- What is Company Tax Return?

- Who Needs to File a Company Tax Return?

- Key Deadlines and Requirements for 2026

- What documents do I need to file my company tax return using CT600?

- Step-by-Step Process for Filing Your Company Tax Return

- Common Mistakes to Avoid When Filing Your UK Company Tax Return

- Special Considerations for 2026: New HMRC Rules and Changes

- Filing Extensions and Special Circumstances

- FAQs: Frequently Asked Questions

- Conclusion

Maintaining compliance with HMRC is critical as the time for filing your 2026 CT600 tax return approaches avoiding expensive penalties starts with accurate filing. Filing your company tax return (CT600) may appear hard, but with the appropriate steps, it can be simple.

In this blog, we will go through the process, point out typical pitfalls to avoid, and offer advice on how to stay on track. Whether you’re submitting for the first time or trying to improve your existing approach, this blog will help you navigate the CT600 with confidence and prevent costly mistakes.

What is Company Tax Return?

A Company Tax Return (CT600) is the formal document that UK firms must submit to HMRC to report their profits and calculate the corporation tax they owe. It gives specific information on a company’s financial performance, such as revenue, allowed expenses, and taxable earnings. All limited corporations, regardless of size, are required to file a CT600 on an annual basis, even if they owe no taxes. Failure to file or submit wrong information can result in penalties, so firms must fully grasp the procedure. To remain in compliance with UK tax regulations, file this return within 12 months of the end of your accounting period.

Who Needs to File a Company Tax Return?

Any UK company or organisation subject to Corporation Tax that receives a formal “notice to deliver a Company Tax Return” from HMRC must file a Company Tax Return (form CT600), even if it makes no profit or owes no tax. This normally includes most trading limited businesses and other bodies, but excludes sole traders and ordinary partnerships, which submit Self Assessment returns.

Core rule: notice from HMRC

- A corporation or association must file a corporation Tax Return if HMRC receives a “notice to deliver a Company Tax Return” to its registered office.

- The obligation still applies whether the company incurred a loss or has no Corporation Tax to pay. A nil return is still needed.

Types of entities that usually file

- UK limited companies (Ltd): Most private limited firms registered with firms House that conduct business must register for Corporation Tax and file a Company Tax Return each year.

- Foreign companies with a UK presence: Overseas companies with a UK branch or office that are subject to UK Corporation Tax may be required to submit a CT600.

- Certain non‑profit bodies and clubs: Companies and some associations with taxable income (such as trading profits or investment income) must file if HMRC notifies them.

Do I need to file a Company Tax Return if my company is dormant?

A UK dormant business is typically not required to file a business Tax Return, but there are certain key circumstances and exceptions.

When a dormant company does not file:

If HMRC has been formally informed that the company is dormant for Corporation Tax purposes and acknowledges this, the company is not required to pay Corporation Tax or file further Company Tax Returns for the entirely dormant periods.

For this to apply, the corporation must be completely non-trading and have no taxable revenue (such as interest, rent, or trade receipts) throughout the accounting period.

When a dormant company must still file

- If HMRC issues a “notice to deliver a Company Tax Return,” the firm is required to file a return even if it is dormant or does not owe Corporation Tax.

- If the firm traded during the accounting period before becoming dormant, it must file a firm Tax Return for the time it was active and pay Corporation Tax on any gains.

Other filings that still apply

- Even when a limited company is dormant for Corporation Tax purposes, it is still required to file annual dormant accounts and a confirmation statement with Companies House.

- These streamlined “dormant company accounts” must be filed on time each year to avoid late-filing penalties and potential strike-off.

If your company becomes active again:

- When a dormant firm resumes trading or receives taxable income, HMRC must be notified, usually within three months of the return to trading.

- From that time on, the company must submit Company Tax Returns and pay any Corporation Tax payable for the active periods.

Key Deadlines and Requirements for 2026

In 2026, UK companies must pay Corporation Tax 9 months and 1 day after year-end, file the CT600 within 12 months of year-end, and file accounts with Companies House within 9 months of the accounting reference date (private companies).

- CT600 Filing Deadline: Your Company Tax Return (CT600) must be completed within 12 months of the conclusion of your company’s accounting period. For example, if your accounting period ends on March 31, 2025, your CT600 must be submitted by March 31, 2026.

- Corporation Tax Payment Deadline: Corporation tax owed must be paid prior to the CT600 filing date, which is typically 9 months and 1 day after the end of your accounting period. In the identical case, tax for the 31 March 2025 year-end would be due on 1 January 2026.

Important Filing Requirements:

- CT600 returns must be submitted electronically via the HMRC’s online service or equivalent software.

- Paper submissions are usually not accepted unless HMRC grants special permission.

Missing these deadlines might result in penalties and interest costs, so prepare your papers well in advance of these important dates.

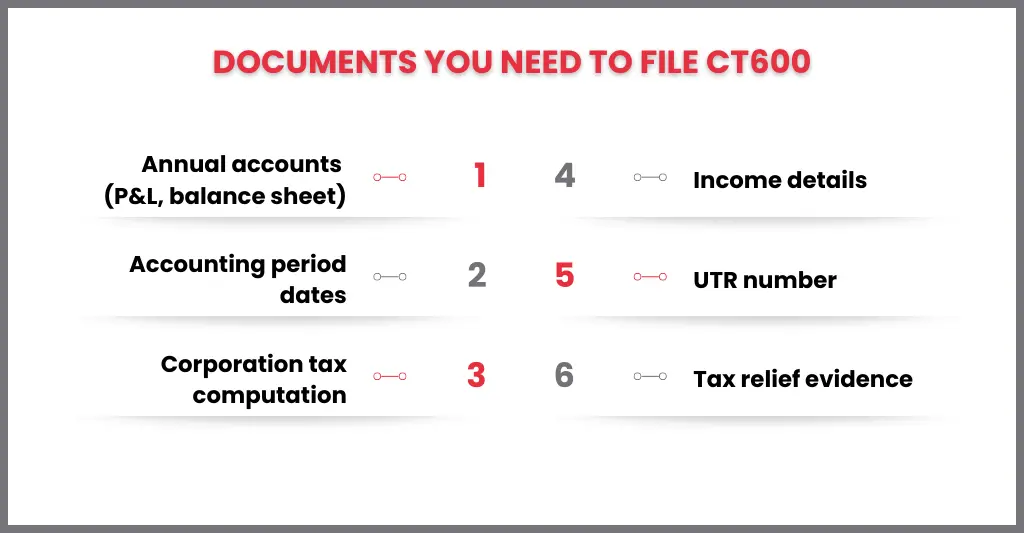

What documents do I need to file my company tax return using CT600?

To guarantee that your CT600 return is accurate and comprehensive, you must acquire a number of essential papers. Here’s a list of the crucial documents you will require:

Annual Accounts (Financial Statements): You must submit the documents such as balance sheet,profit and loss account, and cash flow statement. These documents provide information about your company’s financial situation and helps in calculating your taxable profits.

Accounting Period Information: Make sure you have the exact dates for your accounting period, as the CT600 return will be based on these dates. This is usually when your fiscal year concludes.

Corporation Tax Computation: To determine your taxable profits and tax payable, you will need to use a Corporation Tax computation. This document summarizes your company’s income, authorised expenses, and tax adjustments.

Details of Taxable Income: Include any income or profits your company generated during the accounting period. This may include sales revenue, interest collected, and investment income.

HMRC Reference Number & Unique Taxpayer Reference (UTR): You will require your HMRC reference number and your company’s Unique Taxpayer Reference (UTR). This information is critical for HMRC to identify your firm.

Tax Reliefs & Credits: If your company is qualified for any tax breaks (such as R&D tax credits or losses carried forward), you must provide the relevant supporting documentation to claim them.

Step-by-Step Process for Filing Your Company Tax Return

Filing your UK Company Tax Return (CT600) does not have to be difficult, if you follow the steps in the proper order. Here’s a simple, step-by-step tutorial to help you file correctly and stay compliant with HMRC.

- Prepare Your Statutory Accounts: Start with completing your company’s annual accounts. This contains the profit and loss statement, balance sheet, and supporting notes, all prepared according to the guidelines of UK GAAP or IFRS standards. These data serve as the foundation for your Corporation Tax estimate, thus accuracy is crucial.

- Calculate Your Corporation Tax Liability: Adjust your accounting profit to include permissible expenses, disallowable charges, capital allowances, and any reliefs (such as R&D or loss relief). This calculates your taxable profit as well as the amount of Corporation Tax owed.

- Complete the CT600 Form: The CT600 form is used to record your company’s income, profits, tax calculations, and relief applications to HMRC. It must be completed with HMRC-approved software; paper submissions are no longer allowed.

- Attach Supporting Documents: Along with the CT600, please upload your complete statutory accounts and thorough tax computations. HMRC requires these documents to be fully aligned with the data in the return.

- File the Return Online with HMRC: Submit the CT600 and attachments electronically using suitable software. HMRC will send you confirmation once you have submitted your form; retain it for your records.

- Pay Corporation Tax on Time: Corporation tax is typically payable 9 months and 1 day after the end of your accounting period, while the CT600 can be filed up to 12 months after year-end. Missing a payment deadline might result in interest and penalties.

- Retain Records for Compliance: HMRC requires businesses to maintain accounting and tax records for at least six years. These may be required during compliance inspections or inquiries.

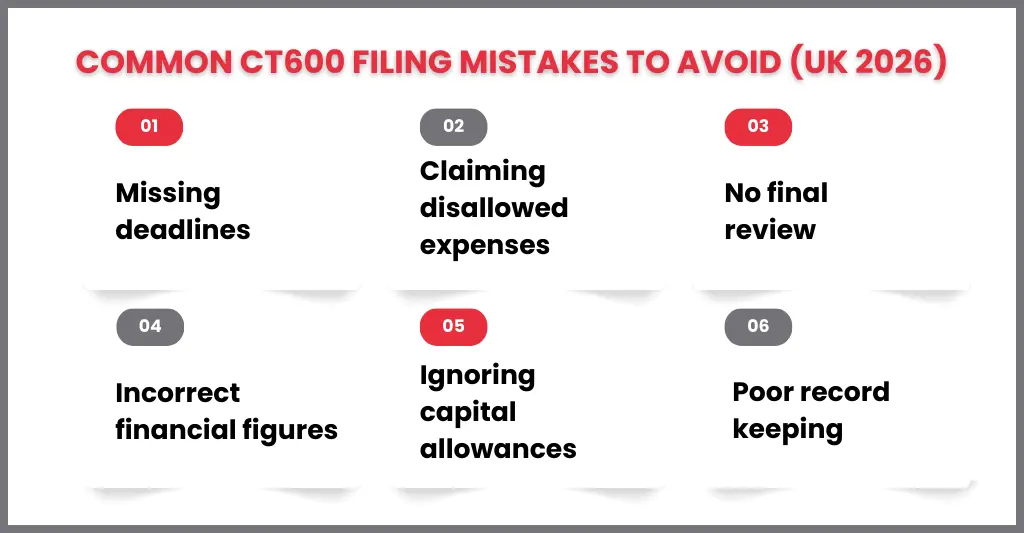

Common Mistakes to Avoid When Filing Your UK Company Tax Return

While filing a tax return you need to be very careful with every minute detail. Otherwise, it can lead to HMRC enquiries, penalties or delayed refunds. Below are the most common mistakes UK companies make, and how to avoid them.

- Missing the Filing or Payment Deadlines: Many businesses believe filing and payment deadlines are the same, but they are not. Your Corporation Tax payment is due 9 months and 1 day after the end of your accounting period, whereas the CT600 can be filed up to 12 months after the end of the year. Late payments nearly invariably result in interest costs.

- Using Incorrect or Incomplete Financial Figures: Submitting draft or unreconciled accounts is a regular concern. Your CT600 should precisely match your final statutory accounts. Any discrepancy between the accounts, computations, and return raises a red flag for HMRC.

- Claiming Disallowable Expenses: Not every business expense is tax deductible. Client entertainment, personal spending, and some fines or penalties are examples of common disallowed costs. Incorrect claims might exaggerate reliefs and result in HMRC investigations.

- Forgetting Capital Allowances: Some businesses either ignore capital allowance claims entirely or apply them wrongly. Assets such as equipment, vehicles, and IT acquisitions must be carefully handled to avoid overpaying or underpaying Corporation Tax.

- Submitting Without a Final Review: Rushing to file without a thorough review raises the likelihood of minor but costly mistakes such as improper accounting periods, incorrect company details, or missing attachments.

- Poor Record-Keeping: Incomplete or disorganised records make it difficult to justify figures in the event that HMRC queries them. Companies must keep their tax and accounting records for at least six years.

Special Considerations for 2026: New HMRC Rules and Changes

Getting your figures correct is only one aspect of filing your Company Tax Return (CT600) in 2026; another is adhering to HMRC’s most recent compliance requirements. Delays, HMRC inquiries, or fines may result from even minor rule modifications (or neglected digital requirements).

Here are the key 2026 considerations you should keep in mind before submitting:

- Corporation Tax rates still depend on your profit level: Some businesses still fall into various corporation tax categories in 2026 based on their taxable profits. This means that calculations need to be precise, particularly when marginal relief is involved.

- Businesses are pushed toward digital-first compliance:

HMRC is continuing its move toward a fully digital tax system, which means:

- stricter formatting for returns

- increased data checks

- higher attention on accuracy of submissions

- CT600 Compliance: 2026 HMRC Focus

In 2026, HMRC is especially sensitive to “avoidable” issues such as:

- incorrect UTR or accounting period dates

- mismatch between accounts and tax computations

- missing iXBRL tagging in statutory accounts

- incorrect loss relief claims

- late submission with no reasonable excuse

- MTD: Key to Corporation Tax Readiness: Although Corporation Tax is not yet entirely covered by MTD, HMRC’s intention is clear, improved audit trails and organised digital data are starting to be expected.

This impacts how you prepare your CT600 because HMRC increasingly expects:

- clear bookkeeping records

- supporting evidence for deductions

- clean reconciliation of VAT, payroll, and expenses

- Higher Compliance Focus on Expense Claims:

HMRC continues to monitor:

- director’s loan accounts

- travel and subsistence claims

- home office claims

- salary vs dividend balance

- mixed-use expenses

Filing Extensions and Special Circumstances

HMRC typically won’t give you an extension to file your CT600. Even after your accounting period ends, you still have 12 months to file your return.

However, HMRC may waive penalties if you have a valid “reasonable excuse”, such as:

- serious illness or hospitalisation

- bereavement

- fire, flood, theft, or loss of records

- major IT/system failure beyond your control

To avoid interest and penalties, file as soon as you can if you are unable to do so on time, save any supporting documentation, and, if at all feasible, pay the corporation tax on time.

FAQs: Frequently Asked Questions

How do I file my Company Tax Return?

You must use Corporation Tax filing software to file your Company Tax Return (CT600) online with HMRC. Your final accounts, tax computations, and any supporting documentation (such iXBRL-tagged accounts) are required. After everything has been examined, you can electronically submit the CT600 and save the confirmation for your records.

When is the deadline for submitting a Company Tax Return and paying Corporation Tax?

Company Tax Return (CT600) Deadline: Within a year following the conclusion of your company’s financial period, you must submit your CT600 to HMRC.

Deadline for paying corporation tax: You have nine months and one day from the end of the same accounting period to pay corporation tax.

Should I include overseas profits on my Company Tax Return?

Yes, if your UK firm is subject to UK Corporation Tax on that income, you are often required to include foreign profits on your firm Tax Return (CT600).

Tax treatment, however, is contingent upon a number of criteria, including the source of the revenue, the tax residence of your business, and the applicability of double taxation relief. To prevent mistakes or overpaying taxes, it is best to follow the advice of an accountant.

How do I fill out the CT600 form for my company?

You must enter your company’s information, the dates of the accounting period, and the important numbers from your statutory accounts and Corporation Tax computation (income, expenses, allowances, profits, and tax payable) in order to complete the CT600.

The majority of businesses use HMRC-approved Corporation Tax software to complete the CT600, which provides step-by-step instructions and helps minimise errors prior to submission.

Do I still need to submit a tax return if my company made a loss?

Yes. Even if the company incurred a loss and owes no Corporation Tax, you must still file your Corporation Tax Return (CT600) with HM Revenue & Customs. HMRC needs a tax return for each accounting period while the firm is operational. A loss does not relieve the filing obligation.

Conclusion

It doesn’t have to be difficult to file your Company Tax Return (CT600) in 2026, but it does require timely filing and accuracy. You can maintain compliance and steer clear of needless fines or inquiries with the correct documentation, accurate tax calculations, and filing software that has been certified by HMRC.

Working with a certified accountant or Corporation Tax specialist helps streamline the process if you want to cut down on errors and save time, particularly when handling intricate areas like offshore income, allowances, and year-end adjustments.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.