- What is Traditional Accounting?

- Why Use Traditional Accounting?

- What is Cash Basis Accounting?

- Why Use Cash Basis Accounting?

- Key Difference Between Traditional Accounting vs Cash Basis Accounting

- Pros and Cons: Traditional Accounting vs Cash Basis Accounting

- UK-Specific Accounting Rules and Tax Considerations

- When Traditional Accounting is Required or Beneficial

- Which Method is more suitable for your Business?

- How To Transition Between Each Method?

- Frequently Asked Questions

- Conclusion

Choosing between traditional and cash basis accounting is an important option for any firm. Each strategy has distinct advantages and can affect everything from cash flow tracking to tax reporting. Understanding the distinctions will allow you to make an informed decision that corresponds with your business objectives.

In this blog, we will understand the difference between traditional accounting and cash basis accounting to know which is right for your business.

What is Traditional Accounting?

The accrual method of accounting, also known as traditional accounting or accrual basis, requires your accounts to include every single invoice you send and receive when calculating your tax return, regardless of whether the invoice has been paid or not.

It means you’ll pay tax on the money you expect to get from an invoice, even if the customer hasn’t paid it yet.

Why Use Traditional Accounting?

Traditional accounting offers a clear, systematic approach to tracking income, expenses, and financial success. It maintains regulatory compliance, facilitates proper tax reporting, and assists firms with budgeting and decision-making.

Examples of Traditional Accounting

On March 28, you submit an invoice for £2,000

The client will pay on April 15.

Record the £2,000 earned in March, when the service was given.

What is Cash Basis Accounting?

Cash accounting keeps track of transactions that take place when money changes hands. This means that income is recorded on the date you receive payment, but expenses are recorded on the date money leaves your company.

Why Use Cash Basis Accounting?

Cash basis accounting is straightforward to implement, particularly for small enterprises. It keeps track of income as it comes in and expenses as they go out, making it easier to monitor actual cash flow. It allows for real-time financial management while avoiding difficult accounting requirements, making tax preparation simple.

Examples of Cash Basis Accounting

You receive a supplier bill for £500 on March 20.

You pay it on April 10.

You record the £500 expense in April, when the cash is paid.

Key Difference Between Traditional Accounting vs Cash Basis Accounting

| Aspect | Traditional Accounting | Cash Basis Accounting |

| Timing of transactions | Record income earned and costs incurred. | Record only when cash is received or paid. |

| Complexity | More complicated and detailed. | Simpler and easier to handle. |

| Accuracy | Provides a more realistic picture of financial health. | May not reflect the true financial position |

| Used by | Larger businesses, limited companies, or those required to prepare statutory accounts under UK GAAP or FRS 102 | Small businesses, sole traders, and partnerships with turnover under £300,000 (under HMRC rules |

| Income | Recorded when a service is performed. | Payments are recorded when they are received. |

| Expense | Recorded when expenses are incurred. | Recorded when the payment is paid. |

Pros and Cons: Traditional Accounting vs Cash Basis Accounting

Traditional Accounting

Income and costs are recorded when they are earned and incurred, regardless of when cash is exchanged

Pros:

Accurate Financial Picture: Income and costs are recorded when they are earned or incurred, rather than when money changes hands, which is important for long-term financial planning.

Better for Growth: It is ideal for larger companies or those seeking external funding because it displays outstanding bills and liabilities.

Supports budgeting and forecasting: Allows for improved future planning by clearly displaying upcoming obligations and receivables.

Professional appearance: More credible to lenders, investors, and business partners since it demonstrates a company’s financial health beyond cash on hand.

Cons

More complex: Invoices, accounts payable/receivable, and accruals must all be tracked.

Higher accounting costs: Professional assistance is frequently required, which raises costs.

Tax Timing: You can pay taxes on income that you haven’t yet received.

Cash Basis Accounting

It is a straightforward technique of accounting in which income and costs are recorded only when money changes hands—that is, when cash is received or paid.

Pros

Simpler to use: Only enter income and expenses as they are received or paid.

Improves Cash Flow Management: You only pay taxes on money you receive.

Lower accounting costs: It is easier for solo traders and small firms to manage without an accountant.

HMRC-Friendly for Small Traders: Sole traders and partnerships with turnover up to £300,000 can use this method. Once turnover exceeds £300,000, businesses must switch to traditional accounting. (As per recent HMRC Rules)

Note: A lower £150,000 threshold applies if claiming Universal Credit.

Cons

Limited Use: Not appropriate for larger enterprises, those with inventory, or those requiring reliable long-term financial information.

No Accruals: Does not include money due to or by the business.

Not Accepted for Some Reports: Not appropriate for organisations that require full financial statements (e.g., lenders or investors).

UK-Specific Accounting Rules and Tax Considerations

When choosing between traditional (accrual) and cash basis accounting in the UK, it is important to understand the relevant HM Revenue & Customs (HMRC) rules and thresholds that apply to your business.

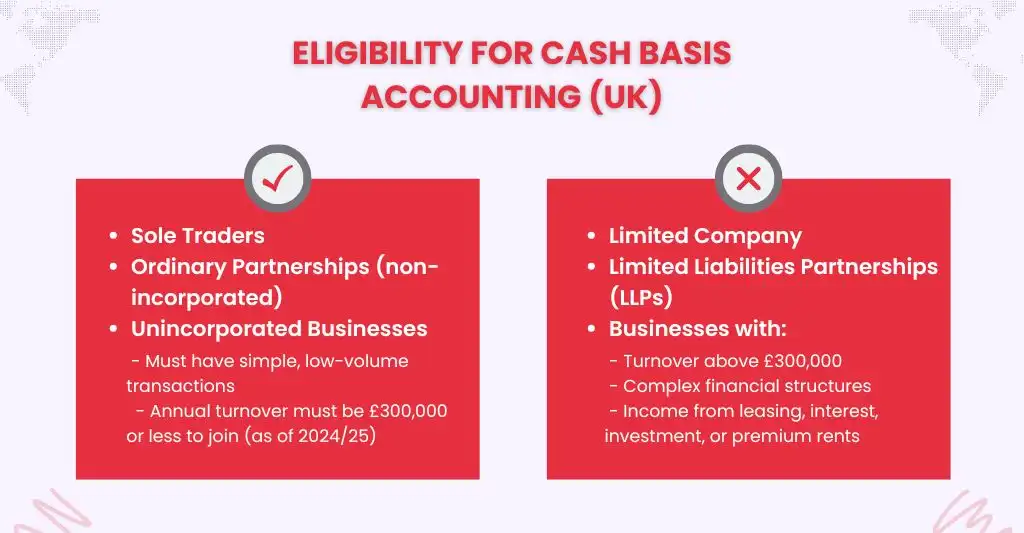

Eligibility for Cash Basis Accounting in the UK

HMRC allows small businesses to use the cash basis for income tax and National Insurance calculations, simplifying record-keeping by recognising income and expenses only when money is received or paid.

- Turnover Threshold: You can use cash basis if your business turnover is £300,000 or less.

- Exit Threshold: You must switch to traditional accounting if your turnover rises above £500,000.

- Universal Credit Claimants: A lower threshold of £150,000 applies.

Business Types:

Not eligible: Limited companies and LLPs (must use traditional accounting)

Eligible: Sole traders and partnerships

Tax Year and Reporting

- The UK tax year runs from 6 April to 5 April the following year. When using cash basis accounting, income and expenses are recorded based on when cash is actually received or paid within this period.

- Traditional accounting recognises income and expenses when they are earned or incurred, regardless of payment date, which can affect the timing of taxable profits.

Advantages of Cash Basis for UK Small Businesses

- Simplifies bookkeeping and reduces paperwork.

- Helps manage actual cash flow more effectively.

- Suitable for businesses that primarily deal in cash or immediate payments.

When Traditional Accounting is Required or Beneficial

- Businesses with a turnover above £300,000.

- Companies that need to prepare accounts compliant with UK accounting standards, such as FRS 102.

- Businesses seeking external funding or loans where formal financial statements are required.

- Organisations that extend credit to customers or have complex transactions.

Which Method is more suitable for your Business?

It is dependent on the size, structure, and financial needs of your organisation.

Select Cash Basis Accounting if…

- You own a small business or are self-employed.

- You have few to no employees.

- You deal largely with cash or immediate payments.

- You want a basic, manageable system.

- You do not require extensive financial reports for investors or banks.

Select Traditional Accounting if….

- Your business is growing or established.

- You provide credit to customers or conduct sophisticated transactions.

- You need to precisely track revenue and expenses for planning.

- You’re looking for loans or investors who want formal financial statements.

How To Transition Between Each Method?

Cash to Traditional

- Unpaid invoices and bills should be recorded as accounts receivable and payable, respectively.

- Adjust income and expenses to reflect when they were earned or incurred.

- Update the inventory and financial statements.

Traditional to Cash

- Remove all unpaid invoices and debts.

- Record revenue and spending only when cash is received or paid.

- Simplify reports and reclassify inventory.

Frequently Asked Questions

Does cash basis accounting provide a complete financial picture?

Not always, it may not indicate owed funds or unpaid earnings.

Can I apply both methods at once?

In general, you must select one for consistency, particularly when reporting taxes.

What are the tax implications of switching methods?

Switching can impact when income and expenses are reported. Always consult with a tax professional.

Conclusion

The size, complexity, and financial goals of your firm will determine whether you use Traditional (Accrual) Accounting or Cash Basis Accounting. While the cash basis is simple and appropriate for small businesses with easy transactions, traditional accounting provides a more accurate and comprehensive view, which is critical for developing businesses and regulatory compliance.

Understanding the advantages and disadvantages of each method, as well as how to transition between them, can help guarantee that your accounting system supports solid financial management and informed decision-making. Always consult a tax specialist to choose the best strategy for your needs.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.