- What Are R&D Tax Credits and Why Are They Important?

- Who Is Eligible to Claim R&D Tax Credits?

- What Research Activities and Expenses Qualify for R&D Tax Credits?

- What Documentation Is Required to Support an R&D Tax Credit Claim?

- Step-by-Step Filing Process for Claiming R&D Tax Credits

- Prepare and complete the Necessary Tax Forms

- How Do You Calculate the Amount of R&D Tax Credit?

- What Are Common Challenges When Claiming R&D Tax Credits and How Can You Overcome Them?

- What Are the Benefits of Successfully Claiming R&D Tax Credits?

- Frequently Asked Questions (FAQ)

- Conclusion

Research and Development (R&D) tax credits offer innovative UK businesses a valuable, government-backed way to reduce their Corporation Tax by rewarding investments in developing new products, improving organisational processes, or creating new software. Claiming R&D tax credits successfully requires understanding HMRC’s eligibility criteria, gathering the necessary documentation, and following the correct application process through your Company Tax Return (CT600).

This comprehensive guide covers everything about how to claim R&D tax credits, from determining R&D tax credit eligibility to preparing documentation and completing the R&D tax credit application process, helping you maximise your claim efficiently and compliantly

What Are R&D Tax Credits and Why Are They Important?

The purpose of research and development tax credits is to encourage companies to invest in technical advancement, product development, and innovation. Companies can use these credits to lower their tax obligations if they engage in R&D tax credit qualified activities.

The UK tax law establishes the claims regulations, which are implemented by HMRC, which has hundreds of caseworkers who examine R&D tax claims. You must make accurate claims for the appropriate number when your business makes them. Under UK tax legislation, fines and interest will be assessed if your company makes a false R&D tax credit claim or for an incorrect amount.

Our expert R&D and Tax Dispute Resolution teams can collaborate with your technical teams to test and validate your claim if HMRC has contested it. Before the disagreement spreads to other areas of your tax compliance, it is best to settle with HMRC.

Who Is Eligible to Claim R&D Tax Credits?

R&D tax credit eligibility extends to any company, regardless of size or industry, that makes innovative investments. Understanding what qualifies for R&D tax credits is crucial for determining if your business activities meet the R&D tax credit requirements. Many businesses ask “how can I claim R&D tax” and the answer starts with meeting these fundamental R&D tax incentive eligibility criteria.

Basic R&D Tax Credit Requirements

To determine how to determine R&D tax credit eligibility, your business must meet these essential criteria:

- In the applicable country, your firm is required to pay income tax.

- Performing R&D tax credit qualified activities.

- There must be technical uncertainty and experimentation in the work.

- The project’s financial risk is your responsibility.

Common Eligible Industries for R&D Tax Credits

The R&D tax credits eligibility spans across various sectors:

- Software and tech

- Manufacturing

- Engineering and design

- Biotech and pharma

- Food and beverage

A claim is worth investigating if your profession entails creativity and using science or technology to solve problems.

What Research Activities and Expenses Qualify for R&D Tax Credits?

Understanding what qualifies as R&D tax credit activities is essential for successful claims. Your company must participate in projects that develop or enhance technology, processes, or products while dealing with technical difficulties. You can check on HMRC Official Website on what activities qualify for R&D Tax Credits.

Qualifying Activities Include

- Developing new products or prototypes

- Improving existing products or manufacturing processes

- Designing or testing new software or systems

- Experimenting with materials or techniques

- Resolving technical uncertainties through trial and error

Qualifying Expenses May Include

- Wages paid to employees for R&D time

- Materials and supplies needed for the creation of an experiment

- Research expenses under contract (outsourced R&D work)

- Tools for software development and testing

What Documentation Is Required to Support an R&D Tax Credit Claim?

Proper documentation is crucial for supporting your R&D tax credit claim and passing audit checks. Understanding R&D tax credit reporting requirements and maintaining thorough records makes the difference between approval and rejection.

Key Documents to Maintain:

- Project summaries describing objectives, difficulties, and outcomes

- Time-tracking documents for research and development employees

- Payroll records demonstrating R&D work compensation

- Receipts and invoices for supplies, materials, and contractor fees

- Technical records, including prototypes, test results, design drafts, and source code.

- Meeting minutes or emails on problem-solving and R&D progress

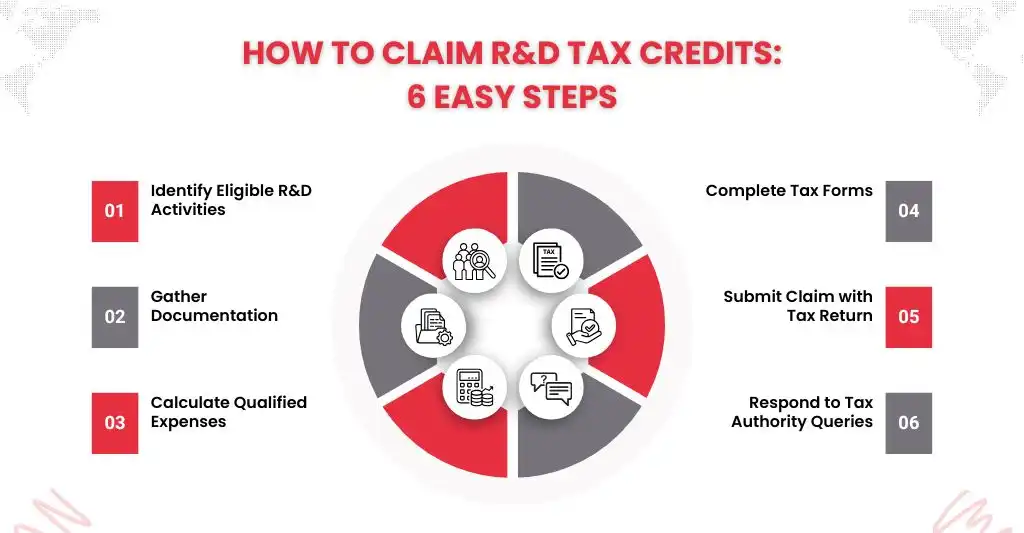

Step-by-Step Filing Process for Claiming R&D Tax Credits

Claiming R&D tax credits can reduce your company’s tax obligation, but it requires careful preparation, precise computations, and comprehensive documentation. You can submit a compelling and compliant claim by following the steps mentioned below:

Identify Eligible R&D Activities

To identify activities that fit the R&D requirements, start by looking at the most recent projects your company has undertaken. Seek employment that:

- Aims to create or enhance a technology, software, procedure, or product.

- Involves problem-solving and technological ambiguity.

- Calls for testing, experimentation, or iterative development.

- To guarantee that all qualifying operations are recorded, involve your financial and technical departments.

Gather and Organise Documentation

It is essential to have documentation to back up your claim and defend it in the event of an audit or review. Keep actual (real-time) records that connect your stated expenses to your R&D efforts.

Key documents may include:

- Technical reports or project descriptions

- Logs of employee time spent on R&D jobs

- Payroll documentation for R&D employees

- Receipts and invoices for supplies or labor performed by subcontractors.

- Meeting minutes or internal emails related to research choices.

- Test data, source code, or models.

Calculate Qualified R&D Expenses

After qualifying activities have been found, figure out the related expenses. Countries differ in the precise categories and percentages permitted, but typically include:

- Employee pay: The percentage of pay that is directly related to research and development.

- Supplies: Items used for development or research.

- Subcontractor costs: Payments to external parties for research services are known as subcontractor costs.

- Cloud services and software: If utilised for testing or development.

Prepare and complete the Necessary Tax Forms

Every nation has different forms and criteria for reporting.

United States: Together with your federal income tax return (Form 1120), submit IRS Form 6765. Additionally, there can be certain guidelines that startups must adhere to while claiming the credit to deduct payroll taxes.

United Kingdom: Provide a thorough R&D technical and financial report with your claim, together with your Corporation Tax Return (CT600). Depending on the size and funding of your business, claims may be covered by the RDEC or the SME plan.

Canada: Incorporate supporting forms such as T2SCH31 and T2 Corporation Income Tax Return with Form T661 for the SR&ED (Scientific Research and Experimental Development) program.

Australia: Before filing the R&D Tax Incentive Schedule claim on your company’s tax return, register qualified R&D activities with AusIndustry.

Submit the Claim with Your Tax Return

Prepare your R&D claim and submit it with your yearly tax return by the due date, which is usually the same as your corporate filing deadline. Remember the important dates because late claims might be rejected.

Working with a tax counselor or R&D specialist will usually take care of this portion for you and guarantee that the submission is timely and proper.

Respond to Tax Authority Inquiries

Tax authorities could ask for more details or an explanation after you file your claim. Be ready to:

- Provide proof of your expenditures and actions.

- Describe your cost-calculating process.

- Demonstrate how your work fits the R&D definition.

How Do You Calculate the Amount of R&D Tax Credit?

The kind of expenses incurred, the size of your organisation, and the particular tax laws in your nation all affect how much R&D tax credit your company is eligible to receive. The overall method is determining eligible R&D spending and applying a credit rate to those costs, while the precise calculation differs depending on the state.

Identify Qualified Research Expenses (QREs)

These typically include:

- Wages paid to employees who work directly in research and development

- Materials and supplies for prototypes or experiments

- Contract research (a percentage of the money you spend on outside parties)

- Costs of cloud computing and software (if employed in R&D)

Apply the credit rate, which varies by country:

- U.S.: Up to 20% of eligible R&D expenses

- UK: Up to 21.5% for SMEs; around 15% for large companies (RDEC)

- Canada: Up to 35% federal + provincial credits

- Australia: 18.5% to 43.5% depending on company size

Account for Limitations and Adjustments

If you’ve received grants or subsidies, your credits can be capped, subject to carryforward regulations, or diminished. Unused credits may be carried forward to subsequent tax years in certain nations.

What Are Common Challenges When Claiming R&D Tax Credits and How Can You Overcome Them?

There are various advantages of claiming R&D tax credits, many businesses encounter preventable problems along the way. Here are some problems faced and solutions for that.

Misidentifying Eligible Activities: Many companies may incorporate non-eligible tasks or ignore qualified work.

Solution: Use the appropriate R&D definitions provided by the tax administration in your nation and involve technical teams as early as possible.

Poor Documentation: Insufficient documentation makes it challenging to support your claim, particularly during an audit.

Solution: Maintain thorough, up-to-date records of R&D initiatives, costs, and employee participation.

Incorrect Expense Calculations: Cost overestimation or underestimation may result in fines or lost advantages.

Solution: Make use of a consistent approach and verify the numbers twice. Think about hiring a specialist or using R&D tax software.

Unfamiliarity with Tax Rules: Due to frequent changes and country-specific variations, compliance can be challenging.

Solution: Stay updated on current guidelines or consult an Research & Development tax advisor.

Delays or Missed Deadlines: Consult an R&D tax professional or stay updated on the latest regulations.

Solution: Be mindful of filing deadlines and begin monitoring R&D at the start of the tax year.

What Are the Benefits of Successfully Claiming R&D Tax Credits?

Businesses involved in innovation might gain substantial financial and strategic advantages by successfully claiming R&D tax credits. Beyond just tax savings, these advantages can significantly affect the long-term expansion and competitiveness of your business.

Reduced Tax Liability: R&D tax credits immediately lower the tax liability of your company. This increases profitability by ensuring that a larger portion of your revenue stays with the business. Certain jurisdictions allow excess credits to be carried forward and used to reduce future tax liabilities.

Improved Cash Flow: Many tax authorities (including those in the US, UK, and Australia) provide refundable credits or permit credits to be deducted from payroll taxes for new and early-stage companies. Even if the company isn’t yet profitable, this brings in money to support continuing operations or new initiatives.

Supports Innovation and Growth: Large-scale development initiatives become more feasible when tax credits are used to lower the cost of research and development. Businesses can put the money they save back into developing new products, employing qualified employees, entering new markets, or developing new technology.

De-risks R&D Investment: The results of research and development are frequently unpredictable. R&D tax credits enable companies to recoup a percentage of their expenses, reducing some of that financial risk and making innovation a more long-term, sustainable approach.

Competitive Advantage: Companies that regularly invest in research and development (R&D) and benefit from associated tax benefits are better positioned to maintain their competitive edge. Stronger IP (intellectual property) portfolios, quicker product development, and improved customer solutions are all examples of this.

Frequently Asked Questions (FAQ)

Are R&D tax benefits available to startups and small businesses?

Absolutely, without a doubt. The SME program, which is more liberal than the RDEC program, allows small and medium-sized businesses (SMEs) with fewer than 500 employees and less than €100 million in revenue or €86 million in gross assets to make claims. Companies that are losing money can still get paid in cash

How long does it take to receive the R&D tax credit?

HMRC usually takes 4 to 8 weeks to process claims, although it may take longer if there are questions or at busy times. Claims are handled more rapidly when they are filed with thorough and understandable paperwork.

In R&D claims, what is meant by “technological uncertainty”?

There is technological uncertainty when a skilled expert in the subject is uncertain about the practicality of a solution or how to get there, and when the information needed to solve it isn’t easily accessible. This is a crucial requirement for eligibility.

Conclusion

Whether you’re a major corporation, a growing start-up, or an established SME, claiming R&D tax credits can be a potent way to recover costs, improve cash flow, and reinvest in innovation. Although the procedure calls for thorough paperwork and adherence to HMRC regulations, there may be substantial benefits.

The secret to success is knowing your eligibility, gathering the necessary supporting documentation, and properly submitting your claim. Working with a skilled advisor or accountant can help you maximise your claim while lowering risk if you’re unclear about any step.

Do you still require assistance or have questions about your R&D claim? With knowledgeable advice catered to your sector and corporate objectives, we are here to assist.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.