- Key Takeaways

- What is a Limited Liability Partnership (LLP) and How is it Taxed in the UK?

- Do Limited Liability Partnerships Pay Corporation Tax in the UK?

- How LLPs Differ from Limited Companies for Tax Purposes

- When Do LLPs Lose Tax Transparency and Become Liable for Corporation Tax?

- How Much Tax Do LLP Members Pay in the UK?

- Do LLPs Pay VAT, Payroll Taxes, and Other Taxes?

- Recent Changes to LLP Tax Rates and Member Impact (2025/26)

- Strategic Tax Planning for LLP Members to Reduce Tax Burden

- Compliance and Reporting Obligations for LLPs & Their Members

- Frequently Asked Questions

- Conclusion

If you’re considering setting up a Limited Liability Partnership (LLP) in the UK, one of the first questions is: do LLPs pay corporation tax? The short answer is no – in most cases, LLPs do not pay corporation tax. Instead, profits pass through to the individual members, who report their share via Self Assessment.

This distinguishes LLPs from limited companies and makes them attractive for professional services firms, collaborating freelancers, and small partnerships. However, tax rules can be complex, and certain circumstances may require the LLP to pay corporation tax.

This article explains LLP taxation in the UK, including when corporation tax applies, comparisons with limited companies, and members’ tax obligations. Whether you’re a solicitor, accountant, consultant, or small business owner exploring an LLP, this guide provides the clarity needed for informed decisions.

Key Takeaways

- LLPs typically do not pay corporation tax – profits pass directly to members, who pay Income Tax and National Insurance on their share.

- Tax transparency is the default – LLPs are treated as partnerships for tax purposes, not separate corporate entities.

- Exceptions apply – LLPs may lose tax transparency and face corporation tax if conditions are not met.

- Members are taxed individually – each reports their profit share via Self Assessment at their personal rate.

- Recent changes apply – National Insurance rates and thresholds have updated, impacting LLP members’ take-home pay in 2026.

What is a Limited Liability Partnership (LLP) and How is it Taxed in the UK?

A Limited Liability Partnership (LLP) combines the flexibility of a traditional partnership with the legal protections of a limited company, offering a balanced structure between the two.

In an LLP, member’s personal assets are protected, if the business faces financial difficulties, personal holdings remain secure. Profits can be shared flexibly, without the administrative burdens of a limited company.

For tax purposes, LLPs benefit from tax transparency: HMRC views the LLP as a partnership, not a separate taxable entity. Members are treated as self-employed, paying tax on their profit share like traditional partners.

Companies House data shows over 60,000 active LLPs in the UK as of 2024, predominantly in law firms, accountancy practices, and consultancies.

Do Limited Liability Partnerships Pay Corporation Tax in the UK?

No, LLPs do not pay corporation tax, unlike limited companies. They benefit from tax transparency instead.

Example: Suppose you and two colleagues run a consulting LLP with £150,000 profit, split equally (£50,000 each). The LLP pays no corporation tax. Each member reports their £50,000 share on their Self Assessment tax return, paying Income Tax and National Insurance accordingly.

This contrasts with limited companies, where the company pays corporation tax first (19% on profits up to £50,000, marginal relief up to £250,000, then 25%), followed by personal tax on dividends or salary.

This transparency rule stems from the Income Tax (Trading and Other Income) Act 2005, treating LLP members as partners in a traditional partnership, not employees or shareholders.

How LLPs Differ from Limited Companies for Tax Purposes

The distinctions between LLPs and limited companies are clear when selecting the optimal structure.

Limited Companies: Separate legal entities that pay corporation tax on profits (19% up to £50,000; 25% over £250,000 from April 2025). Remaining profits distributed as dividends incur dividend tax (8.75% basic rate to 39.35% additional rate).

LLPs: Avoid this two-tier taxation. Profits distribute directly to members, taxed at personal Income Tax rates (20%, 40%, or 45%) plus Class 2/4 National Insurance.

Quick Comparison (£100,000 Profit Example):

| Structure | Corporation Tax | Post-Tax Profits | Higher-Rate Taxpayer Take-Home (After Dividend/Income Tax + NI) |

| Limited Company | £19,000 (19% rate) | £81,000 | £53,595 |

| LLP | £0 | £100,000 | £54,700 |

Outcomes vary by profit levels, extraction methods, and personal circumstances, but LLPs often simplify tax for professionals.

When Do LLPs Lose Tax Transparency and Become Liable for Corporation Tax?

LLPs are generally tax transparent, but they lose this status, triggering corporation tax liability in cases of disguised employment, per HMRC rules.

When LLPs End Up Paying Corporation Tax

An LLP member is reclassified as an employee (making the LLP liable for corporation tax on their profits share) if all three conditions are met:

| Condition | Description |

| A | Member receives a fixed payment, unrelated to business profits. |

| B | Member lacks significant influence over LLP decisions or operations. |

| C | Capital contribution is less than 25% of expected annual “disguised salary” for the tax year. |

If triggered, the LLP deducts PAYE income tax and employer’s National Insurance on the affected member’s allocated profits, treating it as employment income. Only the salaried portion loses transparency, not the entire LLP’s profits.

Who gets Exempt From Corporation Tax

True partners, those sharing risks, decision-making, and capital, maintain transparency, including:

- Members whose income varies with profits.

- Those with significant input on decisions, client relationships, or operations.

- Members contributing at least 25% of their expected profit share as capital.

- Consultants in genuine partnership structures sharing risks and rewards.

HMRC targets junior or fixed-pay members who resemble employees rather than partners.

How Much Tax Do LLP Members Pay in the UK?

LLP members are treated as self-employed individuals. Here’s what you’ll pay on your share of the profits in the tax year 2025-26:

Income Tax rates

- Your first £12,570 – 0% – you get this free!

- £12,571 to £50,270 – 20%

- £50,271 to £125,140 – 40%

- Over £125,140 – 45%

National Insurance contributions:

- Class 2 NICs: £3.45 a week if your profits are over £6,725 per year

- Class 4 NICs: 6% on profits between £12,570 and £50,270, then 2% on profits above £50,270

Let’s say you’re an LLP member who takes home £60,000 in profit share. Here’s what you’d pay in tax:

Income Tax: £12,570 at 0% + £37,700 at 20% + £9,730 at 40% = £11,432

Class 4 NIC: £37,700 at 6% + £9,730 at 2% = £2,456.60

Class 2 NIC: £179.40 a year

Total tax: roughly £14,068 (which is around 23.4% of the amount you made)

Compare that to taking the same amount as a salary and dividends from a limited company – where you’d have to pay corporation tax, income tax, and dividend tax on top.

Do LLPs Pay VAT, Payroll Taxes, and Other Taxes?

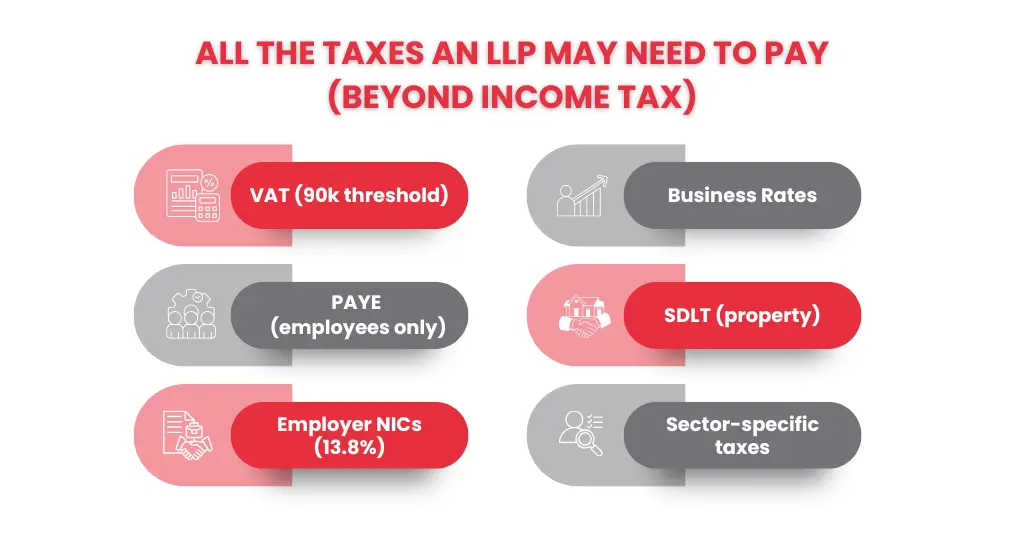

Yes, LLPs face additional taxes beyond members’ Income Tax and National Insurance.

VAT: Register if taxable turnover exceeds £90,000 in any 12-month period (charge VAT on services; reclaim input VAT). Many professional LLPs register voluntarily below this threshold.

PAYE and Employer NICs: For employees (not members), operate PAYE to deduct Income Tax and employee NICs from wages. Pay employer NICs at 13.8% on earnings above £9,100 per employee (2025/26 secondary threshold).

Business Rates: Payable to local councils for commercial premises.

Other Taxes:

- Stamp Duty Land Tax on property purchases.

- Sector-specific: insurance premium tax, landfill tax, etc.

Recent Changes to LLP Tax Rates and Member Impact (2025/26)

Self-employed National Insurance rates changed via Spring Budget 2024:

- Class 4 NICs: 6% on profits £12,570–£50,270 (down from 9%); 2% above £50,270.

- Example: On £50,000 profit, saves £1,131 annually vs. prior 9% rate.

Income tax thresholds frozen until April 2028, causing fiscal drag: inflation pushes profits into higher bands (20% basic to 40% higher at £50,270; £12,570 personal allowance), reducing real take-home pay.

| Key 2025/26 Thresholds | Amount |

| Personal Allowance | £12,570 |

| Higher-Rate Threshold | £50,270 |

| Class 4 NIC Lower Limit | £12,570 |

| Employer NIC Secondary Threshold | £9,100 |

Strategic Tax Planning for LLP Members to Reduce Tax Burden

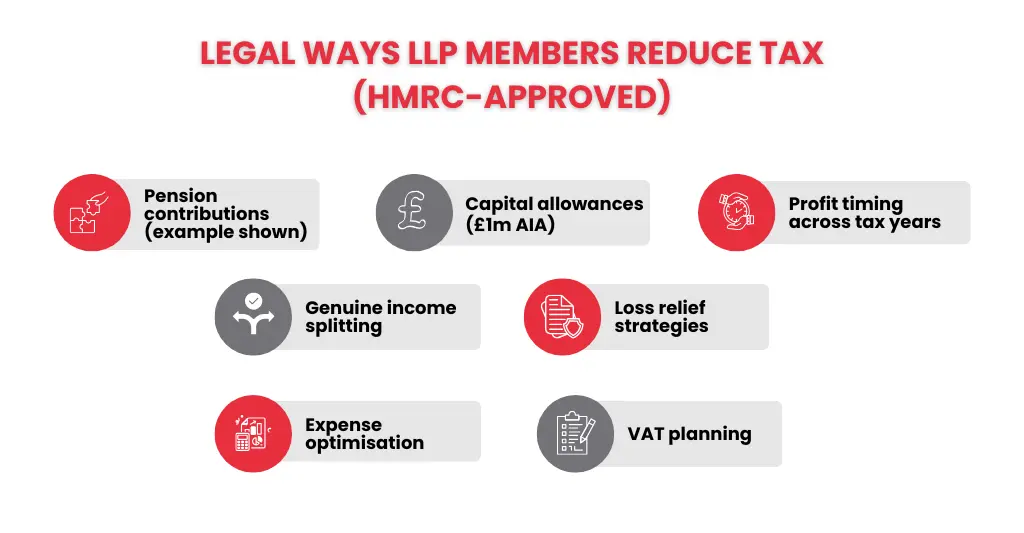

Planning your tax bill can make a pretty big difference for LLP members. Here are some strategies that really work:

Pension Contributions & Tax Relief: Popping some cash into a personal or stakeholder pension means you get that amount knocked off your taxable profits. So if you’re a higher-rate taxpayer on £60,000 and you put £10,000 into your pension, that’s effectively only costing you £6,000 after they add in the tax relief.

Business Expenses to Claim: Make sure you’re claiming all the legitimate expenses you can – office costs, travel, pro membership subs, equipment and training – any of these that reduce your taxable profits.

Income splitting with your Partner: If your spouse/partner is involved with the LLP and in a lower tax bracket, consider adjusting your profit shares so you can take advantage of their lower rate (as long as this genuinely reflects their involvement and isn’t just a clever trick).

Capital Allowances for Equipment etc: Be sure to claim the annual investment allowance on qualifying kit and vehicles. That way you can write off up to £1 million of expenditure in the year of purchase.

Loss Relief: If you make a loss with your LLP you can carry it forward to use against future profits or, in some cases, carry it back against previous years’ earnings.

Timing of Earnings: If you’re just about to hit a higher tax band, consider holding off on taking profits to the next tax year – if possible.

Don’t try to tackle any of this on your own, work with a qualified accountant who’s well-versed in LLP taxation. They can tailor a strategy to suit your needs and make sure you’re complying with all the HMRC rules.

Compliance and Reporting Obligations for LLPs & Their Members

Managing an LLP comes with a pretty straightforward set of rules to follow when it comes to HMRC and Companies House.

Annual Statements & Compliance: The main annual tasks are filing your accounts with Companies House – this applies even if you’re turnover is below the audit threshold, and you also have to file a confirmation statement every year to confirm member details and the address of the registered office.

Partner Tax Return (SA800): The LLP needs to file a tax return that shows the total income, expenses and how the profits are shared out among members. This is usually due on the 31st of January the following year (so 31st January 2026 for the tax year 2024-25).

Individual Self Assessment (SA100): Each member has to file their own tax return by the 31st January deadline, including their share of LLP profits on the partnership pages.

Payment on Account: The majority of members will pay tax in two chunks – 1st on the 31st January and the second on the 31st July, with a balancing payment coming in the following January – all this can create some pretty significant cash flow problems if it’s not properly planned for.

Record Keeping: Make sure you keep all your records of income and expenses for at least 5 years after the tax return deadline.

Member Changes: You need to let Companies House know within 14 days of any member joining or leaving the LLP.

Miss any of these deadlines and you’ll be facing penalties, with Companies House charging £150 for late filing, while HMRC penalties start at £100 and jump if you continue to be late.

Frequently Asked Questions

Do LLPs pay corporation tax or income tax in the UK?

LLPs do not pay corporation tax. Members pay Income Tax and National Insurance on profit shares via Self Assessment. Tax transparency means HMRC taxes individuals directly, not the LLP as a corporate entity.

When would an LLP have to pay corporation tax?

LLPs avoid corporation tax traditionally, but salaried members (fixed pay, limited influence, <25% capital contribution) trigger PAYE and employment taxes on their share, not self-employment taxes.

What are the tax advantages of an LLP compared to a limited company?

LLPs evade double taxation: no corporation tax before personal tax on profits. Limited companies face corp tax (19-25%) plus dividend tax, though they offer lower initial rates and dividend flexibility.

How do LLP members reduce their tax liability legally?

Use pension contributions, allowable expenses, capital allowances, strategic income timing, and compliant income splitting. Consult a qualified accountant for HMRC-approved strategies.

Do LLPs need to register for VAT?

Mandatory if taxable turnover exceeds £90,000 over 12 months. Voluntary registration below this allows VAT recovery on expenses, beneficial for professional services LLPs.

Conclusion

Do Limited Liability Partnerships pay corporation tax? In most cases, no. LLPs enjoy tax transparency, with profits passing to members for Income Tax and National Insurance – a primary reason professional partnerships, consultancies, and small businesses choose this structure.

Exceptions exist, notably salaried member rules, which reclassify certain members as employees, altering tax treatment. Understanding these ensures compliance, leverages planning opportunities, and avoids pitfalls.

Whether you are operating an existing LLP or setting one up, working with LLP tax specialists and experienced corporation tax services providers ensures regulatory adherence, optimises your tax position, and proactively mitigates risk.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.