- What Is an Audit?

- What are the Different Types of Audit?

- UK Audit Thresholds and SME Exemptions

- What is Assurance?

- Types of Assurance Engagements

- Key Differences Between Audit and Assurance

- Key Similarities Between Audit and Assurance in Accounting

- Why Audit and Assurance Are Important for Businesses and Stakeholders?

- Common Misconceptions About Audit and Assurance Explained

- FAQs: Frequently Asked Questions

- Conclusion

Audits and assurance services are key to maintaining trust and accuracy in business financials. An audit is a detailed examination of financial records to verify compliance with regulations and accounting standards. Assurance services look at the whole business and its processes and data to increase stakeholder confidence.

Understanding the difference between audit and assurance helps businesses, investors and regulators have transparency, reduce risk and make informed decisions with trusted information, financial and non financial.

In this blog, we have defined audit and assurance, explore their various types, and highlights the key differences that business owners, financial professionals, and accounting students should understand. By the end, you will gain a full insight into how these services improve accountability, reliability, and support better decision-making within organisations.

What Is an Audit?

An audit is conducted by a competent professional, such as a Chartered Accountants (CA), who looks into an organisation’s financial records, transactions, and internal controls. A variety of audit kinds exist, each with a distinct function. Nonetheless, each of them assists stakeholders in verifying that the topic conforms with accepted guidelines and industry standards.

What are the Different Types of Audit?

The most common types of audits include:

Financial audits

Chartered Accountants or other trained professional conducts an audit, which looks into an organization’s financial records, transactions, and internal controls. There are various audit types, and each has a distinct function. All of them, meanwhile, assist stakeholders in verifying that the topic conforms with accepted guidelines and industry best practices.

Reviews of financial statements

Reviews of financial statements concentrate on the company’s financial data for correctness, accountability, and legality. They are typically less costly than comprehensive audits and have a more restricted scope.

Tax audits

To make sure that tax laws are being followed, HMRC conducts tax audits (commonly known as compliance checks. Understanding the goal and scope of tax audits is essential while getting ready for them. This enables you to compile the pertinent documents and provide pertinent answers to the queries.

Compliance audits

These audits make sure a company complies with rules or guidelines. In order to protect the interests of stakeholders, compliance audits also assist in finding gaps and creating regulations.

Internal audits

Businesses carry out internal audits to verify that internal policies and procedures are being followed. Finding avenues for organisational improvement is the main objective. Internal audits encompass a variety of topics, including operational procedures, risk management, financial reporting, and regulatory compliance.

External audits

External auditors who are not connected to the organization look into the procedures and offer objective reports. These auditors’ judgments are often regarded as credible because they are not affiliated with the organisation. Financial and tax compliance are two topics that may be covered by external audits.

UK Audit Thresholds and SME Exemptions

Not all UK businesses need a full audit. SMEs can be exempt from audit if they meet the criteria set by Companies House and the FRC. These thresholds are usually based on turnover, assets and employee numbers. Understanding these exemptions helps smaller businesses decide when they need to engage an auditor or opt for tailored assurance services for their business.

As of the latest thresholds, companies are exempt if they meet at least two of the following: turnover ≤ £10.2m, assets ≤ £5.1m, employees ≤ 50.

What is Assurance?

Assurance is a separate procedure that enables experts to evaluate audit correctness. It typically follows audits to improve the accuracy and dependability of data used in decision-making.

Services related to assurance can be found in various fields, such as legal, tax, and finance. Assurance services can be used to confirm the accuracy of balance sheets, cash flows, and income statements in the financial domain. In a more comprehensive sense, assurance could reevaluate internal policies and processes to guarantee adherence to laws, accepted standards, and industry best practices.

Enhancing confidence among stakeholders, such as managers, investors, and business owners, is the main goal of assurance. Credibility is increased by having an expert examine reports, procedures, and controls. Additionally, organisations may choose to voluntarily look for assurance services to be transparent and accountable.

Types of Assurance Engagements

Assurance engagements can be used in a variety of contexts where stakeholders want information confidence, and they extend beyond financial audits. The following categories apply to these engagements, which are governed by professional standards (such as those published by the International Auditing and Assurance Standards Board, or IAASB):

Audit Engagements

- The most often used assurance method.

- Involves looking over financial statements on your own.

- Ensures that there are no significant misstatements in the accounts.

Review Engagements

- Less thorough than an examination.

- To offer a limited level of assurance, the auditor conducts analytical procedures and queries.

- Smaller businesses or situations where stakeholders require assurance but not a complete audit frequently employ it.

Risk Assessments

- Focuses on locating and assessing hazards in corporate procedures.

- Assures management that risk management strategies are effective.

Compliance Engagements

- Assesses a company’s adherence to internal policies, laws, and regulations.

- Typical of regulated sectors, including insurance, banking, and healthcare.

Internal Controls Assurance

- Investigates the layout and performance of internal controls and systems.

- Contributes to the dependability of operational procedures, IT systems, and financial reporting.

Sustainability and ESG Assurance

- Examines disclosures related to environmental, social, and governance (ESG).

- Gives stakeholders assurance on non-financial reporting, like CSR or sustainability reports.

Information Systems Assurance

- Data management, cybersecurity, and IT systems are the main topics.

- Confirms if technological systems are safe and efficient in assisting with business operations.

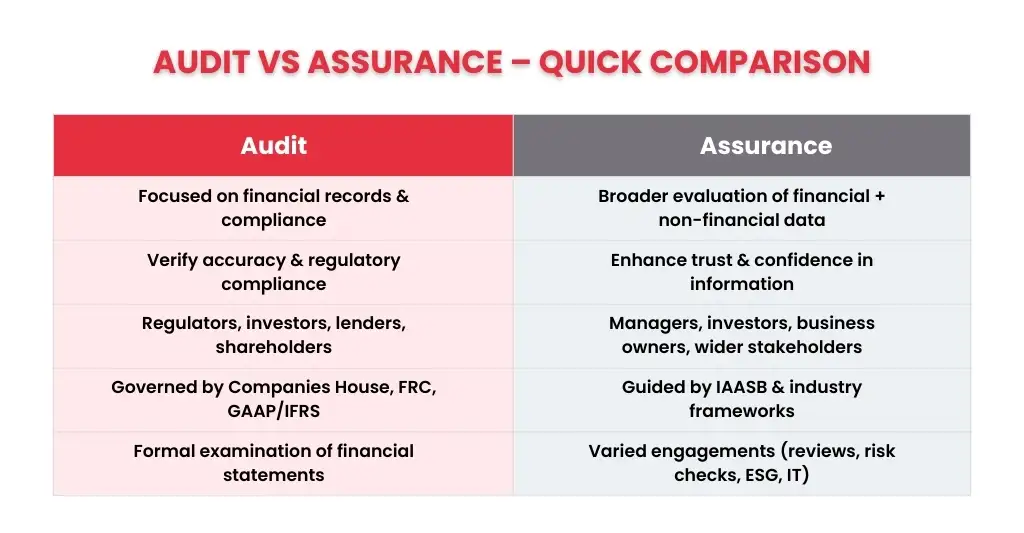

Key Differences Between Audit and Assurance

| Aspect | Audit | Assurance |

| Scope | Focused on financial records and compliance | Broader evaluation of processes and data |

| Purpose | Verify accuracy and regulatory compliance | Enhance confidence and trustworthiness |

| Regulator/Standard | Regulated by FRC, Companies House, UK GAAP, and Companies Act 2006 | Governed by IAASB & industry standards |

| Users | Stakeholders, regulators, investors | Managers, investors, business owners |

| Engagement Type | Formal financial statement examination | Varies from reviews to risk assessments |

Despite having many similarities, assurance and auditing are not the same in the following ways:

Nature

To verify accuracy and adherence to rules and guidelines, the audit process examines an organization’s financial records and internal controls. The audit process itself is typically included in assurance services, which have a wider scope. A variety of engagements where an impartial expert assesses the dependability of data and procedures are covered by assurance.

Purpose

An audit ensures that procedures or reports follow corporate policy, industry standards, or legal requirements. However, assurance raises the information’s dependability and trustworthiness when it comes to making decisions. It offers a second, impartial evaluation of different organisational elements.

Uses

Audits can be used for a variety of purposes, including internal efficiency, legal, and financial. Assurance is typically used to determine a company’s level of risk or performance. The target audience for audits consists of both internal and external stakeholders. In many cases, assurance is necessary when a third party is involved.

Agent

Depending on the kind of audit, either internal or external auditors may provide audit services. Typically, assurance is carried out by independent or external auditors. The independent auditors carry out thorough evaluations and produce objective reports. Additionally, they provide suggestions on how the business might reduce risks.

Scope

Audits typically have a more limited scope and are subsets of assurance services. Although it might focus on a certain area of the business’s activities, assurance is all-encompassing. By default, assurance is wider.

Key Similarities Between Audit and Assurance in Accounting

Professionals: Assurance services and audits both use qualified auditors, some of whom hold professional certifications. A Chartered Accountants is a prime example, having written and passed an exam given by a reputable accounting authority. The industry is governed by professional bodies such as the Financial Reporting Council (FRC), ICAEW, ACCA, CIMA, or ICAS, which set standards and regulate Chartered Accountants.. Although professional evaluations can have a variety of uses, they usually aim to guarantee the accuracy and legitimacy of information within the company.

Objective: Enhancing confidence in the information presented is the goal of an audit, which is a component of assurance. Reports that are accurate, trustworthy, and in compliance with applicable standards or laws are guaranteed by audits and assurance.

Reporting: Reports are the result of assurance and audit procedures. The professional’s findings, conclusions, and suggestions are conveyed in the reports. Financial reports are among the papers that auditors gather and examine before creating reports. The relevant stakeholders then receive the reports from the auditor, who uses the evaluations to help them make decisions.

Why Audit and Assurance Are Important for Businesses and Stakeholders?

As you must have read above, what role audit and assurance play in the business. Audit improves accountability, openness, and trust in the corporate world. Whereas, assurance evaluates whether the audit is done properly. Beyond merely meeting legal obligations, they are useful instruments for long-term sustainability and decision-making. Here’s why they’re important:

Enhancing Credibility: Trust in financial accounts, reports, and disclosures is increased via independent audits and assurance activities.

The information offered reduces confusion for regulators, lenders, and investors.

Supporting Better Decision-Making: Stakeholders and management can make the right strategic decisions with the use of accurate and valid information. Stronger business planning is supported by assurance of risk management and internal controls.

Ensuring Compliance: Audits verify compliance with tax laws, industry-specific rules, and accounting standards. Assurance engagements make sure that reporting frameworks, policies, and procedures follow best practices and legal requirements.

Detecting and preventing errors: Finding significant fraud, irregularities, or misstatements is aided by routine audits. System and process flaws are brought to light via assurance evaluations, enabling prompt remedial action.

Long-Term Value Creation: Resilience and growth are supported by assurance in domains including IT systems, risk management, and sustainability. Companies that exhibit honesty and conformity draw in greater capital and customers.

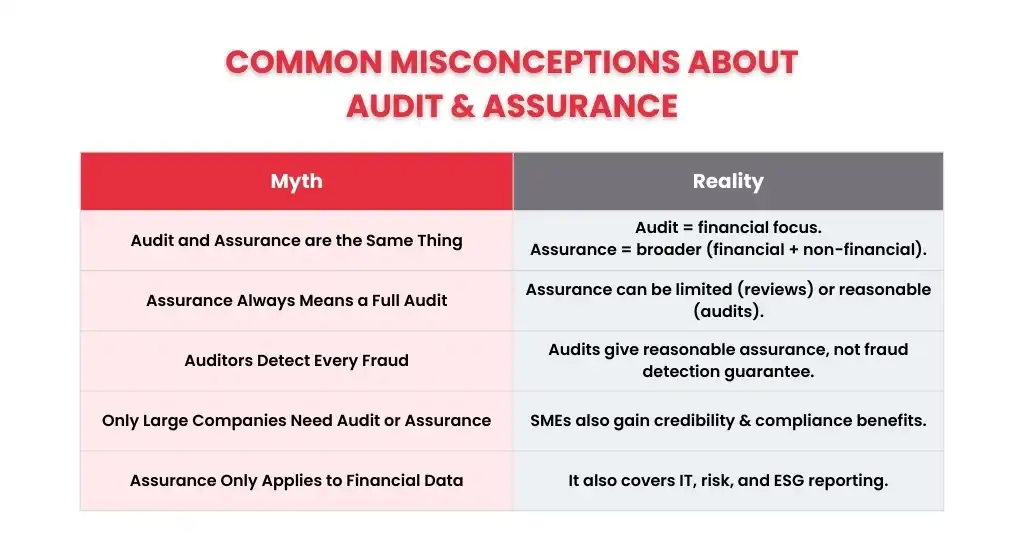

Common Misconceptions About Audit and Assurance Explained

As said before, audit and assurance are often misunderstood by several people. Both terms are closely related but have different goals, objectives, and results. The following are common misconceptions:

Audit and Assurance Are the Same Thing

Reality: A particular kind of assurance engagement that focuses on financial statements is called an audit.

The scope of assurance is wider and might include non-financial domains like internal controls, sustainability, and compliance.

Assurance Always Means a Full Audit

Reality: Different levels of assurance can be offered, ranging from reasonable (audits) to limited (reviews).

Not every assurance assignment entails the extensive testing and evidence collection necessary for an audit.

Auditors Detect Every Fraud

Reality: Audits offer a reasonable level of assurance rather than absolute certainty.

The primary goal is not to find every incidence of fraud or error, but rather to make sure financial statements are free from substantial misstatement.

Only Large Companies Need an Audit or Assurance

Reality: The truth is that small and medium-sized companies gain as well.

Assurance enhances credibility, processes, and compliance even in situations when audits are not mandated by law.

Assurance Only Applies to Financial Data

Reality: Assurance also encompasses non-financial domains such as risk management, IT systems, and ESG reporting.

Assurance is being used by businesses more and more for cybersecurity and sustainability assessments.

Audit and Assurance Are Just Regulatory Burdens

Reality: They are instruments for increasing stakeholder trust, lowering risk, enhancing governance, and creating value.

They can improve reputation and competitiveness rather than only being a compliance exercise.

FAQs: Frequently Asked Questions

Who needs an audit, and is it compulsory for all businesses?

Larger businesses that reach certain turnover, asset, or employee levels are required to undergo audits in the UK and many other jurisdictions.

Smaller companies might nevertheless profit from assurance services even if they are not legally obligated to audit.

Which assurance engagement types, aside from audits, are most frequently used?

Sustainability/ESG assurance, risk assessments, compliance checks, internal control evaluations, and review engagements are typical examples.

Can information that isn’t financial be covered by assurance services?

Yes. Assurance extends beyond money. Internal controls, compliance, IT systems, sustainability disclosures, and ESG (environmental, social, and governance) reporting are some of the topics it may cover.

Can assurance help small enterprises even if they don’t have to audit?

Yes. Even if a formal audit is not required, assurance can help SMEs increase their credibility, strengthen internal procedures, and win over lenders or investors.

Conclusion

Assurance and audit are essential instruments that assist companies in establishing accountability, openness, and trust. Although the primary objective of an audit is to confirm the integrity and compliance of financial statements, assurance goes beyond this to offer trust in both financial and non-financial data, such as internal controls, risk management, and sustainability reporting.

In addition to fulfilling legal obligations, they enhance decision-making, win over investors, and promote sustained company expansion. In the UK, aligning with FRC regulations and Companies Act requirements ensures that audits and assurance engagements not only meet legal obligations but also strengthen stakeholder confidence.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.