- What Is the Savings Interest Tax Trap?

- How the Trap Works in Practice?

- Why So Many People Fall Into It?

- The True Cost of the Savings Interest Tax Trap

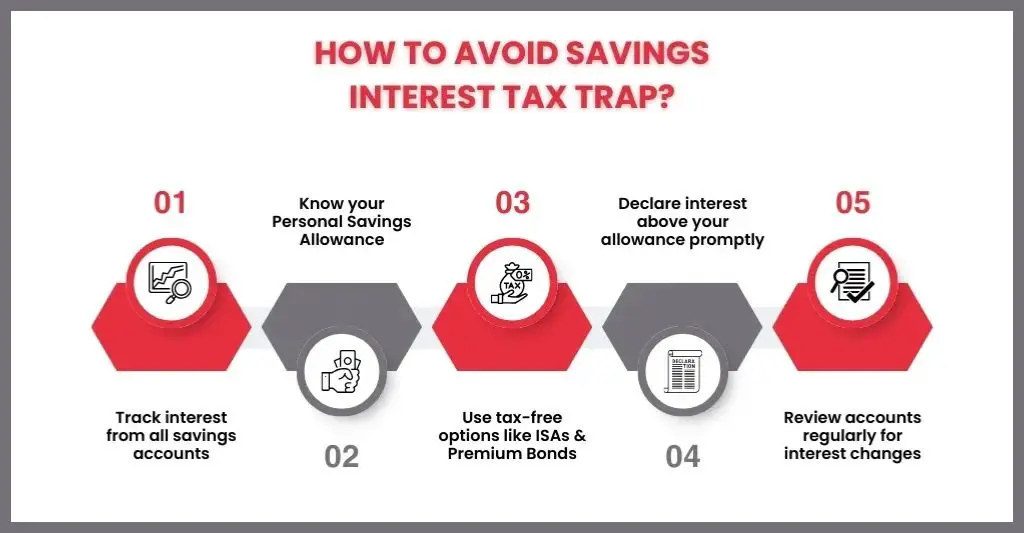

- How to Avoid the Savings Interest Tax Trap?

- Common Misconceptions About the Taxation of Savings Interest

- Quick Self-Check: Could You Be at Risk?

- Frequently Asked Questions

- Conclusion

Unknowingly, millions of UK savers each year pay more tax than needed on their hard-earned interest. It may seem sensible and safe to put money aside in savings accounts, but the interest you earn isn’t always tax-free. In the UK, tax on savings is governed by strict HMRC rules, and many consumers are unaware of the “savings interest tax trap” until it’s too late, often after an unexpected bill from HMRC. The good news? With a few easy techniques and the right information tailored to UK rules, you can protect your savings from needless tax deductions and increase the efficiency of your finances.

As a UK taxpayer, understanding UK-specific rules and allowances makes the difference between a tax shock and maximising your returns. This guide breaks down the main traps, but more importantly, offers proven, legitimate strategies under current UK law to help you avoid them. Make the tax man less concerned about your financial path by enabling yourself to keep more of what you earn

What Is the Savings Interest Tax Trap?

People who earn interest on their deposits but fail to realise that this income is taxable are said to be in the savings interest tax trap. Even though banks automatically pay interest, they don’t always deduct taxes at the source, thus people are still responsible for declaring them. Many people eventually learn that their profits have exceeded the tax-free allowance because they believed that little amounts of interest would not matter.

For instance, the Personal Savings Allowance (PSA) in the UK enables basic rate taxpayers to earn up to £1,000 in interest-free savings, and higher rate taxpayers to earn up to £500 (tax-free).Additional rate taxpayers (those earning over £125,140 per year in 2025) get no allowance. All interest earned above these limits is taxable and must be disclosed on your Self Assessment tax return or will be automatically taxed if HMRC amends your tax code.

The trap occurs when savers don’t recognise that they’ve gone over their allotment, don’t report the additional income, and wind up with unforeseen tax costs or penalties.

Also, if your total income (not savings interest) is less than £17,570 for the year, you may qualify for the “starting rate for savings” of up to £5,000 tax-free, which most UK savers overlook.

Note: If you want to know more about how HMRC warns savers about taxable interest, check out our other blog on the HMRC savings interest tax warning.

How the Trap Works in Practice?

Earning interest from your savings seems simple at first: deposit money, watch it grow, and enjoy additional cash. However, the trap starts when interest collected gradually exceeds your tax-free amount without your knowledge.

- Each of your three savings accounts gives you a small amount of interest. The sums appear little when taken separately—£200 here, £300 there.

- You will have accumulated £1,200 in interest by the end of the tax year.

- Only the first £1,000 is tax-free under the Personal Savings Allowance if you are a basic-rate taxpayer. Taxable income is created from the additional £200.

Since banks often do not automatically deduct tax, HMRC depends on you to disclose the extra interest. Otherwise, the unpaid tax builds up and may result in letters, penalties, or an unforeseen change to your tax code. In some cases, this can even trigger an HMRC investigation into your savings interest, leading to backdated tax demands or fines.

Falling into the trap is considerably simpler for higher-rate taxpayers with a lesser £500 allowance.

Basically, if you’re not keeping track of your overall interest across all accounts, what appears to be simple savings growth might easily become a tax issue.

Why So Many People Fall Into It?

Due to unclear regulations, the majority of savers fall into the savings interest tax trap. It’s easy to underestimate the overall amount generated because interest frequently comes from several accounts. People also think that banks take care of taxes automatically, but in fact, it is the saver’s duty to declare any excess. This misunderstanding, when coupled with fluctuating rates and exemptions, causes millions of people to ignore taxable interest until the bill is sent.

With rates changing frequently and many UK providers paying gross (before tax), it is especially easy to miss when your accumulated interest crosses the annual PSA or starting rate allowance. Always check your total taxable interest—not just individual account statements.

The True Cost of the Savings Interest Tax Trap

Paying more taxes is only one aspect of the trap; other consequences include penalties, unexpected expenses, and worse returns on your savings. Some savers become frustrated and run out of cash when the tax they owe eliminates a large portion of the savings benefits.

Reduced effective return after tax

After taxes are subtracted, the actual return on your savings is frequently far lower than expected. An apparently favourable interest rate can rapidly drop, often causing your money to grow more slowly than inflation.

Compounding impact over several years

You will have less money available for growth if you pay interest taxes annually. When this accumulates over time, your savings become significantly less than they could have been.

Inflation further eroding real gains

The real worth of your savings decreases when inflation increases more quickly than your after-tax interest. This implies that over time, your money will buy less even though your balance increases.

How to Avoid the Savings Interest Tax Trap?

Being alert and using a few clever techniques are the first steps in avoiding the trap:

- Track all your accounts: To determine whether you’re reaching your allowance, add up the interest from all of your savings accounts.

- Know your Personal Savings Allowance: £1,000 for basic rate taxpayers, £500 for higher rate, and none for additional rate. Check your income to see if you also qualify for the starting savings allowance—up to £5,000 extra if your non-savings income is under £17,570. These rules interact closely with your personal tax allowance, which affects how much of your income is tax-free overall.

- Use ISAs or tax-free accounts: The amount you save in these accounts is not deducted from your allotment.

- Consider tax-free UK options like Premium Bonds and NS&I accounts.

- Report excess interest promptly: To avoid penalties, declare anything that exceeds the maximum permitted amount.

- Review regularly: As interest rates fluctuate, things that were previously below the limit can eventually surpass it.

Using tax-free savings choices and monitoring your overall interest will allow you to increase your money without worrying about unexpected tax expenditures.

Common Misconceptions About the Taxation of Savings Interest

Millions of people fall victim to the savings interest tax trap in large part due to common misconceptions and assumptions. Now let’s examine the most common ones:

Banks automatically deduct the tax for me: Many savers believe that their bank will handle their tax responsibilities. In actuality, the majority of banks pay interest in full without taking taxes into account. Any taxable interest beyond your Personal Savings Allowance (PSA) must be reported by you. However, from 2016 onwards, all UK banks and building societies must report interest payments to HMRC directly.

Small amounts of interest don’t matter: Interest of £50 or £100 might seem very less. But these sums soon accumulate, when you have several accounts. A basic-rate taxpayer’s £1,000 PSA maximum might be easily exceeded, for instance, by £300 from one fixed deposit, £400 from a savings account, and £350 from another. The easiest way to get caught is to ignore “small amounts.”

Only high earners pay tax on savings interest: This is a common yet false misconception. The PSA can be exceeded even by middle-class savers, particularly during times when interest rates are greater. Your savings interest may be taxable even if you are not “wealthy.”

The rules never change: Savings interest regulations and tax breaks are subject to change. Always check the latest thresholds and consult gov.uk before each tax year.

If I don’t declare it, HMRC won’t notice: Banks now exchange interest data with tax authorities through digital reporting; not declaring exposes you to the risk of backdated demands and fines.

You may maintain financial control and stay clear of the costly mistakes that so many individuals make by clearing these myths and learning the truth about how savings interest is taxed.

Quick Self-Check: Could You Be at Risk?

Not sure if the savings interest tax trap applies to you? A quick self-check can give you clarity:

- Do you own more than one savings account? Even little sums of interest from several banks pile up.

- Is your Personal Savings Allowance approaching or surpassing it? Basic-rate taxpayers pay £1,000, higher-rate taxpayers pay £500, and additional-rate taxpayers pay nothing.

- Have you recently opened any new high-interest accounts or fixed deposits? You might not realise it, but rising interest rates could drive you over the edge.

- Do you depend on automatic tax deductions from your bank? The majority of banks don’t; it is your duty to declare.

- Have you looked over your yearly tax summary yet? Ignoring it could result in the loss of unnoticed interest.

It’s worthwhile to check your savings income and make sure you’re not unintentionally on the edge of a tax payment if you said “yes” to any of them.

Frequently Asked Questions

How will HMRC know about my savings interest?

HMRC receives interest income reports from banks and financial institutions. Even if you choose not to disclose information, HMRC may still change your tax code or get in touch with you.

Do ISAs count toward my allowance?

No, interest in an Individual Savings Account (ISA) is not included in your PSA and is entirely tax-free.

Will my bank send me a tax statement?

Yes, an annual interest summary is provided by the majority of banks. However, it is your responsibility to keep records and declare taxable interest that exceeds your allowance.

Do ISAs count toward my allowance?

Your PSA is not affected by interest earned in an Individual Savings Account (ISA), which is entirely tax-free.

Conclusion

Millions of people are unknowingly caught in the savings interest tax trap every year, despite its minor appearance. Savers often wind up with unexpected tax payments and lower returns because they misunderstand allowances, ignore small amounts of interest, or assume institutions take care of everything. The good news is that by being a little more aware—keeping records, checking the latest HMRC thresholds, and using UK tax-free savings vehicles—you can retain more of your hard-earned money.

Examine your savings accounts, determine how much interest you’ve earned this year, and confirm you remain within your allotted amount. A quick review now could save you a surprise tax bill and help you make the most of your savings in the UK.

And if you’re unsure whether you’re managing your allowances correctly, it may be worth speaking with a professional accountant who can review your finances and ensure you’re not paying more tax than necessary.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.