- Key Takeaways

- Personal Savings Allowance (PSA) and Starting Rate for Savings 2026/27

- What is the HMRC Savings Tax Warning?

- When and Why Does HMRC Send a Tax Warning?

- Understanding Personal Tax Allowance

- How Does HMRC Know About Your Savings Interest?

- How HMRC Collects Tax on Savings Interest

- What Happens If You Ignore an HMRC Tax Warning?

- How to Check If You Owe Tax on Savings Interest?

- How to Legally Avoid Paying Tax on Your Savings?

- What Should You Do If You Receive a Tax Bill from HMRC?

- Frequently Asked Questions

- Conclusion

Rising interest rates mean more UK savers are now crossing tax-free limits without realising it. As a result, HMRC savings tax warnings have become more common, with many taxpayers receiving letters or seeing changes to their tax code after their savings interest exceeds allowed thresholds.

For many people, the issue arises quietly. Interest is paid gross, banks report it automatically, and HMRC later identifies that tax is due. This can lead to an unexpected HMRC savings tax warning letter, even where no tax return has ever been filed.

Understanding why HMRC issues these warnings, who is affected, and what action to take is essential for avoiding penalties and managing savings tax correctly in the 2026/27 tax year.

This guide explains what the HMRC savings tax warning means, how HMRC becomes aware of your savings interest, and what steps you should take if you receive a letter or tax code adjustment.

Key Takeaways

- Rising interest rates in 2026/27 mean more people exceed the Personal Savings Allowance and receive an HMRC savings tax warning.

- Banks and building societies report savings interest directly to HMRC

- HMRC may issue a warning letter, adjust your tax code, or raise a tax bill.

- Using ISAs, splitting savings between partners, and managing taxable income are effective ways to reduce or avoid savings tax.

- Promptly addressing any HMRC tax warning can help you avoid penalties, interest, and further enforcement actions.

Personal Savings Allowance (PSA) and Starting Rate for Savings 2026/27

| Income Tax Band | Personal Savings Allowance (PSA) | Starting Rate for Savings |

| Basic Rate (20%) | £1,000 | Up to £5,000 (subject to income limits) |

| Higher Rate (40%) | £500 | £0 |

| Additional Rate (45%) | £0 | £0 |

Your Personal Savings Allowance is linked to your income tax band. If your income increases so that you become an additional rate taxpayer (usually when your income is above £125,140), your PSA is reduced to zero and all savings interest becomes taxable. If your savings interest exceeds £10,000 in a tax year, you will normally need to report it through a Self Assessment tax return rather than relying only on tax code adjustments.

The starting rate for savings gives up to an extra £5,000 of tax‑free savings interest, but it only applies if your non‑savings income is low enough. The more non‑savings income you have above the personal allowance, the more this £5,000 band tapers down until it reaches £0.

What is the HMRC Savings Tax Warning?

An HMRC savings tax warning is a notice that HMRC believes you may owe tax on interest earned from savings. These warnings are often issued as letters, sometimes referred to as HMRC savings tax letters, or through adjustments to your tax code.

The warning does not always mean tax is immediately payable, but it signals that HMRC has identified savings interest above your tax-free allowance and expects you to review the position.

HMRC Tax Warnings for UK Pensioners’ Savings and Pension Threshold Notices

In 2025, HMRC is cracking down on pensioners’ bank accounts with a lot more scrutiny. Here’s what pensioners should be keeping an eye on:

- Pension Savings Notice Threshold: When you earn more than £597 in interest on your savings, you’ll get a warning letter from HMRC – and it’s a sign that you might be due a tax bill on your combined income.

- What the Notices Are About: These letters are a heads up on how your savings interest is affecting your tax situation, taking into account your state pension, personal allowance and tax bands.

- Why Are Pensioners Getting These Letters? With interest rates high, more pensioners are accidentally going over the PSA limits – and HMRC is automatically sending these warning letters based on what they see in your bank reports to make sure you don’t get caught out.

- What to Do Next: If you receive one of these letters, do not panic. Just take a look at your HMRC Tax Account, double check the interest totals, and if you need, get some advice or consider moving your savings to an ISA.

When and Why Does HMRC Send a Tax Warning?

HMRC issues a savings tax warning when reported interest exceeds your Personal Savings Allowance. This usually occurs because:

- Interest rates have increased

- Savings are spread across multiple accounts

- Income has moved into a higher tax band

Banks report interest automatically. HMRC then compares this against your allowance and decides whether tax should be collected through your tax code or by issuing a bill.

Understanding Personal Tax Allowance

The Personal Savings Allowance (PSA) is the amount of tax-free interest you can earn from your savings each tax year (April 6–April 5). Your income tax band determines your allowance:

- Basic-rate taxpayers (20%) can earn up to £1,000 in interest tax-free.

- Higher-rate taxpayers (40%) have a reduced allowance of £500.

- Additional-rate taxpayers (45%) get no allowance.

Your excess interest is taxable if it surpasses your PSA. Building societies and banks notify HMRC immediately of your interest, and HMRC may issue you a bill or change your tax code. More savers, often without realising it, are crossing the threshold in 2025 as interest rates remain high.

How Does HMRC Know About Your Savings Interest?

Banks, building societies, and other financial institutions automatically report your savings interest to HMRC. This is done annually under the UK’s automatic reporting system.

This implies that since HMRC already has the statistics, you don’t need to submit them yourself. Even if you haven’t done a Self-assessment, HMRC may change your tax code or issue a tax bill if your total interest exceeds your Personal Savings Allowance. Thus, if they’re not paying close, even passive savers could be caught off guard.

2025 Tax Crackdown on UK Savings Accounts: Chancellor Rachel Reeves’ New Rules

In August 2025, Chancellor Rachel Reeves gave approval for changes often described as a “tax crackdown on savings accounts”, following a sharp rise in the number of UK savers exceeding their tax-free allowances. Reporting at the time noted that around 300,000 more people were paying tax on savings interest compared with five years earlier, largely due to higher interest rates and frozen thresholds.

Despite the language used in headlines, the tax crackdown on savings accounts does not introduce a new tax. Instead, it focuses on improving how existing savings tax rules are applied, allowing HMRC to identify taxable interest more accurately and collect the correct amounts through established PAYE systems.

Source: The Independent (UK), August 2025

How HMRC Collects Tax on Savings Interest

Savings interest that exceeds your Personal Savings Allowance is immediately taxed by HMRC. It operates as follows:

- Through Your Tax Code: HMRC may modify your tax code to progressively collect the tax due on your savings interest over the year if you are employed or get a pension.

- Self Assessment: You could have to file a Self Assessment tax return and pay the tax directly if you work for yourself or have a sizable amount of savings interest.

- No Tax Deducted at Source: Banks no longer deduct tax before interest payments, unlike in the past. The entire sum is given to you, and you have to make sure that any taxes owed are paid.

Example: How an HMRC Savings Tax Warning Happens

PAYE employee example

A basic-rate taxpayer earns £38,000 and receives £1,350 in savings interest during the 2026/27 tax year.

The Personal Savings Allowance is £1,000, leaving £350 taxable.

HMRC receives the interest figure from the bank and adjusts the taxpayer’s PAYE tax code to collect the tax automatically. The taxpayer also receives an HMRC savings tax warning letter explaining the adjustment.

What Happens If You Ignore an HMRC Tax Warning?

Major consequences may result from disregarding an HMRC tax warning. If you do nothing in return, HMRC might:

- To have taxes deducted automatically from your income, modify your tax code.

- Provide an official tax bill that includes interest or penalties for the amount that has not been paid.

- Impose late payment penalties, particularly if they think you’ve purposefully evaded payment.

- If there has been a history of non-compliance, start a tax investigation.

Verify your savings interest and take immediate action, even if the warning seems insignificant. You can prevent further fees and needless stress by taking care of the problem as soon as possible.

How to Check If You Owe Tax on Savings Interest?

Use these procedures to determine whether you owe taxes on your savings interest:

- Review Your Bank Statements: Verify the total interest earned during the current tax year (April 6–April 5) by checking all of your accounts.

- Add Up All Interest: Aside from current accounts, savings accounts, and even peer-to-peer loans, include interest on fixed-rate bonds.

- Compare with Your Personal Savings Allowance:

- £1,000 for basic-rate taxpayers

- £500 for higher-rate taxpayers

- £0 for additional-rate taxpayers

- Log in to your Tax Account: Check if tax is payable and view reported interest using HMRC’s online site.

- Use a Savings Tax Calculator: Depending on your tax band and total interest, online calculators can assist you in determining if you will owe anything.

Note: If you don’t have a Personal Tax Account, you can read our article on how to set up a Personal Tax Account.

How to Legally Avoid Paying Tax on Your Savings?

In the UK, you can lower or avoid paying taxes on your savings interest in several smart and lawful ways:

Use an ISA (Individual Savings Account)

Regardless of the amount of money you save, interest generated in a Cash ISA is entirely tax-free. The maximum amount you can save in 2025 across all ISAs is £20,000 each tax year.

Split Savings Between Partners

When two people who are both basic-rate taxpayers use their Personal Savings Allowances, their tax-free interest is essentially doubled.

Use High-Interest Current Accounts Carefully

Some current accounts provide high interest on tiny deposits. Staying below the limit can be facilitated by distributing savings throughout several accounts.

Invest in Premium Bonds

NS&I Premium Bonds offer tax-free prize payouts, but returns are not certain.

Manage Your Total Taxable Income

Contributions to charities or pension plans can lower your taxable income if you’re just below the higher-rate tax bracket, which could raise your PSA.

Gift Savings to Lower-Income Family Members

Sometimes, the total tax payment can be decreased by giving money to a family member who has unused PSA and is exempt from parental tax laws.

For official details, see HMRC’s guide to tax on savings interest and NS&I Premium Bonds.

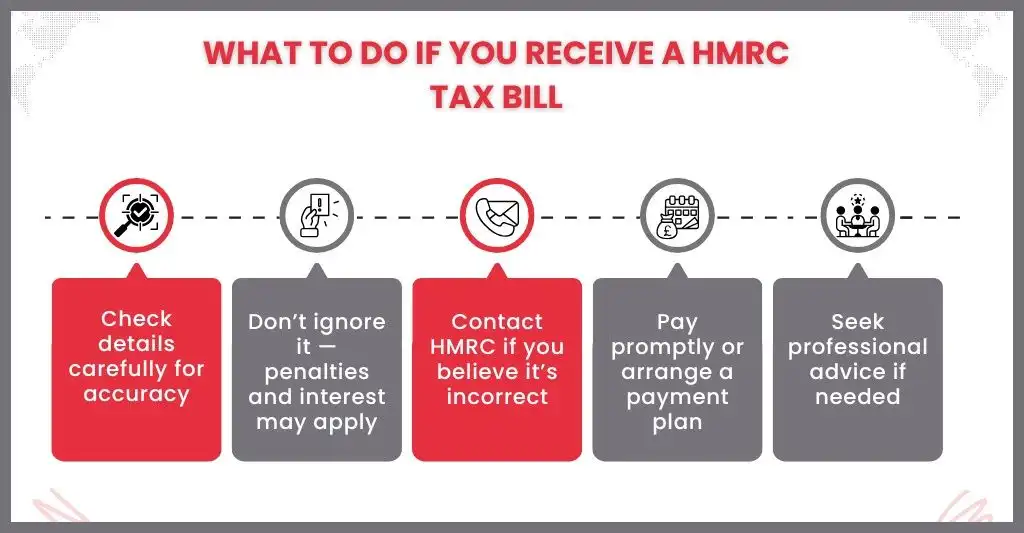

What Should You Do If You Receive a Tax Bill from HMRC?

Although receiving a tax statement from HMRC might be upsetting, you can handle the situation more skillfully if you act promptly. Here’s what you should do:

Check the Details Carefully:

- To make sure all the numbers are correct, check the bill.

- Verify the accuracy of your deductions, tax code, and income.

- Verify your paychecks, P60/P45, or Self-assessment records if something seems off.

Don’t ignore it

- Interest and fines may result from ignoring a tax bill.

- If HMRC doesn’t get payment, they could pursue enforcement action.

Contact HMRC if You Think It’s Incorrect:

- If you think there is an error, get in touch with HMRC right away to get clarification.

- You can contact them by phone or online using your Tax Account.

Pay the Bill or Set Up a Payment Plan:

- Pay the bill by the due date to avoid additional fees if it is accurate and you can afford it.

- HMRC may be able to set up a Time to Pay plan with you if you can’t pay in full, allowing you to stretch the payment over a number of months.

Seek Professional Advice if Needed:

- You can get help understanding the bill and dealing with HMRC on your behalf from a tax consultant or accountant.

- This is especially useful if you are disputing the bill or if your tax situation is complicated.

Keep All Correspondence

Maintain a record of any correspondence, emails, and phone conversations you have with HMRC, as well as any documents you have sent or received.

Frequently Asked Questions

Do I need to declare my savings interest to HMRC if I am employed and have never filed a tax return?

If you are employed and pay tax through PAYE, and your savings interest is below your Personal Savings Allowance (PSA), you usually do not need to declare it. Banks and financial institutions report your interest directly to HMRC, and if you exceed your allowance, HMRC can adjust your tax code to collect the tax automatically. However, if your interest income is high or you receive other untaxed income, you may be asked to file a Self Assessment tax return.

What is an HMRC tax warning on savings?

An HMRC tax warning on savings is a letter or online notice telling you that your savings interest may be above your tax‑free allowance and that you might owe tax or need a tax code change.

Does interest from foreign savings accounts count towards my Personal Savings Allowance (PSA)?

Yes. Interest from foreign savings accounts is taxable in the UK and counts towards your total savings interest for the year, so you should declare it to HMRC.

How do I check if HMRC has the correct information about my savings interest?

You can check your reported savings interest and tax code in your HMRC Personal Tax Account, which shows the figures sent by banks and any tax due.

What do I do if I think my reported interest or tax bill is wrong?

Contact HMRC as soon as possible with your bank statements and tax documents, so they can correct any errors and update your bill or tax code.

What happens if I do not receive any letter from HMRC by 31 March 2025 but suspect I owe tax?

If you think you owe tax, contact HMRC and report your savings interest rather than waiting for a letter, as delays can lead to interest and penalties.

What types of savings accounts are subject to the savings tax?

Most interest earned from UK bank accounts, building societies, credit unions, peer-to-peer lending, fixed-rate bonds, and some investment funds is taxable. However, interest on Individual Savings Accounts (ISAs) is tax-free and does not count towards your Personal Savings Allowance. It’s important to check the type of account and whether it qualifies for tax exemption

Do HMRC send savings tax warnings or notices to UK pensioners?

Yes. HMRC can send savings tax letters to UK pensioners when their savings interest and state pension push them over their tax‑free allowances, warning that tax may be due and prompting them to check their interest and pay or correct any shortfall.

Conclusion

An HMRC savings tax warning is increasingly common as interest rates remain higher. While receiving a letter or tax code change can be worrying, most cases are straightforward to resolve once the figures are checked.

Understanding how savings interest is reported, knowing your allowances, and responding promptly to HMRC communication can prevent unnecessary stress and penalties.

If you need help reviewing a savings tax warning or dealing with HMRC, professional guidance can help ensure the issue is resolved correctly.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.