- The Economic Backdrop: Why the Autumn Budget Matters in 2025

- Tax Changes You Can Expect in the Autumn Budget 2025

- What This Autumn Budget Means for UK Businesses

- What You Can Still Do Before Year End: Smart Tax Moves

- What’s Likely to Feature in the Autumn Budget 2025

- How We Can Help: Strategic Planning for You and Your Business

- FAQs: Frequently Asked Questions

- Conclusion

Every autumn, the UK Chancellor steps up to deliver one of the most anticipated financial updates of the year, the Autumn Budget. It’s when tax rules, allowances, and spending priorities for the year ahead are revealed, setting the tone for businesses and advisers alike.

The Autumn Budget replaced the old “Autumn Statement” back in 2017, giving the government one main opportunity each year to announce significant tax changes. The Spring Budget 2025 that came earlier in the year gave us a mid-year update, but the Autumn one is the big picture event. It tells accountants what’s really changing from April 2026, and what can still be done before 31 March.

As always, much of the Budget’s impact will filter through HMRC updates and compliance notices, so staying alert to post-announcement guidance is just as important as watching the speech itself.

Key Takeaways: Autumn Budget 2025

- The Autumn Budget 2025 will be delivered on 26 November 2025, setting tax and spending plans that apply from April 2026.

- It is the first post-election Budget from the new government, arriving as inflation cools, growth remains patchy and interest rates stay high.

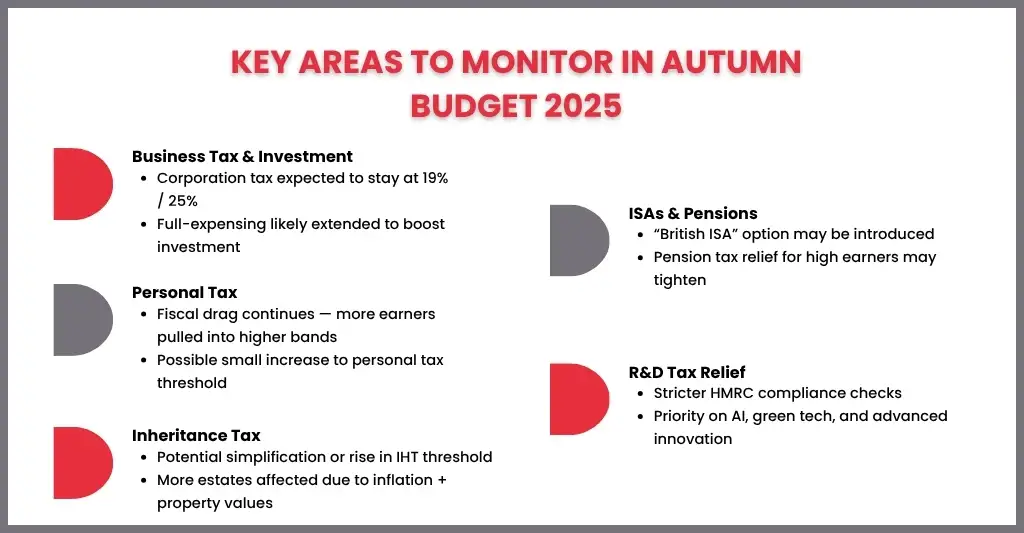

- Key tax areas to look out for: corporation tax, income tax thresholds, inheritance tax, pensions and R&D tax relief

- Businesses may see: capital allowances, payroll and NICs, VAT thresholds, investment incentives and digital tax compliance

- Before 31 March: review salary vs dividends, maximise pension contributions, time capital investments, prepare R&D claims early, plan cash flow

The Economic Backdrop: Why the Autumn Budget Matters in 2025

This year’s Budget lands at a sensitive moment for the UK economy. Inflation has cooled but not quite settled, growth is still patchy, and interest rates are holding firm. Add to that the first post-election Budget from a new government, and it’s easy to see why accountants are keeping a close watch.

Businesses are feeling the squeeze from higher borrowing costs, rising wage expectations, and cautious consumer spending. The Chancellor will need to show that fiscal discipline can coexist with growth incentives, and that’s a tough balancing act.

For accountants, this means clients will be asking the big questions:

- “Should I invest before year-end?”

- “Will corporation tax rise again?”

- “What will happen to my R&D claim?”

This is the Budget that could set the direction for the next few years, not just for tax but for business confidence overall.

Tax Changes You Can Expect in the Autumn Budget 2025

While we can’t see the Red Box in advance, a few likely areas are already being discussed across the industry. Here’s what could be coming.

Corporation Tax 2025

The corporation tax rate currently stands at 25% for profits above £250,000 and 19% for smaller firms. That isn’t likely to rise, but the focus may shift to how companies invest. There’s growing talk about extending the “full expensing” policy, allowing businesses to write off 100% of qualifying capital spend, to encourage investment.

For accountants, this means checking which clients could benefit from bringing forward capital purchases or timing investments carefully before 31 March.

Income Tax Thresholds

Frozen thresholds have been quietly pushing more people into higher bands, the so-called “fiscal drag.” There’s mounting pressure on the Treasury to ease the burden. We might see a modest lift in personal allowances or the higher-rate threshold, but any big cut is unlikely.

A small shift, however, can still change your clients’ salary and dividend mix, so it’s worth reviewing remuneration plans early.

Inheritance Tax Changes 2025

Inheritance Tax reform has been on and off the agenda for years. With housing wealth continuing to rise, the Chancellor might offer a simplified or more generous system, perhaps a higher nil-rate band or reduced rate for estates passing to direct descendants.

Even if the rules stay the same, accountants should treat this as a reminder to review clients’ estate planning. The combination of frozen thresholds and inflation means more families are getting caught by IHT every year.

ISA and Pension Reforms

The government has been exploring ways to boost UK investment through savings incentives. Expect possible tweaks to ISA limits or the introduction of a “British ISA” for UK-based investments.

Pensions could also come under review. While major reforms are unlikely, a change to contribution limits or tax relief rules is always possible. This would directly affect high earners and company directors looking to top up before year-end.

R&D Tax Relief 2025

The R&D regime continues to evolve. After merging SME and RDEC schemes, the government is expected to tighten compliance further while promoting genuine innovation, especially around AI, green tech, and advanced engineering.

If your clients rely on R&D claims, this is a good time to check record-keeping and project documentation. Delays and rejections have become more common as HMRC steps up scrutiny.

What This Autumn Budget Means for UK Businesses

For most UK SMEs, the Autumn Budget 2025 will influence cash flow, hiring decisions, and investment planning. Accountants will need to translate policy headlines into practical steps.

Payroll and National Insurance

Any movement in thresholds or rates will affect net pay and employer contributions. Payroll systems may need quick updates in April.

VAT Adjustments

The VAT registration threshold may come under review again. Even small changes can push growing micro-businesses into registration territory.

Incentives and Allowances

Businesses investing in software, energy-efficient equipment, or green transport could see new or enhanced deductions.

R&D and Innovation Funding

Sectors such as technology, pharmaceuticals, and manufacturing should prepare for stricter but potentially more rewarding R&D rules.

The key message for firms? Don’t wait until the Budget is announced to plan, start mapping out “what if” scenarios now.

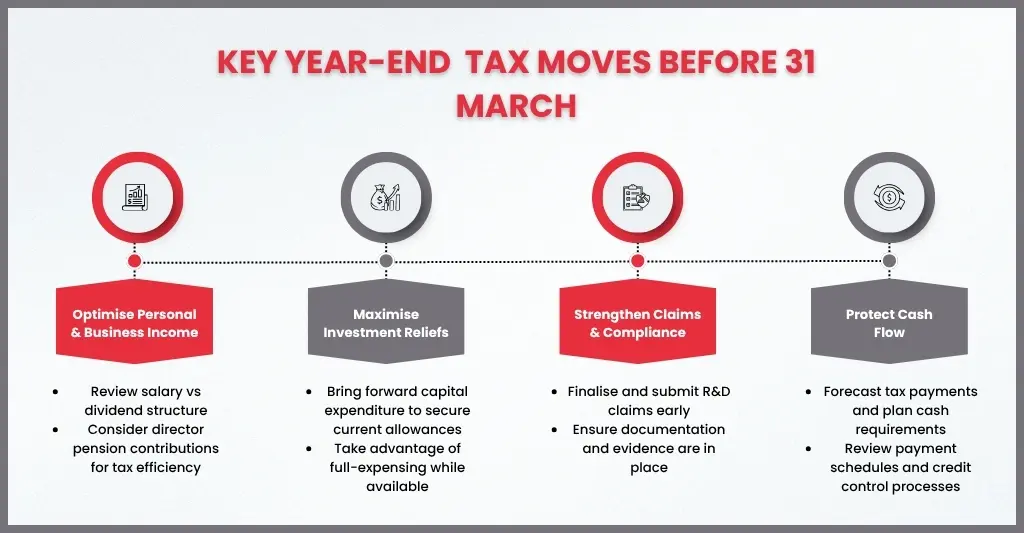

What You Can Still Do Before Year End: Smart Tax Moves

There’s still time to act before 31 March. Here are some practical tax moves accountants can help clients make now before any changes take effect.

1. Review Your Salary and Dividends

With dividend allowances shrinking and tax rates holding firm, it’s worth reviewing the balance between salary and dividends. Sometimes a slightly higher salary can reduce overall liabilities once NICs and pension contributions are considered.

2. Maximise Pension Contributions

If the Chancellor does tighten relief rules, using this year’s full allowance makes sense. For directors, employer contributions can still be an efficient way to lower corporation tax while investing for the future.

3. Use Capital Allowances While They Last

If you’re planning equipment purchases, do it before the year-end to claim under current rules. Full expensing may continue, or it might not. Timing those purchases now can lock in valuable deductions.

4. Submit R&D Claims Early

If your firm handles R&D claims, finalise them ahead of any new compliance tweaks. A well-prepared, early claim avoids surprises and gives clients peace of mind.

5. Manage Cash Flow

Tax planning isn’t only about saving tax, it’s about avoiding shocks. Review upcoming liabilities, payment schedules, and credit control to keep year-end accounts smooth.

What’s Likely to Feature in the Autumn Budget 2025

While we won’t know everything until the big day, most signs point towards a Budget that blends fiscal caution with targeted support. Expect to see:

Investment in Growth

Possible extensions to regional investment zones and incentives for manufacturing.

Support for Green Business

Tax credits or reliefs for companies investing in renewable technology, EV infrastructure, or energy efficiency.

Personal Tax Tweaks

Slight adjustments to allowances or benefit tapers to relieve middle-income pressure.

Simplification and Compliance

Continued emphasis on Making Tax Digital and aligning digital record-keeping with quarterly updates.

In other words, evolution not revolution. But even small policy shifts can have a big ripple effect across payroll, bookkeeping, and forecasting.

How We Can Help: Strategic Planning for You and Your Business

At Cox Hinkins, we help individuals and businesses stay ahead of these changes, not just react to them. Our role goes beyond compliance; we help clients plan, model, and make confident financial decisions before and after the Budget.

Here’s how we support you:

Year-End Tax Planning UK: Identifying timing opportunities and optimising your position before 31 March.

Strategic Advice: Assessing how changes in corporation tax 2025, inheritance tax, or allowances affect your forecasts.

R&D and Investment Support: Helping you prepare compliant, evidence-backed claims that align with HMRC’s evolving rules.

Cash Flow and Forecasting: Ensuring your numbers tell a clear story for the months ahead.

Our advice is straightforward and tailored. We speak the language of business owners and accountants, clear, practical, and proactive.

FAQs: Frequently Asked Questions

When is the Autumn Budget 2025?

The Autumn Budget 2025 will be delivered on Wednesday 26 November 2025.

How is it different from the Spring Budget 2025?

The Spring Budget updates forecasts and short-term spending. The Autumn Budget sets out long-term tax and fiscal measures that usually take effect from the following April.

What are the main tax changes expected?

Possible changes to corporation tax, inheritance tax, and pension allowances, plus tweaks to ISA limits and R&D tax relief rules.

How could it affect small businesses?

It could alter payroll costs, VAT thresholds, or capital allowances, all of which impact cash flow and tax planning decisions.

What should accountants do before year-end?

Review salaries and dividends, maximise pensions, complete R&D claims early, and prepare forecasts for different tax scenarios.

Who delivers the Autumn Budget?

It will be delivered by the Rachel Reeves, the Chancellor of the Exchequer of the UK.

What does it cover?

The Autumn Budget sets out the UK government’s plans for taxation, public spending and the economy for the coming year. It includes forecasts from the Office for Budget Responsibility (OBR)

Conclusion

The Autumn Budget 2025 will shape how accountants, advisers, and business owners plan for the year ahead. While no one can predict every announcement, preparation makes the difference between reacting and leading.

Take the next few months to tidy up your year-end planning, make strategic investments, and talk to your accountant before the Chancellor stands at the dispatch box.

Because in tax planning, like in business, timing is everything.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.