Managing the world of personal finance can be stressful, especially when faced with decisions about investments, retirement planning, tax strategies, and wealth management. With constantly changing financial markets and complex regulations, it’s easy to feel uncertain about the best course of action for your money. This is where a professional financial advisor can make a significant impact.

Oxford, is well-known for its esteemed educational institutions and vibrant business community, is home to numerous qualified financial advisors who can provide professional advice catered to your individual requirements. Having an experienced financial advisor in Oxford, at your side can help you make confident and well-informed financial decisions, regardless of your position: retiree wanting long-term security, business owner seeking strategic financial planning, or individual hoping to increase your wealth.

Working with a financial expert gives you access to helpful data, individualised plans, and continuous assistance in navigating opportunities and issues related to money. In this guide, we will be looking the top five advantages of working with a financial advisor in Oxford and how their knowledge will help you succeed financially and in the long run.

What Does Financial Advisor Do for You?

The public is often confused or unaware about what a financial advisor can do for you. Let’s understand what crucial role a financial advisor plays in terms of managing the finances.

A financial advisor assists you to maintain a track record with your financial objectives by serving as your mentor, assistant, and instructor. Usually, you begin by discussing investment and financial strategies that are specific to your values, stage of life, and financial situation. Early on, that might mean concentrating on debt repayment and budgeting, but it’s not as if setting financial restrictions won’t accompany you for the majority of your life.

An advisor can assist you in delving deeper into estate planning, tax strategies, and investment planning as your funds increase. A financial advisor should work with you at every stage to figure out how much money you should be investing in your portfolio, which stocks, bonds, and other assets best fit your needs, and how to modify all of this as your life and profession change.

Who Needs a Financial Advisor?

People Facing Major Life Changes

- Marriage or Divorce: Whether you are getting married or separating from a spouse careful financial planning is necessary for stability.

- Planning a child: If a couple is deciding to have a child, they need to save money for child’s future, education expenses and family’s financial security.

- Retirement Planning: It takes sound financial practices to make the shift from earning to spending in order to guarantee a relaxing retirement.

- Buying or Selling a Business: Professional advice is necessary for business transactions involving tax issues, valuations, and investment plans.

People with Financial Complex Situation

- High net worth individuals: Wealthy people prefer financial advisor for diversified investments, tax optimisation, and estate planning.

- Business Owners: Managing sources of income, tax obligations and investment options is not easy for business owners. Therefore, they prefer taking assistance of financial advisor.

- Investors with diverse or complex portfolios: Those who own a variety of assets—stocks, bonds, real estate, etc.—benefit from expert supervision to minimise risks and maximise returns.

People Lacking Financial Knowledge or Time

- Unfamiliar with Investing and Financial Planning: A financial advisor in Oxford offers advice on retirement savings, risk management, and wealth growth.

- Busy Professionals: Expert guidance can help people make wise financial decisions if they lack the time to keep an eye on their finances.

People who struggle with Financial Discipline

- Difficulty with Budgeting and Saving: To manage spending and increase savings, advisors assist in the creation of organised financial plans.

- Emotional Investment Decisions: Professional advice can help avoid market-driven anxiety and impulsive investing decisions.

- Need for Accountability: A financial advisor makes sure you stay on course and make the necessary modifications to reach your financial objectives

Types Of Financial Advisors in Oxford

Certified Financial Planner

A highly qualified advisor who has received the CFP accreditation from the CFP Board is known as a Certified Financial Planner. A CFP has a fiduciary duty to you as a client and may be knowledgeable in a variety of financial matters.

Robo-Advisor

A robo-advisor is a type of financial advisor that builds your investment portfolio by automating the investing process. Numerous routine investment task can be handled by a robo-advisor, which can also conduct some more complex duties that would be challenging for a human advisor to handle.

Wealth manager

High-net-worth individuals receive comprehensive guidance from wealth managers on a variety of financial matters, particularly those pertaining to accumulating and preserving money over time. Investment management, financial planning, estate planning, and tax planning are important subjects.

Financial salesperson

Some financial advisors work as salespeople for financial firms, which means they have a strong desire to sell their employer’s goods. These items might be suitable for your needs, but they might not be the best fit for your particular circumstance or have high commissions.

Portfolio manager

A portfolio manager has a more focused attention to detail regarding your investments. A portfolio manager chooses your investments, determines when to sell, harvests capital losses for tax deductions, and handles other investment-related matters for you.

5 Benefits of Hiring a Financial Advisor

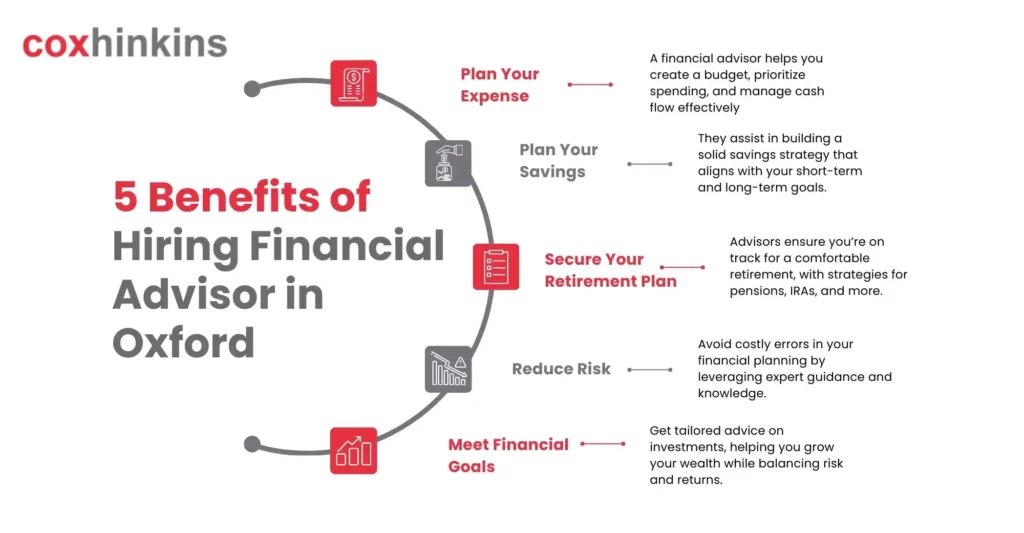

To Help you Plan Your Expenses

A financial advisor assists you in developing a reasonable budget that takes into account your demands, income, and way of life. They examine your spending habits and make recommendations on how to prioritise critical expenses while reducing wasteful spending. Financial Advisor in Oxford ensure that you avoid financial hardship by helping you manage debt effectively. In order for you to enjoy life while safeguarding your future, they offer techniques for striking a balance between your immediate and long-term financial needs.

To Plan Your Savings

Financial advisors in Oxford assist you in establishing reasonable savings targets for unexpected costs, significant life events, and emergencies. To effectively increase your funds, they provide investment options and high-yield savings accounts. In order to provide financial stability in the event of unforeseen circumstances, such as medical issues or job loss, advisors assist in creating an emergency fund. To optimise savings without sacrificing your regular spending, they develop customised strategies.

To Secure Your Retirement Plan

Financial Advisor in Oxford assist you in estimating the amount of money you will require for retirement, taking into account lifestyle decisions, healthcare costs, and inflation. They recommend the best retirement accounts to help you develop a solid retirement fund, such 401(k), IRA, or pension plans. To increase your retirement savings and reduce your responsibilities, financial professionals provide tax-efficient alternatives.

Reduce the Risk of Mistakes

An advisor can help customers avoid costly mistakes by offering unbiased, data-driven advice. Many people make emotional financial decisions, such as panic selling investments. By utilising available credits and deductions and guaranteeing adherence to tax regulations, they assist you in avoiding tax penalties. Through market analysis and the creation of a diverse, well-balanced portfolio, advisors lower the risk associated with bad investment decisions.

To Meet Your Financial Investment Goals

A financial advisor in Oxford will assist you to prepare personalised investment strategy to meet your financial goals. Whether you want do retirement planning, wealth growth or risk management.

How To Find Financial Advisor in Oxford?

Searching for a financial advisor is not so easy quick task as it requires some research and analysis of your needs. Therefore, the first step is to determine your financial objectives, including estate management, retirement planning, investment strategies, and tax preparation. For professional financial advice, look for respectable local companies like CoxHinkins or use internet directories like Unbiased. Make sure the advisor is qualified by looking at their credentials, including whether they are FCA-registered for regulatory compliance and whether they have any appropriate certifications, such as DipPFS or Chartered Financial Planner status.

Evaluate their services and pricing schedules to determine the nature of their fees: fixed or hourly charges, or a portion of the assets they manage. Contact a number of advisors to set up initial meetings to gauge affinity, the method used, and the level of experience. Demand references of past customers, online reviews, or advice of experts such as attorneys or accountants. Finding an honest financial advisor in Oxford with whom you share financial objectives and gives wise advice for the future can only be found through research.

Frequently Asked Questions

Are financial advisors in Oxford regulated?

Yes, the Financial Conduct Authority (FCA) requires registration for financial advisors in the UK. You can confirm that an advisor satisfies regulatory requirements by looking up their credentials on the FCA Register.

How does a wealth manager differ from a financial advisor?

Financial advisor focuses on budgeting, investments, and general financial planning. Whereas, people with high net worth hire wealth manager to perform services such as investment diversification, estate planning and tax efficiency.

How do I determine if a financial advisor is the correct person for me?

Based on their qualifications, experience, fee schedule, and customer feedback, pick a financial advisor. Set up a session to talk about your financial objectives and determine if their strategy suits your requirements.

Conclusion

There is no hard-and-fast rule on when to hire a financial advisor in Oxford. However, if you’re attempting to determine whether you need a financial advisor, there are a few factors to think about. Look for an advisor if you have enough cash in your bank account to begin investing. If you’re going through a big life transition, that’s another indication you need an advisor. Planning for your child’s future, for example, can be facilitated by contacting a financial advisor if you recently became a parent. Consulting a financial advisor is totally a individual’s choice there is no compulsion on any of your decision