- What Is a Confirmation Statement?

- Who Needs to File a Confirmation Statement?

- When Do You Need to File the Confirmation Statement?

- What Information is required in a Confirmation Statement?

- How to File a Confirmation Statement with Companies House?

- How Much Does It Cost to File a Confirmation Statement?

- What Happens If You Don’t File a Confirmation Statement?

- What Are Common Mistakes to Avoid When Filing?

- How Can an Accountant Help with the Confirmation Statement?

- FAQs: Frequently Asked Questions

- Conclusion

A Confirmation Statement is a legal requirement for all Limited companies and limited liability partnerships, registered in the UK. Yes, keeping your company details up-to-date in Companies House is legally required and crucial for transparency. Filing this document at the right time will keep you on the good books of HM Revenue & Customs and will avoid imposition of penalties on you-whether you are an expert or novice Director or Business Owner.

This guide explains what a Confirmation Statement is and why it matters, in plain language. It shows how to file step by step. Deadlines are covered here as well, and expenses and some useful tips that will help make this process simple and not at all painful.

By the end of this article, you will know what steps to take next- to meet your Companies House duties correctly and fully.

What Is a Confirmation Statement?

A Confirmation Statement is a document filed annually to confirm that the details Companies House holds about your company are up-to-date and correct. It is submitted via Form CS01 online or by post. This includes all the important details regarding the management, ownership, and operations of the business, regardless of whether it is inactive or not in business.

Even if your company isn’t trading, you are still legally required to file the Confirmation Statement. Failing to do so could lead to serious consequences, including penalties or the potential dissolution of your company. It’s crucial to stay compliant, even if the business is not currently operational.

Who Needs to File a Confirmation Statement?

Whether your business is bustling or barely chugging along, all limited companies and limited liability partnerships (LLPs) that are registered in the UK have to send in a Confirmation Statement to Companies House. It is also applicable to:

- Private Limited Companies (Ltd)

- Community Interest Companies (CICs)

Even if there are no changes to your company’s officers, shareholdings, or organisational structure, the requirement applies every 12 months, even if there have been no changes to your company’s information. The goal is to guarantee that Companies House always has accurate and current information about your company

Directors may face legal consequences, the company may be removed from the register, and late filing penalties may result from failing to file your Confirmation Statement on time.

When Do You Need to File the Confirmation Statement?

A Confirmation Statement has to be filed every 12 months. There’s a bit of a time frame you need to keep track of called your “confirmation period”. This is a 12-month block of time that kicks in either:

- The date your company was incorporated, or

- The date you last filed a Confirmation Statement.

Once this confirmation period ends, you have 14 days to submit your Confirmation Statement to Companies House. For example, if your first confirmation period ends on 31st December 2024, and your company was incorporated on 1st January 2024, your filing deadline would be 14th January 2025.

During this time, it’s also a good idea to check for any changes in your company, such as new shareholders or changes to your SIC code. If you’ve had any updates, you will need to file an amended Confirmation Statement.

What Information is required in a Confirmation Statement?

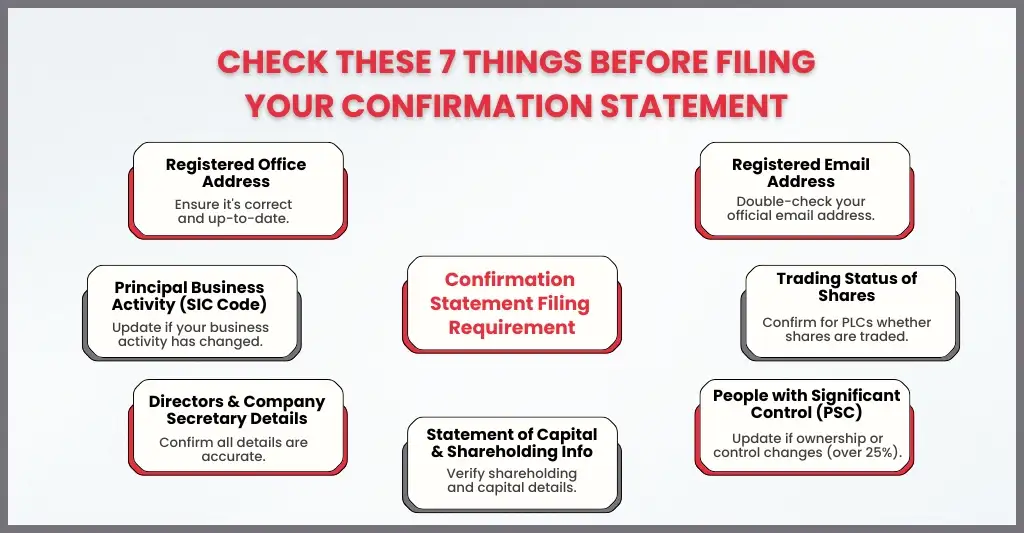

Companies House uses a Confirmation Statement to verify that the data it has about your company is true and current. If any information has changed, it should be modified either before or during the statement filing process. Generally speaking, the following details are needed:

Registered Office Address: Verify the accuracy of the legally registered address for your business, that’s where Companies House and HMRC will be sending any official post.

Principal Business Activity (SIC Code): The SIC code represents your company’s primary business activity. It’s important to ensure that your SIC code reflects your current operations, as this can change over time. If your business expands or shifts focus, you should review and update this code to ensure it remains accurate and relevant.

Details of Directors and Company Secretary: Just check that the details for the directors and any company secretary you have, are correct.

Statement of Capital and Shareholdings: Verify the total number of shares, their nominal value, and shareholder information for limited corporations with shares. And if you’ve made any changes to the ownership or share structure, it needs to be reported.

People with Significant Control (PSC): The PSC refers to any individual or entity that holds more than 25% of the company’s shares or voting rights. It could also include those who can exercise significant control over the company, even if they don’t directly own the majority of shares. These individuals or entities must have their details verified and updated regularly.

Trading Status of Shares and Exemptions: Public limited corporations (PLCs) need to check if they’re claiming any exemptions on PSC info and whether their shares are traded on any market.

Registered Email Address (if applicable): And last of all, you’ll need to check your registered email address, which is used for sending official digital communications if your company is registered under the new Companies House procedures.

Maintaining the accuracy of this information is vital to ensuring transparency and trust in the public eye, as well as to keep in line with the law.

How to File a Confirmation Statement with Companies House?

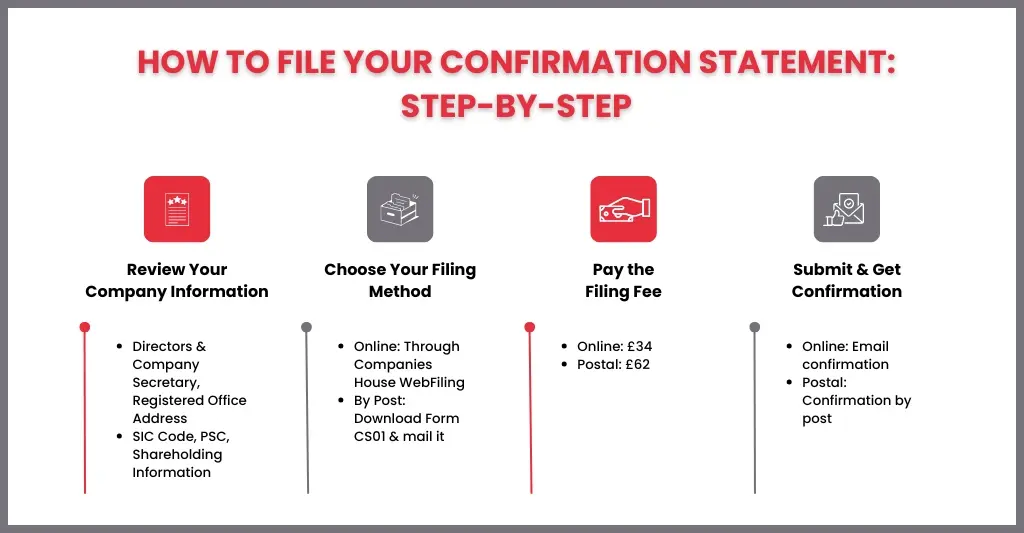

The process of getting this done is pretty straight forward, you can either do it online or by good old-fashioned post. Most businesses take the online route because it’s much faster, cheaper and safer. Here’s a step-by-step guide to help you through it:

Step 1: Check and Update Your Company Information

Examine your company’s information on the Companies House database before filing. Verify the accuracy of your directors, shareholders, SIC code, PSC information, and registered office address.

Make sure to amend any necessary details (such as a new director or changed shareholding) using the relevant Companies House forms.

Step 2: Choose How to File

There are two ways you can submit your Confirmation Statement:

- Online: Using the Companies House online account or WebFiling service.

- By mail: Download Form CS01 and send it to Companies House.

Step 3: Log In and Complete the Statement

For online filing:

- Log in to your Companies House account.

- Select your company and choose “File a Confirmation Statement (CS01)”.

- Review each section and confirm the details are accurate.

Step 4: Pay the Fee

You’ll need to pay a filing fee to get the process underway:

- £34 if you file online

- £62 if you file by post

You can submit several updates throughout that year without having to pay again because the charge is valid for a full year.

Step 5: Submit and Get Your Confirmation Back

Once you’ve reviewed all your info and paid the relevant fee you can submit your statement. Companies House will send you an email confirmation when they’ve processed everything (if you filed online).

Step 6: Keep A Record – Just in Case

- Save a copy of your payment receipt and Confirmation Statement for your business records

- By filing on time every year, you can stay on the companies House register and avoid any fines, or the worst-case scenario – your company gets dissolved.

How Much Does It Cost to File a Confirmation Statement?

The cost of filing is going to depend on how you file it and what organisation you are, but here are the basics:

- If you file online it’s going to be £34

- If you file by paper form, the fee is £62.

- These increased fees came into effect on 1 May 2024, replacing the previous amounts of £13 (online) and £40 (paper).

What Happens If You Don’t File a Confirmation Statement?

Your company and its directors may face financial and legal consequences if you fail to file your Confirmation Statement with Companies House. This is a significant compliance issue. You are legally obligated to submit this declaration every 12 months, regardless of whether your business is operating or not.

Here’s what can happen if you don’t file on time:

Your Company Status Becomes Non-Compliant: Your company will be listed as “overdue” on the public register by Companies House. This could harm the credibility and reputation of your business with customers, lenders, and investors.

Potential Late Filing Notices: Companies House may send you letters and notices reminding you to turn in your Confirmation Statement as soon as possible. Ignoring these alerts may cause the problem to worsen rapidly.

Risk of Company Strike-Off: Companies House may initiate strike-off procedures to remove your business from the public register if the statement is not filed for an extended length of time. The firm legally dissolves after it is struck off, and any assets it possesses are acquired by the crown (government).

Director Liability and Prosecution: It is legally required of company directors and secretaries to ensure that filings are submitted on time. Failing to comply may lead to fines and personal prosecution. Directors may occasionally be restricted from managing other businesses.

What Are Common Mistakes to Avoid When Filing?

Despite the apparent simplicity of filing a Confirmation Statement, many business owners make minor but expensive mistakes that can result in delays, denials, or problems with compliance. The following are some typical errors to clear while sending your statement to Companies House:

Missing the Filing Deadline: One of the most common errors is failing to file within 14 days of the end of your confirmation period. Warnings, possible strike-off action, and reputational harm can result from late filing. You can keep this on track by employing an accountant’s compliance service or setting calendar reminders.

Not Updating Company Changes First: The purpose of the Confirmation Statement is to verify current information, and not make significant changes. Before submitting the statement, you must update any data about directors, registered address, share capital, or PSCs using the appropriate Companies House forms.

Using Outdated SIC Codes: When their business operations change, many organisations neglect to update their Standard Industrial Classification (SIC) codes. Using out-of-date or inaccurate codes can mislead stakeholders and misrepresent your company.

Paying the Fee Multiple Times: Every time an update is submitted within the same 12-month period, some businesses inadvertently pay the filing fee. You can file more than one Confirmation Statement without having to pay again until the next period starts because the charge is valid for a whole year.

Filing Through the Wrong Method: When online filing is available, using the paper form (CS01) can result in needless delays and increased expenses. The online approach offers rapid proof of receipt and is faster and less expensive.

Ignoring Dormant Company Requirements: You are legally obligated to submit a Confirmation Statement every year, even if your business is not trading. For the simple reason that the owner thought they didn’t need to file, many dormant businesses get shut down.

How Can an Accountant Help with the Confirmation Statement?

Your Confirmation Statement can be filed quickly, precisely, and without worry with the help of an accountant. They are going to:

- Set a deadline reminder to ensure you never miss a filing date.

- Review and update company details like directors, shareholders, and PSCs.

- File the statement on your behalf to Companies House.

- Check for accuracy and compliance with legal requirements.

FAQs: Frequently Asked Questions

Can my accountant submit the Confirmation Statement?

Yes, your accountant is capable of managing the entire procedure and making sure everything is submitted accurately and on time.

Are Annual Accounts and Confirmation Statements the same thing?

No, they are different. Annual Accounts are financial reports that detail your company’s performance, while the Confirmation Statement verifies the accuracy of your company’s legal details such as directors, shareholders, and company address

Where do I submit my Confirmation Statement?

If you want to do it the easy way, you can use Companies House WebFiling service to file it online, or if you prefer the snail mail route you can send it in using Form CS01.

Conclusion

Filing a Confirmation Statement is an essential part of keeping your business on the right side of Companies House regulations. By doing this you can keep all your company’s info up to date and transparent to the public eye.

By filing on time every year you can save your business a world of trouble, keep your partners and customers trusting in you, and ensure you keep on the right side of the law.

If you’re not sure about the process or want to save some time, getting a professional accountant on board can make things a lot simpler and ensure everything is accurate and gets filed on time.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.