- HMRC’s Penalty Points System Pilot Explained

- Complete 2026 Penalty Escalation Timeline

- Martin Lewis’ “Rough Guess” Lifeline for Late Filers

- 7 Freelancer Mistakes Triggering 80% of Penalties (List)

- £44Bn Tax Debt: Why 2026 Crackdown Hits Harder

- Immediate Action Plan: File, Appeal, Time To Pay (Steps)

- FAQs: Frequently Asked Questions

- Conclusion

Let’s be honest: most people don’t intentionally miss the Self Assessment deadline. They postpone because they are waiting for paperwork, are unsure what expenses to claim, or simply do not have time to sit down and work on tax return filing.

But in 2026, HMRC will no longer be so forgiving. Following £325m in fines/interest on 600k+ late Self Assessment filers last year, amid £44bn tax arrears driving 2026 enforcement ramp-up. This means that penalties can begin fast and continue to increase if the return is not submitted.

In this blog, we will clarify the penalties and give practical tips for staying organised and filing on time. Keep reading till the end to know the useful insights

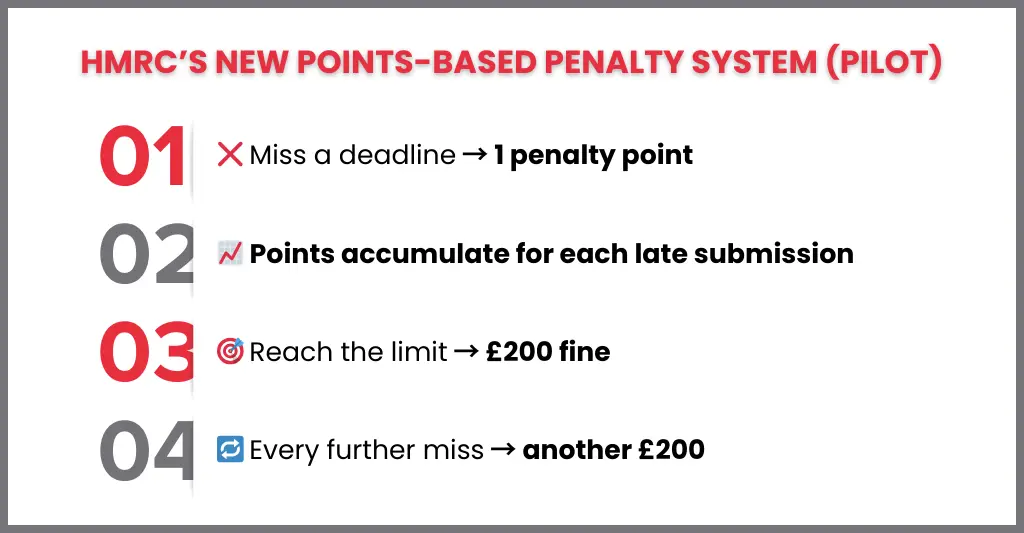

HMRC’s Penalty Points System Pilot Explained

HMRC is rolling out a fresh approach to tackle late Self Assessment returns, and it’s quite different from the current setup. This pilot is part of Making Tax Digital for Income Tax Self Assessment (MTD ITSA) starting in April 2026 with around 100 initial users. It gives 1 point for each late quarterly update, triggering a £200 fine after 4 points, and it’ll target those earning over £50k later on.

Instead of an automatic fine right away, the points-based system feels a bit like a “strike” model. Miss a deadline, and you rack up a point. Hit the threshold, and that’s when the penalty kicks in.

How the points system works (in simple terms)

- Late submission = 1 penalty point

- Points accumulate with each missed deadline

- Reach the limit, and HMRC hits you with a £200 penalty

- Further misses can mean another £200 each time, no quarterly fines in the first year to help people adjust.

Why did HMRC introduce this pilot?

According to HMRC, the new system is intended to be more lenient and fairer. The concept is:

- Those who occasionally miss deadlines will not be punished harshly.

- People who consistently file late will face higher fines.

What does this mean for taxpayers in 2026?

This trial is a strong indication that HMRC is shifting towards tougher compliance and automation. Even if it starts as a pilot, it demonstrates HMRC’s future direction: fewer warnings, greater tracking, and fines based on late filing trends.

So, if you have a habit of filing at the last minute, take this HMRC tax warning seriously. Under the points system, frequent delays could result in substantial fines.

Complete 2026 Penalty Escalation Timeline

If you miss your Self Assessment deadline, HMRC will charge you more than just one penalty. Instead, penalties increase gradually the longer your return remains unfiled, and late payment penalties may also apply if you owe tax.

So the key takeaway is simple:

- The earlier you file, the less you pay.

- The longer you delay, the more HMRC adds on.

Below is the full penalty timeline explained clearly.

Stage 1: 1 Day Late

As soon as the deadline is missed, HMRC applies an automatic penalty.

- Penalty: £100

- This applies even if:

- you owe no tax, or

- you file just 1 day late

Example: Deadline is 31 January. If you file on 1 February → £100 penalty.

Stage 2: 3 Months Late (Daily penalties start)

If your return is still not filed after 3 months, HMRC starts adding daily fines.

- Penalty: £10 per day

- Charged for up to 90 days

- Maximum daily penalty total = £900

So at this stage, your penalty can become:

£100 + up to £900 = £1,000 total

Stage 3: 6 Months Late (Big additional penalty)

If your return is 6 months late, HMRC adds another penalty.

- Penalty: £300 OR 5% of the tax due (whichever is higher)

So if you owe a larger amount of tax, the penalty can be more than £300.

Stage 4: 12 Months Late (Another big penalty)

If the return is still not filed after 12 months, HMRC adds yet another penalty.

- Penalty: £300 OR 5% of the tax due (whichever is higher)

At this stage, HMRC may also take a stricter approach if they believe the return was deliberately delayed.

Martin Lewis’ “Rough Guess” Lifeline for Late Filers

If you have missed the Self Assessment deadline (or are about to miss it), fear is understandable, but Martin Lewis has provided a practical tip that can help reduce the harm.

He says that if you are having trouble completing your return but have an idea of how much tax you might owe, it’s still worth paying an estimated amount to HMRC straight away.

What does Martin Lewis mean by “Rough Guess”?

This isn’t about paying a random amount. It just means:

Pay what you reasonably believe you owe, even if your return is not yet complete.

For example:

- You think your tax bill will be around £10,000

- You pay £10,000 now

- Later, HMRC confirms the actual bill is £11,000

In that scenario, HMRC would only charge interest on the £1,000 outstanding sum, not the entire amount.

Why this helps (the real benefit)

Once the payment deadline passes, HMRC starts charging:

- interest daily on unpaid tax, and

- possible late payment penalties if you continue to delay

So, even if your return is late, paying now can help to lower the interest that accumulates over time.

Important note:

According to Martin Lewis, filing the return properly as soon as possible is the best choice, as paying an approximate amount will not prevent late filing penalties if not submitted. However, it can lessen the additional charges associated with unpaid taxes.

This approach is especially useful for self-employed people, landlords, and side-income earners who are late because of missing papers or disorganised records.

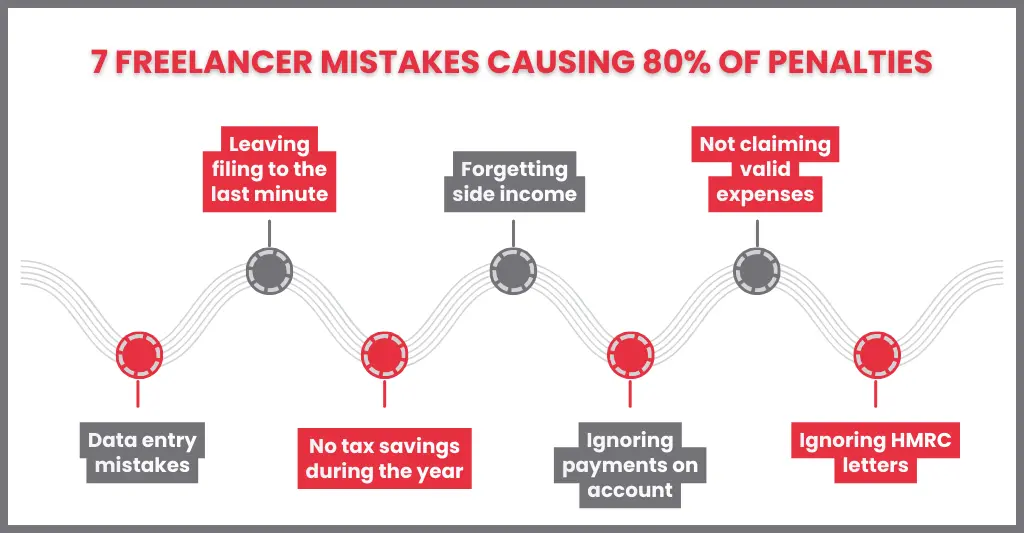

7 Freelancer Mistakes Triggering 80% of Penalties (List)

Most self-employed individuals and freelancers are caught by a small group of recurring faults that HMRC and advisers come across annually.

- Leaving the return to the last minute can result in missed deadlines, login issues, or lost documents.

- Forgetting about “small” income streams like side hustles, infrequent freelance assignments, or rental income, all of which must be reported.

- Failure to claim eligible expenses (e.g., home office, professional fees, phone, travel) can lead to overpayment of taxes and fines for other mistakes.

- Simple data entry errors, such as incorrect amounts, mixed gross/net, or mistyped dates, can lead to HMRC checks and delays.

- Failure to budget throughout the year, then being unable to pay in January and quickly going into interest and penalty trouble.

- When “payments on account” have been overlooked, the January bill is far greater than planned, resulting in missed or short payments.

- Missing the deadline and then ignoring HMRC notifications results in a £100 fine compounded with daily fines, surcharges, and collection action.

£44Bn Tax Debt: Why 2026 Crackdown Hits Harder

HMRC is not cracking down in 2026 simply to “be strict.” The general reason is simple: the UK is dealing with an increasing tax debt problem, and HMRC wants to recover that money as soon as possible, especially after Autumn Budget 2025 allocated extra funding for enforcement.

According to reports, the UK’s total tax debt has risen to roughly £44 billion, implying that billions of pounds in unpaid tax remain outstanding. When tax debt rises, HMRC often responds in the same way: stricter enforcement, faster penalties, and tougher follow-ups.

So why does this crackdown hit harder in 2026?

- HMRC has less patience for late filing habits: With such a high level of tax debt, HMRC is under pressure to close gaps quickly. This means that late filers are more likely to face penalties without any warnings or delays.

- Penalties are becoming more automated: HMRC systems now send penalties and reminders more quickly than before. In many cases, penalties are triggered automatically once deadlines are missed, leaving little room for “I forgot” or “I was busy.”

- Interest makes late tax more expensive: Even if you plan to pay later, HMRC charges interest on unpaid taxes. So, even if your original tax cost was manageable, the more you wait, the higher your final total will be.

- Repeat late filers are targeted more aggressively: HMRC is focusing more on patterns. If you consistently file or pay late, you are more likely to be detected, monitored, or subjected to harsher penalties.

- Freelancers and landlords feel it the most: Freelancers, contractors, and landlords often don’t have payroll deductions like employees. That makes it easier to fall behind, and harder to catch up once penalties start stacking.

Immediate Action Plan: File, Appeal, Time To Pay (Steps)

If you have missed the Self Assessment deadline (or received a penalty notice), don’t panic. What matters most is what happens next. Here’s a simple action plan to reduce penalties and get back in control.

Step 1: File Your Tax Return ASAP (Even If You Can’t Pay Yet)

This is your first priority. Even if you don’t have the funds ready, submit your return right away. Filing stops late filing penalties from growing and reduces the risk of bigger charges later.

Step 2: Do Partial Payments

If you owe tax, don’t wait until you can pay everything.

Even a part payment:

- reduces interest,

- lowers future penalties,

- shows HMRC you’re trying to resolve it.

Step 3: Check If You Can Appeal the Penalty

In many cases, you can appeal Self Assessment penalties if you had a valid reason (known as a “reasonable excuse”).

Examples could include:

- serious illness or hospital stay

- Bereavement (lost a closed one)

- unexpected personal emergencies

- HMRC online service issues

Step 4: Apply for a “Time to Pay” Arrangement

If you can’t pay the full tax bill, don’t ignore it — request a Time to Pay plan.

This is an HMRC payment arrangement that lets you:

- pay in instalments (monthly)

- avoid further enforcement action

- manage cash flow without panic

HMRC is more likely to approve Time to Pay when:

- You file your return first

- You act early

- You give a realistic repayment plan

Step 5: Save every document

Once penalties start, organisation becomes your protection.

Save:

- HMRC letters/emails

- payment confirmations

- appeal submissions

- screenshots of HMRC portal messages

This helps if you need to prove timelines later.

Step 6: Get Support to Prevent Repeat Penalties

The biggest cost isn’t the first £100 penalty, it’s the penalties that come after.

A professional accountant can help you:

- Get your books in order

- Submit on time every year

- Reduce tax errors

- Avoid late filings completely

FAQs: Frequently Asked Questions

How can I avoid Self Assessment penalties in 2026?

The best strategy is to file early, organise your records, and keep track of deadlines. Using an accountant also minimizes errors and last-minute delays.

What should I do if I can’t pay my tax bill on time?

File your return first, and then pay what you can. Next, apply for Time to Pay to prevent further action.

What is HMRC’s “Time to Pay” arrangement?

Time to Pay is an HMRC payment plan that allows you to pay your tax bill in instalments if you cannot afford the whole amount at once.

Conclusion

HMRC’s 2026 penalty enforcement is a strong warning: late Self Assessment filing is no longer considered a slight inconvenience. With stricter monitoring, faster penalties, and rising tax debt driving stronger enforcement, even little errors can swiftly escalate into costly fines.

What is the good news? Most penalties are entirely avoidable. Staying organised, filing early, and acting swiftly when concerns emerge can help you avoid extra charges and last-minute stress. If you’ve already missed the deadline, don’t worry – submit immediately, pay what you can, and look into options like appeals or HMRC’s Time to Pay agreement.

If you want to avoid penalties and remain compliant with confidence, partnering with a professional accountant can make the process much easier, smoother, and stress-free.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.