A Personal Tax Account (PTA) is a free, secure online service provided by HMRC that lets UK taxpayers view and manage their personal tax information in one place — 24/7, without needing to call or write to HMRC. Think of it as online banking, but for your taxes.

Whether you are employed, self-employed, or receiving a pension, your PTA gives you instant access to your tax records, lets you update your details, and keeps you in control of your tax affairs, all without sitting on hold with HMRC.

This guide covers everything you need to know about the Personal Tax Account, including the latest changes, how to set it up step-by-step, its key features, and why it’s essential for staying compliant and in control of your taxes.

What is a Personal Tax Account?

A Personal Tax Account is a secure online service provided by HM Revenue & Customs (HMRC). It brings all of your personal tax data together in one place, accessible at any time without calling or writing to HMRC. The service is available 24/7 and works similarly to online banking, you can view your records, make changes, and communicate with HMRC entirely online.

Introduced in December 2015, the PTA is now available to all UK taxpayers, whether employed, self-employed, or retired. Over 16 million people in the UK have already set one up.

Benefits of a Personal Tax Account

- Manage your tax affairs online 24/7, from any device — no need to call or write to HMRC

- Keep accurate, up-to-date records in one place, replacing paper-based processes

- Update and check tax information in real-time

- View up to 5 years of income and tax history at a glance

- Receive alerts and reminders for tax deadlines and account changes

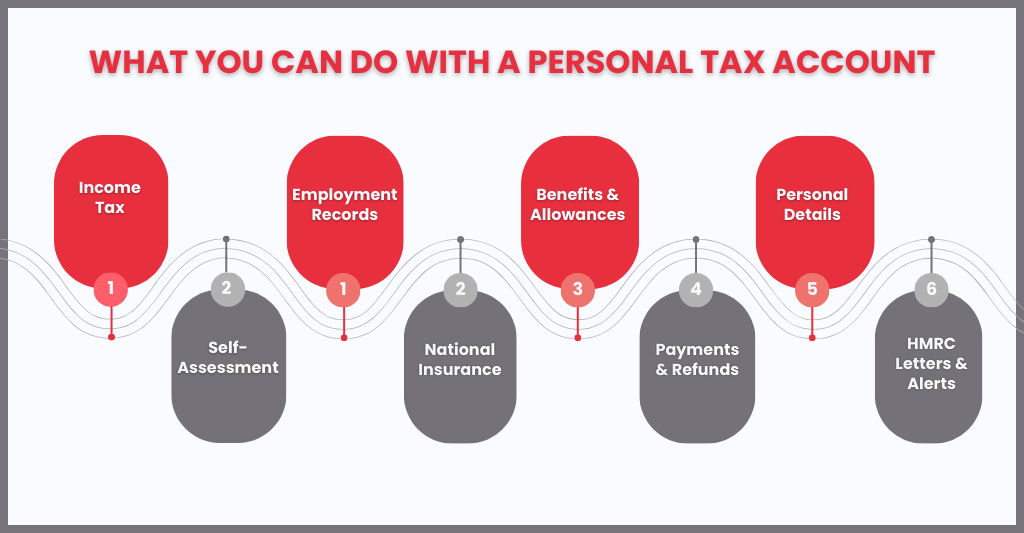

What Can You Do With a Personal Tax Account?

Your Personal Tax Account is your digital tax hub. Here is a full breakdown of what you can do:

Income Tax

- Check your tax code and get an Income Tax estimate

- Claim a tax refund directly into your bank account

- View your income from employment for the previous 5 years

- Check how much Income Tax you paid in the previous 5 years

- Determine whether Income Tax has been overpaid or underpaid for previous years, and what action is required

- Check your Simple Assessment tax bill

Self-Assessment

- Submit your tax return online and track its status

- Register for Self-Assessment if you are self-employed or have other untaxed income

- Review and print your tax calculation

- Appeal any tax penalties imposed by HMRC

- Inform HMRC that you are no longer self-employed

- Apply to reduce your payments on account if your circumstances change

- Access your Unique Taxpayer Reference (UTR) number

National Insurance & State Pension

- Check for gaps in your National Insurance contributions (NICs)

- Check your State Pension forecast

- Find your National Insurance Number

Benefits and Allowances

- Check and manage your tax credits

- Check or update your Marriage Allowance

- Manage Child Benefit, apply for, update, or stop your claim

- Check or update employment benefits such as a company car or medical insurance

- Claim working from home tax relief

Payments and Correspondence

- Make a payment to HMRC

- Set up and manage direct debits for tax payments

- Go paperless and receive communications from HMRC by email or online

- Access digital copies of tax documents and HMRC letters

- Track the status of forms you have submitted online

Personal Details

- Inform HMRC about a change of address

- Update your name, address, or contact details directly with HMRC

- Find your Unique Taxpayer Reference (UTR) number

How to Set Up a Personal Tax Account (Step-by-Step)

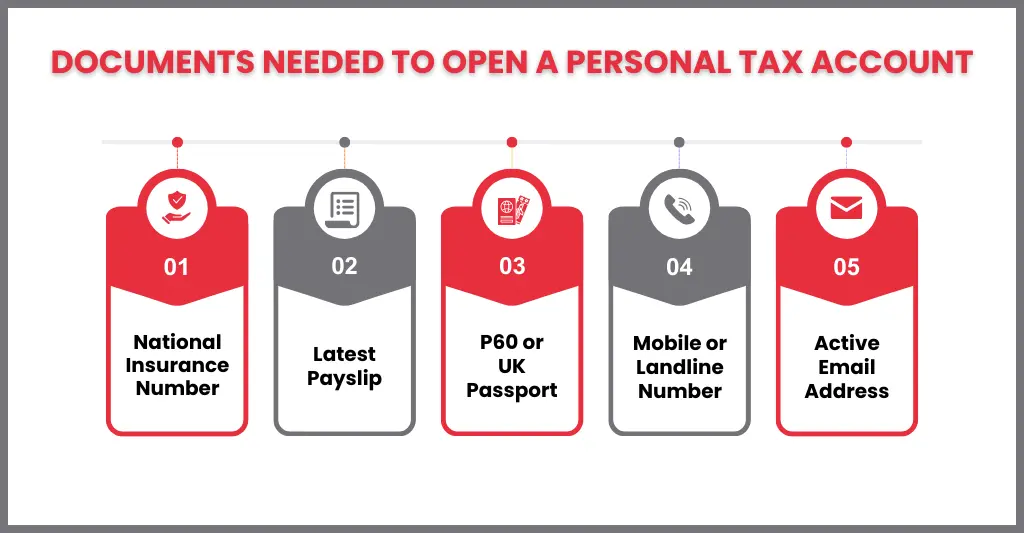

Setting up your Personal Tax Account takes around 10 minutes. Before you start, make sure you have the following to hand:

Documents you’ll need:

- Your National Insurance number

- A valid UK passport, photocard driving licence issued by the DVLA, or biometric residence permit

- A recent payslip (within the last 3 months) or a P60 from your last tax year

- Your current mobile number or landline (for two-step verification)

- An active email address

Step 1: Visit the official HMRC website

Go to www.gov.uk/personal-tax-account and click “Sign in”.

Step 2: Sign in or create a Government Gateway account

If you have previously submitted a Self-Assessment tax return, claimed Tax-Free Childcare, or used any other HMRC online service, you likely already have Government Gateway credentials. Use those. If not, click “Create sign-in details”, enter your email address, create a password, and set up a recovery word.

Step 3: Verify your identity

HMRC will ask you to confirm your identity using your National Insurance number plus one or two of the following: a valid UK passport, a photocard driving licence, a recent payslip or P60, or details from a previous tax credit claim or Self-Assessment return.

Step 4: Set up two-step verification

Choose to receive a security code by text message or phone call. Enter the code to confirm your identity.

Step 5: Complete registration

Answer the remaining security questions. Once verified, your Personal Tax Account is active and ready to use.

Step 6: Log in any time

Return to www.gov.uk/personal-tax-account using your Government Gateway User ID and password whenever you need to access your account.

What About the HMRC App?

Once you have a Government Gateway account, you can also download the free HMRC app to your smartphone. The app gives you access to the same information and services as the Personal Tax Account website, including your tax code, National Insurance number, and tax estimates.

It is particularly useful for quickly checking your details on the go, without needing to log in through a browser. The app is available on both iOS and Android via the official app stores.

What Your Accountant Can and Cannot Access

This is one of the most important things to understand about your Personal Tax Account, and it directly affects how you and your accountant can work together most effectively.

What your accountant can do on your behalf:

- Review changes to your tax codes and contact HMRC as necessary

- Check for changes to your employment benefits

- Help calculate and submit claims to reduce payments on account (if you are in Self-Assessment)

- Review information you share from your PTA to advise you on tax liabilities, refunds, or gaps in your NI record

What only you can access directly:

- Your National Insurance record and State Pension forecast

- Tax Credits and Child Benefit information

- Your P60 pay and tax details, HMRC no longer provides these to accountants over the phone, making your PTA the most reliable source of this data

This means that even if you have an accountant handling your Self-Assessment or other tax matters, setting up your own Personal Tax Account is still essential. Your PTA is updated monthly with your pay and tax details. If you have lost your P60 or not yet received it, you can retrieve this information from your PTA and pass it to your accountant, helping confirm your tax position sooner and giving you more time to prepare for any payments or receive any refunds owed.

Safety and Security

Your Personal Tax Account is protected by multiple layers of security, including a unique Government Gateway User ID and password, plus two-step verification every time you log in. HMRC also uses firewalls and data encryption to monitor for unauthorised access.

Your responsibilities:

- Always log out after each session

- Never share your password or security codes with anyone, including your accountant, who does not need them to assist you

- Treat your Government Gateway credentials like online banking login details

Frequently Asked Questions

Can I file all my tax returns through my Personal Tax Account?

Yes — if you are in Self-Assessment you can file your tax return directly through the PTA. However, if your accountant submits your return on your behalf, they will do so via their own HMRC agent portal. You do not need to file separately in that case.

What if I forget my Government Gateway User ID?

You can recover your User ID using the email address linked to your account. Visit the HMRC sign-in page and click “I’ve lost my user ID or password”.

If you no longer have access to that email, you may need to re-verify your identity or contact HMRC support.

How do I pay my tax bill through my Personal Tax Account?

Once logged in, navigate to the payments section. You can pay by bank transfer, debit card, or set up a direct debit for regular payments.

Is my data safe in the Personal Tax Account?

Yes. HMRC uses multi-layer security including two-step verification and encrypted data storage. Treat your login credentials as you would your online banking details and never share them.

Can I access my Personal Tax Account on my phone?

Yes. You can use the mobile-optimised website at gov.uk/personal-tax-account or download the free HMRC app from the iOS or Android app store.

Conclusion

Your Personal Tax Account is the simplest and most reliable way to stay on top of your UK tax affairs. With 24/7 access to your records, the ability to update your details instantly, and secure communication with HMRC, it puts you firmly in control. Even if you have an accountant managing your Self-Assessment or other tax matters, your PTA holds information only you can access, making it an essential tool for both you and your adviser.

If you have complex tax affairs or need help interpreting what you find in your Personal Tax Account, our team at CoxHinkins is here to help. Contact us to speak with a qualified tax adviser.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.