- Important Self Assessment Deadlines

- What Are Self Assessment Penalties?

- What are the penalties for filing your Self Assessment late?

- How much will I be charged if I pay my tax late?

- What interest does HMRC charge on late payments?

- How do I appeal against a Self Assessment penalty?

- What counts as a “reasonable excuse” in the eyes of HMRC?

- Does a Time to Pay arrangement stop late payment penalties?

- What happens if I never file my Self Assessment return?

- Can I reduce penalties if my return was issued by mistake?

- How long do I have to submit a penalty appeal?

- What evidence should I include with my penalty appeal?

- Can penalties be added to my tax code or spread out in instalments?

- What support is available if I cannot afford to pay my penalties?

- Can HMRC give bigger penalties if you make mistakes on purpose?

- Can I use an accountant to appeal a penalty on my behalf?

- FAQs: Frequently Asked Questions

- Conclusion

Filing your Self Assessment tax return late can be stressful and many UK taxpayers want to avoid it. This blog explains the self assessment penalties HMRC charge for late filing and late payment in the 2025/26 tax year so you know what to expect if you miss the deadlines. Knowing this in advance will help you stay compliant and avoid unexpected costs.

To answer a common question: What happens if you file your Self Assessment late? HMRC charge a £100 penalty from day one. £10 a day for three months then up to £900 plus additional penalties of £300 or 5% of your tax owed at 6 and 12 months late. Interest also accrues daily on unpaid tax until it’s paid in full. This gives you an idea of how quickly the penalties add up.

Throughout this blog you’ll find a breakdown of the different types of penalties, how interest is calculated, the appeals process and how to set up payment plans with HMRC. You’ll also find out what’s classed as a “reasonable excuse” for missing deadlines and practical advice on how to minimise your penalties or appeal them.

Important Self Assessment Deadlines

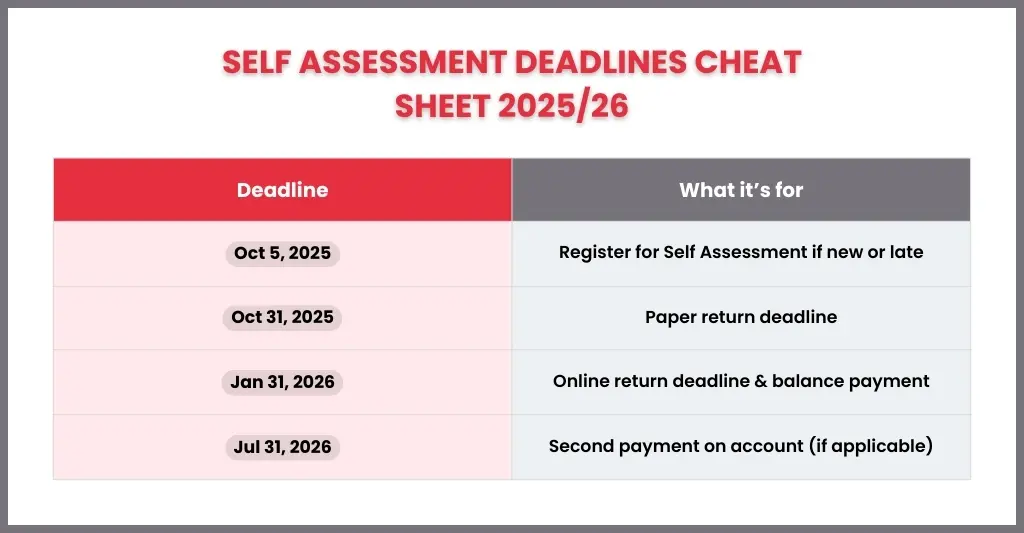

To avoid penalties make sure you know the Self Assessment deadlines for the 2025/26 tax year:

- Register for Self Assessment: You must register with HMRC by 5 October after the end of the tax year if you’re new to Self Assessment.

- Paper tax returns deadline: 31 October 2026.

- Online tax returns deadline: 31 January 2027. Filing after these dates will incur penalties.

- Payment deadlines:

- First payment on account: 31 January 2026.

- Second payment on account: 31 July 2026.

- Balancing payment (if any): 31 January 2027.

Don’t miss these deadlines, or you’ll get penalised for late filing and late payment.

Note: If you haven’t registered for Self Assessment yet, check our other guide on How to Register for Self Assessment for step-by-step instructions.

What Are Self Assessment Penalties?

Self-assessment penalties are the fines and costs that HMRC imposes when you fail to file your tax return or pay your tax bill by the deadline. The purpose of these is to motivate individuals to maintain compliance with their tax obligations, as failure to do so can swiftly result in costly obligations.

There are three primary kinds of Self Assessment penalties you should be aware of:

- Penalties for late filing are assessed if your tax return is not filed on time.

- Penalties for late payments are assessed if you fail to pay your taxes by the due date.

- Interest is charged on any overdue taxes every day until the total is paid.

Furthermore, in some circumstances, HMRC does accept appeals; however, to succeed, you will need a legitimate “reasonable excuse.”

What are the penalties for filing your Self Assessment late?

Missing the Self Assessment filing date is not simple for HMRC; even a single day’s delay will result in an automatic fine. The penalties increase with the amount of time you delay. This is how the 2025–2026 tax year operates:

- There is a £100 penalty for being one day late, regardless of the amount of tax you owe (even if you have nothing to pay).

- £10 more every day for three months after the due date, up to a total of £900.

- There is an additional £300 penalty or 5% of the tax owed (whichever is higher) for being six months past due.

- After a year, there will be an additional £300 or 5% of the tax owed, whichever is higher. HMRC may impose even harsher fines in certain circumstances.

How much will I be charged if I pay my tax late?

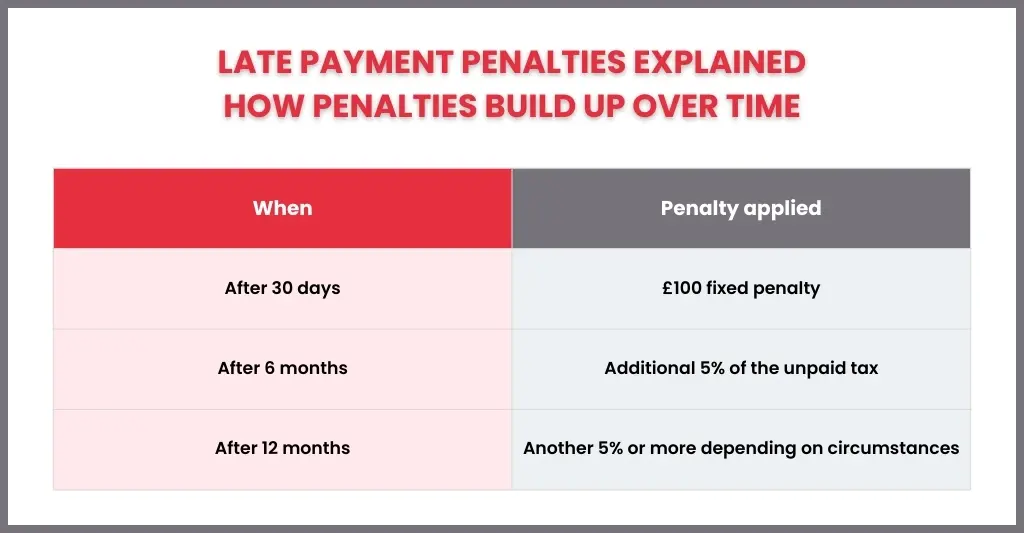

Penalties and interest will be added to your tax liability by HMRC if you fail to make the Self Assessment payment deadline. Late payment fees, as opposed to filing penalties, are determined by the length of time you fail to pay the bill:

- 30 days late – 5% of the unpaid tax.

- 6 months late – another 5% of the unpaid tax.

- 12 months late – a further 5% of the unpaid tax.

Furthermore, from the day following the payment deadline until the debt is paid, HMRC charges interest on the past-due amount every day. Because it is based on the base rate of the Bank of England + 2.5%, the interest rate fluctuates periodically.

What interest does HMRC charge on late payments?

Interest on any unpaid Self Assessment tax is assessed by HMRC in addition to late payment penalties. This charge accumulates every day until the remaining amount is paid off; it is not a one-time expense.

The base rate established by the Bank of England, plus 2.5% is the interest rate. HMRC periodically modifies its late payment interest rate due to the possibility of base rate fluctuations. In other words, you will accrue interest the longer you fail to pay your taxes.

Example

The daily interest rate for a £5,000 tax debt with a 7.75% HMRC late payment interest rate would be around £1.06. That’s about £100 in additional fees after three months, on top of the penalty for late payments.

At first glance, it may not seem like much, but interest accumulates over time and is assessed on top of any fixed penalty. Because of this, paying even a portion of your account might assist in reducing interest.

Penalties for Underreporting or Underpayment

As well as late filing and late payment penalties, HMRC also penalise you for underreporting your income or underpaying your tax because of an inaccurate return. These penalties depend on whether the mistake was careless or deliberate:

- Careless errors: Up to 30% of the extra tax due.

- Deliberate mistakes: 20-70% if you disclose the error late or 30-100% if HMRC finds the error.

- Get it right and on time and you’ll avoid these nasty financial consequences.

How do I appeal against a Self Assessment penalty?

If you feel that a penalty you have received is unfair, you have the right to appeal. Appeals will only be taken into consideration by HMRC if you can demonstrate that you had a “reasonable excuse” for missing the payment or deadline.

Some examples HMRC usually accepts include:

- A serious illness or unexpected hospital stay.

- Bereavement (particularly close family).

- Technical issues with HMRC’s online services.

- Postal delays are out of your control.

- Fire, flood, or other unexpected events.

HMRC does not accept the following as justifications: relying on someone else (such as an accountant) who failed to file on time, forgetting the deadline, or not having the funds to pay.

What counts as a “reasonable excuse” in the eyes of HMRC?

Certain ups and downs or tough situations keep happening in life sometimes. During such a phase, you may miss out on some important tasks to be completed. For example, tax filing has to be done on time.

But what to do if you missed filing a self assessment? If you have a valid justification, HMRC may cancel or lessen your penalty because they understand that this sometimes happens. We refer to this as a “reasonable excuse.”

A reasonable excuse is essentially a serious or unexpected event that prevented you from meeting the deadline. The following are instances that HMRC typically accepts:

- You were very ill or in the hospital.

- Someone close to you passed away.

- HMRC’s website wasn’t working when you tried to file.

- There was a fire, flood, or another disaster.

- The post was delayed, and it wasn’t your fault.

But there are also reasons HMRC won’t accept, such as:

- You forgot about the deadline.

- You didn’t have the money to pay.

- Your accountant or someone else didn’t do it for you.

Does a Time to Pay arrangement stop late payment penalties?

Yes, you can avoid late payment fees if you and HMRC agree on a Time to Pay arrangement before penalties start. Instead of paying your tax bill all at once, you can spread it out over monthly installments with a Time to Pay plan.

Here’s how it works:

- Late payment penalties won’t be assessed if you get in touch with HMRC prior to the due date and they accept a plan.

- As long as you follow the plan, penalties that have already accrued may still be imposed if you set it up after the deadline has passed. However, no additional penalties will be accumulated.

- The unpaid tax will still be subject to interest even if you have a Time to Pay plan.

Example: You can’t pay the whole £3,000 in taxes due on January 31. You can avoid the 5% late payment penalty if you give HMRC a call ahead of time to arrange a payment plan. Dividing the expense is easier and less expensive than ignoring the loan, but you will still pay some interest.

What happens if I never file my Self Assessment return?

Self-assessment returns do not disappear if you ignore them. The problem really becomes worse the longer you ignore it.

Here’s what HMRC will do if you never file:

Automatic penalties: You will be subject to the usual late filing penalties (£100 initially, followed by daily penalties and further fees at six and twelve months). These can build up to thousands of pounds very rapidly.

Estimated tax bill: A “determination,” which is essentially an estimate of the amount they believe you owe, may be raised by HMRC. You cannot dispute this amount unless you file your return, and it is typically greater than your actual tax.

Debt collection: HMRC may take legal action, utilize debt collectors, or deduct funds straight from your bank account or earnings if the payment isn’t paid.

Interest and late payment penalties: These keep increasing until the tax is paid.

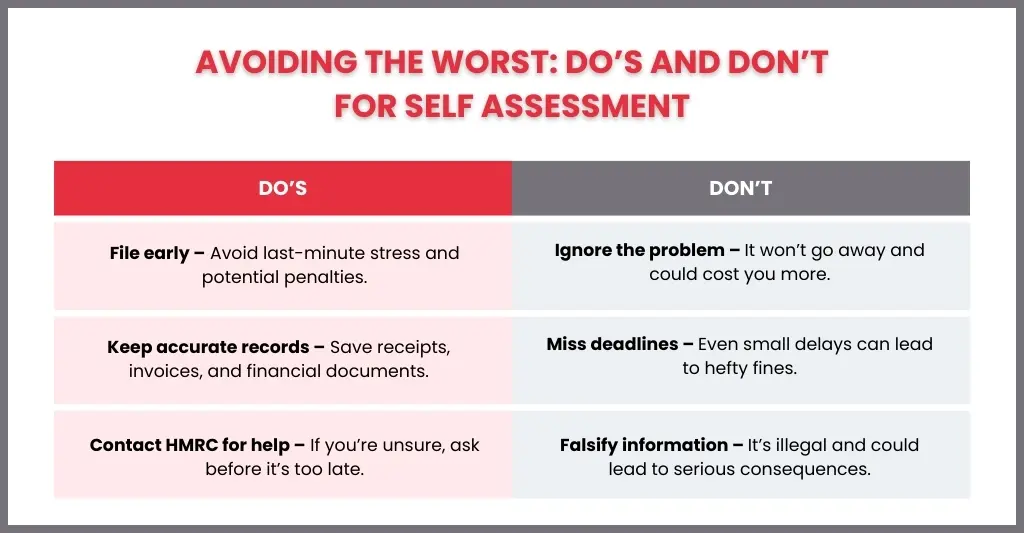

Simply said, the worst course of action is not filing. Submitting the return on time is always preferable, even if you are unable to pay your account immediately. In this manner, you can discuss a payment plan with HMRC and avoid some of the penalties.

Can I reduce penalties if my return was issued by mistake?

Yes, if you were not required to file a Self Assessment return and HMRC accidentally issued you one, you can request that the penalties be canceled.

Even when a person’s circumstances may not necessitate filing a return, HMRC occasionally requests it (for instance, if your income was taxed exclusively through PAYE and you had no other income to disclose). If this occurs:

- You must get in touch with HMRC right away and explain why you believe you shouldn’t have received a refund.

- The return will be withdrawn if HMRC concurs. Any associated late filing penalties are waived upon withdrawal.

- If you have already received a fine, it will typically be waived as soon as the return is formally withdrawn.

Examples of how Self Assessment penalties add up

The cost of your Self Assessment return or payment increases with the amount of time you delay. These two straightforward examples demonstrate how rapidly the numbers can increase.

Example 1: Late filing only

- You file your return 6 months late, but your tax is already paid.

- £100 fixed penalty (1 day late)

- £900 daily penalties (£10 × 90 days, from 3 to 6 months)

- £300 six-month penalty

= £1,300 in total fines (even though no tax was owed).

Example 2: Late filing and late payment

- You owe £5,000 in tax and filed your return 12 months late.

- £100 fixed penalty

- £900 daily penalties

- £300 six-month penalty

- £300 twelve-month penalty

= £1,600 in filing penalties

On top of that:

- £250 late payment penalty at 30 days (5% of £5,000)

- £250 late payment penalty at 6 months (another 5%)

- £250 late payment penalty at 12 months (another 5%)

= £750 in payment penalties, plus daily interest.

Total: £2,350 in penalties + interest — on top of the original £5,000 tax bill.

How long do I have to submit a penalty appeal?

You have a limited amount of time to challenge a Self Assessment penalty if you believe it is unreasonable. You typically have 30 days from the date of the penalty notice to submit your appeal to HMRC.

Here’s what that means for you:

- The 30-day period does not begin on the day you get the penalty notice; rather, it begins on the date shown at the top.

- You can file an appeal online via your HMRC account or by completing the notice’s accompanying paper form and returning it.

- If you miss the 30-day deadline, you might still be able to appeal, but HMRC will decide whether to accept it after you explain the delay.

What evidence should I include with my penalty appeal?

HMRC won’t believe you if you appeal a Self Assessment penalty; you will need to provide evidence to support your claim. Your chances of having your appeal granted increase with the quality of your evidence.

The kind of proof you want will vary depending on why you are appealing, but the following are typical examples:

- Illness or hospital stay – doctor’s notes, hospital letters, medical certificates.

- Bereavement – death certificate or funeral paperwork.

- Technical issues – screenshots of error messages, confirmation emails from HMRC’s support team.

- Postal delays – proof of postage, tracking receipts.

- Unexpected events (fire, flood, theft, etc.) – police reports, insurance claims, or official letters.

If you lack documented proof, provide a detailed explanation of what transpired and why you were unable to fulfill the deadline. Evidence always supports your argument, but HMRC will take your explanation into account.

Can penalties be added to my tax code or spread out in instalments?

Yes, in order to make managing Self Assessment penalties easier, HMRC may collect them in a variety of ways.

Added to your tax code: HMRC may modify your tax code to collect what you owe (including penalties) if you are employed or get a pension. This implies that the funds are deducted annually in modest quantities straight from your paycheck or pension.

Spread out in instalments: If you are unable to pay the penalty all at once, you might be able to work out a Time to Pay plan with HMRC. This enables you to pay the total amount due in monthly installments, including tax, fines, and interest. HMRC must be contacted, your circumstances must be explained, and a reasonable payment schedule must be agreed upon.

Interest will continue to accumulate until the entire amount is paid, even if you can spread the expense over time. Therefore, the sooner you pay, the lower your total cost will be.

What support is available if I cannot afford to pay my penalties?

There are various ways to get help if you are unable to pay your Self-Assessment penalties:

Time to Pay arrangement: To divide your taxes and penalties into manageable monthly installments, get in touch with HMRC. Larger debts typically need contacting HMRC; smaller debts can frequently be paid off online.

Appeal penalties: Asking HMRC to cancel or lessen the penalty is possible if you have a valid reason (such as a significant sickness, a death in the family, or an issue with the HMRC system). Proof is required.

Reduce Payments on Account: To avoid overpaying, you might ask to reduce your advance payments if your income is declining.

Budget Payment Plan: To control future liabilities, make smaller advance payments to HMRC throughout the year.Debt advice support: You can get assistance negotiating or learning about your rights from free agencies like TaxAid and Citizens Advice.

Can HMRC give bigger penalties if you make mistakes on purpose?

True. Deliberate mistakes are given far more weight by HMRC than incidental ones.

- HMRC may impose a penalty equal to up to 30% of the additional tax due if your error was careless.

- Penalties rise to 20% to 70% if the error was intentional, depending on whether you inform HMRC of it or they discover it.

- Penalties can increase to 30% to 100% of the tax owed if it is intentional and covered up (for example, by concealing records or fabricating numbers).

Can I use an accountant to appeal a penalty on my behalf?

- Formal authorisation must be granted by you (typically by filling out form 64-8 or via HMRC’s online services).

- Once accepted, they can speak with HMRC on your behalf, file the appeal, and offer proof.

- You are still legally in charge of making sure your return is accurate and of paying any taxes or penalties that are due.

Employing an accountant can help your appeal because they are knowledgeable with HMRC’s regulations and can clearly explain your position.

FAQs: Frequently Asked Questions

What happens if I miss the Self Assessment deadline?

Even if you don’t owe taxes, you will typically receive a £100 fixed penalty. If the delay persists, there are further daily and percentage fines.

Can I appeal a penalty?

Yes, if you have a valid reason (such as a serious illness, a death in the family, or an IT failure). You have to give evidence and an explanation of your situation.

Will interest be charged on penalties?

Unless the penalties are unpaid, interest is typically not charged on late tax payments.

Can I pay penalties in instalments?

Yes, A Time to Pay agreement could be agreed upon by HMRC, enabling you to spread the expense.

What if I made a genuine mistake?

If it was a casual mistake, you can still be penalised, but if you report it right once, HMRC usually lowers the penalty.

Can penalties ever be cancelled?

Yes. The penalty may be canceled or reduced by HMRC if they approve your appeal.

Should I get professional help?

Your chances of success can be increased by having a tax advisor or accountant file the appeal on your behalf (with permission).

Conclusion

Although HMRC fines can seem excessive, they are not unmanageable. You have three options if you are unable to pay in full or feel that the penalty is unjust: you can set up a Time to Pay plan, seek expert advice from professionals, or appeal with a valid cause. Being proactive is essential; if you get in touch with HMRC before debts worsen, they are much more likely to agree to flexible alternatives. Recall that there is assistance available, and that you may minimise expenses, lessen stress, and maintain compliance with your tax responsibilities by taking the appropriate approach.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.