- What Are Service Charge Accounts?

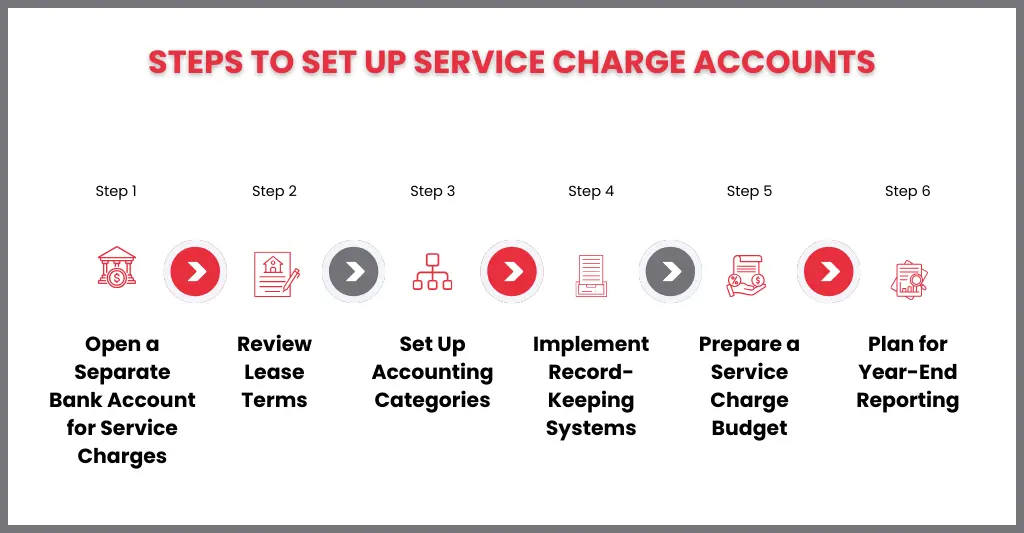

- How to Set Up Your Service Charge Account?

- The Legal Side: What Rules Do You Need to Follow for Service Charge Accounts?

- Types of Service Charges Accounts

- How to Split Service Charges Among Tenants and Avoid Disputes

- Service Charge Budgeting and Cost Allocation

- Managing and Collecting Service Charges

- Tracking and Recording Service Charge Expenditure

- Reconciliation of Service Charge Accounts

- How to Stay Compliant with Service Charge Reporting and Avoid Legal Trouble

- Common Challenges in Managing Service Charge Accounts

- Service Charge Accounts for Residential vs. Commercial Properties

- Service Charge Accounts for Right to Manage Companies (RTMs)

- FAQs: Frequently Asked Questions

- Conclusion

If you own a flat in a leasehold property or manage residential blocks in the UK, you have most likely heard the term service charge accounts. However, for many property owners and even some managing agents, what these accounts involve and why they are so important can be confusing.

Service charge accounts are essentially detailed financial documents that indicate how money received from leaseholders is spent on building maintenance and management. This encompasses everything from cleaning and upkeep to insurance, repairs, reserve funds, and compliance with UK rules. Aside from being a simple income-and-expense summary, they are an important transparency tool for safeguarding leaseholders, directing managing agents, and ensuring compliance with UK accounting and property law standards.

In this article, we’ll go over what service charge accounts are, what they must include, how they’re prepared, and why accuracy is critical for both property owners and managing agents in the UK.

What Are Service Charge Accounts?

The landlord or management normally prepares and issues service charge accounts to leaseholders once a year to account for actual service charge income and expenses. They are typically known as accounts, and legislation uses the term’summary of relevant costs’. The lease will normally specify how service charges should be accounted for, the expenditures that can be recovered, and the time period that the accounts should cover.

How to Set Up Your Service Charge Account?

Setting up a service charge account effectively is not only good practice; it is critical for compliance, transparency, and tenants trust. Whether you’re a managing agent, freeholder, or member of a Resident Management Company (RMC), getting the structure right from the start helps to avoid future disputes and audit concerns.

Here’s a simple step-by-step guide to correctly setting up your service fee account in the UK.

Open a Separate Bank Account

Service charge funds should be maintained separate from the managing agent’s or landlord’s business funds. Under UK property law, these funds are usually held in statutory trust for leaseholders.

Best practice:

- Open a dedicated client/trust bank account

- Clearly label it with the property name

Ensure it is not mixed with office operating funds

This protects leaseholder money and avoids serious compliance breaches.

Review the Lease Terms Carefully

The lease is your rulebook.

Before setting up accounting categories:

- Identify what costs are recoverable

- Check how service charges are apportioned

- Confirm reserve fund provisions

- Review timing of demands and accounting year-end

You can only collect and spend funds in line with the lease terms, nothing more.

Create Clear Accounting Categories

Set up your chart of accounts to reflect typical service charge headings, such as:

- Cleaning & maintenance

- Repairs

- Insurance

- Utilities

- Managing agent fees

- Reserve/sinking fund

- Health & safety compliance costs

Clarity here makes year-end reporting and audits significantly easier.

Implement Proper Record-Keeping Systems

Use professional accounting software (such as Xero, QuickBooks, or particular property management systems) to:

- Record every invoice.

- Keep track of payments from leaseholders

- Monitor arrears

- Separate reserve fund transactions

All invoices and accompanying documentation should be kept for audit and leaseholder review.

Set Up Budgeting & Forecasting

Prepare an annual service charge budget before demanding funds.

This should:

- Estimate expected costs

- Account for inflation or rising insurance premiums

- Include reserve contributions where required

- Be clearly communicated to leaseholders

Transparent budgeting reduces disputes.

Plan for Year-End Reporting

Decide early:

- Whether accounts require independent certification

- Whether an audit is required under lease terms

- Reporting format expected by leaseholders

Many leases require service charge accounts to follow recognised accounting principles and be independently reviewed.

The Legal Side: What Rules Do You Need to Follow for Service Charge Accounts?

Service charge accounts are not only internal financial records; they are subject to special UK property regulations. Understanding the legal structure is critical for freeholders, managing agents, and directors of Resident Management Companies (RMCs) who want to prevent conflicts, tribunal claims, and regulatory concerns.

Here are the important legal ideas and rules you need to follow:

Landlord and Tenant Act 1985

Under the Landlord and Tenant Act 1985, service charges must be:

- Reasonable

- Incurred properly

- For works or services of a reasonable standard

Section 21 also allows leaseholders to ask for a written statement of service charge costs. Failure to produce this within the specified term may result in legal penalties.

Funds Must Be Held on Trust

Service charge revenues for leaseholders are kept in statutory trust under Section 42 of the Landlord and Tenant Act 1987.

This means:

- Funds must be kept separate from business accounts

- They cannot be treated as the landlord’s income

- They must only be used for authorised lease purposes

Misuse of funds can expose directors or managing agents to serious legal risk.

Consultation Requirements (Section 20)

Landlords must follow consultation processes outlined in Section 20 of the Landlord and Tenant Act 1985 when undertaking large works or entering into long-term agreements.

If you fail to consult properly:

- Recovery may be capped (usually at £250 per leaseholder for works)

- Leaseholders can challenge the charges

This is one of the most common areas where managing agents face disputes.

Right to Challenge at Tribunal

Leaseholders can challenge service charges at the First-tier Tribunal.

They may question:

- Whether costs are reasonable

- Whether works were necessary

- Whether the lease allows the expense

Poor record-keeping significantly weakens your position in tribunal proceedings.

Lease-Specific Requirements

The lease itself may impose additional obligations, such as

- Independent accountant certification

- Annual audits

- Specific accounting formats

- Time limits for issuing accounts

You must follow both statutory law and the contractual terms in the lease.

Accounting Standards & Transparency

While there is no one legislative format for service charge accounts, best practice frequently adheres to professional accounting standards (such as UK GAAP principles where applicable).

The key expectations are:

- Clear income and expenditure reporting

- Disclosure of reserve funds

- Opening and closing balances

- Transparent notes explaining variances

Clarity reduces legal exposure.

Types of Service Charges Accounts

- Fixed Service Charge: Fixed service charges are the same throughout the year. These are calculated based on expected annual costs and divided equally among all payment periods.

- Variable Service Charge: Variable service charge fluctuates based on actual expenditure. You gather money throughout the year and alter it based on actual costs spent.

- Reserve Funds: Reserve funds (also known as sinking funds) are collected from the service charge for future large projects. This money accumulates over time to fund unexpected repairs or planned projects such as roof replacements, redecorations, and structural repairs.

Some properties utilise a combination of these categories. You might charge a flat fee for routine maintenance while collecting variable fees for seasonal utilities.

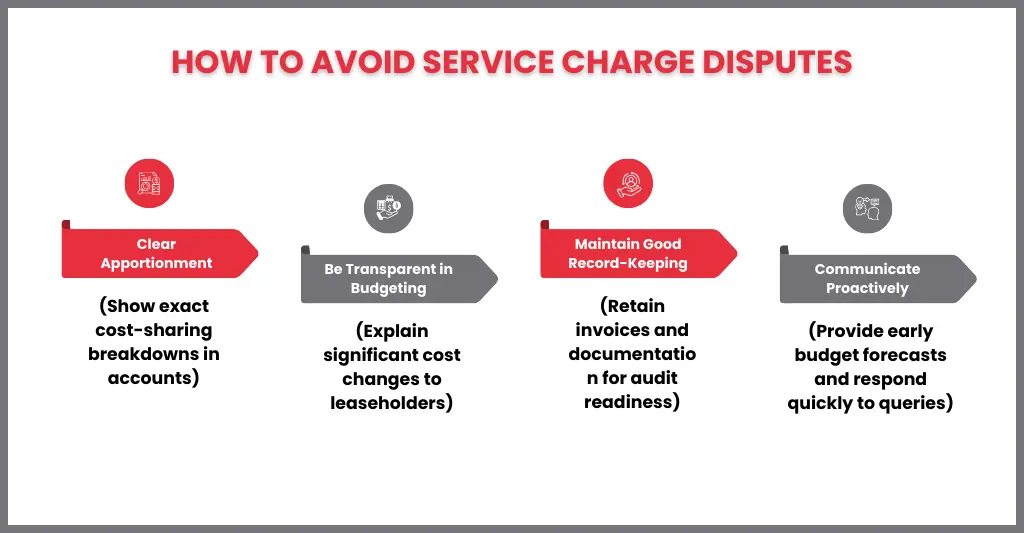

How to Split Service Charges Among Tenants and Avoid Disputes

One of the most prevalent sources of disagreement in leasehold properties is not the magnitude of the service charge, but how it is shared. If the allocation is not clearly computed and presented, disagreements might quickly develop. For property owners, managing agents, and RMC directors, the main idea is straightforward:

Here’s how to split service charges correctly and minimise the risk of disagreements.

Always Start With the Lease

The lease sets out exactly how service charges must be apportioned.

Common methods include:

- Equal split (e.g., divided equally among all flats)

- Percentage allocation (e.g., each flat pays a fixed percentage)

- Floor area basis (larger units pay more)

- Block-specific allocation (for multi-building developments)

- Usage-based allocation (e.g., lifts only charged to upper floors)

You cannot modify the manner unless the lease is properly changed. Even if a different division “seems fairer,” the lease language is binding on law.

Separate Shared vs Block-Specific Costs:

In larger developments, not all costs apply to every leaseholder.

For example:

- Roof repairs may apply to the whole block

- Lift maintenance may apply only to certain floors

- Underground parking costs may apply only to parking space holders

Clear cost coding in your accounting system helps ensure expenses are allocated correctly. This is where structured service charge accounting prevents disputes later.

Apply Reserve Fund Contributions Properly: If the lease provides for a sinking or reserve fund, contributions must be divided according to the same allocation criteria, unless the lease indicates otherwise.

Important:

- Reserve funds must be clearly separated in the accounts

- Leaseholders should understand what they are contributing towards

Lack of clarity around reserve funds is one of the biggest causes of mistrust.

Be Transparent in Your Calculations: Many disputes happen because leaseholders don’t understand how figures were calculated.

Best practice:

- Include a clear apportionment table in year-end accounts

- Show each unit’s percentage or share

- Provide explanatory notes for unusual variances

- Offer breakdowns on request

Transparency reduces suspicion.

Avoid Common Mistakes That Trigger Disputes:

Here are the typical errors that lead to tribunal challenges:

- Charging items not permitted under the lease

- Misapplying percentages

- Failing to follow Section 20 consultation rules for major works

- Allocating shared costs incorrectly

- Poor documentation of invoices

If challenged, leaseholders can take matters to the First-tier Tribunal, where you will need strong records to defend your position.

Communicate Before Issues Escalate: Sometimes disputes arise not because the charge is wrong, but because it’s unexpected.

Proactive steps include:

- Sharing budgets early

- Explaining significant cost increases (e.g., insurance spikes)

- Issuing clear year-end summaries

- Responding promptly to queries

Transparency in communication maintains trust.

Service Charge Budgeting and Cost Allocation

Service charge budgeting ensures that residential blocks are financially healthy, compliant, and transparent. Under the Landlord and Tenant Act of 1985, charges must be reasonable and allocated exactly according to the lease.

Building a Realistic Annual Service Charge Budget

A service charge budget should reflect:

- Historical expenditure (previous 2–3 years)

- Inflation and contractor cost increases

- Insurance premium trends

- Planned major works

- Regulatory changes (e.g., building safety compliance)

Understanding Cost Allocation Methods:

Cost allocation must strictly follow the lease. This is non-negotiable.

Common allocation structures include

- Equal split between all units

- Percentage based on floor area

- Different percentages for different blocks

- Separate schedules (e.g., lift costs only charged to upper floors)

If the allocation does not meet the lease terms, it can be legally challenged even if the total expenditure is appropriate.

Fixed vs Variable Costs

A well-managed block separates:

Fixed Costs

- Managing agent fees

- Insurance

- Contracted cleaning

Variable Costs

- Reactive repairs

- Emergency works

- Seasonal maintenance

Understanding this split helps forecasting accuracy while reducing unexpected balance adjustments.

Reserve Funds (Sinking Funds)

Reserve funds are necessary for long-term stability. Rather than issuing huge one-time demands for roof replacement or exterior redecorations, blocks should establish annual reserves.

Best practice includes:

- Professional reserve fund forecasting (10–20 year plan)

- Transparent disclosure in annual statements

- Separate trust bank accounts

Avoiding Common Budgeting Mistakes

Managing agents often face these issues:

- Copy-pasting last year’s budget without review

- Failing to adjust for insurance inflation

- Ignoring planned compliance upgrades

- Misallocating shared costs between blocks

- Not reconciling actual vs budget quarterly

Regular variance analysis (quarterly at minimum) reduces audit pressure at year-end.

Transparency Reduces Disputes

Leaseholders are more likely to accept increases when:

- Budgets are clearly itemised

- Explanations are provided for major increases

- Allocation methods are referenced to the lease

- Reserve planning is shared proactively

Clear documentation protects managing agents during audit and tribunal challenges.

Managing and Collecting Service Charges

Managing and collecting service charges entails ensuring consistent cash flow while remaining completely compliant with UK leasehold law. The Landlord and Tenant Act of 1985 requires that service costs be reasonable, appropriately demanded, and accurately documented.

Key Steps:

1. Issue Clear and Compliant Demands

Every demand must:

- Follow lease terms

- Include a clear breakdown

- State payment due dates

- Contain the required statutory notices

Non-compliant demands can become legally unenforceable.

2. Maintain Separate Trust Accounts

Service charge funds must be held in designated trust bank accounts, not mixed with company funds.

3. Monitor Arrears Proactively

- Send reminders promptly

- Follow structured escalation

- Keep clear records of communication

Delays impact contractor payments and building operations.

4. Use Digital Systems

Practice management software helps track:

- Invoices raised

- Payments received

- Outstanding balances

- Arrears reports

This improves transparency and audit readiness.

Tracking and Recording Service Charge Expenditure

Accurate recording of service charge expenditures is critical for audit readiness, leaseholder transparency, and regulatory compliance. Leaseholders have the right to receive a summary of relevant expenditures under the Landlord and Tenant Act of 1985, which requires that records be clear and well-maintained.

Key Practices:

1. Record Every Expense Promptly

Log all invoices with:

- Supplier name

- Invoice date and number

- Cost category (repairs, cleaning, insurance, etc.)

- VAT treatment

Delays lead to reconciliation issues later.

2. Use Separate Ledgers

Maintain distinct accounting records for:

- Each property

- Each cost category

- Reserve fund transactions

Funds should never be mixed across blocks.

3. Reconcile Regularly

Monthly bank reconciliation ensures:

- Payments match invoices

- No duplicate entries

- No missing transactions

This reduces year-end surprises.

4. Keep Supporting Documentation

Store:

- Contractor invoices

- Approval records

- Payment confirmations

Clear documentation protects managing agents during audit or tribunal review.

Reconciliation of Service Charge Accounts

Reconciliation verifies that service charge records correspond to the real bank balance held in trust. It is an important check for audit preparedness and compliance with the Landlord and Tenant Act 1985.

Key Points:

- Match ledger to bank statement monthly

- Verify all invoices and payments are recorded

- Identify unpresented cheques or timing differences

- Ensure reserve funds are separately reconciled

Regular reconciliation prevents errors, protects trust funds, and reduces disputes during year-end audits.

How to Stay Compliant with Service Charge Reporting and Avoid Legal Trouble

Service charge compliance is one of the most sensitive aspects of residential block management. Errors in reporting, allocation, or documentation can lead to conflicts, court challenges, and reputational damage. Under the Landlord and Tenant Act of 1985, service costs must be reasonable, legitimately demanded, and backed by good documents.

Here’s how managing agents and RMCs can remain safe:

Follow the Lease Wording Exactly

The lease is the governing document.

You must:

- Allocate costs exactly as stated

- Charge only permitted expenditure

- Apply the correct percentage splits

- Respect timing provisions for demands

Even reasonable costs can be challenged if they are not charged strictly in accordance with the lease.

Ensure Service Charge Demands Are Legally Valid:

A demand must:

- Clearly show the amount due

- Include required statutory notices

- Be served correctly

- Reflect accurate calculations

If the format is incorrect, the charge may become legally unenforceable, regardless of whether the cost itself is valid.

Reconcile and Review Regularly

Monthly reconciliation ensures:

- Ledger matches bank balances

- No duplicate or missing entries

- Early detection of errors

Quarterly internal reviews help avoid audit surprises.

Keep a Strong Audit Trail

Maintain:

- Contractor invoices

- Approval documentation

- Payment confirmations

- Communication regarding major works

Common Challenges in Managing Service Charge Accounts

Managing service charge accounts entails much more than just collecting money and paying invoices. It necessitates tight compliance, precise accounting, prudent cash flow management, and open communication with leaseholders. Under the Landlord and Tenant Act of 1985, service costs must be reasonable, appropriately demanded, and adequately documented, making errors potentially costly.

The following are the most typical operational and compliance issues that managing agents and RMCs face:

Interpreting and Applying Lease Terms Correctly

Every service charge account is governed by the lease. Challenges arise when:

- Cost allocation percentages are unclear

- Shared services apply to multiple blocks

- Certain expenses (e.g., lift, roof, car park) apply only to specific units

- The lease wording is outdated or ambiguous

Misinterpretation can make charges legally challengeable, even if the expense itself is valid.

Maintaining Accurate and Segregated Accounting Records

Service charge funds must be held separately in trust and accounted for clearly. Common issues include:

- Mixing operational funds with service charge money

- Incomplete transaction records

- Missing invoices or approval documentation

- Failure to reconcile bank accounts monthly

Weak accounting controls increase audit risks and legal exposure.

Budgeting and Forecasting Errors

Accurate budgeting is difficult, especially when:

- Insurance premiums increase unexpectedly

- Major repairs arise mid-year

- Inflation impacts contractor pricing

- Reserve fund planning is inadequate

Under-budgeting leads to large balancing charges. Over-budgeting leads to dissatisfaction and complaints.

Preparing for Audit and Tribunal Scrutiny

Service charge accounts are frequently reviewed by:

- Independent accountants

- Leaseholders

- Property tribunals

If documentation, reconciliations, or allocations are weak, the agent’s credibility can be questioned.

Service Charge Accounts for Residential vs. Commercial Properties

Service fee accounting varies greatly between residential and commercial buildings. While both require collecting contributions to cover shared expenses, the legal structure, reporting criteria, and dispute risks differ.

Understanding the differences is critical for compliance and risk management.

| Aspect | Residential Properties | Commercial Properties |

| Primary Governance | Governed mainly by the Landlord and Tenant Act 1985 | Primarily governed by lease contract terms |

| Charge Requirements | Charges must be reasonable | More flexibility in cost allocation |

| Cost Allocation | Strict lease-based allocation | Determined by lease agreement |

| Reporting Obligations | Leaseholders can request cost summaries | Reporting depends on lease agreement |

| Statutory Protections | Stronger legal protections for leaseholders | Fewer statutory protections |

| Dispute Focus | Higher risk of tribunal disputes | Disputes focus on lease interpretation |

| Compliance Level | Stricter and more regulated | Generally less regulated |

Service Charge Accounts for Right to Manage Companies (RTMs)

Right to Manage Companies (RTMs) take over a building’s management from the landlord, however this comes with complete financial responsibility, particularly for service charges.

RTMs are governed by the Commonhold and Leasehold Reform Act 2002, and once the Right to Manage is obtained, the RTM firm is responsible for collecting, administering, and reporting service costs accurately.

Key Responsibilities of RTMs:

Collecting Service Charges

RTMs must issue valid demands that comply with the lease and regulatory obligations. Incorrectly issued demands may become unenforceable.

Maintaining Accurate Accounting Records

RTMs must:

- Record all income and expenditure

- Allocate costs strictly as per lease terms

- Maintain supporting invoices and approvals

- Reconcile bank accounts regularly

Annual Reporting Requirements

RTMs must prepare accurate income and expense statements at the end of the year. Leaseholders have the right to seek summaries and inspect supporting documentation under the Landlord and Tenant Act of 1985.

Failure to maintain proper accounts can result in:

- Leaseholder disputes

- Tribunal challenges

- Personal liability risks for directors

FAQs: Frequently Asked Questions

How do you record service charges in accounting?

Service charges are not corporate income; they are maintained in trust for leaseholders.

Here’s a simple way to document them:

When you raise a demand, record it as money owed by the leaseholder.

When payment is received, deposit it in a separate service charge trust bank account.

When you pay expenses (for repairs, cleaning, or insurance), record them as service charge expenses from the same trust account.

Reconciling monthly makes sure your ledger reflects your bank balance.

Do you have to prepare service charge accounts?

Yes, usually, you do. If the lease mandates it, annual service fee accounts must be prepared. Under the Landlord and Tenant Act of 1985, leaseholders can also receive a summary of charges.

What is the difference between service charge and expense accounts?

A service charge account keeps track of the money that leaseholders pay to cover shared building expenditures (such as cleaning, maintenance, and insurance). This money is held in trust and is not considered corporate income.

An expenditure account (also known as a corporate expense account) tracks the business’s own operational costs, such as payroll, office rent, and utilities. These are the company’s expenses.

How do I handle surpluses in my service charge account?

A service charge surplus occurs when the amount collected exceeds the amount spent during the year.

The manner in which it is handled is determined by the lease, although typically:

Carry it forward to decrease next year’s service charges.

Transfer it to the reserve fund (if the lease permits).

Refund it to the leaseholders (less common).

The key point is that the surplus belongs to the leaseholders, not the landlord or the managing agency.

What are the common pitfalls in managing service charge accounts?

Common mistakes include:

Not following the lease when allocating costs

Mixing service charge funds with company money

Poor record keeping (missing invoices or approvals)

Failing to reconcile monthly

Under-budgeting, leading to large balancing charges

Issuing non-compliant demands

These issues can lead to disputes, cash flow problems, and legal challenges.

Conclusion

Managing service charge accounts is more than just an accounting duty; it is a legal and financial obligation. From budgeting and expense allocation to reconciliation and annual reporting, each stage must adhere to the lease and comply with UK requirements.

Strong record keeping, accurate trust accounting, regular reconciliation, and open communication with leaseholders are critical for avoiding conflicts and legal issues.

In brief, disciplined processes and lease-aligned reporting are essential for maintaining compliance, conserving finances, and assuring effective service charge management.