- What Are Quarterly Instalment Payments (QIPs)?

- How Do Quarterly Payments Work for Corporation Tax?

- How Do You Calculate Quarterly Instalment Payments for Corporation Tax?

- Who Is Required to Make Quarterly Instalment Payments?

- What are the benefits of making quarterly installment payments?

- Special Circumstances and Exceptions

- Tips for Managing Quarterly Instalment Payments

- FAQs: Frequently Asked Questions

- Getting Help with Your Quarterly Installment Payments

Corporation tax is no longer something that huge enterprises consider only once a year. For many UK firms, Quarterly Instalment Payments (QIPs) have imposed a structured approach to revolutionised how tax is planned, managed, and funded throughout the year. Instead of paying a single payment at the end of the year, eligible businesses must now pay their Corporation Tax in four installments, frequently before profit is fully gained.

QIPs can provide unexpected cash flow pressure in firms with growth, fluctuating profits, or complex group structures if they are not well planned. HMRC may assess interest for missed or underpaid payments, even if the entire tax liability is paid in full. This blog defines Quarterly Instalment Payments, which organisations must adhere to the QIP regime, how payments are computed, and how to successfully handle QIPs without impacting cash flow.

What Are Quarterly Instalment Payments (QIPs)?

Quarterly Instalment Payments (QIPs) are a UK Corporation Tax system under Corporation Tax Self-Assessment (CTSA) that requires eligible companies to pay their estimated tax in four instalments rather than one lump sum at the end of the year. Payments are made during the accounting period based on anticipated profits, and interest may be charged if installments are underpaid or late.

How Do Quarterly Payments Work for Corporation Tax?

- Eligibility: Quarterly Instalment Payments (QIPs) apply to “large” UK businesses with taxable profits that exceed HMRC standards, £1.5 million or more including certain group corporations (divided by number of active associated companies). “Very large” companies (£20m+) have accelerated schedules.

- Estimated Profits: Businesses must estimate their annual taxable profits at the start of each accounting period.

Instalment Schedule (for large companies, 12-month period):

- First: 6 months and 13 days after period start

- Second: 3 months after first instalment

- Third: 3 months after second instalment (14 days after period end)

- Fourth: 3 months and 14 days after period end

- Split Payments: The total projected Corporation Tax liability is split into four installments

- Payment Timing: During the accounting period, installments are paid at regular intervals, with the first payment often due before the end of the year.

- Adjustments Allowed: If profits rise or fall over the year, instalment amounts can be adjusted to reflect fresh projections.

- Interest Charges: HMRC charges debit interest on late or underpaid instalments, even if the entire Corporation Tax is paid later on (rates 7.75-8.25% as of Jan 2026)

- Cash Flow Planning: Accurate forecasting and regular financial evaluations are critical for avoiding cash flow problems and interest charges.

How Do You Calculate Quarterly Instalment Payments for Corporation Tax?

- Estimate annual taxable profits: To calculate QIPs, begin with forecasting your company’s taxable income for the accounting period.

- Apply the Corporation Tax rate: Calculate your projected Corporation Tax liability using the current UK Corporation Tax rate. (19% on profits £0-£50k; marginal 26.5% £50k-£250k; 25% over £250k for FY2026).

- Check QIP thresholds: Confirm that your company falls under the Quarterly Instalment Payments scheme based on profit levels or group membership.

- Divide the tax into installments: Divide the expected total corporate tax liability into four instalments per schedule above (early ones equal based on estimate) quarterly instalments.

- Adjust as needed: Review profit predictions on a regular basis and adjust installments as profits rise or fall during the year.

- Reconcile after year-end: Once the final accounting is completed, pay any shortfalls or request a refund/offset if too much tax was paid.

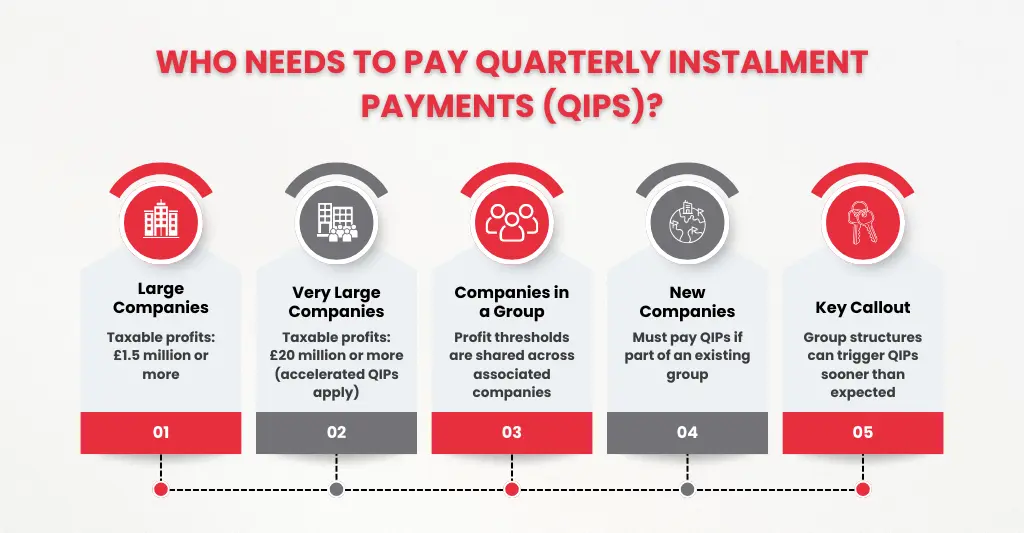

Who Is Required to Make Quarterly Instalment Payments?

“Large” Quarterly Instalment Payments (QIPs) are mandatory for available to large and expanding UK businesses that surpass HMRC’s profit criteria for Corporation Tax. In general, enterprises must adhere to the QIP regime if their taxable profits exceed £1.5 £1.5 million in a 12-month accounting period.

For business groups, this level is split by the number of linked active associated firms, which means that even smaller individual organisations may be subject to QIPs if they are part of a larger group structure. Newly created firms are normally exempt from QIPs for their first period (if profits <£10m and not part of existing group) accounting period, as long as they are not part of an existing group.

If a corporation meets these criteria, it must pay Corporation Tax in quarterly installments rather than a single payment at the end of the year.

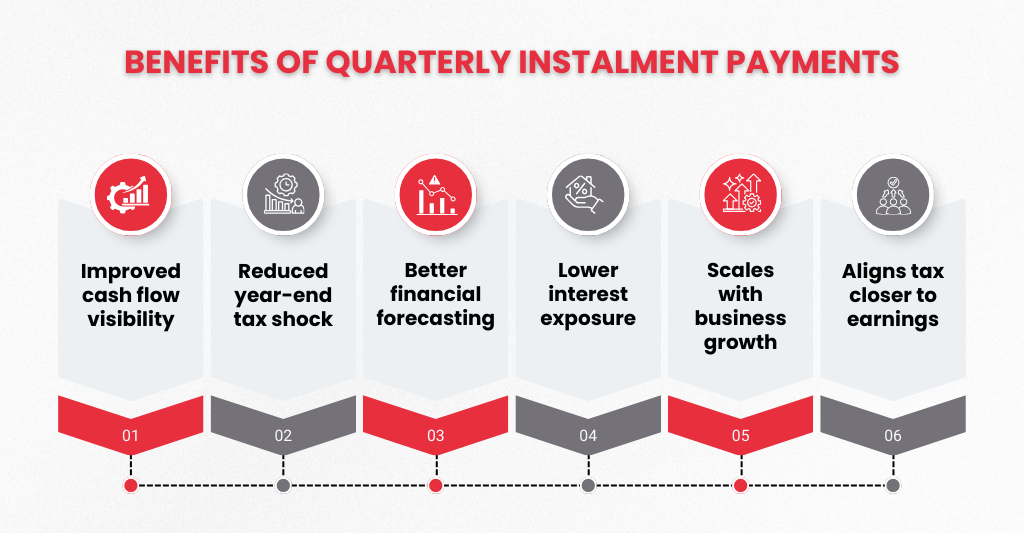

What are the benefits of making quarterly installment payments?

- Improved cash flow planning: Paying Corporation Tax in installments distributes the cost across the year, making huge tax bills more manageable.

- Avoids last-minute tax pressure: Regular payments lessen the possibility of receiving a large lump sum payment at the end of the year.

- Better financial visibility: Quarterly payments promote more accurate profit projections and regular financial reviews.

- Reduces interest exposure: Timely and precise installments help to reduce HMRC’s interest rates on unpaid taxes.

- Supports growing businesses: As profits rise, QIPs assist businesses in progressively adjusting to rising tax liabilities.

- Aligns tax with earnings: Paying taxes closer to the time revenues are made results in a more balanced and predictable tax process.

However, QIPs require earlier payments than small companies pay (9 months +1 day post-period), which might not always be a benefit for cash flow.

Special Circumstances and Exceptions

While many large and expanding organisations use Quarterly Instalment Payments (QIPs), there are several cases when the requirements differ or exemptions apply.

- First-year companies: Unless they are part of an existing corporate group, newly created companies usually don’t have to make QIPs in their first accounting quarter.

- Associated companies: For groups, the £1.5 million profit barrier is shared by affiliated enterprises, potentially bringing smaller entities into the QIP system sooner than expected (post-2023 rules exclude dormant/inactive).

- Short accounting periods: If a company’s accounting period is less than 12 months, the QIP requirements are proportionally reduced (instalments adjusted).

- Fluctuating profits: Companies with fluctuating revenues can vary payment amounts throughout the year if estimates change.

- Overpayments and underpayments: Overpayments can be refunded or canceled, (or carried forward), while underpayments may result in HMRC interest.

- Very Large Companies (£20m+ profits): Accelerated schedule starts earlier (first payment ~2 months 13 days); consider Group Payment Arrangements (GPA) for relief

Tips for Managing Quarterly Instalment Payments

- Forecast profits accurately: Calculate installments using realistic and periodically updated earnings predictions to avoid under or overpayments.

- Review figures quarterly: Reassess your predicted profits before each installment to ensure that payments reflect your most recent financial status.

- Plan cash flow in advance: Set aside funds throughout the year to guarantee that payments are paid on time without compromising operating capital.

- Adjust instalments when needed: If profits increase or decrease, make adjustments to future payments rather than waiting until the end of the year.

- Monitor interest exposure: Keep track of payment dates to avoid HMRC interest costs for late or insufficient installments.

- Get professional support: Working with a tax professional or accountant can help ensure that QIPs are computed appropriately and maintained efficiently.

FAQs: Frequently Asked Questions

What are Quarterly Instalment Payments (QIPs) and how do they relate to quarterly tax payments for businesses?

Quarterly Instalment Payments (QIPs) are a UK Corporation Tax scheme that requires qualified corporations to pay their estimated tax burden in four installments over the accounting period rather than in one large sum at year-end. They primarily apply to larger or rapidly developing enterprises and assist match tax payments with when profits are produced, while also requiring accurate profit forecasts to be HMRC compliant.

Who is required to make quarterly payments for taxes?

Corporation Tax installment levels (large: £1.5m; very large: £20m). This often applies to large or rapidly growing companies, particularly those within corporate groupings where the profit threshold is shared by affiliated enterprises. Unless they are a member of an existing group, newly created companies are typically excluded in their first accounting period

What Happens If You Get It Wrong?

If Quarterly Instalment Payments are late or underpaid, HMRC may assess interest on the difference [rates 7.75-8.25%], even if the full Corporation Tax obligation is subsequently paid on time. While this interest is not a penalty, it can raise the total tax bill. Interest accrues daily from due date; use HMRC overpayment interest relief if applicable.

Can Small Businesses Avoid Quarterly Instalment Payments?

Yes. Most small firms are not required to make Quarterly Instalment Payments because their taxable profits are less than HMRC’s standards. They normally pay Corporation Tax in a single amount after year-end, but expanding businesses should keep track of profits in case QIPs apply in the future.

How Can I Manage Quarterly Installment Payments Effectively?

Quarterly Instalment Payments can be properly managed by forecasting profits accurately, examining data before each installment, and adjusting payments as profits change. Planning cash flow ahead of time and seeking professional tax guidance can also help to prevent HMRC interest costs.

What if my company is very large (£20m+ profits)?

Very large companies follow an accelerated QIPs schedule with earlier first payment. Thresholds divided by active associated companies; consult HMRC for GPA.

Getting Help with Your Quarterly Installment Payments

Managing quarterly installments Payments can be difficult, especially if revenues rise and predictions fluctuate during the year. Incorrect calculations can cause cash flow problems or unwarranted HMRC interest costs. With the correct help, QIPs may be managed smoothly and confidently.

Working with skilled tax professionals guarantees that your profit estimates are correct, payments are adjusted on schedule, and your Corporation Tax responsibilities are fully compliant. This allows you to focus on running and expanding your business while knowing your quarterly payments are under control and in line with your overall tax strategy.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.