- Understanding UK Tax Return and Company Account Filing Deadlines

- When and Why You Might Need to Extend Your Filing Deadline?

- Step-by-Step: How to Extend the Self Assessment Tax Return Deadline

- What Happens If You Miss the Deadline?

- Step-by-Step: How to Extend the Company Accounts Filing Deadline

- What Happens If You already miss the Filing Deadline?

- How to Ask Company House to Extend Your Filing Date?

- How to Avoid Needing an Extension For Filing a Tax Return?

- Tips to Avoid Late Filing Penalties

- FAQs: Frequently Asked Questions

- Conclusion

One of the most crucial dates on the UK financial calendar is the filing deadline; if you miss it, you risk automatic penalties, interest charges, and needless worry. However, life and business don’t always go as planned. Occasionally, you may require more time to organise your company’s accounts or complete a tax return during the busy 2025/26 tax year.

We’ll cover all you need to know in this blog regarding extending the reporting deadlines for UK company accounts and tax filings in 2026. We will go through every step of the process, including when HMRC and Companies House will grant extensions, what constitutes a good reason, and how to submit your tax return. Regardless of your role, self-employed, a limited company director, or an accountant overseeing several clients. This post will help you stay in compliance and clear of expensive errors while avoiding last-minute issues with your tax bill.

Understanding UK Tax Return and Company Account Filing Deadlines

Understanding the typical filing requirements for UK people and businesses is crucial before examining ways to extend deadlines. Being aware of the fundamentals is crucial because missing certain dates can result in fines.

Self Assessment Tax Returns (Individuals & Sole Traders)

- Deadline for paper returns: 31 October 2025, following the end of the tax year.

- Deadline for online returns: 31 January 2026, following the end of the tax year.

- Payment deadline: 31 January (with a possible second payment on account due 31 July).

For the 2023/24 tax year, for example, online returns must be filed by 31 January 2025.

If you need more time to complete a tax return or gather records for the 2025/26 tax year, understanding these dates is essential.

Company Accounts (Limited Companies)

- The corporation has nine months from the end of its fiscal year to file its annual accounts with Companies House.

- The HMRC Corporation Tax return date is 12 months following the conclusion of the accounting period; however, the Corporation Tax itself is due 9 months and 1 day following the end of the year.

For example, if your company’s year-end is 31 March 2024, your accounts must be filed with Companies House by 31 December 2024, and Corporation Tax is payable by 1 January 2025. Especially useful to remember when planning for April 2025 or April 2026 .

Self Assessment Tax Returns

HMRC collects income tax from people who do not have it automatically taken from their salaries or pensions via the Self Assessment system. Self-employed people, landlords, directors of businesses, and people with other sources of income are usually included in this.

Note: Don’t miss out on important deadlines—find out how to register for Self Assessment and file your tax return on time.

Key Deadlines

- Paper tax return: 31 October following the end of the tax year.

- Online tax return: 31 January following the end of the tax year.

- Payment deadlines:

- 31 January – any tax owed for the previous year, plus the first “payment on account” for the current tax year (if applicable).

- 31 July – second “payment on account” deadline.

Example

For the 2023/24 tax year (covering income from 6 April 2023 to 5 April 2024):

- Paper return deadline: 31 October 2024

- Online return deadline: 31 January 2025

- Balancing payment and first payment on account: 31 January 2025

- Second payment on account: 31 July 2025

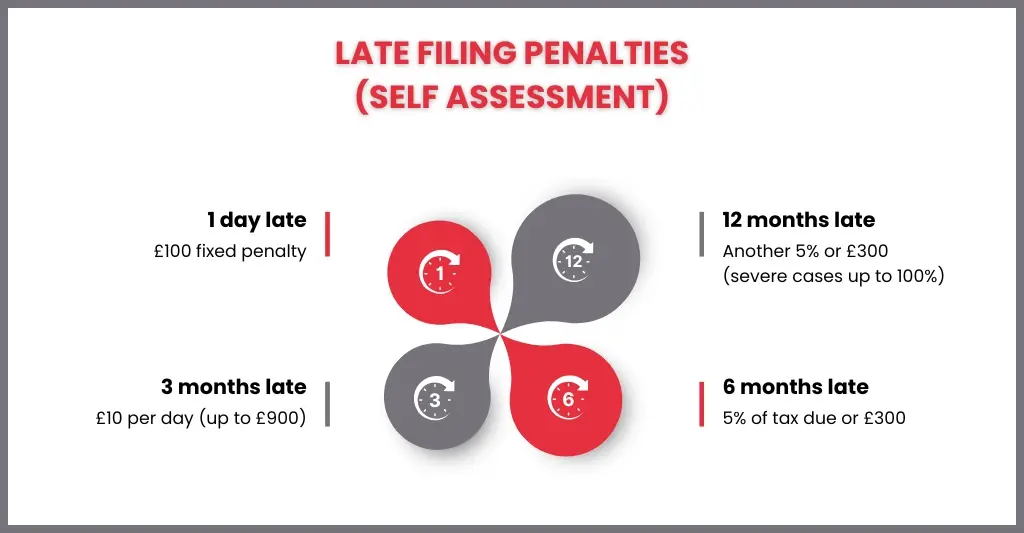

Penalties for Late Filing

- 1 day late: £100 fixed penalty (even if no tax is owed).

- 3 months late: £10 per day (up to £900).

- 6 months late: 5% of tax due or £300 (whichever is greater).

- 12 months late: Further 5% or £300, with harsher penalties for deliberate delays.

Company Accounts (Limited Companies)

In the UK, limited firms have two primary filing obligations: filing a Company Tax Return with HMRC and submitting yearly accounts to the firm’s House. Both have tight due dates, and failing to meet them may result in penalties for the company and possible problems with directors’ compliance.

Key Deadlines

- Annual accounts (Companies House): Must be filed 9 months after the company’s financial year end.

- Corporation Tax return (HMRC): Must be filed 12 months after the end of the company’s accounting period.

- Corporation Tax payment: Due 9 months and 1 day after the end of the accounting period.

Example

If a company’s year-end is 31 March 2024:

- Accounts must be filed at Companies House by 31 December 2024.

- Corporation Tax payment is due by 1 January 2025.

Corporation Tax return must be filed by 31 March 2025.

When and Why You Might Need to Extend Your Filing Deadline?

Businesses and individuals occasionally find it difficult to fulfill filing deadlines, even with the finest preparation. Although most persons are expected to submit on time by HMRC and Companies House, there are several legitimate reasons why an extension might be allowed.

Common Reasons for Extension Requests

- Serious illness or bereavement: When a family member’s death, illness, or hospitalisation keeps them from filing on time.

- Unexpected technical issues: For instance, issues with Companies House filing systems or a failure of HMRC’s online services around the deadline.

- Delays outside your control: such as waiting for missing financial data, delays from auditors, or postal strikes that impact paper submissions.

- Exceptional events: For example, fires, natural calamities, or cyberattacks that prevent access to company communications.

When Extensions Are Not Usually Granted?

- Insufficient planning or ineffective time management.

- The business owner had plenty of time to furnish records, but the accountant took too long.

- Not remembering the due date.

What Is Not a Valid Reason?

Although HMRC and Companies House are rigid about what doesn’t qualify as a legitimate justification, they will take extensions into consideration in truly extraordinary situations. You can avoid using arguments that are likely to be rejected by being aware of these beforehand.

Examples of Invalid Reasons

- Poor time management – leaving everything until the last minute.

- Being too busy with work or holidays – day-to-day commitments are not considered exceptional.

- Relying solely on your accountant – HMRC and Companies House view filing as ultimately the responsibility of the taxpayer or director.

- Forgetting login details or passwords – these are preventable issues.

- Deliberate delay to manage cash flow – withholding a return or accounts because you cannot yet pay the tax due is not acceptable.

Step-by-Step: How to Extend the Self Assessment Tax Return Deadline

The majority of Self Assessment tax returns should be submitted within the regular dates, according to HMRC. Rarely, though, you might be able to get more time. The procedure is not automatic; you must provide a “reasonable excuse” for your tardiness. This is how it functions:

Identify if You Have a Valid Reason

If any of the following stopped you from submitting, HMRC might grant an extension:

- Bereavement, hospitalisation, or serious sickness.

- System malfunctions (outage of HMRC’s online service).

- Things that are out of your control, such as mail delays, floods, or fires.

File as Soon as Possible

As soon as you can, file your return, even if you miss the official deadline. The longer the delay, the more difficult it is to make your point.

Appeal the Penalty

If you’ve already missed the deadline and received a penalty, you can appeal it. To do this:

- Log in to your HMRC online account.

- Select ‘Self Assessment’ → ‘Appeal a Penalty’.

Explain your reasonable excuse and provide supporting evidence (e.g., hospital records, proof of system outages).

Alternatively, you can appeal by post using form SA370.

Provide Evidence

Your case will be stronger the more specific you are. HMRC typically requests:

- dates of incidents or illnesses.

- copies of official announcements, medical certifications, or other records.

- Images of HMRC error messages are examples of proof that attempts were made to file on time.

Wait for HMRC’s Decision

Once HMRC has reviewed your appeal, they will do the following things:

- If your excuse is approved, you can either cancel or lessen the penalty.

- If they don’t think your justification is good, uphold the punishment.

What Happens If You Miss the Deadline?

Even if you have no outstanding taxes, you will still be subject to automatic penalties if you miss the Self Assessment tax return deadline. The expenditures increase with the length of the wait. This is what to look forward to:

Penalties Timeline:

- 1 day late – £100 fixed penalty (applies even if no tax is due).

- 3 months late – £10 per day fine (up to 90 days = £900).

- 6 months late – Further penalty of 5% of tax due or £300 (whichever is greater).

- 12 months late – Another 5% of tax due or £300. Severe cases (deliberate withholding) may result in penalties of up to 100% of the tax owed.

Note: It’s always best to check the official HMRC website for the latest updates or changes to payment deadlines.

Step-by-Step: How to Extend the Company Accounts Filing Deadline

If you’re having trouble meeting the deadline for reporting your company’s accounts, you might be eligible to ask for an extension. But since renewals are only given in certain situations, it’s critical to follow the right procedure.

Check if you’re eligible

Unless an unforeseen circumstance (such as a director’s illness, problems with your auditor, or a natural disaster) prevents you from submitting, Companies House rarely offers extensions. Workload demands or general delays are not regarded as acceptable explanations.

Apply before the deadline

You have to apply for an extension before the initial deadline expires. Applications that arrive late are automatically denied.

Gather the required information

- When submitting an application, you must provide:

- Your business number

- The cause of your inability to file on time

- supporting documentation (such as an auditor’s letter or a doctor’s note)

Submit your application

You can submit your request by mail or online using the Companies House service. Applications submitted online are processed more quickly and are confirmed right away.

Await confirmation

- After reviewing your application, Companies House will send you an email.

- You will be given a file extension (often for an extra month) if you are accepted.

- In order to avoid penalties, you must file by the initial deadline if it is disallowed.

File as soon as possible

Even if you have been given an extension, it is advisable to finish and submit your accounts well in advance of the revised due date in order to minimize the possibility of additional delays.

Note: If you’re running a limited company, you may want to learn how to register for Corporation Tax to meet your business tax obligations. Read our full step-by-step guide here.

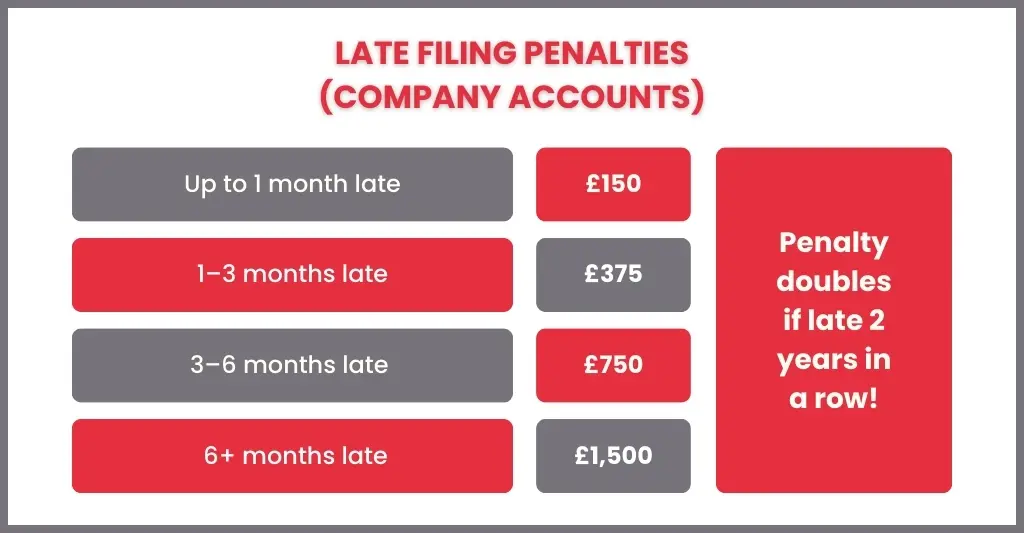

What Happens If You already miss the Filing Deadline?

An extension cannot be requested once the filing deadline has passed. A penalty will be automatically assessed by Companies House, which will start at £150 if you are up to one month past due and increase to £1,500 if you are past six months. If your business files late twice in a row, the penalty doubles. Directors may face punishment if they continue to fail to file, or your company may be removed from the register. It might also damage your company’s reputation because late filings are made public. Filing your accounts as soon as possible may help you avoid penalties and other hazards.

How to Ask Company House to Extend Your Filing Date?

Before your filing date, you must request an extension and justify your inability to submit your accounts on time. Additional time is only granted by Companies House in extraordinary circumstances, such as illness, unforeseen issues with auditors, or uncontrollable circumstances.

You will need your company number, the cause for the delay, and any supporting documentation when you apply. Applications can be submitted via the Companies House website, which is quicker than the postal method.

If accepted, you will often be given an extra month to submit your accounts. You still have to submit before the initial date if you are refused in order to avoid penalties.

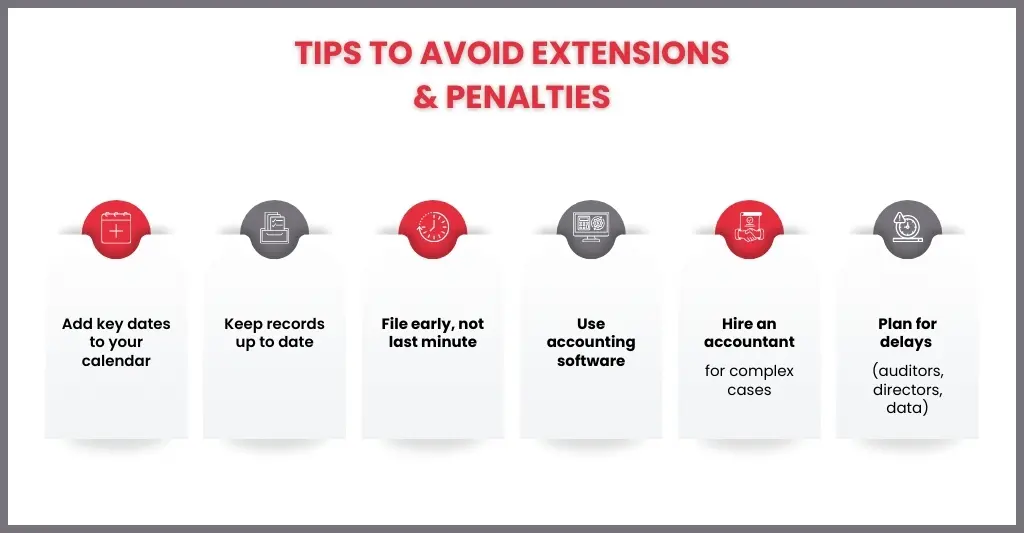

How to Avoid Needing an Extension For Filing a Tax Return?

Maintaining organisation and planning is the simplest method to prevent asking for an extension. Maintain current financial records all year long to make it easier to compile information when the time comes.

Give yourself plenty of time by setting reminders well in advance of the filing date. To lessen stress and identify any mistakes that need to be fixed fast, many firms decide to file early.

Consider employing an accountant if your accounts are complicated, so that everything is finished on time and accurately. It is also possible to expedite the process and avoid last-minute delays by using trustworthy accounting software.

Tips to Avoid Late Filing Penalties

- Put important dates on your calendar: Put the filing deadline for your business there and add reminders.

- Keep records: Maintain correct financial records throughout the year to facilitate filing. Keep records up to date.

- File early: Before the deadline, submission allows you to correct any mistakes; don’t wait until the last minute.

- Utilise accounting software: Use accounting software to cut down on errors and automate calculations.

- Consult an accountant: Expert assistance guarantees speed and correctness.

- Plan for delays: Make a delay plan by accounting for possible problems with directors, auditors, or paperwork.

FAQs: Frequently Asked Questions

Can I appeal against a late filing penalty?

Yes, but for the filing penalty, you need to support your claim with data and a convincing case. Common problems like being overly busy or forgetting the deadline are not acceptable.

How can I avoid penalties in the future?

Use reminders, file early, keep records up to date, and think about hiring an accountant or using accounting software.

How long can the extension be?

If granted, Companies House often extends the period by up to one month.

Conclusion

Filing your company accounts and tax returns on time is essential to avoid costly penalties, safeguard your business’s reputation, and maintain compliance with UK law. While extensions may be granted in exceptional circumstances, it is always best to plan ahead, keep accurate records throughout the year, and submit your filings early whenever possible. Doing so reduces stress, helps avoid last-minute errors, and ensures you stay on the right side of HMRC and Companies House regulations.

If you’re unsure about your filing deadlines or need assistance with extensions or appeals, don’t hesitate to seek professional advice. Staying informed and prepared is the key to smooth and hassle-free tax and accounts management.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.