- What is Corporation Tax?

- When is the Corporation Tax Due?

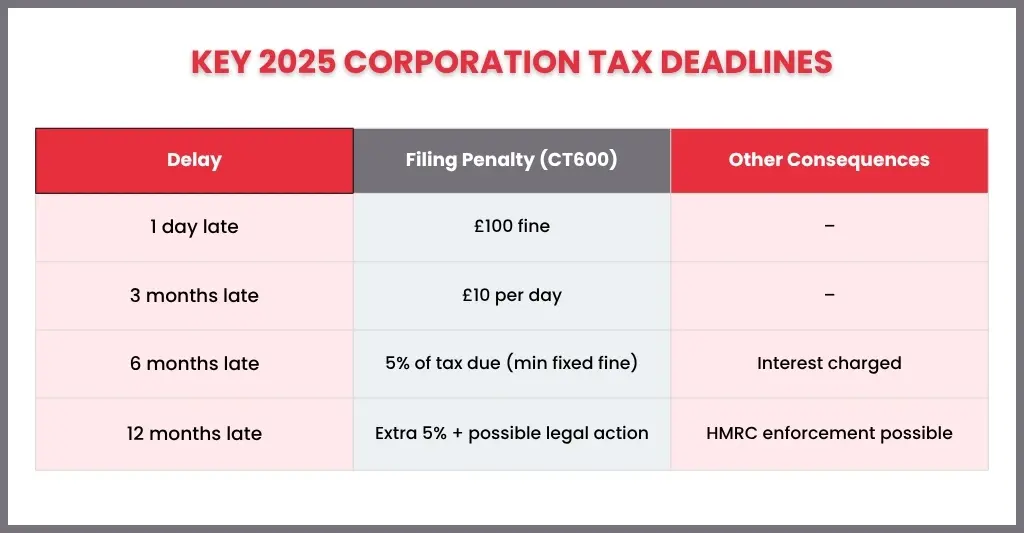

- What Are the Key Corporation Tax Deadlines?

- Understanding Corporation Tax Deadlines for Different Business Types

- What Happens if I Miss Corporation Tax Deadlines?

- How Much Are the Fines for Late Corporation Tax?

- How Can I Reduce Corporation Tax Fines?

- Are There Other Solutions if I Can’t Pay Corporation Tax on Time?

- Tips to Avoid Missing Corporation Tax Deadlines?

- FAQs: Frequently Asked Questions

- Conclusion

Corporation tax is an essential aspect of managing an organisation, and there can be severe fines and penalties if important dates are missed. All types and sizes of companies must be aware of crucial corporation tax deadlines for filing, payment plans, and reporting in 2026 in order to comply with HMRC standards.

This guide offers a comprehensive summary of all the 2026 company tax deadlines, as well as helpful advice to assist companies in preparing ahead of time, steering clear of blunders, and maintaining efficient tax administration all year long. Regardless of your level of experience, this blog will give you the knowledge you need to remain on top of your taxes, whether you’re a business owner or an experienced accountant.

What is Corporation Tax?

Corporation tax is a tax that UK companies pay on the profits they make from their business activities. This includes money from selling products or services, investments and any gains from selling company assets. If your business is a limited company or certain other organisations like clubs or associations you will need to pay corporation tax on these profits.

The tax is annual and must be paid to HMRC by specific deadlines. The amount depends on how much profit your business makes. Understanding corporation tax is important so you can keep your business on the right side of the law and avoid any penalties or fines.

When is the Corporation Tax Due?

After a company’s accounting period ends, corporation tax must be paid within a certain amount of time. The regulations in the United Kingdom are as follows:

When filing a corporation tax return, businesses have 12 months from the end of their accounting period to send their CT600 form to HMRC.

In most cases, corporate tax is due nine months and one day after the end of the accounting period.

For instance, your CT600 return must be filed by March 31, 2026, and your corporation tax payment is due by January 1, 2026, if your company’s accounting period ends on March 31, 2025.

Note that larger businesses with profits over £1.5 million have the benefit of paying tax in installments instead of paying the whole amount at a time. Therefore, planning is essential to maintain compliance and prevent needless fees because missing these deadlines might result in penalties and interest.

Corporation Tax Rates and Changes for 2026

For 2026, the UK corporation tax rate is 25% for companies with profits over £250,000. Smaller companies with lower profits may pay a lower rate depending on the specific thresholds.

HMRC are cracking down on accurate profit reporting and compliance so expect more checks this year. There may also be changes to reliefs and allowances so stay informed or talk to an accountant to avoid surprises and manage your tax.

What Are the Key Corporation Tax Deadlines?

To prevent fines, it’s essential to keep track of company tax dates. In 2026, UK businesses should be mindful of the following important dates:

- End of Accounting Period: Indicates the end of the financial year for your business. Corporation tax is due on all profits made up to this point.

- Deadline for Corporation Tax Payment: Typically, this is nine months and one day following the conclusion of the financial year.

- CT600 Filing Deadline: Within a year following the conclusion of the accounting period, the company tax return must be filed.

- Payments in installments: Businesses with income exceeding £1.5 million typically make payments in quarterly installments beginning six months and thirteen days following the beginning of the accounting period.

- Penalties for Late Filing and Payment: HMRC charges interest on late payments and fines for missing deadlines.

Understanding Corporation Tax Deadlines for Different Business Types

| Business Type | Corporation Tax Liability | Key Notes on Deadlines and Rates |

| Limited Company (Ltd) | Yes | Must file CT600 return; tax payable within 9 months + 1 day after accounting period ends; eligible for small profits rate (19%) if profits ≤ £50k, main rate (25%) if profits > £250k. |

| Public Limited Company (PLC) | Yes | Same rules as Ltd but often larger; quarterly installment payments required if profits exceed £1.5m. |

| Small and Medium Enterprises (SMEs) | Yes | Generally follow standard filing and payment deadlines; may qualify for small profits rate and reliefs. |

| Startups | Yes (if incorporated) | Same deadlines as SMEs; important to register corporation tax within 3 months of starting business. |

| Sole Traders and Partnerships (including LLPs) | No (except LLPs treated as partnerships for income tax, not corporation tax) | Pay income tax instead of corporation tax; do not file CT600. |

| Non-UK Companies with UK Branch | Yes | Pay corporation tax on UK profits; filing and payment deadlines as per UK businesses. |

| Close Investment Holding Companies (CIHC) | Yes | Not eligible for small profits rate; taxed at main rate regardless of profit level. |

| Clubs, Co-operatives, Associations | Yes | Must pay corporation tax on profits; similar filing deadlines apply. |

What Happens if I Miss Corporation Tax Deadlines?

Missing corporation tax deadlines can result in several financial consequences as well as issues with HMRC. This is what may occur:

Late Filing Penalties: HMRC will automatically apply penalties if your CT600 tax return is filed after the deadline. These have a set starting price and may go up the longer the refund is past due.

Interest on Late Payments: Interest is charged on any unpaid corporate tax from the day it was due until it is paid in full. This implies that the fee increases with the length of time you put off payment.

Additional Fines for Continued Non-Compliance: If deadlines are consistently missed, penalties may increase and may be equivalent to the tax liability.

Impact on Business Credit and Reputation: Regularly missing tax deadlines can damage your company’s creditworthiness and connections with banks, partners, and investors.

Potential Legal Action: HMRC has the authority to file an action to recover unpaid taxes in severe circumstances.

How Much Are the Fines for Late Corporation Tax?

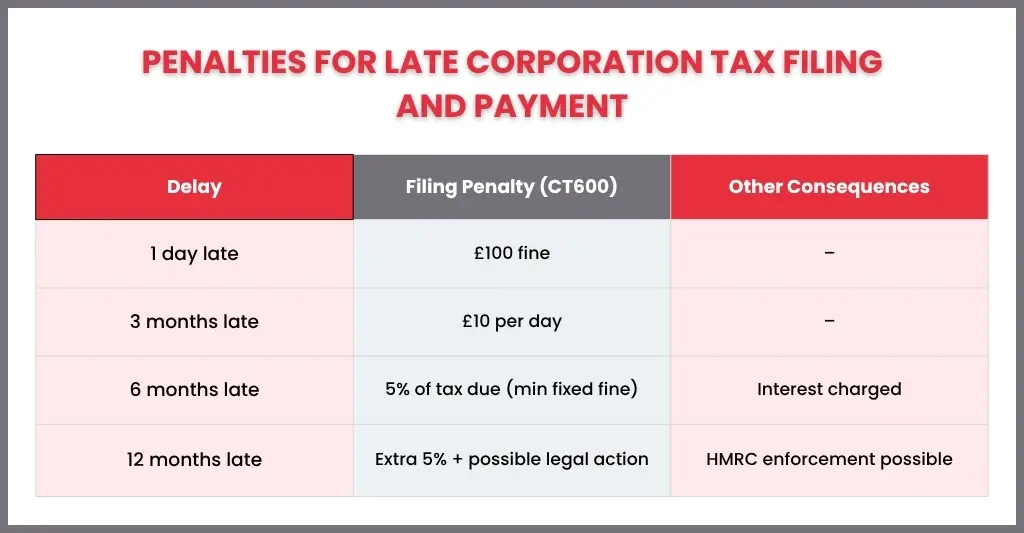

Failing to meet corporation tax deadlines can be costly. HMRC imposes fines and interest for both late filing and late payment:

Late Filing Penalties:

- 1 day late: Automatic £100 penalty.

- 3 months late: Daily penalties may apply, starting at £10 per day for small companies.

- 6 months late: Further penalties of 5% of the tax due or a minimum fixed amount.

- 12 months late: Additional 5% of the tax due or a minimum fixed penalty, plus possible criminal penalties for persistent non-compliance.

What to Do If You Dispute Corporation Tax Fines

If you think a corporation tax fine is unfair or wrong you do have options to challenge it. First contact HMRC as soon as possible to discuss the issue. Sometimes fines can be reduced or waived if you can show a reasonable excuse for the delay or error.

You can ask HMRC to review your case or appeal the penalty. Make sure you keep all relevant documents and correspondence handy to back up your case. It’s always helpful to get advice from a professional accountant or tax advisor during the appeals process to increase your chances of a good outcome.

Act fast and communicate with HMRC is key to resolving disputes and reducing penalties.

How Can I Reduce Corporation Tax Fines?

It might be unpleasant to miss company tax dates; however, there are strategies to reduce penalties and maintain compliance:

File early: Avoid last-minute errors and automatic fines by submitting your CT600 return before the 12-month deadline.

Pay on Time: To avoid interest and late payment penalties, pay your corporate tax by the deadline, which is nine months and one day after the end of your accounting period.

Use Instalment Payments (if eligible): The risk of missing a sizable one-time payment is decreased when major firms pay in quarterly installments.

Correct Mistakes Promptly: As soon as you discover a mistake in your filed return, make the necessary corrections quickly. Penalties are frequently lowered by HMRC when errors are willingly fixed.

Seek Professional Help: To lower your risk of penalties and interest, an accountant or tax advisor can help make sure your files are proper and that deadlines are met.

Are There Other Solutions if I Can’t Pay Corporation Tax on Time?

There are ways to help handle the matter and prevent expensive fines if your company is having trouble paying corporation tax by the due date:

Time to Pay Arrangements: HMRC might allow companies to delay payments for a predetermined amount of time. If you can show that you are experiencing actual financial difficulties and get in touch with HMRC prior to the payment deadline, this is typically available.

Pay What You Can: Interest and penalties can be avoided even if you pay a portion of your taxes on time. After that, HMRC will often coordinate with you to make the last payment.

Seek Professional Advice: To make sure you take advantage of the available relief options while staying in compliance, an accountant or tax advisor can negotiate with HMRC on your behalf.

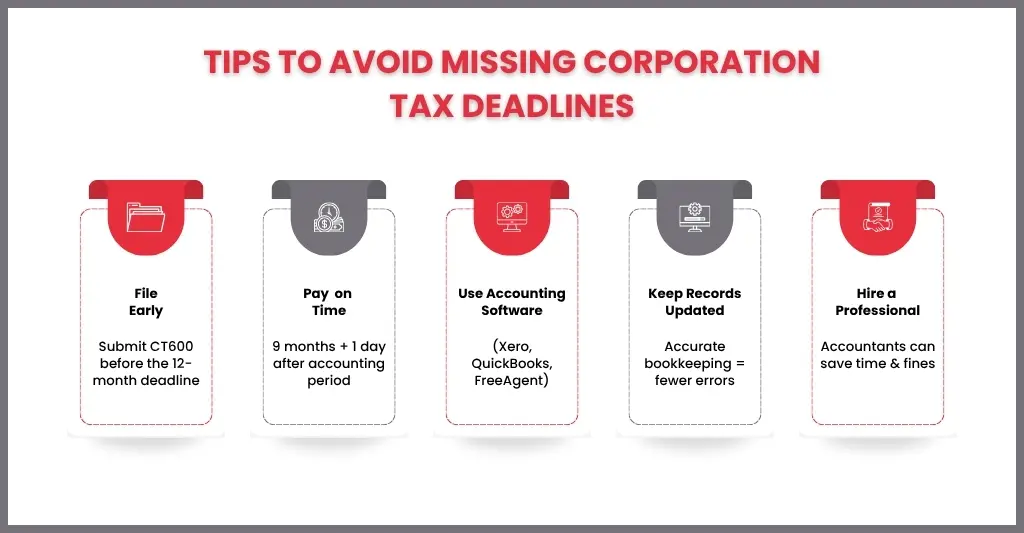

Tips to Avoid Missing Corporation Tax Deadlines?

The best strategy to prevent missing significant corporate tax deadlines is to maintain discipline. The following straightforward yet useful advice will help you keep on course:

Know Your Accounting Period: Recognise the beginning and ending of the accounting year for your business. These dates are the foundation for all of your corporation tax due dates.

Mark Deadlines Early: As soon as the accounting period is over without fail, mark the dates for filing and payment on your calendar.

Use Accounting Software: Software is a lifesaver in the tech-savvy world. Through software, tax requirements can be tracked more easily, and reminders can be automated with cloud-based accounting software (such as Xero, QuickBooks, or FreeAgent).

Keep Financial Records Updated: Keep current and accurate records all year long. This lessens anxiety when it comes time to figure out and submit your return.

Work With an Accountant: A professional accountant or tax advisor can help you identify areas for tax savings, manage deadlines, and guarantee compliance.

FAQs: Frequently Asked Questions

What happens if I miss my corporation tax deadline?

If a deadline is missed, there may be fines, interest on late payments, and in extreme situations, HMRC enforcement action.

Are the corporation tax deadlines different for small businesses?

No, although reporting requirements and payment methods may differ based on profit levels, all limited corporations adhere to the same fundamental regulations.

Can my accounting period be changed?

Yes, however, there are specific guidelines and restrictions. You can inform Companies House and HMRC to shorten or extend your accounting period.

Conclusion

Corporation tax may appear a complicated task, but the procedure can be made much easier by being organised and knowing the important deadlines. If you are well-prepared and have planned all the essential things, it will be an easy task. Being prepared will surely assist you in avoiding expensive fines and interest.

Being proactive is the key to stress-free compliance, whether you manage taxes yourself or with an accountant’s assistance. In addition to providing financial protection for your company, meeting corporate tax deadlines also gives you peace of mind, enabling you to concentrate on expansion and success in 2026 and beyond.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.