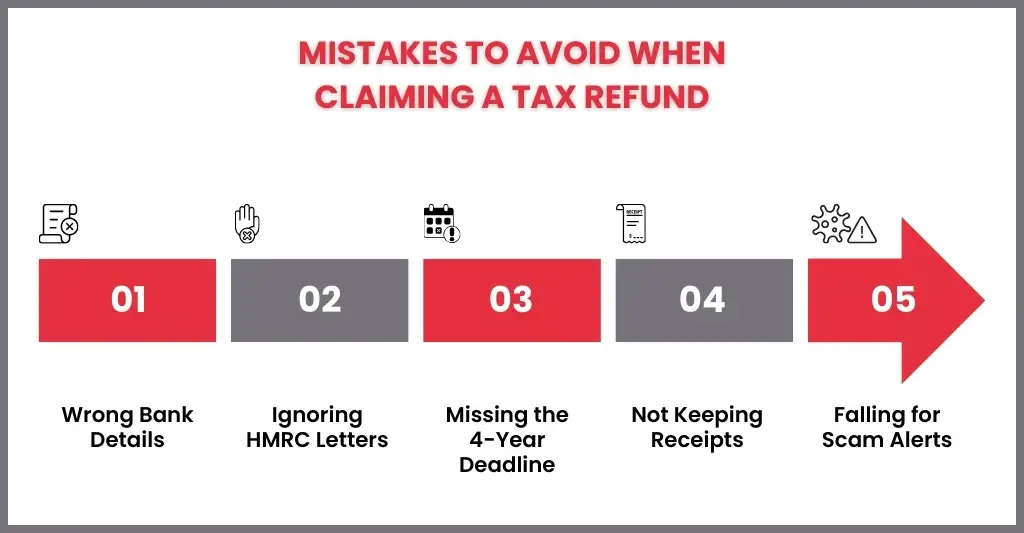

What Mistakes Should You Avoid When Claiming A Tax Refund In The Uk?

Refund claims may seem straightforward, but even little mistakes can cause your payment to be delayed or rejected. The most typical risks and ways to avoid them are as follows:

- Submitting the Wrong Bank Details: HMRC cannot process your return if your account number or sort code is incorrect. This could result in delays or the issuance of a cheque.

- Ignoring HMRC Letters: A lot of individuals discard P800 or Simple Assessment letters because they think they are tax invoices. These frequently inform you that a refund is due.

- Missing the Deadline for Past Years: Refunds are only available for the last four tax years. Even if HMRC made a mistake and the overpayment occurred, you still lose out if you miss this date. Please check out this official guide for more information.

- Forgetting to Include All Income: HMRC may postpone your refund if you fail to disclose all of your income, including pensions, savings, interest, self-employment, and employment.

- Not Keeping Evidence: Before approving your claim, HMRC could request receipts, P60s, P45s, or expense records. Your claim can be diminished or denied if you are unable to prove it.

- Falling for Refund Scams: Fraudsters frequently pretend to be sending you a “tax refund” through fake emails or SMS. This is not how HMRC ever gets in touch with people for refunds.

Claiming Expenses You’re Not Entitled To: HMRC investigations may be initiated by claiming for non-allowable expenses, faking expenses, or inflating mileage.

What Should You Do If Hmrc Rejects Your Tax Refund Claim?

Rejecting your tax return can be upsetting, but it doesn’t always mean you don’t deserve the money. You can usually fix it because of a misunderstanding, mistakes, or missing paperwork.

Understand Why It Was Rejected

HMRC will usually explain the reason in their letter or online message. Common reasons include:

- Missing or incorrect documents (e.g., no P60 or receipts).

- Incorrect bank details.

- Claiming expenses that aren’t allowable.

- Being outside the 4-year deadline for backdated claims.

Review and Correct Your Claim

- Verify the figures you sent in again.

- Collect any supporting documentation you might have overlooked, such as accounting records, invoices, or paystubs.

- Resubmit the claim via postal mail with the correct information, or fix errors in your online account.

Contact HMRC for Clarification

Call the HMRC helpdesk and get a thorough explanation if you’re not sure. A brief conversation can sometimes resolve misunderstandings and have your claim re-examined.

Appeal the Decision

If HMRC still refuses, you may have the right to:

- Formally appeal the decision in writing within 30 days of the rejection.

- Request an independent review by another HMRC officer.

- Escalate to the Tax Tribunal if you still disagree.

Seek Professional Help

Consider seeing a tax advisor or accountant for difficult instances (particularly those involving large amounts, non-resident claims, or disputed expenses).

Frequently Asked Questions

How do I know if I’ve paid too much tax?

You can wait for a P800/Simple Assessment letter, check your HMRC Personal Tax Account, or compare your P60/P45 with your tax code.

How do I claim tax refund from HMRC?

You can do it online through your Personal Tax Account, through a Self Assessment return, or by filling in a specific form like P50, P85, or P87, depending on your situation. If HMRC has already spotted an overpayment on their end, they’ll send you a P800 letter with instructions on how to get your money back.

Can I claim tax refund if I left the UK or worked abroad?

You can still claim. If you left the UK partway through the tax year or spent time working overseas, there’s a good chance you overpaid tax and are owed something back. You’ll likely need to complete Form P85 or file a final Self Assessment return to confirm everything. It’s worth doing because many people leave money behind simply because they don’t realise they’re entitled to it.

Can I claim a tax refund on savings interest if I’ve paid too much tax?

Yes. If your savings interest tax deductions exceed what you owe after applying your Personal Savings Allowance, you can claim a refund from HMRC. Many taxpayers overpay because banks automatically deduct tax without considering allowances.

How long does it take to claim tax refund in the UK?

Online claims are generally the fastest route. Once HMRC approves your refund, the payment usually lands within 5 working days. If you go down the postal route, expect to wait anywhere between 2 and 4 weeks. For more complicated situations like non-resident claims or requests going back several years, it can take a bit longer, so it’s worth being patient and keeping an eye on your account.

Can I claim tax refund for previous tax years?

Yes, and this surprises a lot of people. You can go back up to four tax years to reclaim overpaid tax. Just keep in mind there’s a deadline, four years from the end of the tax year in question. Once that window closes, the money is generally gone unless HMRC themselves made an error.

Do HMRC automatically refund overpaid tax?

Sometimes. If you’re on PAYE and HMRC notices you’ve overpaid, they’ll send a P800 tax calculation and you can request the refund from there. But in plenty of cases, particularly with Self Assessment or expense claims, you’ll need to take the first step yourself and actively make a claim.

Do I need an accountant to claim tax refund?

Not legally, no. Many people handle their own claims without any professional help at all. That said, if your situation involves multiple income streams, older tax years, or a mix of PAYE and Self Assessment, getting advice from an accountant can save you time and make sure you’re not leaving anything on the table.

Conclusion

It’s not difficult to claim a tax refund from HMRC, but many people lose out because they neglect to verify their records or think HMRC would take care of everything for them. You may make sure you get back every pound you’re due by being aware of the typical causes of overpayment, maintaining the appropriate records, and following the correct procedure.

Whether you are self-employed, employed, a non-resident, or filing for previous years, the most important things are to stay on top of deadlines, avoid errors, and maintain accurate records. Professional guidance might help you maximise your rights if your situation is more complicated.

Keep in mind that a tax refund is your money being returned, not a bonus. Don’t fail to claim it.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.