- What is Corporation Tax?

- When Do You Need to Register for Corporation Tax?

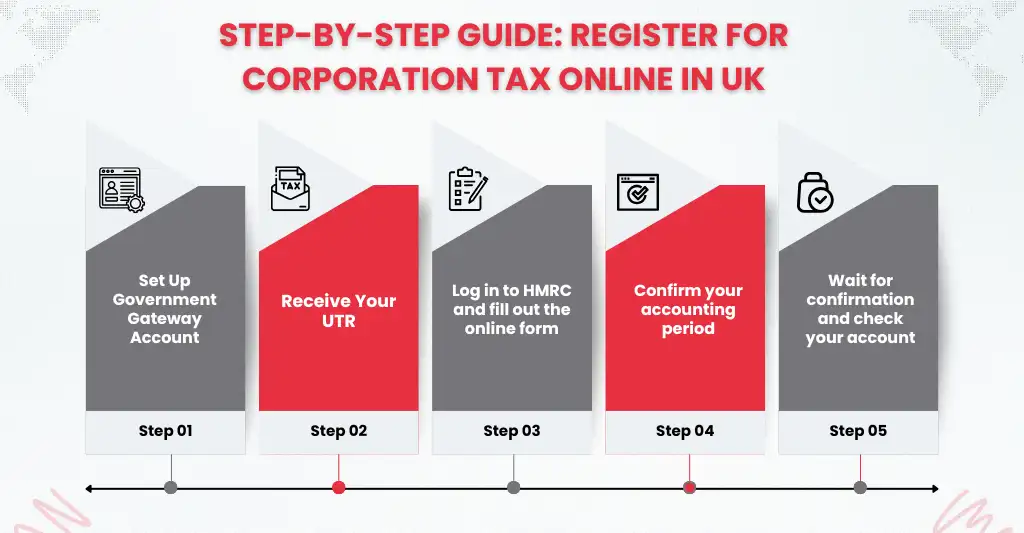

- How to Register for Corporation Tax Online (Step-by-Step Guide)

- What Happens After Registering for Corporation Tax Online?

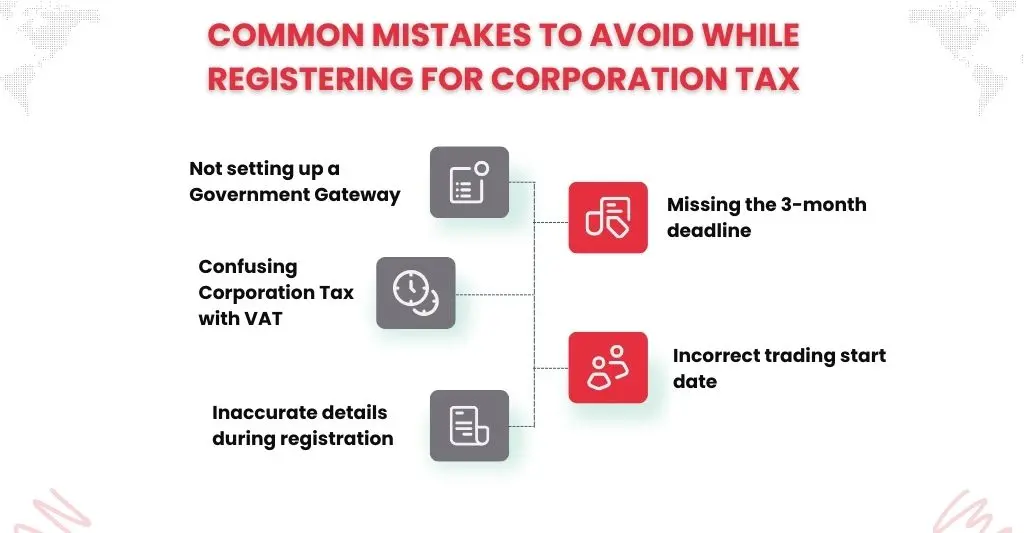

- Common Mistakes to Avoid When Registering

- How To Register if You Missed the 3-Month Deadline?

- Frequently Asked Questions

- Conclusion

It’s an exciting move to start a new business in the UK, but in addition to introducing your goods or services, you also have essential legal obligations to manage, one of which is filing for corporation tax. To register for Corporation Tax in the UK as a new company, you must notify HM Revenue & Customs (HMRC) online within three months of starting any business activities, such as trading, advertising, or buying stock. Failing to register on time can result in penalties and interest charges.

Don’t worry; registering for Corporation Tax doesn’t have to be complicated or stressful. In this guide, we will walk you through each process step, explain exactly what information you’ll need, and help you avoid the common mistakes that trip up many new business owners. Whether this is your first company or you’re simply brushing up on the rules, you’ll find everything you need right here to make sure your business gets off on the right foot with HMRC.

What is Corporation Tax?

Corporation tax is simply the tax that a limited company pays on its earnings. If you are an owner of a limited company, you cannot afford to overlook corporation tax, as it is required by HMRC to stay compliant.

Think of it like this: just as individuals pay income tax on their earnings, your company pays corporation tax on its profits from trading, investments, or selling services or products. Every limited company must be registered for corporation tax with HMRC within three months of starting business activities.

Many New business owners face penalties for corporation tax because they focus completely on launching their products or services, and often don’t realise how important it is to register for corporation tax. Missing the registration Deadline can lead to penalties that eat your hard-earned profits.

When Do You Need to Register for Corporation Tax?

In the UK, you must register your company for Corporation Tax within three months of starting any business activity. This deadline is set by HM Revenue & Customs (HMRC) and applies from the moment your company begins trading, not from when you first formed the company or started planning your business.

Some actions don’t count as the beginning of your trading period. For instance, creating your company’s infrastructure or writing a business plan is not regarded as trade activity. The clock begins to tick the moment you enter into business dealings that bring you money.

Documents Required for Registering for Corporation Tax

In the UK, you must submit certain information and company-related documents to register for corporation tax. Although physical documents are not required to be uploaded during the registration process, you should prepare the following details:

- Company Registration Number (CRN): When you incorporate your business, Companies House will provide your Company Registration Number (CRN).

- Company Name and Registered Office Address: The name of your business and the address of your registered office are as stated in your Companies House documents.

- Date You Started Trading: The date on which your company started engaging in any taxable activities, such as hiring employees, selling, or purchasing shares.

- Nature of Business (SIC Code): A brief explanation of the activities or goals of your organisation.

- Company’s Accounting Period: The accounting period of the company usually starts on the day you begin trading and lasts for a full year; you can match this with your fiscal year.

- Director’s Details: Name, National Insurance Number, and contact information for the director.

- Company’s Unique Taxpayer Reference (UTR): HMRC sends the business’s Unique Taxpayer Reference (UTR) two to three weeks after the company is formed. If you don’t have your UTR, you can get it from the HMRC Official Website.

- Contact Information for the Company: Phone number and email address.

How to Register for Corporation Tax Online (Step-by-Step Guide)

This is a comprehensive guide that will assist you in registering for Corporation Tax online in the United Kingdom:

Step 1: Set Up Your Government Gateway Account

- If you do not currently possess one:

- Proceed to the registration page of HMRC.

- Choose “Organisation” after selecting “Register.”

- Create a user ID and password for Government Gateway by following the instructions.

- An activation code will be mailed to you by HMRC; this process may take up to 10 days.

Step 2: Wait for Your Company’s UTR Number

HMRC will automatically send your Unique Taxpayer Reference (UTR) to your registered office address within two to three weeks of your company being incorporated with Companies House.

To register for corporation tax, you must have this UTR.

Step 3: Sign In and Register for Corporation Tax

After obtaining your UTR and Government Gateway login:

- Go to the registration page for Corporation Tax.

- After selecting “Start Now,” log in with your Government Gateway login information.

- Enter the necessary information:

- Name of business and registration number

- UTR number

- Address of the registered office

- When your business became active, or when you began trading

- Your company’s nature (SIC code)

- Details of the company’s director

- Contact details

Step 4: Confirm Your Accounting Period

HMRC will establish your company’s first accounting period based on your trade start date during the procedure. If necessary, you can change this to reflect your preferred fiscal year.

Step 5: Wait for Confirmation

After being submitted:

- HMRC will provide you with confirmation.

- Your online account will display your corporation tax liabilities, including filing and payment deadlines.

- If necessary, you can then register for additional taxes, such as VAT or PAYE.

What Happens After Registering for Corporation Tax Online?

A Corporation Tax reference number will be issued by HMRC following a successful registration. After that, you’ll have to:

Maintain Records: In compliance with HMRC regulations, maintain correct financial records.

Submit Annual Tax Returns: Explain the profits of your business and any eligible deductions on your yearly Corporation Tax form. Even if you have no corporation tax to pay or a loss, you still need to file a company tax return. You should complete this within a year following the conclusion of your accounting period.

Pay Corporation Tax: Calculating and paying your corporation tax is your responsibility. To determine your required tax payment, use the Corporation Tax Calculator. After your “accounting period,” typically your fiscal year ends, you have nine months and one day to make the payment.

Common Mistakes to Avoid When Registering

In the United Kingdom, new business owners frequently make preventable errors when registering for VAT or Corporation Tax, which can result in penalties, delays, or compliance problems. The following are typical errors to look out for:

Missing the Registration Deadline: If you don’t register for Corporation Tax within three months of beginning your business, HMRC may punish you. Your taxable turnover must reach £90,000 (as of 2024) for you to register for VAT.

Using the Wrong Trading Start Date: Your incorporation date and your trading start date are not always the same. It’s the point at which your firm starts doing things like advertising, purchasing stock, or offering services. Your tax periods and deadlines may be impacted if you use the incorrect date.

Not Having Your UTR Ready: To register for Corporation Tax, you must have your Unique Taxpayer Reference (UTR) from HMRC. Many people neglect this step or misplace the UTR letter, which causes registration to be delayed.

Inaccurate Business Information: Inaccurate information entered, such as your registration address, SIC code (business activity), or company name, may result in applications being denied or future tax return problems.

Skipping Government Gateway Setup: A Government Gateway account is required to register online. The entire process may be delayed if you forget to set this up or handle your login information incorrectly.

Confusing VAT with Corporation Tax: It is a common misconception among new business owners that registering for Corporation Tax automatically entitles them to VAT. These are distinct registrations with various requirements and procedures.

How To Register if You Missed the 3-Month Deadline?

If you failed to register for Corporation Tax within the allotted three months:

- Register right away using your company’s UTR on the HMRC website.

- If HMRC inquires as to why you were late, be truthful.

- If your tax returns are also late, you can be subject to penalties or interest.

- As soon as feasible, file any past-due Company Tax Returns (CT600).

- Think about seeking an accountant’s assistance.

- Await letters from HMRC outlining the next steps.

Frequently Asked Questions

What if my company hasn’t started trading yet?

Although there is no tax owed, you must still notify HMRC if your business is dormant (not trading)

How can I tell HMRC why I registered so late?

Include a brief note or letter explaining the cause for the delay (such as “administrative oversight” or “health issues”) with your registration. There is no need for much detail; just be factual and concise.

What happens if I make a late Corporation Tax registration?

Although you might not be penalized for simply being late with your registration, you might be subject to fines and interest if it causes you to postpone filing your company tax return or paying your taxes.

Will interest on overdue taxes be automatically assessed by HMRC?

Yes. Interest is charged starting nine months and one day after the end of your accounting period, which is when your corporation tax would have been due, and continuing until it is paid.

How can I contact HMRC for corporation tax inquiries?

To contact HMRC for corporation tax inquiries, you can call their helpline, use the secure messaging service through your HMRC Online Account, or send a letter to the address provided on your Corporation Tax notice. For the most up-to-date contact details, visit the official HMRC website.

Conclusion

In the UK, registering for corporation tax is an essential first step for any new business. Even if you haven’t earned a profit yet, you have to complete it within three months of beginning your firm. Using your company’s UTR and Government Gateway account, you can complete the easy online process through HMRC.

Keeping up with your tax and registration obligations keeps your business compliant from the start, helps you avoid fines, and fosters confidence with HMRC. To make sure everything is set up correctly, think about seeing an accountant if you have any questions at any point.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.