- What is a Payroll Number?

- What is the importance of a Payroll Number?

- How to find the Payroll Number in the slip?

- How to find the Payroll Number without the slip?

- Is the PAYE Reference the same as the Payroll Number?

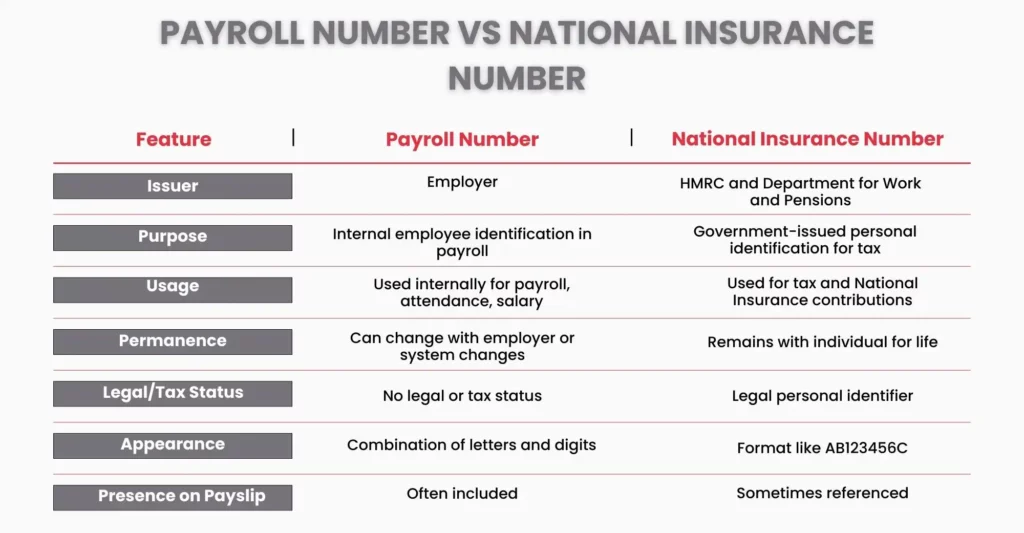

- Payroll Number vs National Insurance Number

- Common Payroll Number Issues

- Frequently Asked Questions

- Conclusion

Payroll numbers are crucial, whether you’re a company looking to streamline the procedure or an employee trying to look for a pay slip. Companies utilise payroll numbers, which are unique identifiers provided to each employee, to effectively manage payroll, benefits, tax records, and employment histories. It may seem like just another number, but it’s essential for maintaining organisational records and processing payments accurately. While also helping reduce risks linked to data breaches.

This comprehensive guide will explain what a payroll number is, where to find it in various papers and systems, and how to handle problems if your number is inaccurate or absent. You will be learning the essential information about payroll numbers with ease, regardless of whether you manage a company or a workforce.

What is a Payroll Number?

A payroll number is a unique combination of letters and digits assigned by an employer to identify each employee for payroll purposes.

To identify each employee from a payroll point of view, an employer can assign a payroll number, which is a distinct combination of letters and digits. Some employers also refer to this as an employee number or internal ID.

By eliminating the need to maintain vast amounts of employee detail across numerous systems, employee number assist firms in managing payroll and provide an extra degree of security, guaranteeing that employees are being paid accurately and protecting their personal information against potential data breaches.

Payroll numbers aren’t legally required, but many businesses, whether big or small, use them to reduce the possibility of mistakes during payroll processing to make it simpler and to identify salaried staff.

What is the importance of a Payroll Number?

A payroll number performs several vital tasks that contribute to precise and seamless payroll processing, making it more than just an internal tracking tool. Here’s why it matters:

- Unique Identification: To avoid confusion between employees with similar names, each employee is given a unique payroll or employee number. This guarantees that the right individual receives payments, benefits, and records.

- Efficient Processing: It is the number that gives payroll software and systems a consistent point of reference, which streamlines and expedites the processing of salaries, bonuses, deductions, and pay period entries.

- Accurate Recordkeeping: Payroll numbers facilitate the management of employee details, tax paperwork, leave balances, and historical wage data by keeping employee records structured.

- Compliance and Auditing: It is a number that facilitates the systematic verification of personnel records, pay tax records, and transaction tracing in the event of an audit or compliance assessment.

- Internal Communication: When explaining employment data or answering questions, HR and payroll departments frequently use payroll numbers to maintain uniformity and clarity.

- System integration: Number is also used by many firms to link different systems, such as accounting software, time-tracking, and benefits platforms, guaranteeing that data moves reliably between departments.

How to find the Payroll Number in the slip?

For employers

It’s a good idea to look up the employee numbers in the employee records or settings of your payroll program, as most software systems create and assign numbers automatically.

However, your payroll department or service provider should have payroll number records and be able to assist you if you don’t use the software.

Payroll figures are frequently stored in HR databases or employee files as a final option.

For employees

The payslip should always have your payroll number on it, but if you’re unsure, ask your human resources department.

Additionally, if your firm uses an online portal for HR and payroll services, you can usually find your number by logging in and looking at your profile or payroll information.

How to find the Payroll Number without the slip?

- Check Your Employment Contract or Welcome Kit: Payroll numbers are sometimes included in onboarding paperwork by companies.

- Employee Self-Service Portal: Check your profile or payment information under your profile if your organisation utilises HR software (such as Sage, Workday, ADP, or PeopleHR).

- P60 or P45 Forms: Your payroll number, particularly if it was provided by your employer, is frequently included in the year-end tax forms.

- Contact HR or the Payroll Department: Asking them is the simplest method. They can provide you with the number and confirm your identity.

Check Your Bank Statement: Employers sometimes include a payroll ID or reference in the payment description.

Is the PAYE Reference the same as the Payroll Number?

No. Your employer’s tax plan with HMRC is identified by your PAYE reference number, commonly known as the Employer PAYE Reference. It looks like 123/AB456 and is used to submit national insurance and pay taxes.

In contrast, your employer assigns a payroll number internally to identify workers. It is not legally required by HMRC and has no external tax or legal purpose.

Payroll Number vs National Insurance Number

Payroll Number

Employer gives you a unique identification number that is exclusive to your business. Internally, it’s utilised to monitor payroll, attendance, park, and salary. Employers who use payroll numbers mention it on payslips or in employee self-service portals. Outside of the company, it has no legal or tax status.

National Insurance Number

HMRC and the Department for Work and Pensions utilise this government-issued personal identification number. It guarantees that all of your tax records and National Insurance contributions are accurately filed under your name. It looks like this: AB123456C, and it remains with you forever, regardless of the employer.

Common Payroll Number Issues

- Duplicate Payroll Numbers: When two employees are accidentally given the same employee number, it causes difficulties in both employee records and payment processes.

- Missing Payroll Numbers: Sometimes numbers are completely absent from employee records or pay slips, which makes it difficult to track payments or answer questions.

- Inconsistent Payroll Numbers: Mismatches in records may arise from the numbers that vary between systems (for example, payroll software and HR).

- Confusion with Other Identifiers: Payroll numbers are frequently mistaken for National Insurance numbers or PAYE references by employees, which can result in inaccurate reporting or communication.

- Incorrect entry: Errors made when manually entering payroll figures may cause payment misallocation or delays in salaries.

- Reuse of Old Payroll Numbers: Data inconsistencies and compliance problems may arise when old employees’ payroll numbers are transferred to new ones.

Frequently Asked Questions

Is my payroll number confidential data?

To prevent misunderstandings or data errors, it should be handled as secret, even though it is not as sensitive as your NI number.

Can I Change My Payroll Number?

Yes, it can, particularly if your employer restructures departments, rehires you after a leave of absence, or changes payment systems.

Do all employers use payroll numbers?

Not all the time. The majority of businesses with payroll software assign a unique payroll number, while some smaller firms might use employee names or other identifiers instead.

Conclusion

A crucial component of your job and payroll records, your payroll number may not get as much attention as your salary or tax code. It guarantees that your deductions are applied correctly, your payments are processed appropriately, and your personal information is maintained and organised within the systems of your business. You can prevent confusion by understanding the distinction between your payroll number and other identifiers, such as your National Insurance number or PAYE reference, particularly when completing paperwork or interacting with HR.

If you can’t find your employee number, or if you see a mismatch or have changed responsibilities within your firm, it’s a good idea to check with your payroll or HR department. Keeping track of these minor but important facts promotes a seamless payroll process overall and preserves the integrity of your employment records.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.