- What Is a Self Assessment Tax Return?

- Who Needs to File a Self Assessment Tax Return?

- When Do You Need to File a Self Assessment Tax Return?

- Key Self Assessment Deadlines for 2026

- Penalties, Fines, and Interest: What Happens If You Miss the HMRC Deadlines

- Registering for Self Assessment & Getting a UTR

- What Documents & Information Do You Need to File an Assessment Tax Return

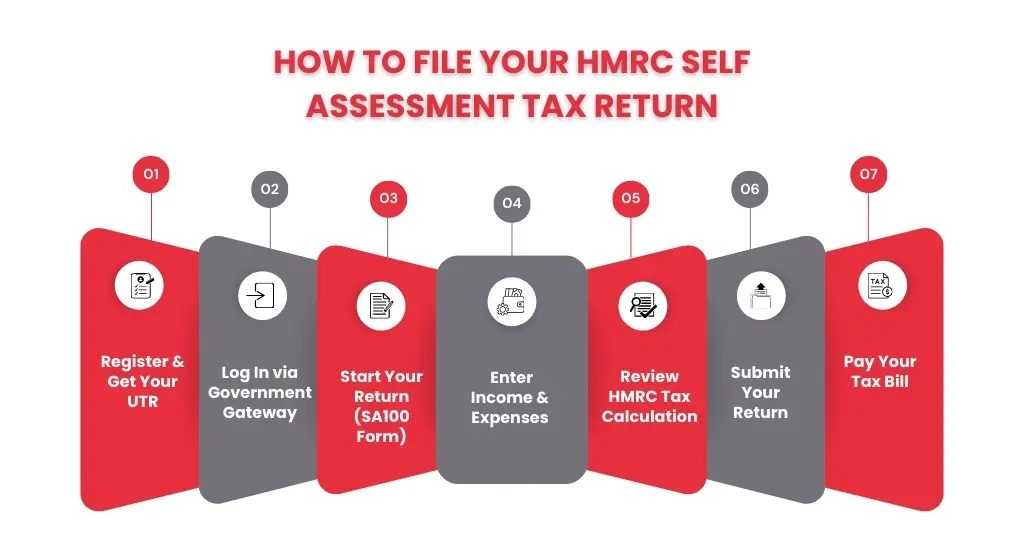

- How to Fill In Your Self Assessment (SA100) — Step-by-Step

- Claimable Expenses & Simplified Expenses

- How HMRC Calculates Your Tax & Payments on Account

- Making an Amendment / Dealing with HMRC Enquiries

- FAQs: Frequently Asked Questions

- Conclusion

You must file your HMRC Self Assessment tax return for 2026 if you have income that isn’t taxed at source, such as self employment, property rental, dividends or foreign earnings. This allows you to report your income, claim expenses and reliefs and pay the right amount of tax. Although the thought of doing a tax return can be daunting, knowing the deadlines, documents and step by step process can make it much easier.

In this guide you’ll learn how to file your Self Assessment tax return accurately and on time, avoid penalties and feel confident throughout. Whether this is your first time or you’re experienced with Self Assessment, our checklist and explanations will help you navigate HMRC’s requirements stress free.

What Is a Self Assessment Tax Return?

HMRC uses a Self Assessment tax return to collect income tax from individuals whose income isn’t subject to PAYE (Pay As You Earn) automatically. Reporting your income, expenses, and any applicable tax breaks is your responsibility rather than your employer’s.

For example, whether you are self-employed, a landlord, get dividends or savings, or have foreign income, you will need to fill out a Self Assessment. HMRC can determine your tax and national insurance obligations, as well as whether you have overpaid and should receive a refund, using the return.

Who Needs to File a Self Assessment Tax Return?

In the UK, not everyone is required to file a self-assessment. Only those who fall into specific categories or whose income isn’t fully taxed at source through PAYE will need to fill out one. You have to submit if:

- You’re self-employed as a sole trader and earned more than £1,000 (before expenses).

- You’re a partner in a business partnership.

- You earn rental income from property.

- You have savings, investments, or dividend income above your allowances.

- You receive foreign income, such as from overseas work or property.

- Your total income is more than £100,000.

- You or your partner receives Child Benefit, and your income is over £50,000 (High Income Child Benefit Charge).

- You have untaxed income, like freelance work, tips, or commissions.

- You need to claim tax reliefs or allowances not already included in your tax code.

When Do You Need to File a Self Assessment Tax Return?

There are penalties for skipping the self-assessment returns, which have tight deadlines every tax year. Your filing dates may vary depending on how you file during the UK tax year, which runs from April 6 to April 5:

- Paper tax returns: Must be filed by 31 October following the end of the tax year.

- Online tax returns: Must be filed by 31 January following the end of the tax year.

- Tax payments: Any tax you owe must also be paid by 31 January.

Example: For the 2024/25 tax year (6 April 2024 – 5 April 2025):

- Paper deadline: 31 October 2025

- Online deadline: 31 January 2026

- Payment deadline: 31 January 2026

Every year, if you’re paying on account, your first installment is due on January 31 and your second by July 31.

Key Self Assessment Deadlines for 2026

The greatest method to prevent late filing fees and interest costs is to stay on top of deadlines. Important dates for the 2025–2026 tax year (which covers income from April 6, 2025, to April 5, 2026) are as follows:

- 5 October 2025 – Deadline to register for Self Assessment if you’re new to it (self-employed, landlord, etc.).

- 31 October 2025 – Deadline for filing a paper tax return.

- 31 January 2026 – Deadline for filing an online tax return for 2024/25.

- 31 January 2026 – Deadline to pay any tax owed for 2024/25.

- 31 January 2026 – First payment on account due for 2025/26 (if applicable).

- 31 July 2026 – Second payment on account due for 2025/26 (if applicable).

Penalties, Fines, and Interest: What Happens If You Miss the HMRC Deadlines

Lost Deadlines for the HMRC Self Assessment might soon become costly. If you fail to pay on time or file beyond the deadline, the following will occur:

Late filing penalties

- 1 day late: Automatic £100 fixed penalty, even if you don’t owe tax.

- 3 months late: Daily penalties of £10 per day, up to £900.

- 6 months late: An extra penalty of £300 or 5% of the tax due (whichever is higher).

- 12 months late: Another £300 or 5% of the tax due (higher amount). In serious cases, penalties can be even higher.

Late payment penalties

- 30 days late: 5% of the unpaid tax.

- 6 months late: Another 5%.

- 12 months late: Another 5%.

Interest: HMRC charges daily interest on any overdue taxes from the day following the deadline until they are paid, in addition to penalties.

Registering for Self Assessment & Getting a UTR

You must have a Unique Taxpayer Reference (UTR) and be registered with HMRC before you can submit a Self Assessment. For tax purposes, you are identified by this 10-digit number.

How to register?

- Self-employed or sole proprietors: Use the HMRC portal to register online.

- Not self-employed (for example, a landlord, an investor, or someone who must report additional sources of income): To register, fill out form SA1.

- Partnerships: Each partner and the partnership need to register independently.

Deadlines: Self-assessment registration is due on October 5th, the day after the tax year in which you began receiving untaxed income.

Getting your UTR:

- After you register, HMRC will mail your UTR; if you live outside of the UK, it may take up to 10 working days.

- In order to file online, you must also create an account on Government Gateway.

When to Register?

As soon as you begin receiving income that isn’t subject to source taxation, including dividends, rental income, or self-employment, you must register for Self Assessment.

How to Register (Step-by-Step)

Although registering for Self Assessment is simple, the procedure differs slightly based on your circumstances. This is a concise, step-by-step guide:

Decide your category: Those who work for themselves or as sole proprietors should register through HMRC’s online “Register for Self Assessment and Class 2 National Insurance” program.

Not working for yourself (for example, as a landlord, investor, or side income) => Fill out form SA1 online.

Partnerships: Each partner must register separately, as must the partnership.

Create a Government Gateway account: A Government Gateway user ID and password must be created if you don’t already have one. HMRC’s internet services will be accessed using this.

Submit your details: Fill in your personal information, including your name, address, date of birth, and NI number. As well as mention details about your sources of income, such as investments, rentals, and self-employment.

Receive your Unique Taxpayer Reference (UTR): HMRC will send you a 10-digit UTR number via email. 10 working days may pass in the UK (or longer if overseas).

Activate your account: Additionally, an activation number for your HMRC online account will be mailed to you. To log in and begin filing online, use this.

Troubleshooting Lost UTR / Gateway Access

Losing access to your Government Gateway or misplacing your UTR are frequent occurrences, but both are recoverable. What to do is as follows:

Lost your UTR (Unique Taxpayer Reference)?

- Your UTR is a 10-digit number that can be found by looking through your tax returns, prior HMRC correspondence, or your HMRC online account.

- If it’s not there, ask HMRC for it:

- Make use of the HMRC web portal.

- Contact the Self Assessment help desk as well. HMRC will mail it to the address you have on file; for security reasons, they won’t release it to you over the phone.

Forgotten your Government Gateway user ID or password?

- Choose “I have forgotten my password” or “I have forgotten my user ID” when you get to the Government Gateway login page.

- To reset access, you’ll need your email address, UTR or NI number, and a few other personal details.

Locked out of your account?

- Follow the reset procedure if you are locked out after too many unsuccessful tries.

- A new activation number might occasionally need to be mailed to your address by HMRC.

What Documents & Information Do You Need to File an Assessment Tax Return

The process goes much more smoothly and helps you prevent errors if you have all the required paperwork available before you begin your self-assessment. What you usually require is as follows:

Personal Information

- Unique Taxpayer Reference (UTR)

- National Insurance number

- Personal details (name, address, date of birth)

Income Records

- Employment income (P60, P45, P11D forms)

- Self-employment income and business expenses

- Rental income and property-related expenses

- Dividends and interest from savings and investments

- Foreign income (if applicable)

- Any other untaxed income (tips, freelance work, commissions)

Expense & Deduction Records

- Business expenses (invoices, receipts, mileage logs)

- Pension contributions

- Gift Aid donations

- Any other tax reliefs you plan to claim

Other Relevant Documents

- Records of capital gains from selling property, shares, or other assets

- Details of student loan repayments (if applicable)

- Information about partnerships or trusts

How to Fill In Your Self Assessment (SA100) — Step-by-Step

The key to finishing your self-assessment is to collect accurate data, complete the appropriate parts, and submit them on time. Here’s how to do it exactly:

Log in to HMRC Online Services

- Go to the HMRC Self Assessment website.

- Enter your password and user ID for Government Gateway.

- Set up access with your UTR (Unique Taxpayer Reference) and activation code if this is your first time.

Start Your Return

- Choose the tax year you wish to file for, such as April 6, 2024, through April 5, 2025.

- Verify your name, residence, birthdate, and marital status, among other personal information.

- Update your work status (landlord, self-employed, employed, both, etc.).

Enter Your Income

HMRC will guide you through different sections based on your situation:

- Employment income: Enter the amounts from your P11D (employer-provided costs and benefits), P45 (if you changed employment), and P60 (total salary and tax withheld).

- Income from self-employment: Report your company’s profit, turnover, and permitted expenses. You can use the short form if your turnover is less than £85,000; if it is more than that, you must use the complete form.

- Revenue from a property: Enter rental revenue and deductible costs (insurance, repairs, mortgage interest, letting agent fees, etc.).

- Savings & investments: Add interest from bank accounts, dividends, and other investment returns to your savings and investments.

- Foreign income: Rent, pensions, and foreign earnings are examples of international income; you could also need to apply for foreign tax relief.

- Other income: Other sources of income include commissions, lump sums, trust income, tips, and taxable state benefits of any kind.

Review HMRC’s Tax Calculation

- Once all income and reliefs are entered, HMRC automatically calculates:

- Total taxable income

- Income Tax owed

- National Insurance contributions (if self-employed)

- Payments on account (advance tax for next year, if applicable)

- Double-check figures against your own records — mistakes can mean penalties.

Submit Your Return

- Before submitting, be careful and review the entire return.

- When ready, click Submit.

- Save or print the submission receipt and a full copy of your return for your records.

Pay Your Tax Bill

Deadline: 31 January after the end of the tax year.

If you make payments on account, your second instalment is due by 31 July.

Payment options:

- Bank transfer (Faster Payments, CHAPS, or Bacs)

- Debit/Corporate credit card online

- Direct Debit (set up in advance)

- At your bank or building society (with a payslip)

If you can’t pay in full, contact HMRC to arrange a Time to Pay plan.

Claimable Expenses & Simplified Expenses

Deducting acceptable business expenses from your income can lower your tax liability if you work for yourself. These expenses are “wholly and exclusively” related to your company.

Common allowable expenses include:

- Office costs: stationery, phone bills, software, and internet.

- Business premises costs: rent, utilities, business rates (not if it’s your home).

- Travel costs: fuel, parking, train, bus, flights, and accommodation (excluding commuting).

- Staff costs: employee wages, pensions, subcontractors, training.

- Stock and materials: raw materials, finished goods, and packaging.

- Marketing and advertising: website costs, social media ads, printing.

- Professional fees: accountants, solicitors, and insurance.

- Clothing: uniforms or protective clothing (not everyday wear).

Simplified Expenses: Additionally, HMRC provides a simplified expenditures plan. For some expenses, you can claim flat-rate allowances rather than keeping track of every real cost:

Business mileage:

- 45p per mile for the first 10,000 miles, 25p after that (cars/vans).

- 24p per mile (motorcycles).

- Working from home: Flat monthly rate based on hours worked at home (e.g., £10 for 25–50 hours, £18 for 51–100 hours, £26 for 101+ hours).

- Living at your business premises: Flat rate for living on-site (e.g., guesthouse, B&B(small lodge).

How HMRC Calculates Your Tax & Payments on Account

After you submit your Self Assessment, HMRC calculates your income tax and national insurance liability. It is calculated by subtracting any reliefs and allowances from your total taxable income.

Step 1: Work out taxable income

- Add up all of your income, including dividends, savings, rental income, work (PAYE), and self-employment profits.

- Take advantage of tax breaks, permitted expenses, and your personal allowance (if you qualify).

- Your taxable income makes up the remaining sum.

Step 2: Apply tax bands

For 2024/25 (England, Wales, NI – Scotland has different rates for earned income):

- £0 – £12,570 → 0% (Personal Allowance)

- £12,571 – £50,270 → 20% (Basic rate)

- £50,271 – £125,140 → 40% (Higher rate)

- Over £125,140 → 45% (Additional rate)

Step 3: Add National Insurance (if self-employed)

- Class 2 NICs: Flat weekly rate if profits are above the threshold.

- Class 4 NICs: Percentage of annual profits (with thresholds similar to Income Tax bands).

Step 4: Apply Payments on Account (if required)

When less than 80% of your tax is already collected at source and you owe more than £1,000 in tax (after PAYE deductions), HMRC often requests payments on account for your bill the following year.

- First payment: 31 January (same time as balancing payment for the previous year).

- Second payment: 31 July.

- Each instalment is normally 50% of your last tax bill.

Example:

- 2023/24 tax bill = £3,000.

- On 31 January 2025, you pay:

- £3,000 (balancing payment for 2023/24) + £1,500 (first payment on account for 2024/25).

- On 31 July 2025, you pay:

- £1,500 (second payment on account for 2024/25).

You can request a reduction in account payments if your income is lower the next year.

Making an Amendment / Dealing with HMRC Enquiries

You can still make corrections or reply to HMRC if they have questions about your return after you have submitted your Self Assessment.

Amending your tax return

Changes can be made up to a year after the deadline for online filing.

- For instance, you have until January 31, 2026, to make changes to the 2023–2024 return that is due on January 31, 2025.

- Adjustments may be made by:

- Enter your HMRC login credentials and choose “Amend Return.”

- sending the updated data to HMRC (if you filed on paper).

- Should the adjustment result in an increase in your tax liability, you will also be required to pay interest (and maybe penalties) from the original due date.

- You will receive a refund from HMRC if you overpaid.

HMRC enquiries

- To verify correctness, HMRC may initiate an inquiry into your tax return.

- If they need further information, they will write to you, and you have to reply by the specified timeframe.

- Investigations could examine:

- income numbers that are inconsistent with HMRC’s data.

- claims for large or extraordinary expenses.

- sporadic verifications of conformity.

- You might be required to submit supporting documentation, such as bank statements, invoices, and receipts.

- If mistakes are discovered, you may be subject to additional tax, interest, and penalties; the penalties may be greater if the error was intentional or covered up.

FAQs: Frequently Asked Questions

Which costs are covered by my self-employment claim?

Travel, office expenses, professional fees, equipment, and other costs associated with working from home are all considered allowable business expenses. It is not possible to claim personal expenses.

How long do I need to keep my records?

Maintain records (invoices, statements, receipts, etc.) for a minimum of five years beyond the filing date of January 31.

What if I make a mistake on my return?

After the deadline, you have 12 months to make changes to your return. Then you have to get in touch with HMRC. If the error led to an underpayment of taxes, there can be penalties.

Can I pay my tax in instalments?

Yes. HMRC may be able to set up a “Time to Pay” plan with you if you are unable to make the entire payment before January 31.

What steps should I follow to complete my self-assessment as a company director?

If you’re a company director, filing your self-assessment is pretty similar to anyone else, but there are a few extra things you need to include, like your salary and dividends. Here’s how to go about it:

Register for Self-Assessment if you haven’t already done so.

Collect your documents — you’ll need your P60, P11D, and info about any dividends or salary you’ve paid yourself.

Log into your HMRC account and start filling out your self-assessment form (SA100) online.

Fill out the sections for directors — this will include your salary, dividends, and any benefits you’ve received from your company.

Double-check everything and then submit your return, including any allowable business expenses you want to claim.

By following these steps, you’ll have your self-assessment sorted in no time!

Conclusion

Filing your HMRC Self Assessment tax return might be difficult, but it can be made much easier by organising your paperwork in advance and breaking it down into simple steps. Keep in mind the important dates: October 31, 2025, for paper returns, and January 31, 2026, for online submissions and payments, to avoid needless fines. Maintain thorough records, make sure you’re getting all the reliefs and allowances you’re entitled to, and verify your return one last time before filing.

If your financial situation is more complicated or you have questions about any step of the procedure, think about using approved software or consulting a certified accountant. When tax season finally arrives, being proactive and organised will help you fulfill your responsibilities and stay stress-free.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.