- What Is a SIPP and How Does It Work?

- How Is a SIPP Different from Other Personal Pensions?

- How Do I Choose My Own Investments for a SIPP?

- 2025 SIPP Tax Rules Every High Earner Should Know

- Key SIPP Tax Benefits for High Earners (Why It’s Worth It)

- Step-by-Step: How to Claim SIPP Tax Relief for High Earners

- How to Avoid Common Mistakes (and HMRC Red Flags)

- Advanced Tax Planning Tips for High Earners

- What Happens If You Over-Contribute

- FAQs: Frequently Asked Questions

- Conclusion

A Self Invested Personal Pension (SIPP) is basically a super flexible UK pension scheme that’s designed to give high earners a lot more control over how they invest for their retirement, and also a bunch of SIPP tax benefits thrown in for good measure. With a SIPP, you can chuck your money into pretty much whatever assets you like and claim back up to 45% in tax relief – all of which should help your retirement savings grow a lot faster while also saving you some cash on your current tax bill. A SIPP is especially a good idea for those higher and additional rate taxpayers who want to make the most of tax-efficient pension contributions, as much as possible.

In this article, we’re going to explain what a SIPP is and – more to the point – how it’s different from those old-fashioned pensions. We’ll also cover the 2026 tax rules for high earners that you really need to know about, how to grab yourself some extra SIPP tax benefits, some common mistakes to avoid, and some advanced tax planning tricks that will help you get the most out of your SIPP. Whether you’re just starting to think about SIPPs or you want to give your existing strategy a bit of a makeover, we’ve got clear practical advice to help you save some cash on tax and plan a pretty secure retirement.

What Is a SIPP and How Does It Work?

One kind of UK pension that offers you greater control over the investments made with your retirement funds is the Self-Invested Personal Pension (SIPP). A SIPP gives you access to a variety of investment possibilities, such as equities, bonds, funds, and commercial real estate, in contrast to traditional workplace or personal pensions. Understanding how a SIPP functions is essential if you want to maximise your SIPP tax benefits.

Here’s how it works:

Contributions: Depending on your income limits, you or your employer may contribute to your SIPP up to the annual limit, which is currently £60,000 for most people.

Tax Relief: Higher or additional rate taxpayers can claim more relief through their self-assessment, as contributions qualify for tax relief at their highest rate.

Investments Grow Tax-Free: Capital gains and income taxes in the UK are not applied to investments made through the SIPP. which further enhances SIPP tax benefits.

Access at Retirement: Generally, you can begin taking withdrawals at age 55 (it will increase to 57 in 2028). Of this amount, 25% can be taken as a tax-free lump payment, while the remaining amount is subject to income tax.

In summary, high earners wishing to maximise their retirement savings find a SIPP to be an appealing alternative since it combines flexibility, investment choice, and tax efficiency.

How Is a SIPP Different from Other Personal Pensions?

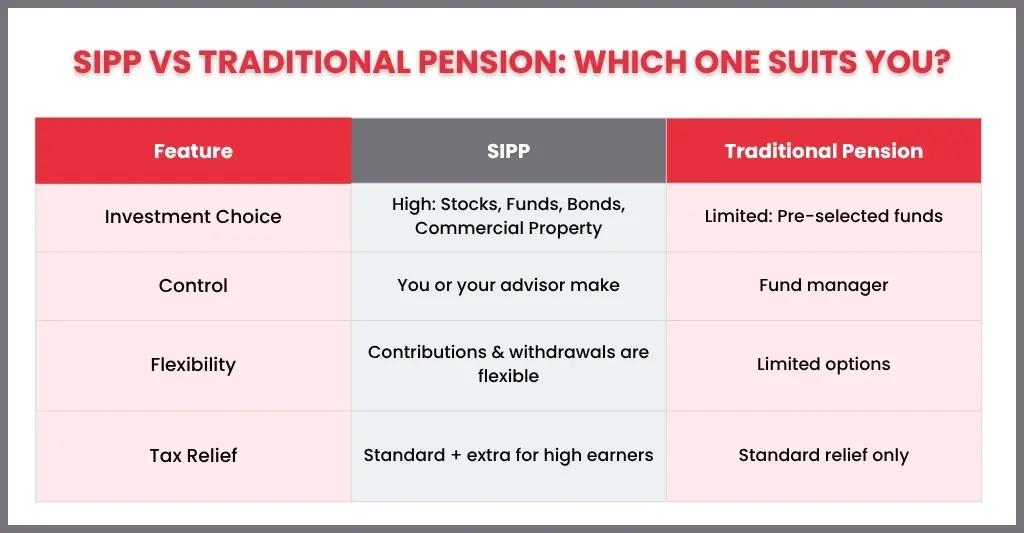

The primary areas of distinction between a Self-Invested Personal Pension (SIPP) and traditional personal or workplace pensions are control, investment choice, and flexibility:

Investment Options: A SIPP gives you more flexibility to customize your portfolio by allowing you to invest in stocks, bonds, funds, ETFs, commercial real estate, and more, whereas traditional pensions frequently restrict you to a specific selection of funds.

Control Over Decisions: A SIPP allows you to make important investment choices on your own (or with the help of a financial advisor), while regular pensions are typically run by fund managers who follow set plans.

Tax Relief Opportunities: SIPPs offer tax relief, similar to conventional pensions, but are especially appealing to individuals in higher tax brackets, as they can claim more relief through self-assessment.

Flexibility in Contributions and Withdrawals: Unlike certain employer-sponsored plans, SIPPs frequently permit more flexible contributions and perhaps more control over withdrawals in retirement.

How Do I Choose My Own Investments for a SIPP?

A Self-Invested Personal Pension (SIPP) allows you to choose your own investments, giving you freedom and control over the management of your retirement funds. But that freedom also comes with responsibility, so it’s critical to weigh your options and make thoughtful investment selections.

Understand Your Investment Goals

Decide what you want your SIPP to do first. Take into account:

- The length of time you have to invest and your retirement age

- The amount of money required for retirement

- How at ease are you with changes in the value of your investments? This is your attitude toward risk.

Know What You Can Invest In

SIPPs offer a wide range of investment choices, including:

- Funds (e.g., index funds, mutual funds, ETFs)

- Individual shares listed on recognised stock exchanges

- Corporate and government bonds

- Commercial property (not residential)

- Investment trusts and REITs

Your SIPP provider will list exactly what types of investments you can hold.

Diversify Your Portfolio

Risk can be decreased by distributing your assets over multiple asset categories and industries. Poor performance in one area is less likely to have a significant impact on a well-diversified portfolio.

Decide How Involved You Want to Be

You can create and manage your portfolio on your own if you like a more hands-on approach. As an alternative, you can select managed funds or ready-made portfolios, in which case you entrust the investment decisions to qualified managers.

Review and Rebalance Regularly

The state of the market and your objectives may evolve. Reviewing your assets at least once a year will help you make sure your portfolio still fits your goals and risk tolerance.

Risks to Consider When Managing a SIPP

- Market Volatility: There is always the risk that your investments in shares or property might take a bit of a nosedive, which could end up knocking a chunk off your pension savings.

- Illiquid Assets: Some of your investments may not be so easy to sell at short notice, which can limit your ability access to cash if you need it.

- Complexity and Costs: If you’ve got a big mix of assets in your SIPP, then you might end up paying higher fees and it’d probably be a good idea to get some financial expertise to help you manage it all.

- Regulatory Risks: If you do choose to go with some unapproved investments, you could end up facing tax penalties and getting on the wrong side of HMRC

Seek Professional Advice if Needed

If you are uncertain about where to make investments, you might want to consult a financial advisor. With their assistance, you can adjust your SIPP investments to your unique circumstances and long-term objectives.

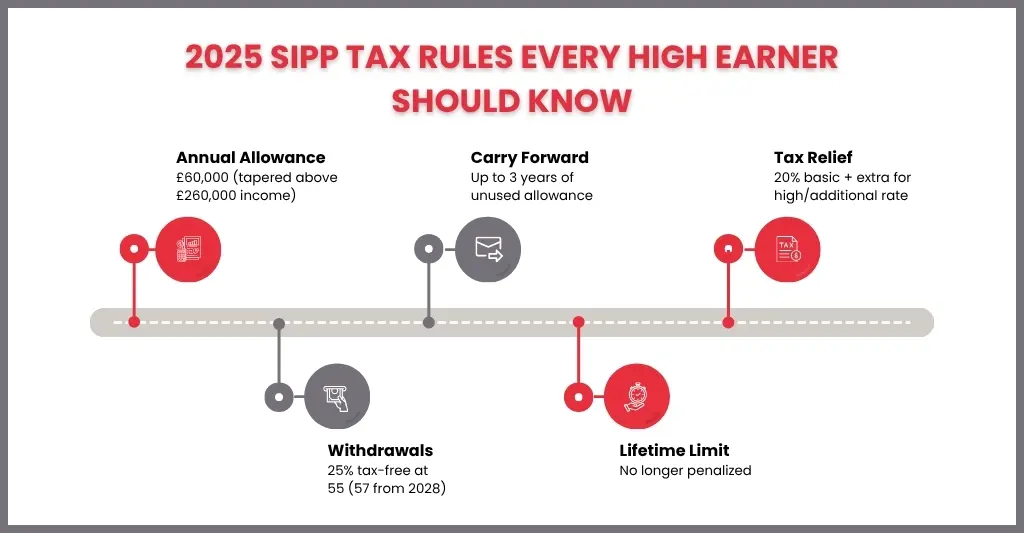

2025 SIPP Tax Rules Every High Earner Should Know

Higher earners in the UK need to understand the main tax regulations about Self-Invested Personal Pensions (SIPPs) for the 2025–2026 tax year (and subsequent years). These rules are crucial to preserving your SIPP tax benefits. You should be aware of the following key points:

Annual Allowance & Tapering

- Tax reduction is typically available for contributions up to £60,000 annually into your pension.

- Your limit decreases if your total income exceeds £260,000 (bonuses and pension payments included).

- If your income is significantly higher, it can drop to at least £10,000.

- You will be subject to a tax charge if you pay more than your allowance.

Use Carry Forward

- In the last three years, have you not used up your entire pension allowance?

- If you had a pension during those years, you can carry it forward and make additional payments this year.

Get Tax Relief

You get tax relief on your SIPP payments:

- 20% is automatically applied.

- Through their Self Assessment, taxpayers with higher and additional rates are eligible to receive further relief.

- You can pay £2,880 even if you are unemployed (which becomes £3,600 with tax relief).

No Lifetime Limit

The Lifetime Allowance is no longer subject to a tax penalty for accumulating a sizable pension fund.

To receive tax savings on new payments, however, you must still be under 75.

Taking Money Out

- At age 55 (it will increase to 57 starting in 2028), you can withdraw funds from your SIPP.

- 25% of your pot is often tax-free.

- The remainder is subject to income tax; the more you take, the higher your potential tax liability.

NICs and Other Tax Relief Interactions

- While SIPPs offer great income tax relief, they don’t reduce your National Insurance Contributions (NICs).

- NICs are calculated separately based on what you earn, and pension contributions don’t usually affect them—unless you have a salary sacrifice arrangement.

- Your SIPP contributions also work alongside other tax reliefs like the Personal Savings Allowance and Dividend Allowance.

- To make sure you’re getting the most tax benefits and everything works smoothly together, it’s a good idea to chat with a tax advisor.

Key SIPP Tax Benefits for High Earners (Why It’s Worth It)

A Self-Invested Personal Pension (SIPP) is a potent tax-saving strategy for high incomes in addition to being a means of saving for retirement. Here are some reasons to think about it:

Big Tax Relief on Contributions

- At your maximum income tax rate, which is 40% or even 45% for wealthy earners, you receive tax relief.

- The government contributes at least £25 for every £100 you pay in, and you can claim considerably more through Self Assessment.

- This implies that you can increase your retirement fund while lowering your tax liability.

Tax-Free Growth

- All of the funds in your SIPP are exempt from capital gains and income taxes in the UK.

- Your money can increase more quickly over time since you don’t have to pay taxes on dividends or profits earned inside the pension.

Flexible Withdrawals in Retirement

- A maximum of 25% of your SIPP may be taken tax-free starting at age 55 (57 from 2028).

- You can decide when and how much to remove, which can help you control your retirement tax cost. The remaining amount is taxed as income.

No Lifetime Allowance Limit

- Building a sizable pension fund is not penalized because the previous Lifetime Allowance tax charge has been eliminated.

- High-income individuals now have more flexibility to continue making contributions and expanding their savings.

Inheritance Tax Advantages

- In most cases, your SIPP is not included in your estate for inheritance tax (IHT).

- It implies that your beneficiaries can inherit your pension pot in a tax-efficient manner, frequently without having to pay IHT.

Smart Way to Use Bonuses or Extra Income

- You can contribute to your SIPP rather than collecting a bonus and incurring higher income tax.

- Short-term income will be converted into long-term wealth, and you will receive tax relief.

Step-by-Step: How to Claim SIPP Tax Relief for High Earners

You are eligible for further tax relief on your SIPP payments if you are a higher-rate or additional-rate taxpayer. Here’s how it operates, step-by-step.

Make Your SIPP Contribution: A 20% basic-rate tax reduction is automatically added by your supplier when you make payments into your SIPP. For instance, you pay £8,000, and the government contributes £2,000, so your pension totals £10,000.

Check Your Tax Rate: If you pay income tax at the higher rate of 40% or the additional rate of 45%, you are eligible for additional relief. On your tax return, you may receive an additional 20% to 25% of your donation.

To Claim the Extra Tax Relief

You can claim it in one of two ways:

Option 1 – Self Assessment Tax Return

- Log in to your HMRC online account.

- Go to your Self Assessment form.

- Enter your gross pension contributions (that’s the amount including the 20% added by your SIPP provider).

- HMRC will adjust your tax bill or issue a refund.

Option 2 – Contact HMRC Directly

- If you don’t complete a tax return, you can call or write to HMRC to update your tax code.

- They’ll adjust your PAYE tax code, so you get the relief through your salary.

Get Your Tax Back:

- The additional assistance will typically be in the form of a tax refund or a reduction in your tax liability.

- In the event that your tax code changes, it may also raise your take-home pay.

Keep Records: Keep your contribution receipts and SIPP statements safe. If HMRC requests documentation of your payments, you may need these.

How to Avoid Common Mistakes (and HMRC Red Flags)

Small errors in SIPP management, particularly for high earners, might result in lost tax benefits or an HMRC investigation. Here are some tips for being safe:

Don’t Exceed Your Annual Allowance

- Before you contribute, find out if your allocation is standard or tapered.

- An annual allowance charge, or additional tax, may result from overpaying.

- Maintain a record of all employer payments and pension contributions.

Keep Accurate Records

- Keep all of your contact with HMRC, SIPP statements, and contribution receipts.

- Answering any HMRC questions and claiming tax relief are made simpler with accurate documents.

Claim the Right Amount of Tax Relief

- Make a claim for relief only for the actual contributions you made.

- Your personal tax return should not include employer contributions, as those are already handled by HMRC.

Watch Out for Tapered Allowances

- High earners might receive a smaller allowance.

- Verify again before making significant donations, particularly if you are receiving bonuses or significant pay raises.

Avoid “Unapproved” Investments

- Funds, shares, bonds, commercial real estate, and other qualifying investments must be held by SIPPs.

- Unusual schemes or residential property may invalidate tax benefits and raise red flags for HMRC.

Don’t Miss Deadlines

- To be eligible for a deduction, contributions must be made within the tax year.

- To receive your further tax relief, submit your Self Assessment claims on time.

Advanced Tax Planning Tips for High Earners

Smart planning can help high earners maximise their tax savings and make their SIPP work harder. Here are a few smart tactics:

Maximise Your Annual Allowance:

- If you did not spend the entire allowance, use carry-forward from the previous three years.

- Carefully balance company and personal contributions to keep under your cap and prevent fines.

Use Salary Sacrifice:

- Agree with your employer to contribute to your pension in exchange for a portion of your pay.

- This doubles your savings by lowering your taxable income and national insurance premiums.

Plan Withdrawals Carefully:

- Plan out the process and timing of your SIPP withdrawal.

- You can maintain a lower tax bracket in retirement by distributing withdrawals over a number of years.

Use Multiple Pension Pots Wisely:

- Think about balancing or merging your several SIPPs or pensions.

- This facilitates efficient fee management, investment strategy, and tax planning.

Get Professional Advice:

- Large contributions, tapering, and complicated tax laws can be challenging.

- A financial advisor can help you minimise taxes while making the most of your contributions, investments, and withdrawals.

What Happens If You Over-Contribute

The annual allowance charge levies taxes at your marginal rate on any excess contributions made to your SIPP over your annual allowance, which is normally £60,000 and reduced to £10,000 for high earners. The tax relief claimed on the additional must be reported on your Self Assessment, and HMRC will retrieve it. You can ask your SIPP provider to repay the excess or use a carryover from the previous three years to avoid penalties. To stay on track, it’s critical to maintain thorough records of all contributions, both personal and professional.

FAQs: Frequently Asked Questions

What is a SIPP?

Unlike traditional pensions, a Self-Invested Personal Pension (SIPP) gives you greater choice and flexibility by allowing you to select and manage your own investments.

Who can open a SIPP?

A SIPP can be opened by anyone under 75 who earns money in the UK or who wants to contribute personally up to the yearly limit.

Is it possible to carry over unused allowances?

Yes, if you were a part of a pension plan during those years, you can carry forward up to three years’ worth of unused allowance.

When can I access my SIPP?

Withdrawals can typically begin at age 55, with the age rising to 57 in 2028. Generally, up to 25% of your pot can be consumed tax-free.

Can I contribute to a SIPP if I am self-employed?

Yes, you can absolutely open and contribute to a SIPP no matter what kind of work you do, providing you’re working for yourself in the UK. And you’ll get the same tax relief benefits as people who are employed, up to the annual allowance.

What happens with tax if I transfer from a traditional pension to a SIPP?

When you move your pension from an old-fashioned pension to a SIPP, it usually isn’t taxed at the time – but you do need to check if you’re losing out on any guarantees or benefits in the process.

Are employer contributions treated differently from personal contributions?

Employer contributions get tax relief straight away, without you needing to claim it back on your tax return, so you do need to keep those separate when you’re filling in your tax forms.

Conclusion

A SIPP can be a great way for high earners to take control of their retirement savings and get some serious tax benefits. By understanding how it all works — from contribution limits to tax relief and investment options — you can make your money work harder and grow faster for the future.

But SIPPs can get a bit tricky, especially when it comes to tax allowances and HMRC rules. Even small mistakes can cost you relief or incur unexpected charges. So before you make big decisions or complex investments, it’s a good idea to talk to a qualified accountant or tax expert. Getting professional advice will help you get the most from your SIPP, avoid the pitfalls and build a tax efficient plan for your retirement.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.