Managing your company’s finances effectively is more important than ever before in 2026 and upcoming future. Aside from guaranteeing adherence to HMRC rules, accurate bookkeeping offers priceless information about the financial health of your company. Whether you are a new business, an expanding SME, or a well-established corporation, working with the best bookkeeping service may help you make better decisions and optimize your operations.

The top ten bookkeeping service providers in the UK are highlighted in this guide; they are well-known for their knowledge, technological integration, and customer satisfaction. These vendors address a wide spectrum of company demands, from AI-powered platforms to conventional businesses providing individualised services. Discover the ideal fit for your financial management needs by looking through our carefully selected list.

Why Businesses Should Hire Expert Bookkeepers?

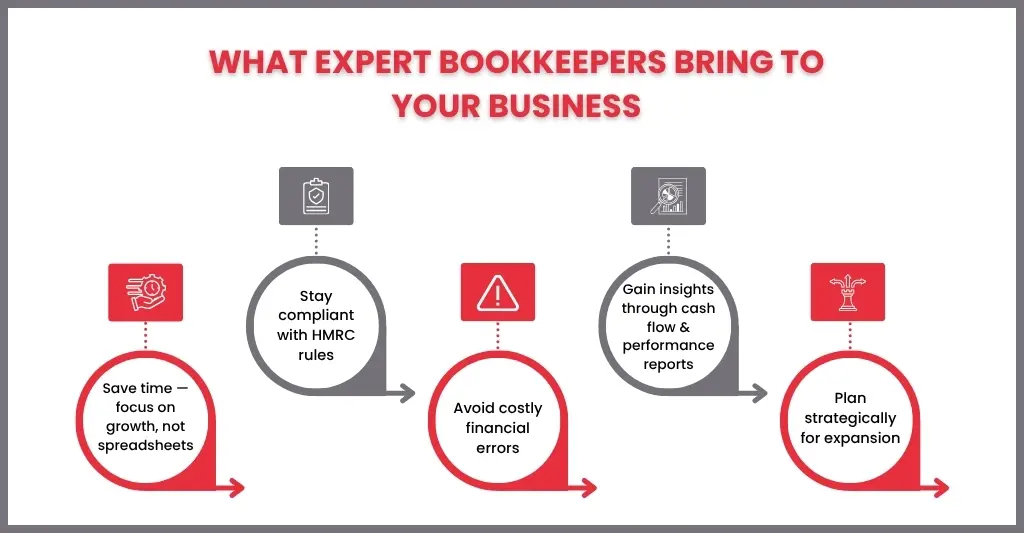

A strategic choice that can have a big impact on the profitability of your company, hiring professional bookkeepers is about more than just keeping your finances organised. Expert bookkeepers contribute accuracy, productivity, and financial knowledge that go well beyond basic data input.

Professional bookkeeping accountants assist you in avoiding expensive errors and HMRC compliance problems by making sure your records are correct and current. They also save your time, so you can take care of essential tasks and expand your company rather than balancing spreadsheets.

Experienced bookkeepers can offer thorough cash flow studies and financial reports to help with decision-making. You are better able to plan for expansion, control spending, and spot areas for improvement thanks to their knowledge of your company’s financial situation.

How We Ranked the Top Bookkeeping Providers?

We carried out a thorough analysis based on a number of important criteria that represent value, quality, and dependability for companies of all kinds in order to determine the top bookkeeping service providers in the UK for 2025. In order to provide a fair assessment, our ranking procedure concentrated on both quantitative measurements and qualitative insights.

Here’s what we considered:

- Experience & Expertise: We assess each provider’s credentials, experience, and record of handling bookkeeping for different industries.

- Technology & Tools: Providers with automated or cloud-based solutions that use contemporary accounting software, such as Xero, QuickBooks, or Sage, received higher scores.

- Client Satisfaction: To evaluate client trust, responsiveness, and general satisfaction, customer evaluations, testimonials, and case studies were examined.

- Service Range: We gave preference to companies who’s main focus is bookkeeping services, including financial reporting, tax preparation, payroll, and VAT management.

- Pricing & Value: Scalability for varying business sizes and transparent pricing structures were important considerations in our assessment.

- Compliance & Accuracy: We made certain that every shortlisted company showed a good adherence to HMRC’s regulations and UK accounting standards.

Top 10 Bookkeeping Service Providers in the UK (2026)

Choosing the correct bookkeeping partner can significantly impact your company. Using cutting-edge technology and specialist knowledge, these companies provide professional bookkeeping, tax compliance, and financial reporting services to tiny startups and well-established businesses. Commencing with the well-known Cox Hinkins & Co., we provide our ranking of the top 10 bookkeeping service providers in the UK for 2026.

CoxHinkins & Co

A reputable accounting and bookkeeping company with more than 50 years of experience, Cox Hinkins & Co. is situated in Oxford and serves sole traders, limited businesses, and SMEs throughout the United Kingdom. They provide bookkeeping services that are more than just crunching numbers; they emphasize accuracy, compliance, and useful financial information.

Customers may view their financial data in real time because to their smooth integration with well-known accounting programs like Xero, QuickBooks, Sage, and FreeAgent. The company’s local knowledge and hands-on attitude make it a great option for small and medium-sized enterprises seeking a personal touch and dependability.

Best For: SMEs and family-run companies in the UK seeking a long-term accounting and bookkeeping partner.

Makesworth Accountants

The multi-award-winning London-based company Makesworth Accountants is renowned for its creative use of cloud bookkeeping tools and unwavering client commitment. They provide a broad range of services, from daily transaction administration to VAT returns and management reporting, and specialise in working with startups, contractors, and established firms.

Their bookkeeping services guarantee that clients stay ahead of deadlines and tax responsibilities because they are completely compliant with HMRC requirements.

Best for: Companies situated in London or those that would rather use a single, integrated outsourced bookkeeping and accounting solution.

Rosemary Bookkeeping

Rosemary Bookkeeping is a well-known brand in the UK that only provides small and medium-sized businesses with expert bookkeeping services. They offer a balance between local accessibility and national knowledge through their numerous local offices and franchise partners.

They collaborate closely with accountants to guarantee that your records are constantly prepared for an audit and are experts in effectively processing and maintaining financial data.

Best for: SMEs want trustworthy local bookkeepers with support from across the country.

E2E Accounting

E2E Accounting offers expert bookkeeping services to assist companies in preserving current and correct financial records. Everything is managed by their staff, including monthly reporting, accounts payable, receivable, and daily transaction inputs and bank reconciliations. With the use of cloud software such as Xero, QuickBooks, and Sage, E2E guarantees smooth, instant access to your books. They provide dependable, scalable, and compliant bookkeeping services for small and medium-sized enterprises with clear pricing, robust data security, and committed bookkeepers.

Best for: SMEs with a variety of services at affordable prices.

Parks Bookkeeping Services

The goal of Parks Bookkeeping Services is to make bookkeeping easier for startups and small enterprises. Clients can concentrate on growth while they manage the books thanks to their award-winning strategy, which blends automation and individualized help.

Additionally, they provide a money-back guarantee, demonstrating their faith in the caliber of their services.

Best For: Growing or new companies looking for flexible and trustworthy bookkeeping assistance.

Myiva

Myiva provides small enterprises, independent contractors, and limited organisations with effective online bookkeeping and VAT return services. You may effortlessly upload documents using their safe, paperless system, and their professionals will take care of precise bookkeeping, reconciliations, and on-time VAT submissions. Myiva helps you keep your finances organised and in compliance so you can concentrate on expanding your business. They do this by offering clear pricing and quick turnaround.

Best for: New budding micro-businesses.

Crunch

Crunch is a technologically advanced accounting and bookkeeping software that provides cloud bookkeeping together with customer service. Their solution is ideal for independent contractors, freelancers, and tiny limited businesses because it automates bank feeds, cost monitoring, and invoicing.

Their user-friendly software and knowledgeable accountants make bookkeeping economical and effective.

Best For: Small businesses, startups, and freelancers looking for reasonably priced digital bookkeeping.

BDO UK LLP

One of the biggest accounting companies in the world, BDO UK, provides accounting and bookkeeping services through its business advisory section. They blend strong systems that are appropriate for intricate, expanding organisations with experienced financial knowledge.

Best For: Big businesses or organizations that require business advice services combined with scalable bookkeeping.

Moore Kingston Smith

Moore Kingston Smith offers small and mid-sized companies in a variety of industries outsourced bookkeeping and accounting services. Their staff makes sure customers stay in compliance while taking advantage of management accounts and organised reports.

Best For: Starting businesses and SMEs that require flexible bookkeeping combined with broader financial services.

Meru Accounting

Virtual bookkeeping services are offered by Meru Accounting to companies both domestically and internationally. They provide precise, effective, and reasonably priced bookkeeping services by utilising automation, artificial intelligence, and cloud computing.

Their bookkeeping, payroll, accounts reconciliation, and management reporting services are perfect for businesses wishing to outsource to other countries but still adhering to UK regulations.

Best For: Enterprises looking for a cost-effective, technologically advanced, worldwide virtual bookkeeping solution.

How to Choose the Right Bookkeeping Service for Your Business?

The efficiency with which your organisation operates might be significantly impacted by your choice of bookkeeping solution. When choosing from the wide range of options available, from tech-driven virtual bookkeepers to local accountants, it’s critical to thoroughly consider your demands. You can select the ideal fit for your company by considering the following important factors:

Understand Your Business Needs: Determine what you truly require from an accounting service first. Do you also need management reporting, payroll, and VAT filing, or just transaction recording and bank reconciliation? You can find suppliers who give just what your company needs by knowing your priorities.

Check Their Experience and Expertise: A trustworthy bookkeeper should be aware of the particular financial laws that are relevant to your industry. Seek out companies that have a track record of managing industries like eCommerce, construction, retail, or healthcare.

Look for Technology Integration: The use of digital technologies is essential in modern bookkeeping. Select a solution that offers automation and real-time data access using cloud-based accounting software such as Xero, QuickBooks, or Sage. In addition to increasing accuracy, this facilitates collaboration and saves time.

Evaluate Communication and Support: Effective bookkeeping involves more than just numbers; it also involves communication. Make sure your provider is available when you need them, transparent, and responsive. Inquire about their online dashboards, phone, email, and meeting support options.

Consider Pricing and Value: Make sure you are getting value for your money by comparing price structures. While some suppliers charge on an hourly basis, others provide fixed monthly fees. Don’t base your decision only on price; the least expensive choice could not offer the experience or dependability your company requires.

Read Client Reviews and Testimonials: To see how a supplier operates in actual situations, look through customer feedback and online reviews. Long-term connections, case studies, and positive feedback are all powerful markers of performance and reliability.

FAQs: Frequently Asked Questions

Do solo proprietors and independent contractors benefit from bookkeeping services?

Yes. For sole proprietors, contractors, and independent contractors, numerous vendors supply customised packages. Self-assessment tax preparation, spending tracking, and streamlined bookkeeping are usually among them.

How frequently is it necessary to update bookkeeping?

To make sure your records are up to date, bookkeeping should ideally be completed weekly or monthly. Frequent updates provide you a clear view of your financial situation all year long and make tax filing easier.

How can I evaluate whether my company requires a bookkeeper?

It’s time to hire a bookkeeper if you’re spending more time handling invoices and receipts than expanding your company. Professional bookkeeping is more advantageous for companies with payroll, VAT, or regular transactions.

Conclusion

Reliable and precise bookkeeping is essential for sound decision-making and financial stability in the fast-paced business world of today. It is not just a matter of compliance. A professional accounting service may help you save time, lower stress, and increase profitability, regardless of whether you’re a startup handling your first transactions or an established business trying to simplify operations.

Great bookkeeping companies can be found all around the UK, ranging from tech-driven companies like Crunch and Meru Accounting to more established firms like Cox Hinkins & Co. From automation and cloud-based efficiency to local knowledge and individualized help, each has special advantages.

Finding a provider who not only maintains the balance of your accounts but also supports the confident expansion of your company may be achieved by evaluating your needs, budget, and desired level of engagement.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.