- What is a Director’s Loan?

- What is the Director’s Loan Account?

- Is the Director’s Current Account Similar to DLA?

- How Does the Director’s Loan Account Work in the UK?

- Why Accurate Director’s Loan Account Tracking Matters for Tax and Compliance

- How much can you borrow from the Director’s Loan Account?

- When do you need to repay the Director’s Loan?

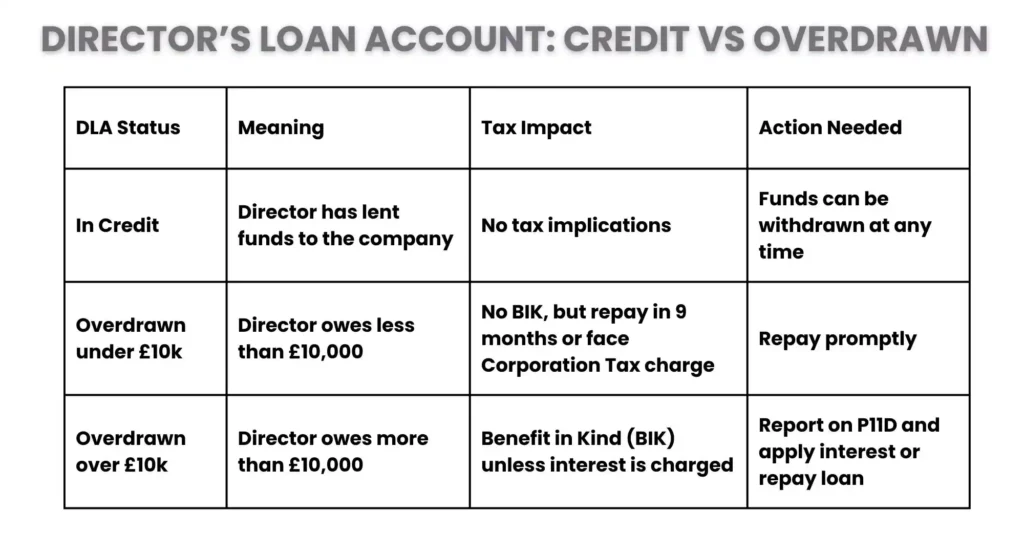

- What is an Overdrawn Director’s Loan Account?

- What will happen if the Director’s Loan Account is in credit?

- Frequently Asked Questions

- Conclusion

Directors’ Loan Accounts (DLAs) are essential financial tools for a business’s operations, particularly for small or closely held companies. These accounts make it easier for directors and their businesses to transfer money for a variety of uses, including personal transactions, investments, and financing.

Directors and stakeholders alike must be aware of the complexities of directors’ loan accounts to guarantee appropriate financial management and compliance.

In this guide, we are going to cover everything you need to know about the director loan account, from the fundamentals to more sophisticated tactics, so you can utilise this effectively to steer your company in the right direction and make better financial decisions.

What is a Director’s Loan?

A director’s loan is any funds taken out of a limited business that aren’t categorised as expenses, salaries, or dividends. Since you are the director, you are borrowing money from the business, and you will eventually be responsible for paying it back. A director’s loan might also take the shape of a loan to your business.

What is the Director’s Loan Account?

The money that a director contributes to and withdraws from the company that is not used for dividends, salaries, or expenditure reimbursements is known as a director’s loan. A director may lend money to the company or withdraw funds from it.

The director’s loan account keeps track of these contributions and withdrawals. This will verify the tax implications for the director and the company and determine whether this is overdrawn.

Is the Director’s Current Account Similar to DLA?

Indeed, the Directors’ Loan Account (DLA), particularly in small UK businesses, is frequently referred to as the Director’s Current Account. They all relate to the same thing: a running log of all financial transactions that don’t involve salaries, dividends, or costs between a director and the company.

It keeps track of whether:

The director has given the business a loan (credit balance), or

The director has depleted the company’s funds (debit/overdrawn balance).

The official word used in tax and compliance documentation is “Director’s Loan Account,” but the phrase “current account” is more frequently used in informal or accounting software situations.

How Does the Director’s Loan Account Work in the UK?

A director’s loan account records all of the money that is exchanged between the director and the business. It’s employed to monitor:

Any funds borrowed by the director from the company: If a director needs financial assistance, he can borrow money from the company. Further, that amount is recorded in the director’s loan account.

Money that a director lends to the business: On the other hand, a director may also lend money to the business, which is documented in the same account.

If interest is charged on the loan: If interest is charged on the loan, it should be evaluated at a commercial rate, which is the same rate that a bank would charge.

Director repayments: The director is required to pay back the loan within a given time frame, usually nine months and one day following the conclusion of the business’s fiscal year.

Legal Framework and Compliance for Director’s Loan Accounts

- Companies Act 2006: This Act dictates the rules for financial transactions between a company and its directors, including using directors’ loan accounts.

- Shareholder Approval: Loans exceeding £10,000 typically require approval from shareholders.

- Tax Compliance: Directors must report loans over £10,000 on their self-assessment tax return, and businesses must pay Class 1A National Insurance on these loans.

Understanding these legal requirements ensures you avoid penalties or complications, such as wrongful trading claims or tax issues.

Why Accurate Director’s Loan Account Tracking Matters for Tax and Compliance

Proper management of a Director’s Loan Account (DLA)or Director’s Current Account is critical for tax efficiency and compliance with UK financial regulations.

If a director’s loan account is overdrawn (meaning the director owes money to the company), it can trigger significant tax consequences under HMRC rules:

- Section 455 Tax: If the loan is not repaid within 9 months and 1 day after the end of the company’s accounting period, HMRC imposes an additional 32.5% corporation tax charge on the unpaid loan balance.

- Benefit in Kind (BIK): If the loan exceeds £ 10,000 and no commercial interest is charged (as per HMRC’s official rate, currently 2.25% in 2024–2025), the director must:

- Pay personal income tax on the benefit.

- The company must pay Class 1A National Insurance Contributions (NICs).

All director‘s loan transactions must be clearly recorded in the company’s financial statements and disclosed in tax filings, especially if they exceed threshold limits or remain unpaid.

Failure to track and report DLAs accurately can lead to penalties, interest charges, or unwanted scrutiny from HMRC.

Maintaining a transparent and up-to-date director’s loan account helps ensure full compliance, avoids unexpected tax bills, and supports sound financial decision-making.

How much can you borrow from the Director’s Loan Account?

The amount of money you can borrow from your business via a Director’s Loan Account (DLA) is not restricted by law. But the sum should be within the range of what your business can lend without risking its capacity to make ends meet.

Key Considerations:

Loans over £10,000: At any time throughout the tax year, a loan that totals more than £10,000 is considered a Benefit in Kind (BIK). In other words:

- It is required to be included on your self-assessment tax return.

- The business is required to pay Class 1A National Insurance and report it on a P11D form.

Deadline for Repayment: Pay back the loan no later than nine months and one day following the completion of the business’s accounting period to prevent further tax liabilities.

Shareholder Approval: It’s wise to get consent from every shareholder for loans over £10,000.

When do you need to repay the Director’s Loan?

A director’s loan must be paid back within nine months and one day after the company’s accounting year-end to avoid any tax penalties.

Nine months following the conclusion of the accounting period in which you paid off the loan, you may be eligible to recover back taxes. As an alternative, you may want to postpone paying your company’s corporation tax until the director’s loan has been paid back. There is more time to pay back the loan because the corporation tax payment deadline is nine months after the end of the business’s financial year.

It’s advisable to look for expert corporation tax services to manage these timings, save needless fees, and maximise your payback plan.

What is an Overdrawn Director’s Loan Account?

When a director’s loan to the company has not been fully repaid, the account becomes overdrawn. The director’s loan account (DLA) balance is calculated after the company’s financial year, taking into account any funds that directors may have borrowed or lent to the business. Any amount owed that has not been settled within nine months and one day is considered “overdrawn” and is liable for taxes.

The amount outstanding on an overdrawn director’s loan account must be shown on the business’s tax return. As part of the corporation tax compliance checklist, HMRC has the right to inquire about the existence of a director’s loan account at any time; all entries must be timely and accurate.

Interest rate on the Director’s overdrawn loan account

A director’s loan over £10k is considered a Benefit in Kind (BIK) if no interest is paid or very little.

As of 2024–2025, the official interest rate established by HMRC is 2.25%. you can check this out on the official website of HMRC.

The director pays personal tax on the benefit, and the business pays Class 1A National Insurance if you don’t charge at least this rate.

To avoid tax, either:

- Repay the loan promptly, or

- Charge interest at HMRC’s official rate.

What will happen if the Director’s Loan Account is in credit?

If your Director’s Loan Account is in credit, meaning the company owes you money, there are no immediate tax consequences. However, it’s important to ensure that the company has enough cash to repay the loan when needed.

A Couple of Real-Life Examples to Help You Better Understand:

- Scenario 1: If a director lends the company £20,000 to cover a cash flow gap. It will be recorded as a loan in the company’s accounts, and the company needs to repay the director within nine months of the financial year-end.

- Scenario 2: On the Other hand, if a director borrows £5,000 from the company to cover personal expenses. This amount must be repaid within nine months to avoid tax penalties.

In both cases, it’s essential to keep track of the repayment deadlines to avoid any issues.

Frequently Asked Questions

Can I pay for personal expenses with the loan?

Yes, but it needs to be properly documented and paid back following the regulations.

What is the due date for loan repayment?

Within nine months and one day following the end of the business’s financial year, to avoid paying 32.5% in corporation tax.

Should I get professional help?

Indeed. Employing professional corporation tax services guarantees efficiency and conformity with tax laws.

Conclusion

Financial transactions between directors and the company are transparently documented in director’s loan accounts (DLAs). Directors and businesses must have a solid grasp of how DLAs work and the associated tax ramifications since improper management of these accounts can have serious consequences.

Getting expert guidance is strongly advised if you are negotiating the intricacies of DLAs or want to maximise your tax approach while maintaining complete compliance. Contact our expert tax advisor team to ensure you avoid tax traps and stay compliant.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.