- What Is an Internal Audit?

- Benefits of Internal Audit

- What is an External Audit?

- Benefits of External Audit

- Internal Audit vs External Audit: Key Differences

- Why UK Businesses Needs Both Internal and External Audits?

- Common Misconceptions About Internal and External Audits

- How to Decide Which Audit Your Business Needs Right Now?

- How CoxHinkins Can Help You with Audits?

- FAQs: Frequently Asked Questions

- Conclusion

Maintaining accurate financial records is not enough to run a successful firm in the UK; transparency, accountability, and trust under UK regulatory requirements are also essential. This is when audits are useful. However, audits vary from one another. Although both are necessary, internal and external audits have somewhat different functions, which is something that business owners frequently hear about. An external audit provides stakeholders with an impartial assurance that your financial statements are accurate and in compliance, while an internal audit focuses on streamlining operations and identifying internal risks.

The main distinctions between internal and external audits will be discussed in this blog, along with the reasons behind their importance, their synergies, and the essential knowledge that any business owner should have to keep ahead of the competition.

What Is an Internal Audit?

An internal audit is a comprehensive, ongoing review of a business’s operations and procedures to improve efficiency, control, and risk management. Internal audits are conducted by your staff or an internal audit team to assess the effectiveness of internal controls and ensure adherence to your organisation’s policies and regulatory requirements, including those under the UK Companies Act 2006 and relevant industry standards. They also help identify risks and areas for operational improvement.

Unlike external audits, internal audits are not legally required in the UK, but many businesses consider them best practice to support sound corporate governance and compliance.

Benefits of Internal Audit

Beyond just ensuring compliance, internal audits help your company grow from the ground up. Instead of only performing a financial check-up, an internal audit serves as a proactive tool for improvement by examining internal processes, controls, and risk areas. The following are some main benefits:

Improved Risk Management: Ensures that risk mitigation measures are effective and comply with UK regulations such as the Financial Reporting Council (FRC) guidelines.

Operational Efficiency: Identifies workflow inefficiencies to assist in cutting waste and streamlining procedures.

Stronger Internal Controls: Guarantees the effectiveness and regular observance of policies, processes, and controls.

Fraud Prevention & Detection: Fraud and misconduct are more difficult to overlook when they are reviewed on a regular basis.

Better Decision-Making: Gives fast and accurate information to management to inform strategic planning.

Regulatory Compliance: Reduces compliance risks by assisting in maintaining conformance to regulatory requirements and industry standards.

What is an External Audit?

An external audit is an independent, annual examination of a company’s financial accounts by a third-party auditor, typically a firm registered in the UK such as those regulated by the Institute of Chartered Accountants in England and Wales (ICAEW). The goal is to verify the accuracy of financial statements, ensure compliance with UK accounting standards (IFRS or UK GAAP), and provide assurance to stakeholders including investors, lenders, and regulatory bodies.

External audits offer objective credibility to your accounts and are often required by UK law for public companies, large private companies, and certain regulated industries.

Benefits of External Audit

The company and its stakeholders gain credibility and confidence from an external audit. Principal advantages consist of:

- Trust and Transparency: Confirms financial statements are reliable and prepared according to legal and ethical standards in the UK.

- Regulatory Compliance: Helps meet industry regulations enforced by bodies like the Financial Conduct Authority (FCA).

- Stakeholder Confidence: Reassures investors, lenders, and customers, facilitating access to capital and business opportunities.

- Independent Opinion: Provides an unbiased view free from internal influence.

- Fraud Detection: Identifies errors or irregularities that might otherwise be overlooked.

Internal Audit vs External Audit: Key Differences

| Aspect | Internal Audit | External Audit |

| Objective | Improve processes, controls, and risk management. | Verify the accuracy of financial statements. |

| Performed By | Employees or the in-house audit team | Independent, third-party auditors |

| Scope | Broad – covers operations, controls, and compliance. | Narrow – focuses mainly on financial reporting |

| Frequency | Ongoing, multiple times a year | Usually once a year. |

| Reporting To | Management and board | Shareholders, regulators, and external stakeholders. |

Why UK Businesses Needs Both Internal and External Audits?

Relying on only one audit type can leave gaps in oversight. Internal and external audits serve distinct but complementary functions that together strengthen your company’s operational and financial health:

Strengthening Internal Operations

Internal audits assist management in assessing risk management systems, finding process flaws, and ensuring corporate policies are being adhered to. This proactive strategy reduces operational inefficiencies, stops fraud, and promotes an accountable culture.

Building External Trust and Credibility

An impartial and independent assessment of the correctness of financial accounts is offered by external audits, in contrast. It is simpler to obtain capital, uphold compliance, and improve the company’s reputation when investors, lenders, regulators, and consumers are reassured.

Compliance and Risk Mitigation

Both audits work together to assist companies in maintaining legal and industry compliance, lowering the possibility of fines, legal issues, or harm to their reputation. Internal audits streamline the audit process and increase its dependability by preparing the business for external evaluations.

Informed Decision-Making

While external audit reports confirm the company’s financial status to stakeholders, internal audit insights provide management with the knowledge they need to enhance daily operations. Together, they guarantee that choices are supported by both financial integrity and operational precision.

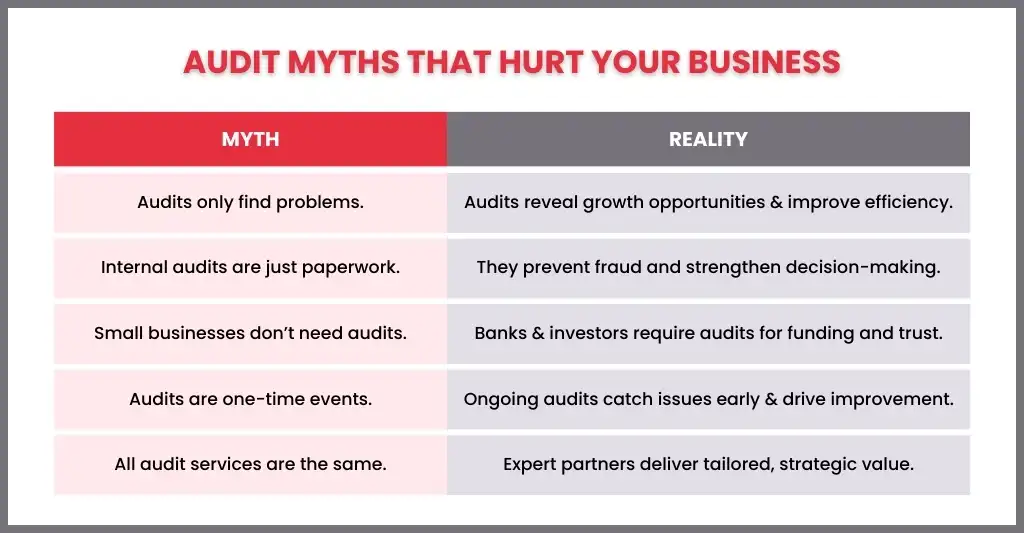

Common Misconceptions About Internal and External Audits

Despite their significance, a lot of business owners are unaware of the true nature of audits. Businesses can see their actual worth by eliminating these myths:

Audits only look for fraud: Audits, especially internal ones, concentrate on enhancing procedures, effectiveness, and compliance, whereas identifying fraud is only one component.

External audits mean something is wrong: For many firms, especially those that are larger or subject to regulations, external audits are a regular necessity. They give credibility rather than doubt.

Internal audits are optional and unnecessary: Internal audits are crucial for early risk identification and operational strengthening, even though they aren’t often mandated by law.

Auditors fix the problems they find: Although auditors point out problems and offer suggestions, management is ultimately responsible for putting those suggestions into action.

Once audited, a business is risk-free: Audits lower risk, but they do not completely remove it. There is still a need for strict internal controls and ongoing monitoring.

How to Decide Which Audit Your Business Needs Right Now?

- If you wish to address operational risks, enhance controls, or improve procedures, go with internal audit.

- If you require independent assurance for lenders, investors, regulators, or compliance, go with an external audit.

- The best course of action is to do an internal audit first to address problems, and then an external audit to establish credibility.

How CoxHinkins Can Help You with Audits?

CoxHinkins offers expert audit support tailored for UK organisations, simplifying what can be a complex and stressful process. Their team meticulously reviews your financial documents to ensure accuracy, completeness, and compliance with the latest UK accounting standards and regulatory requirements.

By addressing potential issues upfront, CoxHinkins helps reduce errors that could complicate your audit, protects your business from fines, and ensures your records meet the expectations of UK auditors and regulators. Their proactive approach prepares you thoroughly, providing peace of mind and enabling you to focus on growing your business.

FAQs: Frequently Asked Questions

Do all organisations need to conduct external audits?

Publicly traded corporations and some regulated industries are required to perform external audits, although not all enterprises are required to do so.

How frequently should audits be carried out?

Internal audits might take place every year or regularly. Usually, external audits are carried out once a year.

Do auditors fix the problems they find?

No, auditors point out problems and offer solutions. The implementation of solutions is the responsibility of management.

Conclusion

Whether through bookkeeping or audits, managing a company’s finances may be difficult and time-consuming. Although many companies attempt to save money by handling their own bookkeeping, there are risks involved, including mistakes, compliance issues, and increased stress. Working with experts like CoxHinkins ensures precision, adherence to regulations, and peace of mind.

CoxHinkins assists companies in reducing risks, streamlining procedures, and concentrating on expansion, from maintaining the organisation of your financial records to offering knowledgeable assistance during audits. In addition to protecting your company, investing in expert financial services opens the door to stability and long-term success.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.