The closing balance is the amount of money or value remaining in an account at the end of a specific accounting period, whether it’s a day, month, quarter, or year. It reflects the net result of all transactions during that period, including credits (inflows such as sales or income) and debits (outflows such as expenses or payments). This figure is crucial because it provides a clear snapshot of a company’s financial position at the period’s close and serves as the opening balance for the next accounting period.

To calculate closing balance, you simply start with the opening balance, add all credits, and subtract all debits within the period.

In this guide, we’ll break down the concept of closing balance, walk you through the calculation process step-by-step, and highlight the key benefits it offers to businesses.

What is Closing Balance?

The closing balance is the amount of money or value remaining in an account at the end of a specific accounting period (day, month, quarter, or year). It reflects the net result of all transactions during that period, including credits and debits.

You can calculate it using this formula:

Closing Balance = Opening Balance + Total Deposits – Total Withdrawals + Interest – Fees ± Other Adjustments

This formula captures all inflows, outflows, and adjustments to provide a complete snapshot of your final account balance.

What is the Closing Balance in Banking?

Closing balance in banking means the amount of money your bank has at the end of the day, month, or year. This includes both credit and debit amounts.

A bank closing balance may not match an accounting closing balance since an accounting closing statement would include outstanding transactions that haven’t been cleared by the bank, but a bank closing balance would not.

Your closing balance, which shows how much money is accessible in your account, is always shown at the top of your bank statement.

What does Closing Balance mean in accounting?

The closing balance in accounting is the total amount in an account at the end of a given time frame, like a day, month, or whole year. After all credits and debits for that period have been taken into consideration, the net total is shown.

This balance serves as the subsequent period’s opening balance. Financial statements such as ledgers, trial balances, and bank reconciliations frequently display it.

For Example, If your bank account starts with £5,000 (opening balance), receives £2,000 in deposits, and has £1,500 in withdrawals, your closing balance would be £5,500.

Why is closing important in accounting?

Closing balances are important in the commercial and financial worlds. They offer important information about the functioning of a business and are useful markers of its financial health. Let’s examine the factors that make closing balances crucial:

- Financial overview: Closing balance is not just a number; it provides a quick overview of the company’s financial situation. The balance gives stakeholders and business owners a summary of the company’s assets, liabilities, and equity, allowing them to assess its financial health.

- Performance evaluation: Comparing closing balances across the various accounting periods is simple. It’s the most effective method for evaluating the success and development of your company. Healthy growth and profitability are shown by positive patterns, such as a steadily rising closing balance. On the other hand, decreasing closing balances draw attention to areas that need work.

- Cash flow management: Tracking the inflow and outflow of funds is made easier with the help of your closing balances. This is a clever method to guarantee that your company keeps the ideal liquidity pattern. You can identify cash surpluses or shortages, plan for future expenses, and make wise financial decisions by closely monitoring closing balances.

- Decision-making: Making wise decisions is mostly dependent on closing balances. Closing balances are quite helpful whether you’re planning to grow, searching for investment options, or considering strategic actions. Knowing these numbers reveals a company’s financial health and the dangers that influence your decisions. Making well-informed judgments that support the financial objectives of your company is beneficial.

- Compliance and reporting: Financial reporting, tax compliance, and audits all depend on accurate closing balances. They provide accountability and transparency by proving that your financial records are accurate and comprehensive. To evaluate a company’s reputation and financial health, lenders, investors, and regulatory agencies frequently use closing balances.

- Forecasting and Planning: Financial forecasting and planning are based on closing balances. You can design plans, set financial goals, and create budgets to accomplish your business objectives by analysing past closing balances and taking future estimates into account. Closing balances help estimate future resource requirements and provide a foundation for financial projections.

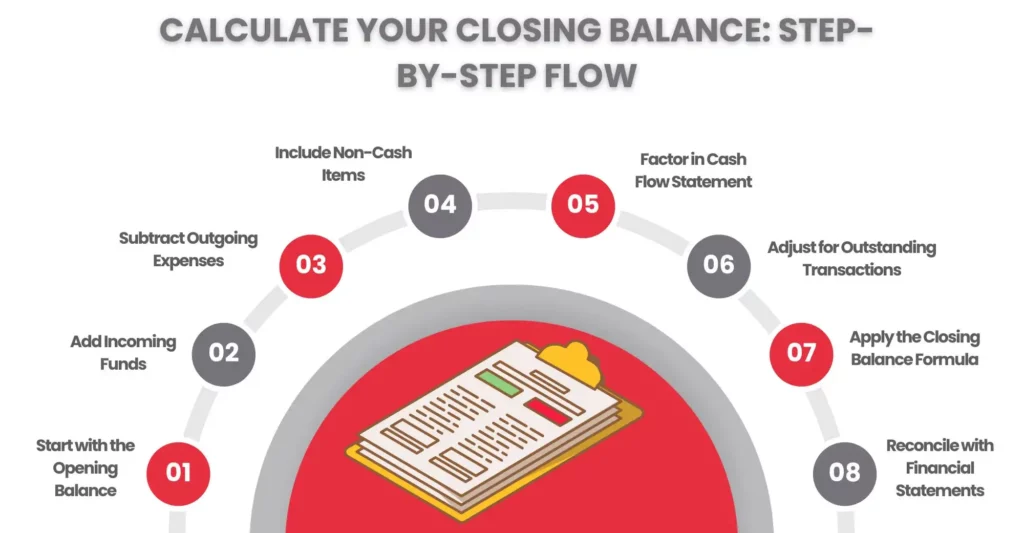

How to calculate closing balance? Step by Step

Effectively managing your company’s financial records requires knowing how to calculate the closing balance. Knowing how to determine the closing balance is crucial, regardless of how big or small your company is. Let’s understand the process of how to figure out the closing balance.

Step 1: Understand your opening balance

The opening balance must be determined before you can calculate the closing balance. Your business account’s opening balance is the total amount of funds accessible at the start of the period you’re interested in, like a month or a financial year. Consult your bank statements or financial records to determine this opening balance amount.

Step 2: Add Up Incoming Funds

Subsequently, total the amount of money received throughout that time. Revenue from investments, loans, sales, and other sources of income is all included in this. A business account should be used for all deposits made within the allotted time frame.

Step 3: Subtract Outgoing expenses

Now, deduct all of the outgoing costs from the sum that was determined in step 2. Salaries, rent, utilities, inventory purchases, marketing charges, and any other expenses your company incurs may be included in these costs. Accurately recording every spending is essential.

Step 4: Consider non-cash items

Non-cash factors like depreciation or adjustments to accounts payable or receivable may occasionally be included in the closing balance computation. If applicable, consider these non-cash items in your computation as they have an impact on your overall financial situation.

Step 5: Incorporate cash flow statement

A cash flow statement’s closing balance is determined by taking into account the net cash flow from financing, investing, and operating activities. Examine your cash flow statement carefully to ascertain the impact of these cash flows on your closing balance.

Step 6: Adjust for outstanding transactions

Keep in mind any unprocessed transactions that are still pending. For instance, make sure your closing balance appropriately reflects any outstanding transactions or cheques that you have issued but haven’t cleared.

Step 7: Apply the closing balance formula

Closing balance = Opening Balance + Incoming Funds – Outgoing Expenses ± Non-Cash Items ± Outstanding Transactions is the formula to determine the closing balance.

Step 8: Reconcile with other financial statements

Reconcile your closing balance with other financial statements, including balance sheets, cash flow statements, and income statements, to guarantee correctness. This step offers a thorough understanding of the financial status of your company.

Closing Balance Formula

Closing Balance = Opening Balance + Total Deposits – Total Withdrawals + Interest – Fees ± Other Adjustments

The closing balance formula is a simple way to track how your account’s balance changes over a specific period by starting with what you had, adding what came in, subtracting what went out, and then accounting for any earnings, costs, or adjustments. In essence, it provides a complete snapshot of your ending balance by capturing every financial movement that occurred. Here’s how each element contributes

Opening Balance

The starting point—your account balance at the beginning of the period.

+ Total Deposits

All incoming funds, such as salary payments, transfers in, or cash deposits.

– Total Withdrawals

All outgoing funds, including withdrawals, bill payments, and transfers out.

+ Interest

Earnings credited to your account if it’s interest-bearing.

– Fees

Charges levied by the bank or service provider (monthly maintenance, transaction fees).

± Other Adjustments

Any additional changes not covered above, like corrections, reversals, manual journal entries, or one-off credits/debits.

Frequently Asked Questions

Is a closing balance always positive?

No. The closing balance can be:

Positive (credit balance) — more money is available.

Negative (debit balance) — the account is overdrawn or in deficit.

Where is the closing balance used?

- Bank statements

- Cash books

- Ledger accounts

- Trial balances

- Financial statements (like balance sheets)

Can the closing balance be adjusted?

Yes. Corrections (such as journal entries or reconciliations) or errors may result in changes to the closing balance.

Is the closing balance the same as net income?

No, net income is the profit or loss after all costs and revenues are taken into account. The final sum in a particular account, not only revenue, is referred to as the closing balance.

Conclusion

In conclusion, proficient financial management requires an awareness of how to determine a company’s closing balance. You can precisely calculate the closing balance of your business account by following the detailed instructions provided.

Don’t forget to begin with the opening balance and take into account all of the money coming in, going out, non-cash things, and unresolved transactions. A thorough understanding of your company’s financial situation is also ensured by integrating the cash flow statement and balancing it with other financial figures.

Accounting software helps improve your financial record-keeping and makes calculations easier. You can stay in charge of your company’s finances, make wise decisions, and ensure a prosperous future for your company by being an expert at figuring out the closing balance.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.y