- What is a P60 Form?

- Why is the P60 Form Important for Employees?

- What Information Does a P60 Form Contain?

- What Are the Uses and Benefits of a P60 Form?

- How and When Do You Receive Your P60 Form?

- Employer Responsibilities: Issuing and Managing P60 Forms

- What to Do If You Don’t Receive Your P60 Form?

- Are P45 and P60 Forms the Same? Key Differences Explained

- What to Do If You Lose Your P60 Form?

- Common Errors on P60 Forms and How to Fix Them

- Frequently Asked Questions

- Conclusion

A P60 form is an essential document issued to employees in the UK who are paid through the PAYE (Pay As You Earn) system. It provides a summary of your total earnings and the tax, National Insurance, and other deductions made over a specific tax year (from April 6 to April 5).

Understanding the P60 form is important because it serves as official proof of your income and tax contributions, which you may need when submitting tax returns, applying for mortgages or loans, claiming tax refunds, or verifying your financial records.

In this guide, we will explain what a P60 form is, why it is important, how to obtain it, and how to avoid common errors to help you stay compliant with HMRC requirements and manage your finances effectively.

What is a P60 Form?

At the end of each tax year, your employer will give you a P60 form if you’re paid through the PAYE system. This document sums up everything you earned over the year, along with the tax, National Insurance, and any student loan repayments that were taken from your pay. It’s a good idea to keep your form somewhere safe, it’s an official record of your income and tax paid, and you might need it when filling out a tax return or applying for things like a mortgage or loan.

Why is the P60 Form Important for Employees?

- It assists the worker in completing their tax return, claiming tax credits, and claiming unpaid taxes.

- Employees can check whether their company is deducting the correct rates and confirm their national insurance number.

- It is useful when applying for a mortgage or bank loan because they want proof of income.

- To find out if you have received that amount, you can check the statutory benefits you have received and compare them with your bank statements. You can confirm this with your employer or HMRC if you have received less.

- If you live in the UK, you can verify the amount of your student loan that has been subtracted from your income.

- You can verify the amount that has been subtracted from PRSI (Pay Related Social Insurance), PAYE, and other social charges if you live in Ireland.

What Information Does a P60 Form Contain?

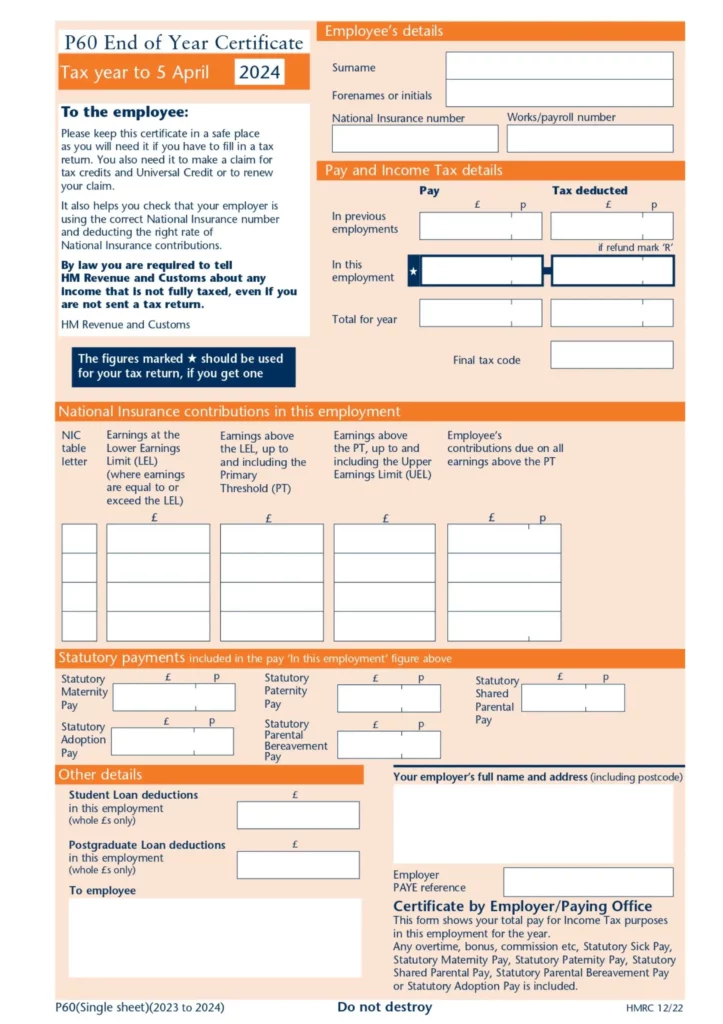

Numerous details on your work and tax contributions are included in the P60 form. The main information you should be seeing on your form is as follows:

- Personal information: To uniquely identify you, the form will include your name, payroll number, and National Insurance number.

- Income Tax and National Insurance Contributions: A breakdown of the income tax and national insurance contributions withheld from your wages during the tax year is given on the P60.

- Statutory payments: Details of any statutory sick pay or maternity pay you have received may also be included on your P60, depending on your specific situation.

- Student Loan deductions: The relevant deductions made during the tax year will be displayed on your form if you are repaying a student loan.

- Employer Details: It also shows your employer’s name, address, and PAYE reference number, which helps link your earnings to the correct employer in HMRC records

- Total Pay for the Year: The P60 shows your total gross earnings from that employer during the tax year, before any deductions were made.

- Tax Code Used: The final tax code used to calculate your income tax is listed, helping you check if you were taxed correctly.

What Are the Uses and Benefits of a P60 Form?

Uses of a P60 Form:

- Proof of Income for Loans and Mortgages: Before granting credit, loans, or mortgage applications, lenders frequently ask for a P60 to confirm your yearly income and tax status.

- Claiming Tax Refunds: If you have overpaid income tax, you can use your P60 as proof to get a refund from HMRC.

- Applying for State Benefits or Tax Credits: To determine your eligibility for benefits like Universal Credit, tax credits, or pension entitlements, government organisations might need your P60.

- Accurate Tax Records for Self-Assessment: When filing a self-assessment tax return, your P60 helps guarantee that all of your income and deductions are accurately reported.

- Employment History and Income Verification: Serves as an ongoing log of your earnings and deductions from work, which is helpful for audits or future job applications.

Benefits of a P60 Form:

- Comprehensive Year-End Summary: Explains in detail your whole income, income tax, National Insurance contributions, and any other deductions you made throughout the tax year.

- Ensures Financial Transparency: Enables you to verify that the right amount of tax has been withheld and paid to HMRC by your employer.

- Supports Personal Financial Planning: Helps you better manage your own budget, savings, or assets by helping you comprehend your net profits.

- Useful in Legal or Tax Disputes: Serves as official documentation in cases involving financial, employment, or tax problems.

- Recognised Official Document: Generally seen as legitimate evidence of income and tax compliance by banks, landlords, and government agencies.

How and When Do You Receive Your P60 Form?

After each tax year, which in the UK runs from April 6 to April 5, you receive your P60 form from your employer. According to the law, employers must give it by May 31 of the year after the tax year ends.

Here’s how it works:

- Issued by the company: Using your final payroll information for the tax year, your company creates the P60.

- Digital or Paper Format: It might be provided to you electronically or in print, depending on the payroll system used by your business.

- One per Employer: Each employer you worked for on April 5th will provide you with a P60 if you worked for more than one employer during the same tax year.

- Keep It Safe: Keep your form safe after you obtain it; it’s a crucial document for banking, loan, and tax considerations.

Employer Responsibilities: Issuing and Managing P60 Forms

In the UK, it is legally compulsory for employers to provide P60 forms to all employees after the tax year (5 April). A summary of an employee’s total compensation and income tax, and national insurance deductions for the full tax year, is given on the P60. For tax records, loan applications, and income verification, it is an essential document.

Key Employer Responsibilities:

- Issue timely: All eligible employees should receive a P60 by May 31st after the tax year ends.

- Accurate Reporting: Make sure that the details, such as total salary, taxes paid, and National Insurance contributions, match payroll records.

- Record Keeping: Copies of forms and related payroll documentation should be kept for a minimum of three years.

- Replacements: Be ready to provide copies in the case that an employee misplaces their P60.

- Compliance: If P60s are not issued on time, HMRC may impose penalties.

What to Do If You Don’t Receive Your P60 Form?

You should do the following if you are an employee and your present company has not provided your P60:

- Request a P60 from your employer before April 5th.

- If it hasn’t arrived yet, get in touch with HMRC and file a complaint.

- Speak with the tax office or social welfare branch in your area.

Are P45 and P60 Forms the Same? Key Differences Explained

| P45 | P60 |

| It is given to the employee by the employer when they are quitting their current position. | It is provided to the employee by the employer at the end of each financial year. |

| It excludes information about statutory payments provided to the employee, such as sick, maternity, and paternity benefits. | It provides information about the employee’s statutory earnings from sick, paternity, and maternity pay. |

| Solely includes tax-related data for that specific job. Additional data comprises PRSI, USC, and PAYE. | Includes tax data for the job and any other jobs the employee worked on during that year. Information about the employee’s PRSI or PAYE is not included. |

| There are several copies available, one of which the new hire should receive. | The employee receives a single copy. |

What to Do If You Lose Your P60 Form?

You should write to your present employer if you have lost your form. Usually, the employer will have a copy. If not, they can request it from HMRC or download it from their payroll software. Since a new P60 is easily accessible and available for download at any moment, there is no additional cost. You can download it yourself if you are a limited business director.

Common Errors on P60 Forms and How to Fix Them

An employee’s pay and deductions for the tax year are summarised in P60 forms, which are crucial tax documents. Confusion, tax problems, or penalties for noncompliance might result from even small mistakes. Maintaining accurate records and fulfilling HMRC regulations requires an understanding of typical errors and how to fix them.

1. Incorrect Personal Details:

- Problem: Inaccurate employee reference, misspelled name, or incorrect N.I. number.

- Fix: Issue a corrected P60 and update the payroll system with the updated data. Keep a copy of the updated form for your records and let the employee know.

2. Wrong Pay or Tax Figures:

- Problem: Inaccurately reported total income, taxes, or NI contributions.

- Fix: Use your payroll records to recalculate. Use your payroll software to submit a corrected year-end submission or an FPS (Full Payment Submission) if the statistics were sent to HMRC in error.

3. Omitted Benefits or Deductions:

Problem: The year summary may be distorted if taxable benefits or salary deductions are not included.

Fix: Confirm that all deductions and benefit-in-kind values have been recorded. If required, update and reissue the P60.

4. Issuing P60s to Ineligible Employees:

- Problem: Only workers who were still employed on April 5th should receive P60s.

- Fix: If a form was issued incorrectly, make sure a P45 was properly provided in its place when the employee departed, and invalidate the form.

5. Late Issuance:

- Problem: Not issuing P60s by the May 31 deadline.

- Fix: Make sure procedures are in place to avoid future delays and provide the past-due P60 right away. Penalties from HMRC may be imposed for repeated delays.

Frequently Asked Questions

Why is the P60 important?

Your P60 might be required to:

Provide proof of income when applying for a loan or mortgage.

Make a tax refund claim.

Verify that your taxes were computed accurately.

Apply for student loans or tax benefits.

Is it possible to obtain a digital copy of my P60?

Yes, if your company employs electronic payroll systems, you may be able to access your P60 securely via email or online through your employee portal.

Do I need to keep my P60?

Indeed. Since your P60 might be used for the following, it is advised that you maintain it for at least four years:

Verifying prior income

Refund or tax credit claims

Answering inquiries from HMRC

Financial applications or visas

Do self-employed people receive P60s?

No, only employees who use the Pay As You Earn (PAYE) system are eligible for P60s. Self-assessment tax returns are required as proof of income for self-employed people.

Conclusion

Employers and employees alike must comprehend the significance and purpose of the form. It is essential for financial planning, compliance, and eligibility for a number of services and benefits in addition to being an official summary of earnings and tax contributions.

In order to help their employees and comply with HMRC regulations, employers must make sure P60s are accurate, timely, and maintained correctly. Workers should carefully go over their P60s, keep them secure, and ask questions if something seems off.

You can prevent typical errors, guarantee compliance, and maximise the usage of this important year-end financial document by remaining knowledgeable and proactive.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.