Having to deal with an HMRC investigation can be stressful and difficult, particularly if you don’t know why you were chosen or what the procedure entails. Stay calm and take the necessary action immediately, regardless of whether it’s a random check or the result of inconsistencies in your tax filings.

You will learn how to react at every stage of an HMRC investigation and what to anticipate from this guide. You can minimise any fines or disturbance to your personal or corporate finances by navigating the process with confidence if you have the correct strategy and assistance.

What is an HMRC Investigation?

HMRC has the right to look into your financial records and tax issues at any time to make sure you’re paying the correct amount of tax. HMRC will notify you in writing or over the phone of what they intend to look into. HMRC will get in touch with your accountant if they prepare your tax returns; they should notify you right away.

In addition to self-assessment tax forms, HMRC also looks into VAT returns, Corporation Tax reports, and employers’ PAYE records, among many other things. HMRC may conduct a complete inquiry, which involves looking at all financial and tax records, or it may concentrate on a single area (such as a recent self-assessment tax return). HMRC also conducts irregular investigations, which may include all taxpayers and businesses, even if they are less frequent. These investigations can be conducted regardless of the quality of your accounts or tax returns.

What Types of HMRC Investigations Are There?

HMRC has the authority to conduct tax investigations at three distinct levels:

Full inquiry: When HMRC conducts a complete inquiry, it will examine all of your company’s documents and, in the case of limited businesses, the tax affairs and accounts of the directors. This is typically due to its perception that there is a high chance of intentional tax evasion or tax errors.

Aspect inquiry: As the name suggests, HMRC will examine one or more parts of your finances. Inconsistencies in a section of a recent tax return may indicate an aspect inquiry, which is typically the consequence of an honest error. If HMRC discovers a mistake, it will wish to look for more discrepancies in earlier periods.

Random check: Random checks are possible at any time and do not indicate that HMRC believes your taxes include any problems. Regardless of the status of your accounts or whether you have raised an alert, HMRC is free to examine your data.

How will you Be Notified About an HMRC Investigation?

HMRC will always formally notify you in writing if it chooses to look into your tax issues. Usually delivered by mail or, in certain situations, electronically through your HMRC online account, this takes the shape of a formal letter.

In addition to identifying the areas being examined, the letter will describe the type of investigation being started, such as a complete inquiry, aspect inquiry, or compliance check. Along with defining the information that HMRC needs from you, such as bank statements, tax returns, or company records, it will also specify when you must respond.

It’s important that you thoroughly read the letter sent by HMRC and reply before the deadline. If you ignore it, you may face fines or other consequences. Before responding to the letter, it’s a good idea to consult a trained tax consultant if you have any questions.

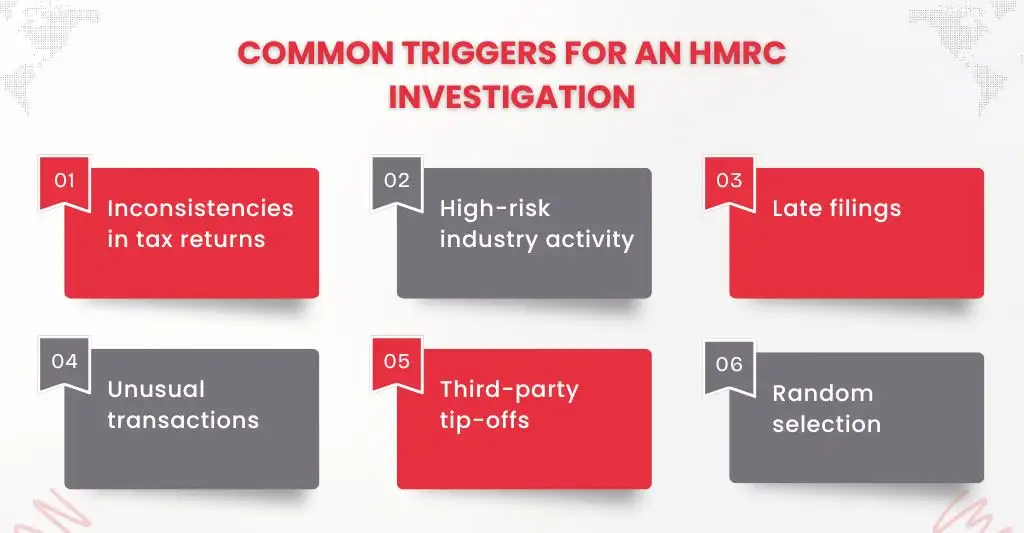

What triggers an HMRC investigation?

HMRC has a complete history about you or your company, so filed tax returns are compared to that information, and any notable discrepancies may lead to an investigation by HMRC. Discrepancies are unlikely to go unreported because anything unexpected can be immediately detected by HMRC’s advanced data technologies.

Therefore, HMRC could want to know why, for instance, your declared company expenditures have increased or your turnover has decreased significantly, lowering your tax liability. It is advisable to be careful while filing your self-assessment tax return because even minor errors can lead to HMRC inspections, and claiming ignorance cannot save you from a fine.

In industries where working “cash in hand” to cover wages is more common, HMRC examinations may be more frequent. Additionally, if the information on your tax return differs from industry or business-type norms, it may raise suspicions. While third-party tip-offs may lead to tax investigations, consistently completing your Self Assessment tax returns after the due date may also result in an HMRC investigation.

How Should I Prepare for an HMRC Investigation?

Understand the Type of Investigation

The extent of HMRC inquiries can differ. Common varieties consist of:

- Random Check: Usually done, but not always because of misconduct.

- Aspect Enquiry: Focusing on a particular area of your return, such as income or expenses, is known as an aspect inquiry.

- Comprehensive Enquiry: An in-depth examination of your entire tax situation, usually for individuals or companies.

- Criminal Investigation: In situations where fraud or tax evasion is suspected.

Knowing the type helps you prepare accordingly.

Read HMRC’s Letter Carefully

A formal letter usually starts the investigation. It will describe:

- The purpose of the investigation

- The documents or information they require

- A cutoff time for your reply

- Be sure to respond promptly; failing to do so can cause the situation to worsen

Seek Professional Advice Immediately

Employ a certified tax advisor, tax investigator, or accountant. They intend to:

- Speak to HMRC on your behalf.

- Examine your documents for any possible problems.

- Give you advice on how to react.

- Assist you in avoiding needless penalties.

Gather and Organise Your Records

Make sure your records are complete and accurate, including:

- Bank statements

- Invoices and receipts

- Payroll records

- VAT returns

- Self-assessment tax returns

Good records strengthen your case and help resolve matters quickly.

Consider Voluntary Disclosure

HMRC’s Contractual Disclosure Facility (CDF) or Let Property Campaign (for landlords) may be useful if you think you may have mistake. Error disclosures made voluntarily frequently result in lower penalties

Understand Potential Outcomes

Based on the results, HMRC might:

- Close the inquiry and accept your records.

- Request more tax payments, along with interest and penalties.

- In severe fraud cases, bring charges.

What Happens During the HMRC Investigation Process?

The following crucial steps are commonly included in the HMRC inquiry process:

- Initial Contact: A formal letter from HMRC describes the parameters of the investigation and the particular data or documents needed.

- Information Collection: You (or your advisor) are required to provide the records that are requested, such as invoices, bank statements, or tax returns.

- Review and Analysis: HMRC examines the data in order to spot any irregularities, underpayments, or indications of fraud.

- Meetings or Interviews (if necessary): If the case is more complicated, HMRC may ask for face-to-face meetings in order to get clarification on information or pose further queries.

- Resolution and Outcome: HMRC decides, which may include a clean bill of health, a request for more taxes and fines, or, in extreme circumstances, legal action.

- Appeals Process: You have the option to contest the decision in a tax tribunal or through internal review if you’re unhappy with the result.

What Are the Possible Outcomes After an HMRC Investigation?

- No Need for Action: The case is closed if everything appears to be in order.

- Tax Due: You could have to pay additional taxes and interest.

- Penalties: The amount of the fine is determined by how careless or intentional the error was.

- Decreased Penalties: Penalties may be decreased through voluntary disclosure.

- Payment Schedule: You may be able to make payments in installments.

- Prosecution: Criminal charges may result from serious fraud.

- Right to Appeal: You have the option to contest HMRC’s ruling via the proper channels.

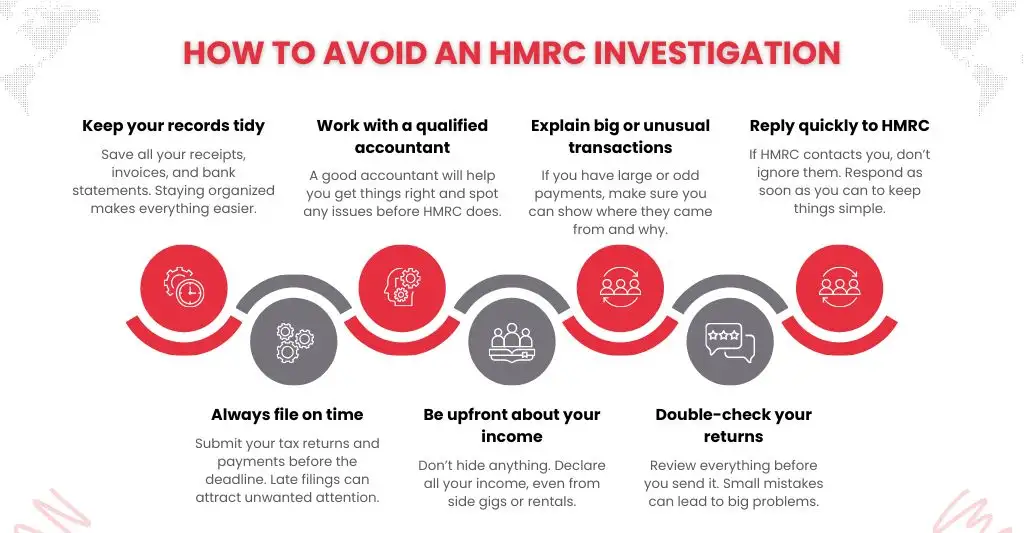

Tips to Prevent an HMRC Investigation

Keep Accurate Records: Keep accurate and transparent financial records.

File Tax Returns on Time: Inaccurate or late filings can lead to an investigation.

Employ a Qualified Accountant: Expert assistance guarantees compliance and lowers errors.

Keep Transparency: Be open and honest by disclosing all of your revenue, including that from side gigs and rentals.

Avoid unexplained transactions: Steer clear of big, unexplained transactions as they may raise suspicions.

Examine Returns Before Submission: Check all the data and statements of the document.

Answer HMRC Letters Right Away: Ignoring questions may result in inquiries.

How long does an HMRC investigation usually take?

Depending on its complexity, an HMRC inquiry may take a few weeks to many months.

- Aspect inquiries could take three to six months.

- Complete investigations may take a year or longer.

- Incomplete records or slow responses may cause delays.

How Far Back Can HMRC Investigate Tax Years from the Distant Past?

HMRC can go back:

- 4 years for innocent errors

- 6 years for careless mistakes

- 20 years for deliberate tax evasion

In fraud cases, there’s no time limit if criminal proceedings are involved.

How Coxhinkins Will Help You If You Receive an HMRC Investigation?

Coxhinkins provides competent and trustworthy assistance to help you navigate an HMRC investigation with assurance. Our staff will evaluate your case as soon as you get in touch with us, describe the kind of investigation you’re dealing with, and suggest the best course of action. We take care of all correspondence with HMRC on your behalf, making sure that your answers are precise, prompt, and well-formatted. To support your position and prevent needless issues, our professionals help collect and examine the required documentation.

To minimise fines and settle disputes as quickly as possible, we also offer strategic counsel specific to your situation. We engage in direct negotiations with HMRC where it is necessary to achieve equitable results, such as tax settlements or payment schedules. After the inquiry is over, Coxhinkins provides ongoing assistance to help you maintain compliance and steer clear of problems in the future. When you have us on your side, you may proceed through the inquiry process with clarity and comfort.

Frequently Asked Questions

Will an inquiry have an impact on my company’s reputation or credit score?

Your credit score is unaffected, but if the situation is severe or made public, it could harm your reputation.

How far back in time can HMRC look at my taxes?

For small mistakes, they can go back four years; for carelessness, they can go back six years; and for intentional fraud, they can go back up to twenty years

What should I do if my tax return contains a real error?

To minimise any fines, it is important to voluntarily notify HMRC of the inaccuracy as soon as possible.

Is it possible for HMRC to look into dormant or closed businesses?

Yes, if they believe there were tax irregularities during the operation of the business.

Conclusion

An HMRC inquiry can be stressful, but it doesn’t have to be if you have the correct help and direction. The key to getting the greatest result is being aware of your rights, comprehending the procedure, and acting quickly. Getting professional assistance can make all the difference, whether it’s a small inquiry or a comprehensive investigation.

Our goals at Coxhinkins are to safeguard your rights, ease your stress, and assist you in finding a speedy and effective solution. If you have received a notice from HMRC or believe you are being reviewed, don’t hesitate to contact us right now for professional or private assistance.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.