- What Is EIS Investment Tax Relief?

- Key EIS Tax Reliefs Available in 2026

- Who Is Eligible for EIS Tax Relief?

- What Types of Companies Qualify for EIS?

- How to Invest in EIS: Step-by-Step?

- How to Claim Your EIS Tax Relief?

- Risks of EIS Investing

- EIS vs SEIS vs VCT – What’s the Difference?

- Frequently Asked Questions

- Conclusion

Are you looking for ways to reduce your taxes while supporting innovative UK startups? One of the most effective strategies is the Enterprise Investment Scheme (EIS). Along with other significant advantages, such as inheritance tax exemption and capital gains tax deferral, EIS investment tax relief remains one of the most lucrative tax breaks available to UK investors in 2026, offering up to 30% income tax relief.

But how exactly does it work? Who qualifies? And what should you be aware of before investing?

From eligibility rules and investment limits to strategies that could maximise your savings, this 2026 guide breaks down everything you need to know about EIS investment tax relief. Whether you’re a seasoned investor or exploring tax-efficient options for the first time, this guide will help you navigate the EIS landscape with confidence.

What Is EIS Investment Tax Relief?

The UK government’s Enterprise Investment Scheme (EIS) offers generous tax breaks to investors who fund high-risk, early-stage businesses. The primary advantage is a 30% income tax exemption on investments up to £1 million annually (or £2 million for knowledge-intensive businesses).

If you hang onto the shares for at least three years, a £10,000 investment might result in a £3,000 income tax reduction.

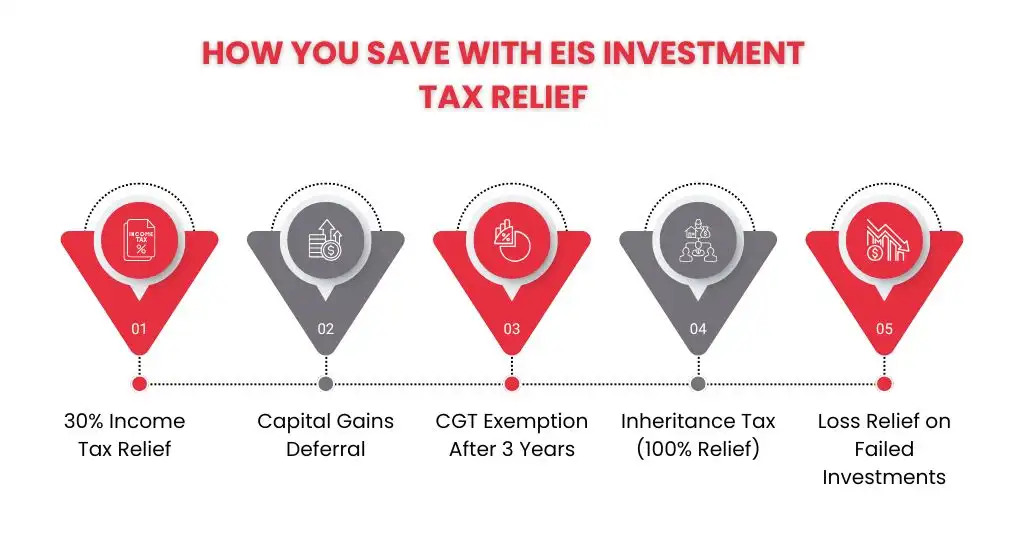

Other benefits include:

- Capital Gains Tax (CGT) deferral

- No CGT on profits after 3 years

- Loss relief if the company fails

- Inheritance tax relief after 2 years

Key EIS Tax Reliefs Available in 2026

Here’s a summary of the main tax benefits you could receive if you’re thinking about applying for the Enterprise Investment Scheme (EIS) in 2025:

Income Tax Relief

On EIS investments up to £1 million a year, investors are eligible for 30% income tax relief (or £2 million if investing in knowledge-intensive enterprises). At least 3 years must be spent holding shares to be eligible.

Capital Gains Tax Exemption

Profits from EIS shares that are held for at least 3 years and for which income tax relief was sought but not withdrawn are exempt from capital gains tax.

Capital Gains Deferral

Gains made up to 3 years before or 1 year after the EIS investment can be reinvested into EIS shares to defer paying Capital Gains Tax. Taxes are only due upon the sale or transfer of EIS shares.

Inheritance Tax Relief

After holding EIS shares for two years, your investment qualifies for 100% inheritance tax exemption through Business Relief.

Loss Relief

If your EIS investment fails, you may claim loss relief against income or capital gains, after income tax relief has been deducted. This reduces your overall downside risk

Who Is Eligible for EIS Tax Relief?

The following requirements must be fulfilled to be eligible for EIS tax relief:

UK Taxpayer: You have to pay income tax in the UK.

Individual Investor: Only individuals, not businesses or trusts, are eligible for EIS relief.

Unrelated to the Business:

- Unless you are a qualified business angel, you cannot be a director, partner, or employee.

- No more than 30% of the company’s assets, voting rights, or shares may be owned by one person.

Appropriate Investment:

- Shares must be new, ordinary shares, fully paid in cash.

- The company must be EIS-qualified.

Minimum Duration of Holding:

- Shares must be held for at least three years to retain the tax relief.

What Types of Companies Qualify for EIS?

A business must fulfill certain requirements established by HMRC to qualify for the Enterprise Investment Scheme (EIS). These regulations are intended to assist smaller, riskier trading firms that foster innovation and economic expansion.

UK-Based: The company must have a permanent establishment in the United Kingdom.

Unquoted company: There must be a qualifying trade made by the company. It is unable to function primarily in non-qualifying or excluded sectors.

Trading Requirement: The business needs to make a qualifying trade. It cannot primarily operate in non-qualifying or excluded sectors

Company Age: In general, the business must have sold its first commercial product within seven years. For businesses that rely heavily on knowledge, this rises to ten years.

Gross Assets Limit: The business should have:

- Before investment: ≤ £15 million

- After investment: ≤ £16 million

How to Invest in EIS: Step-by-Step?

Supporting high-growth UK startups and receiving substantial tax advantages are two benefits of investing in the Enterprise Investment Scheme (EIS). Here’s a detailed guide on how to do it:

Understand the EIS Rules: Learn about the EIS eligibility criteria before investing, both for investors and the businesses you plan to invest in. Tax relief is only provided by HMRC if all requirements are satisfied.

Choose an Investment Route: EIS funds or direct investments in EIS-eligible businesses are also options. Although funds have fees, they provide expert management and diversity.

Perform Due Diligence: Look at the company’s market, team, business model, and EIS status. To make sure the company probably qualifies, ask for their EIS advance assurance.

Make the Investment: After completing the required paperwork, send your money. To be eligible for tax reduction, make sure your investment is made in new ordinary shares.

Receive Your EIS3 Certificate: After issuing shares, the business will submit an application to HMRC for EIS approval. An EIS3 certificate, which is required to claim tax relief, will be issued to you upon approval.

Claim Your Tax Relief: To claim income tax relief through your Self Assessment tax return, use your EIS3 form. If you are carrying back, you can also edit a prior year’s return.

Monitor the Investment: Observe the company’s development. Holding the shares for a minimum of three years and the company continuing to be EIS-compliant are prerequisites for retaining reliefs.

How to Claim Your EIS Tax Relief?

You are eligible to earn significant tax benefits after obtaining your EIS3 certificate. This is how you do it:

Wait for Your EIS3 Certificate

The business or fund must provide you with an EIS3 form before you can make a claim. In addition to providing crucial information such as the amount invested and the date of share issuance, this verifies that your investment is eligible for relief.

Choose How to Claim

You can claim EIS tax relief in one of two ways:

- Through your tax return for self-assessment

- If you don’t typically file a return, you can submit Form EIS3 separately.

Fill in the Tax Relief Section

Fill in the “Additional Information” sections if you’re utilising Self Assessment:

- Under “Enterprise Investment Scheme,” enter the amount you are claiming.

- Declare whether the relief is being carried back to a prior tax year.

Submit Supporting Documents

Attach the EIS3 form or forms to your claim. If claiming outside of Self Assessment, use the information on the form to send the EIS3 straight to HMRC.

Monitor Your Claim

For clarification, HMRC might get in touch with you. Once your tax relief has been processed, you will either receive a refund or have your tax bill reduced.

Keep Records Safe

Keep your EIS3 certifications close at hand. When you sell your shares after three years, for instance, you might need them to claim the capital gains tax exemption.

Risks of EIS Investing

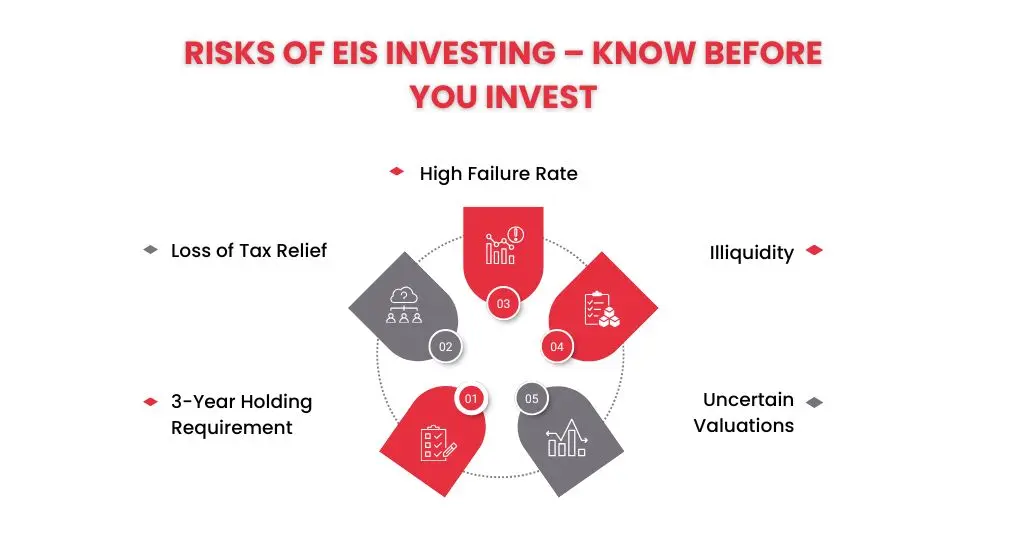

EIS has significant risks even though it provides attractive tax advantages.

High Failure Rate: Even though EIS helps start-ups, a lot of them fail. All or a portion of your investment could be lost.

Illiquidity: Since stocks are not listed on a public exchange, selling your investment may be challenging and time-consuming.

Loss of Tax Relief: Your tax benefits could be taken away if the business stops being eligible for EIS within three years.

Valuation Uncertainty: Startup valuations are frequently speculative, which makes it challenging to determine their actual value.

EIS vs SEIS vs VCT – What’s the Difference?

The Enterprise Investment Scheme (EIS), Seed Enterprise Investment Scheme (SEIS), and Venture Capital Trusts (VCTs) are the three main investment programs that the UK government provides to assist small and expanding enterprises. Although they all provide tax advantages, their target businesses, risk profiles, and organisational structures vary.

| Feature | SEIS | EIS | VCT |

| Stage of Companies | Very early stage | Early to growth stage | Small established business |

| Capital Gains Relief | 50% CGT reinvestment + full CGT exemption | Full CGT deferral + CGT exemption | Full CGT exemption (on gains from shares) |

| Loss relief Eligibility | Yes | Yes | No |

| Minimum Holding Period | 3 years | 3 years | 5 years (for full benefits) |

| Diversification | Single company (usually) | Single or a few companies | Broad portfolio |

| Liquidity | Very low | Low | Higher (LSE-listed shares) |

| Income Tax Relief | 30% | 50% | 30% (up to £200k/year) |

Frequently Asked Questions

Can I invest in SEIS and EIS during the same tax year?

Yes. As long as you stay within the annual restrictions (up to £1–2 million for EIS and £100,000 for SEIS), you can invest in both schemes during the same tax year

Do EIS and SEIS investment dividends qualify as tax-free?

No, dividends paid by SEIS and EIS corporations are subject to taxes. Nonetheless, VCT dividends are exempt from taxes.

Is it ever possible for me to sell my SEIS or EIS shares?

You can sell them, but if you do so within three years, HMRC might take away your tax break. It could be challenging to sell these shares without a secondary market because they are also illiquid

Conclusion

To sum up, investors looking for tax-efficient solutions to help early-stage UK enterprises may find it appealing to use EIS, SEIS, and VCTs. There are differences in the risk and reward of each scheme: VCTs offer a more diversified, income-focused approach, EIS targets more established companies with significant growth potential, and SEIS is best suited for extremely early-stage, high-risk ventures.

Notwithstanding the substantial tax advantages, these investments include some risk; therefore, caution is necessary. Knowing the distinctions and making decisions that fit your risk tolerance and financial objectives are crucial. When in doubt, it’s best to seek advice from a certified financial advisor before investing.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.