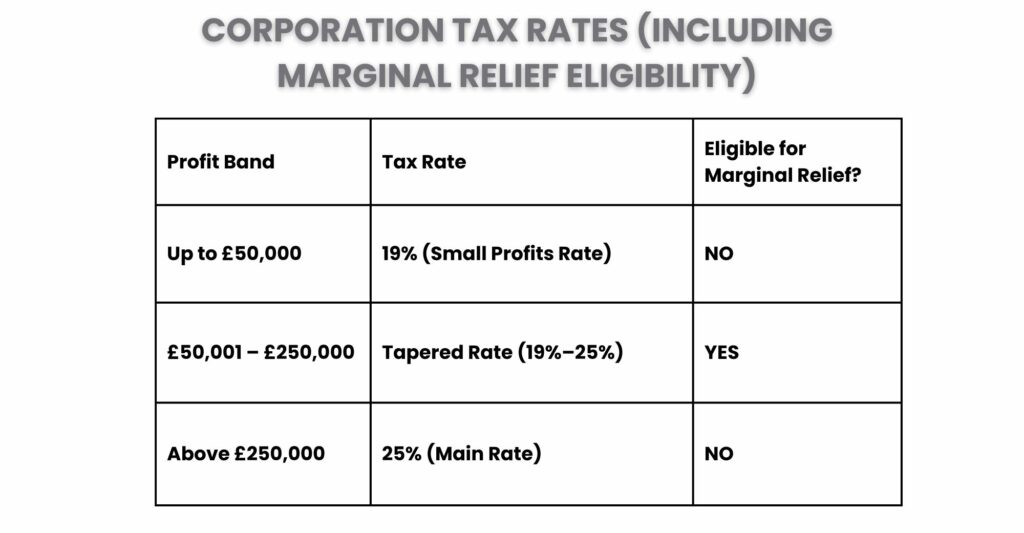

As of April 2023, corporations in the UK are now subject to varying rates based on their profit margins. You are not required to pay the entire 25% main rate if your business makes more than £50,000 but less than £250,000 in taxable profits. Alternatively, you might be eligible for Marginal Relief, which lowers your Corporation Tax liability.

Between the lower and upper profit criteria, marginal relief is a tapering benefit. It makes the transition easier for medium-sized firms by progressively raising your tax rate from 19% (the small profits rate) to 25% (the main rate).

In this article, we’ll explain the particular steps involved in calculating marginal relief for corporation tax using HMRC’s method and include examples to help you grasp the procedure. Understanding how this relief works can help your business save money and avoid unpleasant surprises at the end of the year, regardless of whether you manage your taxes or employ an accountant.

What is Corporation Tax?

Corporation tax is a tax that businesses in the UK pay on their profits, which include capital gains, trading income, and investment income. Corporation Tax is applied as soon as your business turns a profit; there is no tax-free allowance.

- Up to £50,000 in profits are subject to 19% tax.

- Over £250,000 in profits are subject to 25% tax.

Marginal relief may be granted to profits that fall between certain thresholds to reduce the rate increase.

Who needs to pay Corporation Tax?

In the UK, registered businesses are required to pay corporation tax on their profits. It applies not only to limited firms but to a variety of organisations.

Check out this summary to discover if your business must pay:

UK-based limited corporations: Corporation tax is due on the profits of all limited companies that are registered in the UK.

Foreign companies with UK branches: Companies from other countries that have offices or branches in the UK are required to pay taxes on their profits made in the UK, even if they are headquartered outside the country.

Organisations, clubs, and cooperatives: You might also be subject to corporation tax if you oversee the accounting for particular groups, including trade organisations or clubs.

What is Marginal Relief for Corporation Tax?

Companies in the UK with profits between £50,000 and £250,000 are eligible for marginal relief. They pay less in corporation tax, which helps close the difference between the main rate of 25% and the small earnings rate of 19%.

Marginal Relief raises the tax rate gradually as profits increase rather than abruptly from 19% to 25%, making medium-sized businesses pay a more equitable amount.

Who is eligible for Marginal Relief in Corporation Tax?

Your business is eligible to receive Marginal Relief if,

- The range of taxable profits is £50,000 to £250,000.

- It is a resident of the UK.

- If it is not a close investment holding company

- If you have affiliated businesses or a brief accounting period, thresholds are modified.

Profits under £50,000 or over £250,000 are exempt from marginal relief.

How do you calculate Marginal Relief for Corporation Tax?

HMRC’s Formula for 2023/24 Onwards:

Calculating Marginal Relief for Corporation Tax, we need to use the formula (3/200) x (upper limit – total taxable profits), which can be difficult and time-consuming. For example, if your company’s taxable profits are £100,000, the calculation will be as follows:

1. Upper Limit Corporation Tax (25%)

25% of £100,000 =

£25,000

2. Marginal Relief Calculation

Marginal Relief is calculated as:

(3/200)×(Upperlimit–Profits)(3/200) × (Upper limit – Profits)(3/200)×(Upperlimit–Profits)

= 0.015 × (£250,000 – £100,000)

= 0.015 × £150,000

= £2,250

3. Final Corporation Tax Liability

Main Rate Tax (£25,000) – Marginal Relief (£2,250) =

£22,750

However, there is no need to do all of this on your own while completing your accounts and Company Tax Return. You can use HMRC’s Marginal Relief Calculator.

This allows you to determine whether your firm is eligible, calculate the amount of Marginal Relief to which you may be entitled, and estimate your Corporation Tax rate and effective CT rate before and after filing for Marginal Relief.

Frequently Asked Questions

What is the Marginal Relief fraction?

The multiplier is fixed at 3/200, or 0.015. The Marginal Relief formula makes use of this figure.

What is the impact of affiliated enterprises on Marginal Relief?

The total number of related businesses + 1 is used to divide the lower and upper bounds. Divide the restrictions by three, for instance, if you have two affiliated businesses.

Can I automatically receive Marginal Relief?

Yes. It is applied automatically when you file your tax return via HMRC’s Corporation Tax service and the majority of accounting software.

Conclusion

Businesses in the UK benefit from marginal relief, particularly those in the growth stage. It facilitates a smooth transition between corporation tax rates for businesses, lowering tax obligations and freeing up funds for investments.

We at CoxHinkins understand how meticulously you want to handle your taxes and make sure you don’t face any fines from HMRC. Whether you require assistance with corporation tax services, calculations, tax planning, or simply making basic financial decisions for your company, we are here to help.

Marginal relief and other tax laws will allow you to focus on growing your company without having to worry about anything else.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.