- What is DIY Bookkeeping?

- Why Most Businesses Try to Do DIY Bookkeeping?

- Limitations and Challenges of DIY Bookkeeping for Oxford Businesses

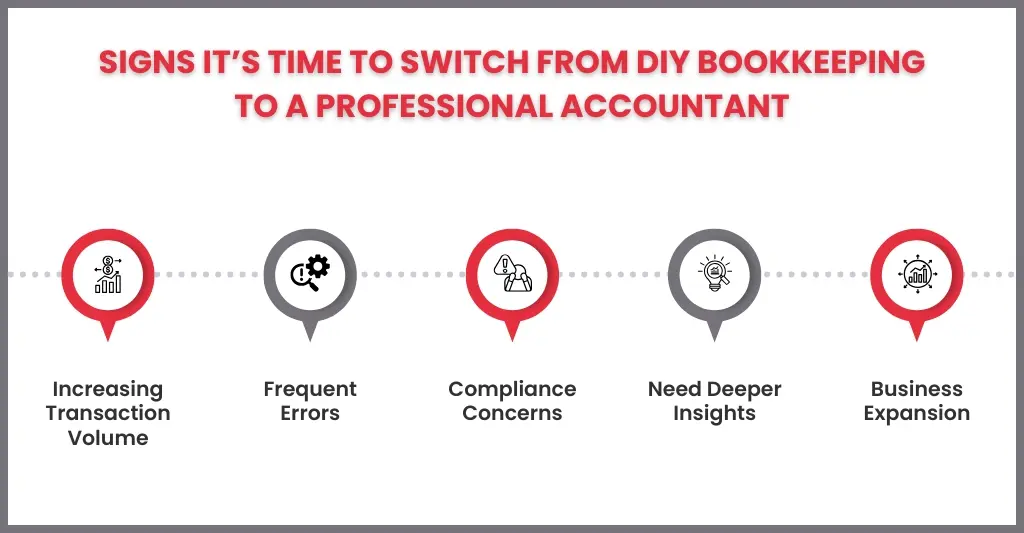

- How Can You Tell When It’s Time to Move from DIY Bookkeeping to Professional Accounting?

- DIY Bookkeeping or Professional Accounting Service: Which One is Right for You?

- What Are the Benefits of Hiring Professional Accountants in Oxford?

- How Can Oxford Businesses Make a Smooth Transition to Professional Accounting?

- FAQs: Frequently Asked Questions

- Conclusion

Oxford businesses should consider switching from DIY bookkeeping to professional accounting when their transaction volume increases, compliance requirements become more complex, or they need deeper financial insights to support growth. While managing your own books can save money and maintain control in the early stages, growing businesses often face challenges that make professional accounting essential for accuracy, compliance, and strategic planning.

Running a business involves juggling many responsibilities, and bookkeeping is one area that should not be overlooked. Whether you are a startup or an established company, deciding when to move from DIY bookkeeping to hiring an expert is crucial for your financial health and business success. This article explores the benefits and drawbacks of each approach and helps you determine the best choice for your Oxford-based business.

What is DIY Bookkeeping?

DIY Bookkeeping (Do-It-Yourself Bookkeeping) is the practice of managing and keeping financial records on your own, without the assistance of a professional bookkeeper. This includes keeping track of income, expenses, invoices, and receipts. Spreadsheets and accounting software are used to keep accurate records and manage funds.

Why Most Businesses Try to Do DIY Bookkeeping?

The majority of businesses attempt to perform their own bookkeeping because they want to, preserve control of their finances. They think it’s easy enough to accomplish without a professional.

Other reasons include:

- Saving money by avoiding bookkeeping fees.

- Having control over every financial detail.

- Low transaction volume in the early stages, makes it manageable.

- Accessibility of tools like Excel, QuickBooks, or Wave.

- Better financial awareness, as owners stay directly involved with their numbers.

Limitations and Challenges of DIY Bookkeeping for Oxford Businesses

DIY bookkeeping is a common starting point for Oxford businesses looking for ways to reduce expenses and keep direct control over company finances. However, this strategy frequently displays several drawbacks and difficulties as businesses expand:

Time-Consuming

Owners of businesses already balance several duties, including overseeing operations, providing customer service, and fostering expansion. Time that may be better spent on strategic tasks is lost when bookkeeping is added to the list.

Risk of Errors

Data input, classification, and reconciliation errors are frequent when one lacks the necessary accounting expertise. Decision-making and tax filings may be impacted by even minor errors that result in erroneous financial reporting.

Compliance and Tax Issues

The tax laws and standards for compliance in the UK might be complicated. Oxford businesses risk fines or legal consequences for missing deadlines, submitting inaccurate VAT reports, or underreporting expenses.

Limited Financial Insights

The primary focus of Do-It-Yourself bookkeeping is on transaction recording rather than analysis. Making wise financial decisions is more difficult for business owners who might not have better insights into cash flow, profitability, or expansion prospects.

Scalability Challenges

Transaction volume and complexity rise with a company’s growth. Once effective for a small business, do-it-yourself methods soon become stressful and ineffective, causing financial management obstacles.

Technology Gaps

Simple spreadsheets or free programs may be useful at first, but they sometimes lack the advanced functionality required for precise forecasting, banking system connection, or real-time reporting.

How Can You Tell When It’s Time to Move from DIY Bookkeeping to Professional Accounting?

DIY bookkeeping is effective while a business is just getting started, but there comes a time when doing it by yourself might cause harm. The following are clear indicators that it’s time to hire a professional accountant:

Growing Transaction Volume: Errors and delays are unavoidable when your company begins managing more invoices, payments, and expenses than you can comfortably monitor.

Frequent Errors or Confusion: If you frequently discover errors in your books, have trouble with reconciliations, or are unsure about your financial reports, you should seek professional assistance.

Compliance and Tax Concerns: Missing deadlines or filing taxes incorrectly might result in penalties as requirements get increasingly complicated. Accuracy and compliance are guaranteed by a qualified accountant.

Need for Deeper Insights: Experts not only manage data, but they also create reports, examine cash flow, and provide strategic counsel to help businesses make decisions.

Business Expansion: Accurate financial records and expert counsel are essential when expanding a business, adding employees, or seeking financing.

DIY Bookkeeping or Professional Accounting Service: Which One is Right for You?

| Aspect | DIY Bookkeeping | Professional Accounting |

| Best for | Startups, very small businesses | Growing businesses, complex finances |

| Cost | Low | Higher upfront cost |

| Control | Full control | Shared control with expert |

| Compliance & Accuracy | Risk of errors and missed deadlines | High accuracy and full compliance |

| Time Commitment | Time-consuming | Saves owner’s time |

| Financial Insight | Limited | Detailed, strategic advice |

The decision between hiring a professional accounting firm and doing your own bookkeeping depends on your company’s status, amount of financial complexity, and expansion objectives.

DIY Bookkeeping

Startups, independent contractors, and extremely tiny enterprises with few transactions can opt for DIY bookkeeping. It helps owners stay in regular contact with their finances and save money. However, when the firm expands, it may become hazardous and time-consuming.

Professional Accounting Services

Businesses that are managing staff or balancing complex tax and compliance obligations should seek professional accounting services. They also offer accuracy of your accounts, advice, tactics, and compliance assistance to promote the safe expansion of your company.

What Are the Benefits of Hiring Professional Accountants in Oxford?

Employing a qualified accountant can change how Oxford companies handle their money. Beyond merely maintaining accounting records, accountants contribute knowledge, precision, and strategic assistance that enable companies to expand with assurance.

Key Benefits:

Accuracy and Compliance

Professional accountants lower the possibility of expensive fines by ensuring that all documents, VAT returns, and tax filings comply with UK laws.

Time Savings

Business owners can concentrate more on their core competencies, clients, and expansion by outsourcing bookkeeping and accounting duties.

Strategic Business Advice

Accountants serve as counselors in addition to being statisticians, assisting with financial planning, forecasting, and budgeting for long-term growth.

Financial Insights

Accountants offer thorough reports and analysis that shed light on long-term financial health, profitability, and cash flow.

Strategic Business Advice

Beyond the numbers, accountants serve as counselors, assisting with financial planning for long-term growth, forecasting, and budgeting.

Support for Growth

Accountants make sure financial systems scale properly, whether enterprises are growing, employing employees, or asking for financing.

Peace of Mind

Be relaxed, sip a coffee! As your accounts are managed by an expert professional. You don’t need to stress over balancing the balance sheet or finding missing calculations.

How Can Oxford Businesses Make a Smooth Transition to Professional Accounting?

It can be difficult to switch from DIY bookkeeping to professional bookkeeping services, but Oxford firms can make the transition easy and profitable with careful preparation.

Steps for a Smooth Transition:

Assess Your Current Records: Make sure all of your current financial information is complete and in order before transferring it over, including bank statements, invoices, receipts, and spreadsheets.

Choose the Right Accountant: Find a nearby Oxford accountant or accounting business with experience in your sector that can offer both strategic and bookkeeping help.

Set Clear Expectations: To prevent misunderstandings, discuss with your accountant the extent of the task, the frequency of reports, and the channels of communication.

Integrate Accounting Software: Make use of compatible software (such as Xero or QuickBooks) to facilitate the smooth transfer and easy access of financial data.

Train Your Team: Make sure employees who work in bookkeeping are aware of new procedures, reporting guidelines, and how to cooperate with the accountant.

Monitor the Transition: To guarantee accuracy and trust in the new system, go over reports frequently, raise questions, and resolve inconsistencies as soon as possible.

Leverage Professional Insights: To optimise business growth, leverage your accountant’s knowledge of financial strategy, tax planning, and budgeting.

FAQs: Frequently Asked Questions

Is DIY bookkeeping suitable for small Oxford businesses?

Yes, DIY bookkeeping can reduce expenses for new businesses or extremely tiny enterprises with few transactions. However, it might become difficult as the company expands.

What are the risks of continuing DIY bookkeeping?

Risks include poor financial insights, missed tax deadlines, record problems, and trouble growing as the company expands.

Can I hire an accountant and still handle some bookkeeping?

Yes, a lot of firms manage their daily invoices or track their expenses, while accountants take care of financial analysis, tax filings, and reconciliation.

Conclusion

Many Oxford businesses find that DIY bookkeeping is a sensible place to start since it gives them early control and cost savings. But when financial responsibilities and transactions grow more complicated, the limitations of managing accounts alone soon become apparent. By switching to professional accounting, you can be confident of accuracy, compliance, and insightful information that promotes long-term growth.

Ultimately, hiring a professional accountant will help your Oxford business succeed in the long run by providing a strong financial foundation, freeing up your time, and ensuring that your records are kept up to date.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.