A financial advisor is a specialist with expertise in managing and growing money legally. A financial advisor’s responsibilities include creating and managing a portfolio and keeping an eye on it all the time. Additionally, financial advisor in Aylesbury design a suitable portfolio that meets the needs and objectives of their clients by using their understanding of the market.

They offer knowledgeable advice on risk management, investments, tax preparation, wealth preservation, and financial planning. Whether you want to maximise your financial choices, save for retirement, or expand your business, a financial advisor in Aylesbury can develop specialised plans that meet your objectives. They assist clients in making well-informed decisions to safeguard their financial future and optimise profitability by drawing on their extensive understanding of financial markets, tax laws, and economic trends. You can achieve long-term financial success and stability by gaining insightful knowledge from engaging with a financial advisor.

Is a Financial Advisor Worth it for Your Business?

Hiring a financial advisor may prove to be a wise investment based on your company’s size, financial complexity, and individual financial management skills. If your company is expanding quickly, a financial advisor can assist with cash flow management, smart profit reinvestment, and sustainable scalability. Likewise, if you are not well-versed in finance, an advisor can help you with forecasting, tax planning, and budgeting. Since they assist in ensuring effective financial planning, they are especially helpful when making important financial decisions like expansion, acquisitions, or looking for investors.

Businesses dealing with complicated tax and compliance concerns can also profit from an advisor’s knowledge of reducing liabilities and maintaining regulatory compliance. An advisor can also help with retirement plans and exit strategy structuring for long-term planning.

But you might not always need a financial advisor. Accounting software and a tax expert may be helpful if your company’s financial structure is straightforward. Similarly, if you are comfortable with budgeting and financial planning, it might not be worth much to hire an advisor. Budgetary restrictions may also play a role because financial advisors demand fees that some small firms may not be able to pay.

Reasons to Hire a Financial Advisor in Aylesbury

- Financial Planning & Strategy: A financial advisor Aylesbury assists you in managing cash flow, setting specific financial objectives, and developing a plan for long-term, steady growth. They offer professional advice on long-term investment plans, profitability, and budgeting.

- Risks Management: Financial risks are unavoidable for any type of business, whether they come from unforeseen costs, market swings, or downturns in the economy. But you can prepare yourself to face the financial risks with courage. Therefore, to reduce financial risks, you need to accumulate savings for difficult times with the assistance of a financial advisor.

- Tax Optimisation & Compliance: Taxes can be complicated, and your company may suffer large losses if you fail to take certain deductions or overpay. A financial counselor makes sure you minimise liabilities and maximise deductions while adhering to tax laws.

- Funding & expansion support: A financial advisor may guide you through financing choices, evaluate risks, and negotiate agreements that support your company’s objectives if you intend to grow, obtain investments, or take out loans.

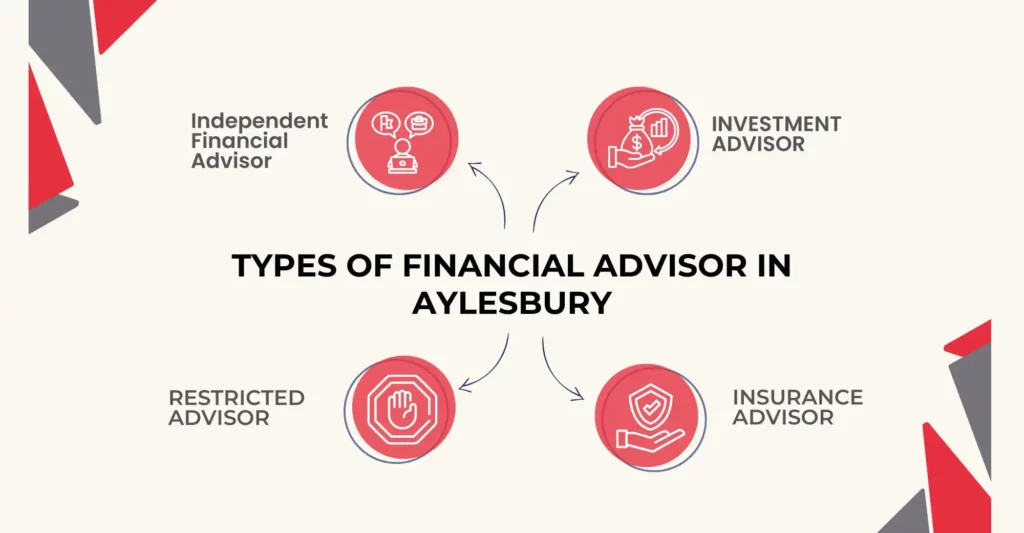

Types of Financial Advisors in Aylesbury

Financial Advisor Aylesbury can be broadly divided into two categories:

Independent Financial Advisor

These experts provide objective financial guidance, investigating the whole market to suggest the best goods for their customers. They represent you by offering tailored advice derived from a thorough analysis of your objectives and financial status.

Restricted Advisers

The selection of goods or service providers that these advisors can suggest is limited. They may represent the offerings of a certain company or concentrate on specialised items, like mortgages. To make sure their advice fits your financial needs, it’s critical to comprehend its extent.

Insurance Advisor

Insurance advisors are authorised agents who offer advice on insurance products. Life and property insurance are among the insurance products they specialise in offering. Alternatively, offer a variety of insurance packages. Every time an insurance product is sold, insurance advisor receives payment.

Investment Advisor

An individual with the ability to manage all of your money is an investment advisor. He is also capable of offering advice on investments in any kind of financial instrument. Portfolio management firms that are registered include investment advisors. The fees that investment advisors charge are also fixed. Alternatively, depending on the size of the portfolio, a yearly charge can be made.

Frequently Asked Questions

How do I choose the right financial advisor in Aylesbury?

A. Qualifications & Certifications: Seek out certified financial planners or chartered accountants.

Experience & Specialisation: Make sure they are knowledgeable in the fields that are relevant to your requirements.

Regulation: Make sure that the Financial Conduct Authority (FCA) regulates them.

Fee structure: Recognise whether they charge a commission-based fee, an hourly rate, or a flat price.

Can a financial advisor help with pensions and retirement planning?

A. Financial advisors do help with investment strategy, retirement income maximisation, and pension planning.

Do I need a financial advisor if I already have an accountant?

A. Financial advisors offer long-term financial planning and investment ideas, whereas accountants concentrate on bookkeeping, tax returns, and compliance. Although they have diverse functions, they complement one another.

Conclusion

In Aylesbury, financial advisors are a very useful resource for both individuals and companies. They assist you in attaining long-term financial success and stability by providing professional advice on money management, risk mitigation, and investment optimisation. If you need assistance with asset management, retirement savings, business expansion, or tax planning, a financial advisor can offer plans that are specifically designed to match your needs.

Although some business owners might try to handle their finances on their own, a financial advisor’s knowledge guarantees that you make wise choices that will protect your financial future and optimise profitability. Speaking with a knowledgeable financial advisor in Aylesbury can be a wise investment in your future whether you want to expand your company, enhance cash flow, or establish a solid financial plan.

Apart from financial advisor, if you are located in Alysebury and you need accountants in Alysebury, just reach out to CoxHinkins with your requirements. Our team will provide you with the best possible advice or assistance.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.