- What Happens When You Pay Corporation Tax Late?

- How HMRC Calculates Interest & Penalties for Late Corporation Tax Payments?

- Why Do Businesses End Up Paying Corporation Tax Late?

- What If I Can’t Pay Corporation Tax?

- Can I Pay Corporation Tax in Instalments?

- What Enforcement Actions Can HMRC Take for Late Payment?

- How to Appeal Corporation Tax Penalties?

- Steps to Prevent Future Late Payments

- FAQs: Frequently Asked Questions

- Conclusion

Paying corporation tax late in the UK results in HMRC charging daily interest on the outstanding amount and imposing escalating penalties the longer the payment is delayed. This can significantly increase the cost of your tax bill. Understanding the consequences of paying corporation tax late, how HMRC calculates penalties and interest, and the options available to avoid or appeal charges is essential for any business.

This article explains what happens when you pay corporation tax late and provides practical advice on how to avoid penalties and manage late payments effectively.

What Happens When You Pay Corporation Tax Late?

HMRC will begin charging interest the day after your payment is due until it is fully paid if your business misses the Corporation Tax payment deadline. This implies that even a brief delay may increase your overall debt.

Although there isn’t a set penalty for paying after the deadline, there are additional penalties for not filing your company tax return on time, and HMRC may look more closely at your repeated late payments. Repeated delays may eventually affect your company’s compliance record as well, making future interactions with HMRC more challenging.

In summary, late payments can harm your company’s reputation for dependability and financial responsibility in addition to costing you extra in interest.

How HMRC Calculates Interest & Penalties for Late Corporation Tax Payments?

HMRC automatically adds late payment interest to the remaining amount when your Corporation Tax payment is late. From the day following your payment deadline until the day you settle the entire amount, this interest is computed every day.

Interest on Late Payments: Late Corporation Tax interest is normally calculated as the base rate plus 2.5% of the Bank of England. This rate is subject to fluctuate multiple times a year, so the longer your payment is past due, the more interest you will accrue. Simple interest, which is calculated solely on the amount owed and not compounded over time, is what HMRC employs.

Penalties for Late Filing: There are penalties for filing your company tax return beyond the deadline, even though HMRC doesn’t impose a penalty for late payments:

- 1 day late: £100 fine

- 3 months late: Another £100 fine

- 6 months late: HMRC estimates your tax bill and adds a penalty of 10% of the unpaid tax

- 12 months late: A further 10% penalty may apply

Firms that consistently miss deadlines may be subject to increased penalties for further delays.

You can see how rapidly expenses may mount up and why it’s so important to stay ahead of deadlines by knowing how HMRC computes these charges.

How HMRC Calculates Penalties?

Corporation Tax penalties are assessed by HMRC based on the lateness of your company tax return, not the date of payment. The penalty gets more severe the later you file. This is how it functions:

- 1 day late: A flat penalty of £100

- 3 months late: Another £100 penalty added

- 6 months late: HMRC makes a “tax determination” — an estimated bill — and adds a 10% penalty on the unpaid tax

- 12 months late: A further 10% penalty may be applied to any remaining unpaid tax

HMRC raises the first two fines to £500 each (instead of £100 each) if your business consistently misses deadlines. The longer your return and payment are past due, the more you will owe in total because these penalties are distinct from the daily interest HMRC collects on late payments.

Interest Charges on Late Payments

Any Corporation Tax that is paid after the deadline is subject to daily interest charges from HMRC. The rate, which was determined using simple interest, is 2.5% plus the base rate of the Bank of England.

Even a slight delay can result in additional expenses. For instance, a £10,000 tax bill that is 30 days past due and accrues interest at 7.75% adds about £63.

Penalties for Late Payment: The 5% Incremental Charges

HMRC also have some additional penalties up their sleeve for when Corporation Tax payments get left unpaid after the deadline. These penalties are on top of the interest youll be charged, and – funnily enough – they escalate over time to encourage you to cough up on time.

- 30 days after the deadline, HMRC will hit you with a 5% penalty on the tax that still needs paying.

- If it’s still unpaid after six months, HMRC will add another 5% penalty.

- And if it’s more than 12 months overdue, a 5% penalty is slapped on again.

For example: if you owe £10,000 and leave it unpaid for a whole year, penalties on their own could add up to £1,500, let alone the daily interest thats been racking up. And don’t worry, these penalties get dished out regardless of whether you’ve filed your tax return or not and are automatically calculated by HMRC.

Being aware of these incremental penalties puts the importance of paying your Corporation Tax on time in sharp relief, or maybe it’s just worth negotiating a Time to Pay arrangement with HMRC to avoid getting hit with those escalating charges.

Common Myths About Penalties

There are a few myths that often confuse business owners:

- If you are a few days late, HMRC won’t notice. They automatically charge interest every day, so even minor delays cost money.

- Penalties are only imposed on large corporations. Regardless of size, all businesses must abide by the same regulations.

- In comparison to submitting late, paying late is less expensive. Interest and penalties mount up rapidly and are frequently more expensive than you expected.

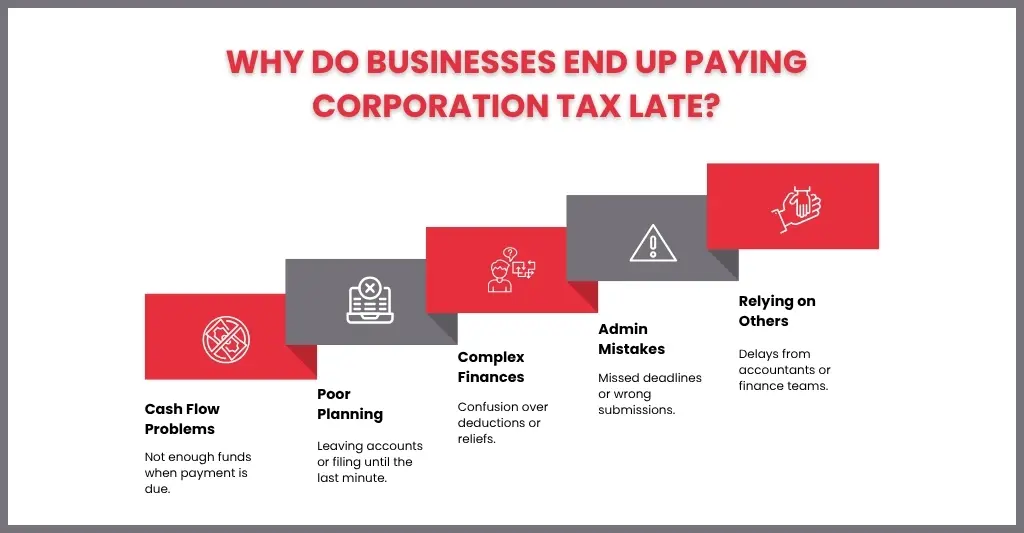

Why Do Businesses End Up Paying Corporation Tax Late?

Even cautious companies may fail to meet their Corporation Tax deadline. Common reasons include:

Problems with cash flow: Not having enough money on hand when taxes are due.

Inadequate planning: Delaying account preparation or tax calculations till the last minute.

Complicated finances: Uncertainty about permitted reliefs, deductions, or foreign earnings.

Administrative mistakes: Include missing HMRC deadlines or incorrectly filed papers.

Dependency on others: Internal finance teams’ or accountants’ delays.

The first step in preventing late payments and needless expenses is realising these pitfalls.

What If I Can’t Pay Corporation Tax?

If your business is unable to pay its Corporation Tax, please contact HMRC immediately. To spread out payments over several months, they may offer a Time to Pay (TTP) plan. Interest, penalties, or legal action may result from ignoring the issue. Contact an accountant or insolvency practitioner to investigate repayment or rescue options if cash flow is a significant problem.

Can I Pay Corporation Tax in Instalments?

Yes, but only with permission from HMRC. A Time to Pay (TTP) arrangement may be requested if your business is unable to make the entire payment by the due date. This lets you pay your corporation tax obligation over a period of months, usually up to a year.

You must explain your company’s financial status to HMRC’s Business Payment Support Service prior to the payment being due. If they agree, as long as you make all agreed-upon payments on schedule, you won’t be penalised (interest will still be charged).

Quarterly Instalment Payments (QIPs) for Large UK Companies

if your company rakes in profits of more than £1.5 million, HMRC want you to pay your Corporation Tax in instalments, rather than all in one go at the end of the year. These QIPs reduce the risk of late payment, but – and it’s a big but – they also have some pretty strict deadlines you’ll need to keep.

If one of your QIPs does get paid late, HMRC will hit you with interest on the amount that’s overdue from the moment it was late right up until it’s paid off in full. The interest rate is the Bank of England base rate plus 4% (which is what it is as of April 2025) and that just adds to the cost.

You really need to keep on top of those QIP payments, because if you dont late payments can quickly start to add up into a serious amount of interest. Keep a close eye on those deadlines and make sure you’ve got a good plan in place to stay on track.

What Enforcement Actions Can HMRC Take for Late Payment?

Interest and Penalties: If you continue to fail to make payments, you may be subject to penalties and interest starting the day following the due date.

If your firm fails to pay Corporation Tax on time and doesn’t contact HMRC, enforcement action can follow. HMRC has extensive authority to collect overdue taxes, including:

Debt Collection Agencies: HMRC has the authority to assign your debt to outside collection firms to get the money back.

Direct Recovery from Bank Accounts: HMRC may occasionally deduct funds directly from your company’s bank account.

Bailiff (Enforcement Officer) Visits: To sell and pay off the debt, they may take possession of the company’s assets.

Court Action: HMRC may issue a County Court Judgment (CCJ) against your company.

Winding Up Petition: If the debt is not paid, HMRC may file a winding-up petition to liquidate your business.

Getting in touch with HMRC as soon as possible if you’re having trouble making your payments will help you avoid these harsh enforcement actions.

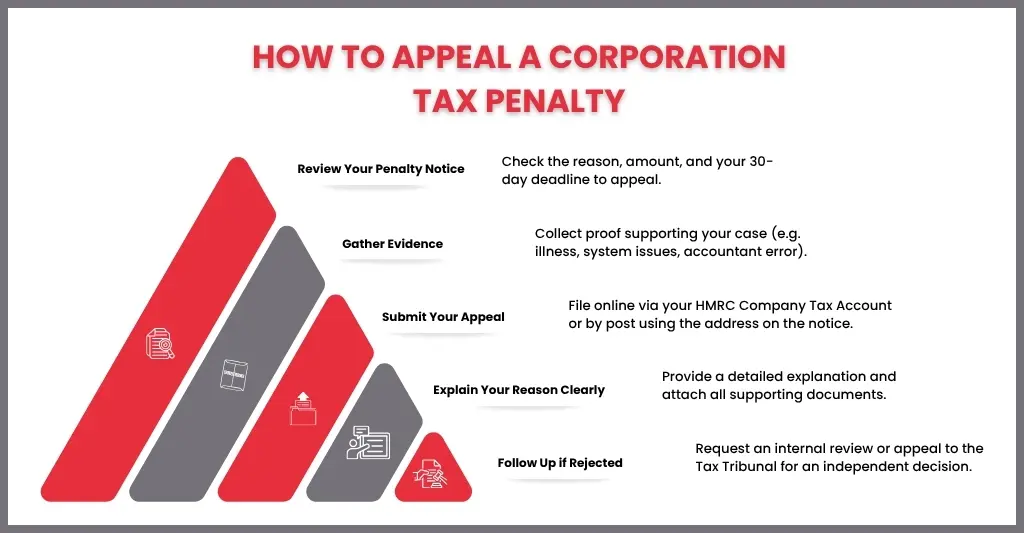

How to Appeal Corporation Tax Penalties?

You have the right to appeal if you think a corporation tax penalty is unfairly imposed on your business. If you can provide a good cause for missing the deadline or making a mistake, HMRC will consider your appeal.

Check the Penalty Notice: Carefully read the punishment letter to understand it:

- The justification for the fine

- The sum that is due

- The appeal deadline, which is typically within 30 days

Submit Your Appeal:

You can appeal:

- You may access your HMRC company tax account online.

- Use the postal address listed on the penalty notice

Give specifics of your reasoning for believing the penalty is incorrect, together with any supporting documentation (e.g., illness, system failure, or accounting error).

Reasonable Excuses May Include:

- Serious sickness or death

- Unexpected problems with HMRC’s systems

- Uncontrollable circumstances that prohibit filing or payment

If HMRC Rejects Your Appeal: You have two options: ask for an internal review or take the matter to the Tax Tribunal for a separate ruling.

Steps to Prevent Future Late Payments

- Set Up Automatic Payments: If at all possible, automate recurring invoices. By guaranteeing timely payments, this lowers the possibility of incurring late fees.

- Create a Payment Calendar: Keep a calendar, either digital or physical, with all of the days that payments are due. Keep ahead of deadlines by setting reminders a few days in advance.

- Prioritise Bills by Due Date: Sort bills according to their due date and urgency. Missed deadlines can be avoided by addressing high-priority payments first.

- Monitor Your Accounts Regularly: To make sure you have enough money for future payments and to identify any inconsistencies early, check your bank and credit accounts often.

- Communicate with Creditors if Needed: Get in touch with your creditor ahead of time if you expect a delay. When notified in advance, many businesses provide flexible payment plans or extensions.

- Review and Adjust Your Budget: To guarantee on-time payments without putting pressure on your budget, regularly assess your income and expenses.

FAQs: Frequently Asked Questions

What counts as a late payment?

Failing to pay a bill or debt by the due date is known as a late payment, and it can hurt your credit score as well as result in fines and interest charges.

How can I avoid forgetting payment due dates?

To remain on top of deadlines, you can utilise digital reminders, automatic payments, or a payment calendar.

Can I negotiate if I miss a payment?

Yes, frequently. If you get in touch with your creditors early on, they will often cooperate with you and provide alternatives like new payment plans or extensions.

Is automating payments always safe?

Yes, in general, but you should keep a close eye on your accounts to make sure there is adequate cash and to identify any mistakes or duplicate charges.

When is the deadline for filing Corporation Tax?

The deadline for filing your Corporation Tax return is 12 months after the end of your company’s accounting period. For example, if your accounting year ends on December 31st, your filing deadline will be December 31st of the following year. However, the payment for Corporation Tax is due 9 months and 1 day after the end of your accounting period. So, if your accounting year ends on December 31st, your payment deadline will be October 1st of the following year.

Ensure to meet both the filing and payment deadlines to avoid any penalties or interest charges from HMRC.

Conclusion

Paying your Corporation Tax late can have some pretty serious consequences, including costly penalties and the added bonus of piling up interest charges. And on top of that, HMRC might just decide to take enforcement action. But on the flip side, with a bit of careful planning, some proactive communication and organisation you can avoid all that hassle. Stuff like setting up automatic payments, keeping a payment calendar and keeping a close eye on your financial accounts can be a big help in staying on top of things and avoiding unnecessary charges.

If you find yourself in a situation where you’re struggling to meet a deadline, getting in touch with HMRC early on to talk about a Time to Pay arrangement (or maybe seeking some professional advice) can help prevent things from getting out of hand and keep your company’s finances on track. Keeping up to date with the latest requirements and preparing for the inevitable helps keep your business compliant, cuts down on stress and helps ensure long term success.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.