Table of Contents

Choosing the right audit firm is a critical challenge for UK small and medium-sized enterprises (SMEs), often complicated by concerns over compliance, costs, and finding a partner that understands their unique needs. These pain points can make the audit process stressful and uncertain.

A good audit firm offers more than just financial checks, it provides insights to spot risks, improve efficiency, and support growth. However, many firms lack the personalised approach SMEs need to truly benefit.

This guide presents the top 10 UK audit firms known for their expertise, local knowledge, and tailored services designed specifically for SMEs. Whether you need to meet legal requirements or want strategic advice for expansion, these firms can help your business succeed.

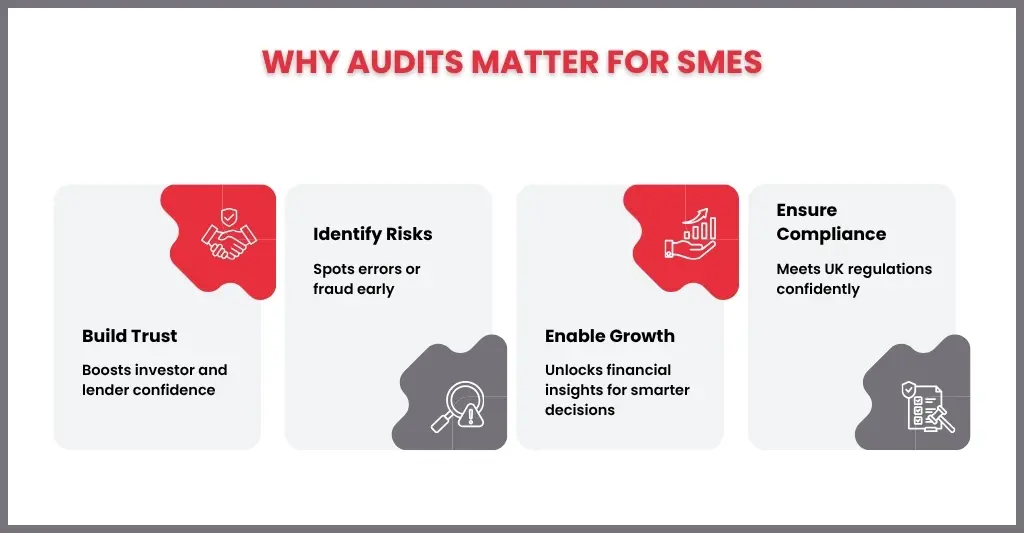

Why SMEs Need Professional Audits?

Professional audits are essential for SMEs to increase financial transparency, establish confidence, and make wise business decisions. An independent audit identifies possible risks, inefficiencies, and growth opportunities in addition to confirming the correctness of financial statements.

For small and medium enterprises professional audit is required for the following reasons:

- An accurate financial report increases the trust and confidence of lenders and investors.

- Ensure that all legal and regulatory standards are met.

- Saves the company from financial loss by identifying mistakes or fraud early.

- Give insightful explanations of cash flow, profitability, and operational efficiency.

In summary, an audit is a chance to improve the financial stability and reputation of your company, not merely to fulfill requirements.

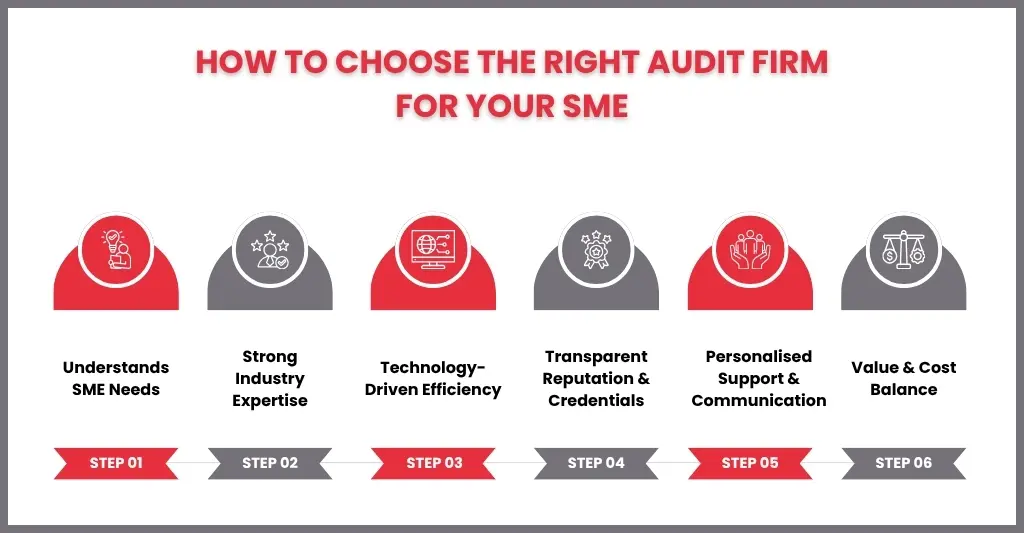

How to Choose the Right Audit Firm for Your SME?

The secret to acquiring precise, trustworthy, and useful financial insights is choosing the appropriate audit firm. The ideal option will differ depending on your company’s size, sector, and expansion objectives, but all SMEs must consider a few important factors.

Here’s what to consider:

- Experience with SMEs: Select a company that is aware of the requirements and difficulties faced by small and medium-sized enterprises.

- Industry expertise: Seek auditors with experience in your industry to guarantee relevant guidance and assistance with compliance.

- Reputation and credentials: Verify credentials, client testimonials, and professional certifications (such as ACCA or ICAEW).

- Technology and efficiency: Businesses may provide faster, more accurate outcomes by utilising contemporary auditing tools.

- Personalised Support: A company can create genuine long-term value if it communicates clearly and offers proactive advice.

More than just looking at the figures, the proper audit partner will support your SME’s growth with assurance and clarity.

Services to Look For

The scope of services provided by the audit firm beyond routine audits should be taken into account when selecting one for your SME. In addition to saving time and lowering risk, comprehensive support can yield useful insights. Important services to seek out include:

Statutory audits: Ensuring adherence to UK accounting and auditing standards.

Internal audits: Looking for risks or inefficiencies by reviewing internal controls and procedures.

Tax planning and compliance: Meeting HMRC regulations and maximising tax responsibilities.

Financial reporting and advisory: Preparing precise financial statements and providing smart financial advice.

Payroll and bookkeeping support: Managing day-to-day financial operations efficiently.

Business advisory services: Providing guidance on financing, operational enhancements, and growth tactics.

Factors to Consider

Several important considerations can help you choose the best audit firm for your small business:

- Experience and knowledge: Choose a company that knows SMEs and your particular sector.

- Credibility and reputation: Assess prior work, professional certifications, and customer feedback.

- Value and cost: Check the cost before doing further agreements.

- Communication and accessibility: Pick a company that is proactive, transparent, and quick to respond.

- Technology and efficiency: Businesses can streamline reporting and audits by utilising contemporary accounting solutions.

- Personalised approach: Make sure the company doesn’t provide a one-size-fits-all solution, but instead customises its services to meet your company’s demands.

Top 10 Audit Firms in the UK for SMEs

When looking for trustworthy financial monitoring and strategic direction, small and medium-sized businesses (SMEs) must choose the correct audit firm. A curated selection of the best UK audit firms that address the particular requirements of SMEs may be found below.

CoxHinkins

A renowned accounting business that provides SMEs with a wide range of services, such as payroll, tax assistance, bookkeeping, and company accounts. With more than 50 years of expertise, they are renowned for their dedication to helping small businesses and their individualised approach. In addition to offering strategic insights to improve corporate performance, their audit services guarantee accuracy and compliance.

Features

CoxHinkins has a reputation for having a thorough understanding of local companies and offering customised audit services that go above and beyond compliance to offer insightful analysis and risk-reduction tactics. They have a long history in Oxford and are a reliable partner for financial oversight because of their commitment to SMEs.

BDO LLP

The next top mid-tier firm offering SMEs audit, tax, and advisory services is BDO. They are well-known for their client-focused methodology and have a proven track record of producing excellent audits. BDO is still a major force in the UK accounting industry, even after the Financial Reporting Council (FRC) recently criticized the quality of its audits.

Features

BDO is a top option for SMEs looking for reliable audit and advisory services because of its wide worldwide network and numerous service offerings. Despite recent difficulties, their determination to increase audit quality demonstrates their commitment to ongoing development.

Grant Thornton UK LLP

With an emphasis on assisting dynamic firms in navigating intricate business difficulties, Grant Thornton provides a variety of services, such as audit, tax, and advisory. To offer SMEs specialised services, they blend local knowledge, quality, and insight with global size.

Features

Grant Thornton is a strong option for SMEs looking for full audit and advisory services because of their recent expansion initiatives, which include foreign acquisitions, and their strategic focus on mid-market companies.

Mazars LLP

It is a multinational tax, audit, and consultancy company that works with small businesses. They have been growing in the UK industry and are well known for providing high-quality audits. In 2024, Mazars’ UK revenues increased 8.3% to £362.4 million, marking the company’s sixteenth consecutive year of revenue growth.

Features

Mazars is a trustworthy partner for SMEs looking for financial monitoring and strategic direction because of its steady expansion and dedication to high-quality audits. Their efforts to expand demonstrate their commitment to satisfying the changing demands of the market.

RSM UK Audit LLP

One of the top suppliers of assurance and audit services to SMEs is RSM. They provide a variety of services aimed at assisting companies in risk management and performance enhancement. RSM is the sixth-largest business advising firm worldwide and the seventh-largest in the UK.

Features

RSM is a top option for SMEs looking for reliable audit and advisory services because of its wide network and numerous service offerings. Their emphasis on mid-market companies guarantees customised solutions that meet particular customer needs.

PKF Littlejohn LLP

They focus on offering useful solutions to support the expansion and success of businesses by providing audit, tax, and consultancy services to SMEs. PKF UK & Ireland’s London office, with a combined fee income of nearly £126 million, they are currently the 11th largest network in the UK.

Features

PKF Littlejohn is a great partner for SMEs looking for financial monitoring and strategic direction because of their solid presence in London’s financial district and dedication to providing workable solutions.

Crowe UK LLP

They provide SMEs with audit and assurance services, emphasizing the delivery of excellent audits and insightful information to support companies in enhancing performance. Because of their expert guidance and ability to make wise decisions, they are trusted by clients all over the world.

Features

Crowe is a trustworthy partner for SMEs looking for thorough financial monitoring and strategic direction because of their global reach and dedication to providing high-quality audits.

Haines Watts

Haines Watts focuses on assisting companies in managing risk and enhancing performance by offering audit, tax, and consultancy services to SMEs. They serve as a sounding board to assist with business improvement ideas and provide guidance on business improvement.

Features

Haines Watts is a useful partner for SMEs looking to improve their financial performance and achieve long-term success because of their individualised approach and emphasis on business improvement tactics.

Azets

One of the top suppliers of audit and assurance services to SMEs, Azets offers a variety of services aimed at assisting companies in risk management and performance enhancement. They have a reputation for being proactive and dedicated to providing top-notch services.

Features

Azets is a dependable partner for SMEs looking for thorough financial management and strategic direction because of their proactive attitude and dedication to providing high-quality services.

Evelyn Partners

With an emphasis on offering workable solutions to support companies’ expansion and success, Evelyn Partners offers audit, tax, and consultancy services to SMEs. They provide a variety of services tailored to SMEs’ particular requirements.

Features

Evelyn Partners is a great partner for SMEs looking to improve their financial performance and achieve long-term success because of their extensive service offerings and dedication to providing workable solutions.

Common Questions SMEs Have About Audit Firms

SMEs frequently ask a number of questions concerning services, costs, and benefits when selecting an audit firm. Business owners can make better judgments when these issues are addressed in advance. Some of the most frequent queries are as follows:

Do all SMEs need an audit?

The law does not mandate an audit for all SMEs. It depends on the factors, such as legal structure, turnover, and company size all affect the necessity. However, audits can offer credibility and useful financial insights even if they are not required.

How much does an SME audit typically cost?

The size of your company, the firm, and the complexity of your accounting all affect audit fees. Smaller businesses might spend a few thousand pounds, while larger businesses with more intricate operations might have to pay more.

How long does an audit take?

The length of time varies according to the business size, accounting systems, and readiness of the business. For well-prepared accounts, firms may provide speedier options, although most SME audits take two to six weeks.

What services do audit firms offer beyond audits?

Numerous businesses offer financial reporting, payroll, tax planning, bookkeeping, and consultancy services.

How can I choose the right audit firm for my SME?

Consider the following things, such as pricing, technology utilisation, individualised service, corporate reputation, and industry experience. Your choice may also be influenced by recommendations and customer testimonials.

Can an audit help my business grow?

Yes. Audits assist SMEs in making well-informed decisions and draw in lenders or investors by identifying financial risks, inefficiencies, and opportunities, in addition to compliance.

Tips for SMEs to Get the Most from Their Audit Firm

A typical compliance duty might be transformed into a profitable business opportunity by collaborating with your audit firm. The following are important pointers to assist SMEs in getting the most out of their audit relationship:

Prepare your financial records early: Being prepared in advance is good to avoid last-minute stress. So, make sure all bank statements, accounting records, and receipts are correct and current. Effective planning minimises delays and increases auditor productivity.

Communicate openly and regularly: Maintain constant contact with your auditors. Transparency increases trust and produces more accurate insights, so talk about any business changes, difficulties, or odd transactions.

Understand the audit process: Learn about the things that auditors look for, including compliance requirements and risk areas. You can deal with problems more proactively rather than reactively with this information.

Ask questions and seek advice: In addition to checking your accounts, your auditors can offer insightful counsel on enhancing internal audit controls, cost control, and financial planning. Never be afraid to seek their professional advice.

Review audit findings carefully: After the audit, carefully review the report. Take advice seriously and apply it to improve your operational effectiveness and financial management.

Build a long-term relationship: Try working with the same firm for a long time, as it gives auditors a deeper understanding of your company, resulting in more pertinent insights and advice that is more specifically customised to your needs.

Leverage technology: Select an audit company that makes use of modern audit and accounting tools. Digital tools offer real-time data analysis, process simplification, and mistake reduction.

FAQs: Frequently Asked Questions

What is the main purpose of an audit for SMEs?

An audit ensures accuracy, compliance, and credibility with stakeholders like as banks, regulators, and investors by acting as an impartial check on your financial statements.

Are small businesses legally required to have an audit?

Not every time. Companies in the UK that fall below specific size requirements (based on assets, turnover, and employee count) may be free from audits, though volunteer audits can still be beneficial.

What paperwork do I need to get ready for an audit?

Financial statements, bank reconciliations, payroll records, invoices, tax reports, and documentation about company registration are important documents.

Is it possible for an audit to identify financial mismanagement or fraud?

Yes. The purpose of audits is to help protect your company from financial risk by spotting irregularities, mistakes, and possible fraud.

Conclusion

A small or medium enterprise must make one of the most critical decisions in terms of finance while choosing its audit firm. Other than just ensuring compliance is met, the right partner aids in enhancing financial clarity, identifying growth opportunities, and guiding intelligent business decisions.

CoxHinkins, BDO, Grant Thornton, and others have made it to this list for companies that have a history of assisting small and medium-sized enterprises in the UK. Each of them brings forth a unique meld between technology and industry expertise with personal service to match the changing needs of SMEs.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.