- What Are Year-End Accounts?

- Why Year-End Accounts Matter More Than You Think?

- Who Needs to Prepare Year-End Accounts?

- What Should Be Included in Year-End Accounts?

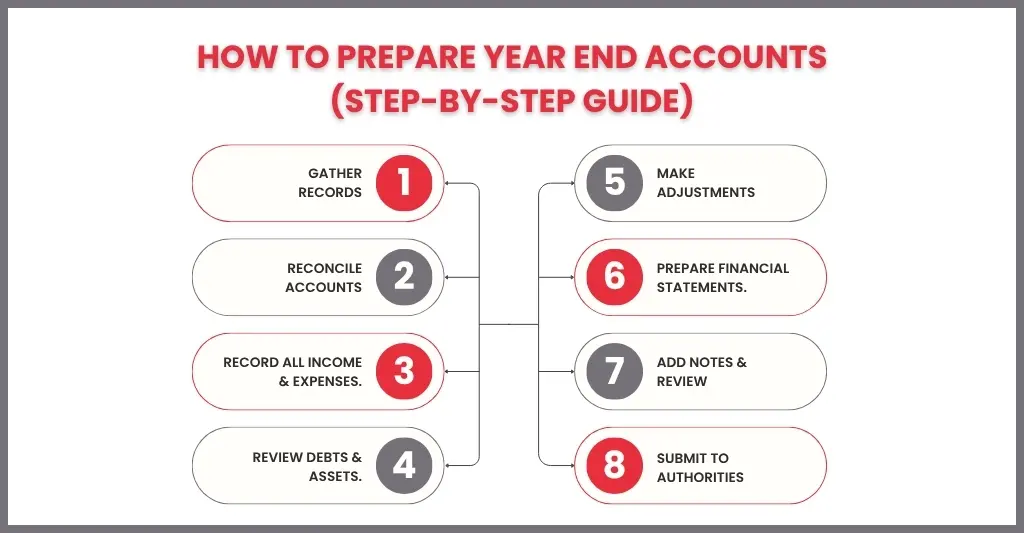

- How to Prepare Year-End Accounts (Step-by-Step Guide)

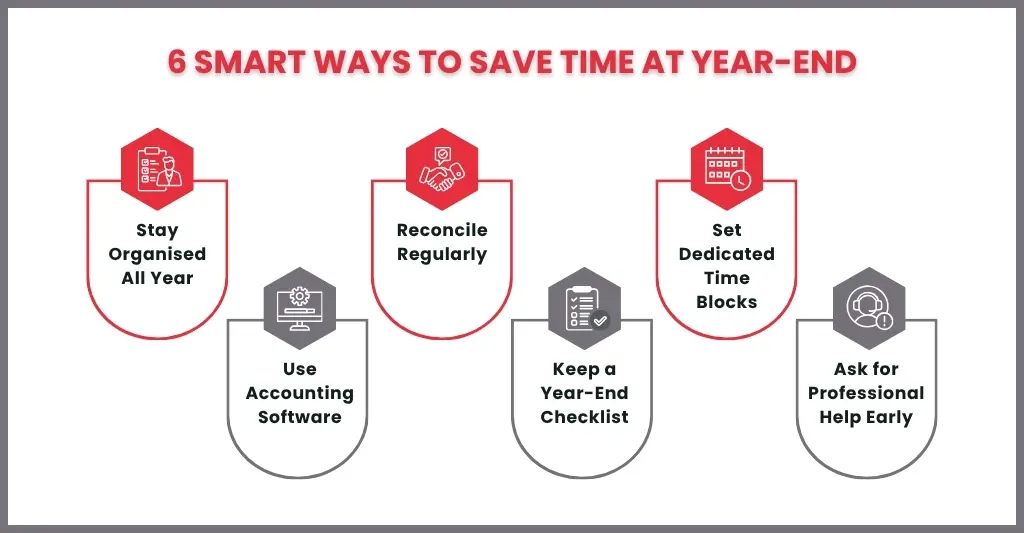

- Best Tips to Save Time and Reduce Stress at Year-End

- What Common Mistakes Should I Avoid When Preparing Year-End Accounts?

- How Can Professional Accountants Help You Wrap Up Your Year-End Accounts Fast and Right?

- FAQs: Frequently Asked Questions

- Conclusion

Year-end accounts are the financial statements a UK company must produce at the end of its financial year to comply with HMRC and Companies House. These accounts give a clear picture of the company’s financial health by summarising its income, expenses, assets, liabilities and overall performance. Preparing accurate year-end accounts means legal compliance and informed business decisions.

Many business owners find the year-end accounting process stressful and overwhelming due to tight deadlines and complex rules. But with proper planning and organisation, producing and submitting your year-end accounts can be a doddle. This article will walk you through what year-end accounts are, why they matter, who has to produce them and how to do it in the UK.

Understanding the key parts of year-end accounts like the profit and loss account, balance sheet and cash flow statement is crucial. Add to that filing deadlines and common pitfalls and you’ll avoid penalties and smooth financials all year round. In this article we will cover the key parts of year-end accounts, legal requirements, preparation steps, common mistakes and top tips to make the process easier for UK businesses.

What Are Year-End Accounts?

Financial statements, often known as year-end or yearly accounts, are records that a firm prepares at the conclusion of its fiscal year. Shareholders are given a glimpse of the company’s financial health through these accounts, which summarise its cash flows, financial performance, and position.

Why Year-End Accounts Matter More Than You Think?

Year-end accounts may seem like just another administrative task to satisfy the tax department. But in reality, they are much more than that. How well your firm performed, where your money was spent, and what opportunities or warning signs can be concealed in the statistics are all revealed by your year-end reports.

Accurate year-end account reports offer you valuable insights that assist you in making better decisions, planning more effectively, and identifying areas for growth in the upcoming year. Clean and precise records also make it much easier to file taxes, get funding, and attract investors.

To put it briefly, year-end accounts are more than just documents. They serve as a guide for your future.

Who Needs to Prepare Year-End Accounts?

All UK-registered limited firms, including micro and small businesses, are required to prepare year-end accounts. It is not legally necessary for partnerships or sole proprietors to file official year-end accounts. But for tax purposes, they still have to maintain correct records.

Filing Deadlines and Penalties for UK Companies

- Limited companies must file their year-end accounts with Companies House within 9 months of their financial year-end.

- Missing the filing deadline triggers automatic fines starting at £150, which can escalate rapidly with continued delay.

- Directors should meet related self-assessment tax return deadlines to avoid penalties.

- Staying aware of these timelines helps avoid fines and ensures full compliance.

What Should Be Included in Year-End Accounts?

It’s necessary to understand precisely what should be in your year-end accounts before you start closing the books. Consider it the financial report card of your company, containing all the information that demonstrates the performance of your business during the previous year.

Here’s what you’ll typically need to include:

- Profit and Loss Statement (Income Statement): Provides a clear picture of how well your firm performed for the year by displaying your total revenue, expenses, and overall profit (or loss).

- Balance Sheet: An overview of the financial status of your company at the end of the year, showing your equity (what’s left over), liabilities (what you owe), and assets (what you own).

- Cash Flow Statement: This keeps track of the money coming in and going out of your company, giving you insight into where it was made and spent.

- Supporting Documents: The details that support your figures include bank statements, invoices, receipts, payroll records, and loan documentation.

- Notes and Adjustments: Any additional information that clarifies particular transactions or modifications, such as depreciation or unpaid invoices.

How to Prepare Year-End Accounts (Step-by-Step Guide)

Before directly starting with year-end accounting, here are some steps to be followed.

Gather All Your Financial Records

Start with gathering all essential documents such as Bank statements, invoices, receipts, salary records, loan documents, and any other supporting documentation should be gathered first. Time is saved and mistakes are decreased when everything is kept in one place.

Reconcile Your Accounts

Verify that the bank statements and the bookkeeping records correspond. Find and fix any disparities, such as unrecorded payments or missing receipts.

Record All Income and Expenses

Verify that all of the year’s transactions are appropriately classified. This covers purchases, sales, running costs, and any one-time expenditures. A trustworthy profit and loss statement is aided by precise classification.

Review Debts and Assets

Keep track of any unpaid bills, loans, or other obligations in your records. Check your property, stock, and equipment, and note their current value, including any depreciation.

Make Year-End Adjustments

Accrued expenses, prepayments, and depreciation are examples of essential adjustments. These guarantee that your accounts accurately depict your company’s financial situation.

Prepare Financial Statements

Using all the information above, create your key statements:

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Statement

Add Notes and Explanations

Any notes that provide an explanation of odd transactions or accounting rules should be included. Investors, stakeholders, and the tax office can better understand your accounting if you have clear notes.

Review and Check for Accuracy

Verify all calculations, totals, and reconciliations one more time. Before submission, a second set of eyes, such as your accountant or a coworker, might help identify mistakes.

Submit Your Accounts

Once everything is accurate and complete, promptly submit your accounts to the appropriate authorities. Maintaining organisation today helps you prevent fines and stress later.

Best Tips to Save Time and Reduce Stress at Year-End

There’s no need for year-end accounting to be a sleepless, panic-filled course. You can make the procedure much less stressful and much faster by using a few clever techniques. These are some excellent pointers:

- Stay Organised Throughout the Year: Avoid waiting till the last minute to sort receipts and invoices. Make a habit of keeping your records organised every time.

- Use Accounting Software: Use modern accounting software that can calculate, track spending, and generate reports. It will save hours of labor-intensive manual labor.

- Reconcile Regularly: Time-to-time reconciling will save you from last-minute panic situations. Be prepared in advance, and have a relaxing time.

- Keep a Checklist: Make a year-end accounting checklist to keep track of completed and unfinished tasks. It helps you stay on track and protect things from falling between the cracks.

- Set Aside Dedicated Time: Dedicate a good amount of time to year-end duties. Avoid distractions and treat it like a serious meeting.

- Don’t Hesitate to Ask for Help: Bookkeepers or accountants can help prevent errors and accelerate the process. The investment is worthwhile due to their experience.

- Review Early, Submit Early: Give yourself enough time to finish your accounts. Reviewing early eases tension and allows you to deal with unforeseen problems before due dates.

What Common Mistakes Should I Avoid When Preparing Year-End Accounts?

When it comes to closing the books, even experienced accountants and business owners make mistakes. You can save a great deal of frustration, money, and time by avoiding these typical pitfalls:

Missing or Incomplete Records: Inaccuracies and possible tax problems may result from not preserving all bank statements, invoices, and receipts. Ensure that all transactions are recorded.

Misclassifying Income or Expenses: Incorrectly classifying transactions may cause your profit and loss statement to be distorted. Verify each item’s recording one more time.

Forgetting Year-End Adjustments: A false impression of your financial situation may result from failing to account for accruals, prepayments, or depreciation.

Ignoring Reconciliations: If bank and account reconciliations are skipped, mistakes can happen, and inconsistencies may become more difficult to resolve later.

Waiting Until the Last Minute: Rushing at the last minute raises the risk of errors and needless stress. Work in phases and get started early.

Overlooking Tax Implications: Penalties or lost savings opportunities may arise from failing to take into account tax laws, allowances, or deadlines.

Not Getting a Second Opinion: Little mistakes can have a major impact. You may miss errors if you have an accountant or coworker look over your accounts.

How Can Professional Accountants Help You Wrap Up Your Year-End Accounts Fast and Right?

Professional accountants may greatly streamline the process, but managing year-end finances alone can be unpleasant, time-consuming, and subject to errors. Here’s how they assist:

Expertise and Accuracy: Accountants are well-versed in the laws, standards, and best practices governing their field. Their background guarantees the accuracy, compliance, and completeness of your accounting.

Time-Saving Support: To give you up to concentrate on managing your firm, they can take care of the heavy lifting, including account reconciliation, financial statement preparation, and adjustment making.

Strategic Advice: Accountants can help your business thrive by providing insights into financial strategy, cash flow management, and tax planning, in addition to performing mathematical calculations.

Reduced Stress and Peace of Mind: The stress of last-minute mistakes or missing deadlines is relieved when you know that a professional is handling your accounts.

Audit-Ready Records: A professional’s prepared accounts will make the audit process easier if your company is ever subjected to one.

FAQs: Frequently Asked Questions

How frequently should year-end accounts be prepared?

Year-end accounts are usually prepared at the conclusion of your company’s fiscal year. However, the procedure is greatly facilitated by maintaining consistent records throughout the year.

How can I reduce stress when preparing year-end accounts?

Throughout the year, maintain organisation, use accounting software, follow a checklist, reconcile accounts frequently, and think about seeking expert accounting assistance.

When should I submit my year-end accounts?

Deadlines change based on your company’s structure and location. Punishments are avoided, and tax authorities are complied with when timely submissions are made.

What happens if I find mistakes after submitting my accounts?

In most cases, you can submit corrected accounts if you discover errors. Make the necessary corrections right away to avoid penalties by getting in touch with your accountant or the appropriate authority.

Conclusion

Completing your year-end accounting doesn’t have to be a hectic rush. You can finish your accounts effectively and quickly with the correct planning, well-organised data, and a clear, step-by-step process, which will provide you with an accurate picture of the financial health of your company.

By avoiding typical mistakes, using accounting software, and getting expert assistance when required, you can save time, lessen stress, and even find areas for improvement in the upcoming year. Consider year-end accounts a useful checkpoint that positions your company for a better, more intelligent start to the new year rather than an inconvenience.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.