- What is a Limited Company?

- Why Set Up a Limited Company in 2026?

- When is the Right Time to Set Up a Limited Company?

- How to Set Up a Limited Company in 2026

- Step 1: Choose a Suitable Company Name

- Step 2: Appoint at Least One Company Director

- Step 3: Decide Who the Shareholders Will Be

- Step 4: Set Your Registered Office Address

- Step 5: Choose Your Business Activity (SIC Code)

- Step 6: Decide Your Share Structure

- Step 7: Register the Company With Companies House

- Step 8: Register for Corporation Tax With HMRC

- Step 9: Open a Business Bank Account

- Step 10: Set Up Accounting, Payroll, and Compliance

- Additional Registrations and Licenses You Might Need

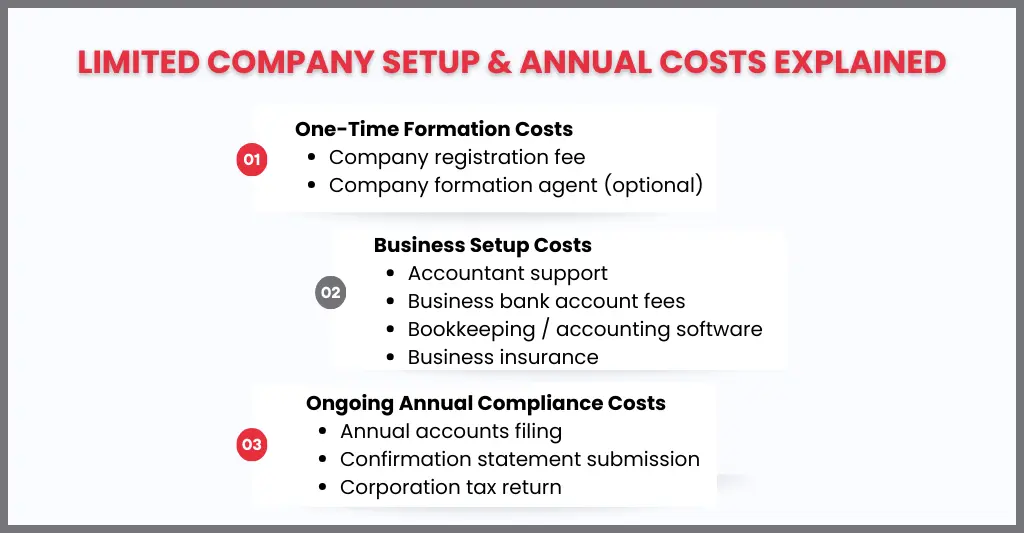

- How Much Does It Cost to Set Up a Limited Company in 2026?

- How Long Does It Take to Set Up a Limited Company?

- Common Mistakes to Avoid When Setting Up a Limited Company

- FAQs: Frequently Asked Questions

- Conclusion

One of the best strategies to launch your business in 2026 is to form a limited company. It protects your personal assets, makes you appear more professional, and helps you create an easier-to-scale organisation.

However, the process of company registration, Companies House, VAT, Corporation Tax, director responsibilities, can still seem overwhelming to new business owners.

Everything you need About UK limited company setup in 2026, per HMRC/Companies House rules, will be covered in detail in this blog, including necessary expenses, deadlines, and post-incorporation actions.

What is a Limited Company?

Compared to the sole trader model, a limited company offers a more official business structure. It establishes a company as a separate legal and financial entity from its owners.

This indicates that, unlike a single proprietor, you have limited liability as a company director and won’t be held personally liable for monetary losses.

However, being a limited company, also means that any earnings belong to the business and that you must take money out as dividends or salaries to earn income.

Why Set Up a Limited Company in 2026?

Establishing a limited company (Ltd) may be one of the best choices you make when launching a business in 2026. Not only does it make your company “official,” but it also allows you a stronger long-term growth potential, a more professional structure, and financial management.

Here are the key reasons why many new entrepreneurs choose to register a limited company in 2026:

- Limited Liability Protection: One distinct legal entity is a limited company. This means that, compared to sole trader status, your personal assets (such as savings or property) are typically protected in the event that the firm suffers losses or is sued.

- Stronger Business Credibility: Being “Ltd” gives your company a more established appearance right away. Because limited corporations are perceived as more reliable and organised, many customers, suppliers, and investors like doing business with them.

- Tax Planning Benefits: Compared to sole proprietorships, limited companies may be more tax-efficient, particularly as profits rise. You could be able to handle business expenses and income (wage plus dividends) more freely.

- Easier to Scale and Raise Funding: A limited business facilitates growth, hiring staff, and partner acquisition. You can formally organise ownership, add directors, and issue shares.

- Clear Separation Between Business and Personal Finances: A limited company facilitates the separation of business revenue and expenses. Bookkeeping, cash flow planning, and year-end reporting become much more organised as a result, which also lessens future misunderstanding.

Who Should Consider Setting Up a Limited Company?

If you desire greater control, credibility, and long-term financial efficiency, forming a limited company may be a wise choice. It’s particularly important to think about if:

- You want a formal structure from the start of your firm because you want it to grow.

- You want to look into more tax-efficient ways to pay yourself because your income is growing.

- You plan to work with bigger clients or suppliers who prefer dealing with registered companies.

- As a contractor or freelancer, you desire a more professional setup and a more powerful brand image.

- In the future, you hope to attract investors or partners.

- You wish to establish a distinct corporate credit profile and facilitate easier access to financing.

When is the Right Time to Set Up a Limited Company?

Although there isn’t a “perfect” date to establish a limited company, there is a period that works best depending on how well your company is doing. It might be appropriate to incorporate if your income is rising, your risks are rising, or you are prepared to appear more professional to consumers.

Here are the clearest signs you should consider setting up a limited company:

- When your profits are becoming consistent: A limited company might provide you with greater structure and financial control if you consistently make a steady profit (month after month).

- When your business income is rising: Due to taxes and National Insurance obligations, continuing to operate as a sole proprietor may become costly as your revenue rises. Depending on your circumstances, limited businesses may occasionally provide greater freedom in tax planning.

- When you want to protect personal assets: Incorporation assists in protecting you from business obligations if your work involves contracts, customer conflicts, or financial risk.

- When clients take you more seriously as a registered business: Many agencies, corporate clients prefer working with limited companies as it gives more sense of security compared to sole proprietorship.

- When you’re ready to scale, hire, or take investment: A limited business becomes more useful and future-ready whenever you intend to expand beyond “just you” by hiring employees, partners, or investors.

- When you want cleaner business finances: A limited corporation facilitates easier reporting, budgeting, and financial planning by promoting a better division of personal and business finances.

How to Set Up a Limited Company in 2026

The good news? As long as you follow the correct procedures and enter your information accurately from the beginning, registering a limited corporation is not difficult. This comprehensive, step-by-step guide will assist you in successfully establishing your limited company.

Step 1: Choose a Suitable Company Name

The very first step is to think about a good unique name for your company. Your company name should be different from other companies as it will appear on Companies House and official documents.

You must ensure:

- The name is not already registered on Companies House

- It’s not too similar to another company name

- It doesn’t contain restricted words unless you have permission (e.g., “Bank”, “Royal”)

Step 2: Appoint at Least One Company Director

There must be a minimum one director in each limited corporation. Legally, a director is in charge of managing the company and making sure it complies with all regulations.

As a director, you’ll be responsible for:

- Keeping company records updated

- Filing annual accounts

- Submitting confirmation statements

- Managing tax filings

You can register as the only director if you are setting up the company alone.

Step 3: Decide Who the Shareholders Will Be

Shareholders are the people who own the company. They hold shares and receive profits through dividends.

Most small businesses start with:

- One founder as the shareholder (100% ownership)

If you are setting up a company with a partner, you will need to decide:

- How many shares each person holds

- The percentage ownership split

Step 4: Set Your Registered Office Address

The official legal address of your business is your registered office address. Letters and notices from Companies House and HMRC will be sent here.

Important points:

- It must be a UK address

- It appears publicly on the Companies House register

- It can be your home address, office, or your accountant’s address

Step 5: Choose Your Business Activity (SIC Code)

A SIC code (Standard Industrial Classification code) tells Companies House what your business does.

You can choose:

- One SIC code (if your company has one activity)

- Multiple SIC codes (if your company has more than one activity)

Example:

- IT consulting

- Marketing services

- Online retail

Choosing the right SIC code helps your business remain correctly classified for legal and reporting purposes.

Step 6: Decide Your Share Structure

Your share structure defines:

- How many shares your company issues

- What type of shares they are (usually “ordinary” shares)

- Who owns how many shares

Step 7: Register the Company With Companies House

Once the above details are ready, you can register your limited company through Companies House.

During registration, you will submit:

- Company name

- Registered office address

- Director details

- Shareholder details

- Share structure

- SIC code

You will also adopt:

- Memorandum of Association

- Articles of Association

These are legal documents that define company rules. Most people use the standard templates provided during online registration.

Step 8: Register for Corporation Tax With HMRC

Once your limited company starts trading, it must be registered for Corporation Tax with HMRC.

You must register within 3 months of starting business activity, such as:

- Making sales

- Paying suppliers

- Running ads or marketing

- Hiring staff or paying yourself

This step is important because Corporation Tax rules apply as soon as your company becomes active.

Step 9: Open a Business Bank Account

Although it’s not legally required, opening a business bank account is strongly recommended.

A separate business account helps you:

- Keep business and personal finances separate

- Track income and expenses properly

- Improve bookkeeping accuracy

- Look more professional to clients and suppliers

Step 10: Set Up Accounting, Payroll, and Compliance

Once your company is registered, the real responsibility begins, staying compliant and keeping finances organised.

You should set up:

- Bookkeeping software (Xero, QuickBooks, Sage, etc.)

- Payroll if you plan to pay yourself salary

- VAT registration (if applicable)

- Expense tracking and invoicing

- Year-end accounts preparation

Limited companies also have annual filing responsibilities, such as:

- Annual accounts

- Confirmation statement

- Corporation tax return

Additional Registrations and Licenses You Might Need

The first major step is to register your limited company at Companies House. However, depending on the nature of your business, you could also require additional licenses, registrations, or approvals in order to operate lawfully in the UK.

It’s crucial to evaluate these standards early because they differ depending on the sector. The most typical extra licenses and registrations that business owners may require in 2026 are as follows:

VAT Registration (If Applicable)

You must register for VAT with HMRC if your business turnover exceeds the VAT threshold. Some firms choose to register even if they are below the threshold in order to appear more established or to recover VAT on purchases.

VAT registration is especially common for:

- eCommerce and online sellers

- Consultants and service providers

- Businesses working with VAT-registered clients

PAYE Registration (If You Hire Staff or Pay Yourself)

You need to set up PAYE (Pay As You Earn) and register as an employer if you intend to hire staff or pay yourself a salary as a director of the firm.

PAYE covers:

- Income Tax deductions

- National Insurance contributions

- Payroll reporting to HMRC

This is essential if you are running payroll, even for just one person.

Business Insurance (Often Required for Contracts)

Many industries and clients demand you to carry insurance before doing business, even if it’s not usually required by law

Common types include:

- Public liability insurance

- Professional indemnity insurance

- Employers’ liability insurance (required if you have employees)

Industry-Specific Licences and Permits

Depending on what they sell or the services they offer, certain firms need specific licenses.

You may need licences if you operate in areas like:

- Food and hospitality

- Construction and trades

- Childcare and education

- Transport services

- Health and regulated services

Even home-based businesses can need permits (for example, if you’re storing or selling goods).

ICO Registration (If You Handle Personal Data)

Under UK GDPR regulations, your company may need to register with the Information Commissioner’s Office (ICO) if it gathers or keeps consumer personal data (names, emails, phone numbers, and addresses).

This applies to most businesses, including:

- online store

- marketing agencies

- service-based companies

- subscription businesses

It’s often overlooked, but important for compliance.

Bank, Payment Processor, and Trading Setup

Once you’re ready to trade, you’ll likely need to set up:

- A business bank account

- Payment gateways (Stripe, PayPal, etc.)

- Invoicing and billing tools

This isn’t a legal registration, but it’s a practical “must-have” to run your business smoothly.

How Much Does It Cost to Set Up a Limited Company in 2026?

The method of registration and the employment of professional assistance (such as an accountant or formation agency) determine how much it will cost to establish a limited company in 2026. The initial startup charges are reasonably priced for many new business owners, but depending on your company’s needs, there may be additional expenses.

Here’s a concise summary:

Companies House Registration Fee (Basic Cost)

If you register your company yourself through Companies House, you’ll pay a simple formation fee.

This covers:

- Incorporating your company

- Issuing the Certificate of Incorporation

- Adding director and shareholder details

- Registering the company officially

Using a Company Formation Agent (Optional Cost)

Many people choose to use a company formation agent because they handle everything for you and often include extra features such as:

- Registered office address service

- Digital incorporation documents

- Support with share structure

- Post-formation guidance

This option is useful if:

- You want the process handled professionally

- You want privacy (not listing your home address publicly)

- You want everything set up correctly the first time

Accountant Support (Common for New Directors):

If you are setting up a limited company with the intention to grow, work with clients, and manage taxes efficiently, many founders involve an accountant early.

An accountant can help with:

- Deciding the best director salary/dividend mix

- Registering for Corporation Tax

- Setting up bookkeeping software

- VAT registration and compliance

- Payroll setup

- Annual accounts and filings

Additional Setup Costs You Should Budget For

Even after incorporation, there are a few common “startup costs” for a limited company in 2026, such as:

- Business bank account fees (depending on provider)

- Bookkeeping software subscriptions (Xero, QuickBooks, Sage etc.)

- Payroll software / PAYE setup (if you pay yourself or staff)

- Business insurance (especially for consultants or client work)

- Domain name and website setup (if needed)

Ongoing Annual Filing Costs (Important to Know)

This is something that many entrepreneurs are unaware of: establishing a limited company is one thing, but keeping it up to date requires annual compliance.

You will likely need to file:

- Confirmation statement

- Annual accounts

- Corporation Tax return

If you use an accountant, this may be included in an annual package depending on the level of support you need.

How Long Does It Take to Set Up a Limited Company?

In the UK, establishing a limited company is typically simple and quick. In 2026, it can frequently be completed in as little as 24 hours, particularly if you register online. However, how you apply and whether your information is prepared ahead of time will determine the precise timetable.

1) Online Registration (Fastest Option)

If you register your company directly through Companies House online, it usually takes:

24 to 48 hours (sometimes even faster)

This is the most common option for new business owners because it is quick, affordable, and simple.

2) Postal Registration (Slower Option)

If you apply by post, the process naturally takes longer due to delivery and manual handling.

Typical time:

8 to 10 working days (or longer)

This option is rarely used unless someone prefers paper-based registration.

3) Using a Company Formation Agent

If you choose a formation agent, the company itself can still be registered quickly (often within a day), but extra services can add time — such as:

- setting up a registered address service

- VAT registration help

- PAYE setup

- business bank account setup

So overall, you can expect:

When filed online, the process usually takes 3-24 hours to complete. Most firms are formed on the same day or the next working day if their documentation is correct and filed during business hours.

Common Mistakes to Avoid When Setting Up a Limited Company

In 2026, creating a limited company is not too difficult, but minor errors at the start might result in more serious problems down the road, such as tax penalties, denied applications, or disorganised accounts. These are the most typical mistakes to steer clear of:

- Choosing the Wrong Company Name: Many applications are delayed because the name contains prohibited phrases or is too close to an already-existing firm. Prior to finalizing your name, always visit Companies House.

- Using Your Home Address Without Thinking: Companies House makes your registered office address available to the public. Use a registered office service or an accountant’s address if you don’t want to use your own address online.

- Picking the Wrong SIC Code: SIC codes explain the activities of your business. When it comes to banking, tax registration, or compliance checks, selecting the wrong one can cause difficulty.

- Setting Up the Share Structure Incorrectly:

A messy share setup can cause problems when:

- Adding a partner later

- paying dividends

- bringing in investors

Keep it simple unless you’re advised otherwise.

- Forgetting to Register for Corporation Tax: You must register for Corporation Tax with HMRC within the allotted time after you begin trading. Many new directors receive compliance notices because they fail to detect this.

- Mixing Business and Personal Finances: Confusion in bookkeeping and an increase in tax filing problems might result from using a personal account for commercial operations. Establish a business bank account as soon as possible.

FAQs: Frequently Asked Questions

Can I set up a limited company by myself?

Sure. A limited company may be registered with just one shareholder and one director. It’s among the most popular arrangements for consultants, independent contractors, and fledgling entrepreneurs.

Do I need an accountant to set up a limited company?

No, it’s not required. However, an accountant can assist you in selecting the appropriate structure, preventing compliance errors, and effectively managing year-end accounts, corporation tax, VAT, and payroll.

When do I need to register for Corporation Tax?

Within three months of beginning to trade (e.g., making sales, advertising, invoicing, or purchasing stock/services), your business must register for corporation tax.

Conclusion

One of the finest strategies to establish a reputable and expandable business in the UK in 2026 is to form a limited company. In addition to strengthening your company’s identity, it helps safeguard your personal assets and establishes a clear framework for handling taxes, money, and long-term expansion.

Choosing the appropriate company details, registering with Companies House, and maintaining compliance with HMRC regulations are all crucial to setting it up appropriately from the start. As your business expands, a limited company can offer you greater control, credibility, and financial certainty with the correct setup and sound accounting practices.