- How to Choose the Best Self-Assessment Tax Return Service Provider

- Benefits of Using a Self-Assessment Tax Return Service

- List of the 10 Best Self-Assessment Tax Return Service Providers in the UK (2026)

- How to File Your Self-Assessment Tax Return with These Providers

- Common Mistakes to Avoid When Filing Self-Assessment Tax Returns

- FAQs: Frequently Asked Questions

- Conclusion

UK freelancers, landlords, company directors, and sole traders must file Self-Assessment tax returns by 31 January—or face automatic £100 HMRC fines, even if no tax is owed. Errors like unreported rental income or ineligible expenses trigger inquiries and penalties up to £900+.

Quick comparison of top 2026 providers:

- CoxHinkins – Personal accountants for straightforward cases

- MyIVA – Digital platform for freelancers (3-5 day turnaround)

- TaxAssist – Local in-person support nationwide

- Crunch – Small businesses & contractors (£95-£124 one-off)

- Fixed Fee Tax Return – Simple filings from £145+VAT

In this guide, you’ll learn how to pick the right Self-Assessment provider (pricing, HMRC know-how, support), key benefits like error-free filing and tax savings, our full top 10 list, step-by-step filing, and mistakes to dodge (£100+ fines). Find your 2026 match and file stress-free!

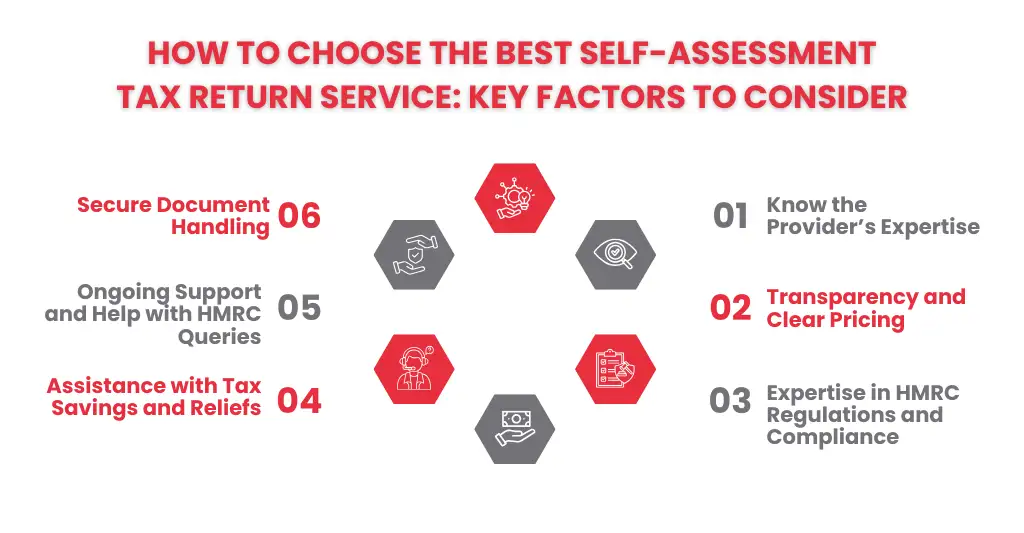

How to Choose the Best Self-Assessment Tax Return Service Provider

Choosing the best self-assessment tax return service provider is a crucial decision. You must be aware of some important factors that are necessary for selecting a service provider. Pricing is not the only factor that you need to consider. First, you need to check whether your service provider is aware of HMRC regulations, accurately manages your revenue and keeps transparency in communication at every step. Search for companies who have a track record of successfully working with directors, landlords, freelancers and sole proprietors, as every other individual has unique tax requirements.

Additionally, it’s critical to confirm if the service covers full HMRC submission on your behalf, tax-saving guidance, and cost reviews. Important signs of a trustworthy supplier include transparent pricing, safe document processing, and continued assistance in the event that HMRC has concerns. Not only do the top Self-Assessment tax return services submit your return, but they also reassure you that it was completed correctly.

Benefits of Using a Self-Assessment Tax Return Service

- Makes sure your self-assessment tax return is correctly filed and compliant with HMRC regulations.

- Minimises the possibility of mistakes, late filing fines, and HMRC inquiries.

- Helps find options for tax savings, reliefs, and acceptable expenses.

- Saves time by taking care of the HMRC submission, calculations, and checks.

- Offers professional assistance and peace of mind in case HMRC requests explanation in the future.

List of the 10 Best Self-Assessment Tax Return Service Providers in the UK (2026)

Your income sources, the twists and turns of your financial situation, and just how much help you need will all depend on which Self-Assessment tax return service you go for. The top 10 Self-Assessment tax return services in the UK for 2026 are listed below, and they include modern online platforms alongside good old-fashioned accounting firms.

CoxHinkins

CoxHinkins is a big name in UK accounting that offers self-assessment tax return services to individuals, sole traders, property owners and company directors. Their way of doing things is all about getting it right, following the rules and giving you your own personal tax expert to turn to – making them a good fit for taxpayers with straightforward or moderately complicated tax situations. You’ll get instant access to a real accountant, and help with any queries you have with HMRC too.

MyIVA

MyIVA is a digital-first tax and accounting solution developed for individuals who desire a straightforward, systematic manner to manage Self Assessment. The software combines guided data gathering with expert monitoring, allowing individuals to file accurately while remaining compliant with HMRC rules. MyIVA is particularly suited to freelancers, sole traders, and individuals looking for an economical, streamlined alternative to established accounting services.

TaxAssist Accountants

TaxAssist is a worldwide network of accounting businesses that provide self-assessment services with local support. Their accountants assist clients with calculating tax liabilities, reviewing expenses, and ensuring returns are filed on schedule. This option is ideal for people who prefer in-person help in addition to professional tax advice.

Crunch

Crunch offers online accounting and self-assessment services backed by trained accountants. The software is intended at freelancers, contractors, and small business owners who require ongoing accounting support in addition to submitting annual tax returns. Crunch also provides information on acceptable expenses and tax efficiency

Perrys Accountants

Perrys Accountants provides Self-Assessment services to a wide range of clients, including directors, landlords, and high earners. Their solution includes tax calculations, compliance checks, and continuing help, making it ideal for anyone with complex personal tax needs.

Fixed fee tax return

Fixed Fee Tax Return focuses on simple Self-Assessment submissions at fixed, clear fees. Individuals looking for cost certainty and professional filing without long-term accounting commitments can benefit from this service.

Gorilla Accounting

Gorilla Accounting offers online self-assessment services backed by qualified accountants. The firm prioritises ease of use and fast filing, making it a popular alternative for single traders and freelancers seeking clear counsel without additional complication.

UK Tax Accountant

UK Tax Accountant provides nationwide Self-Assessment service to individuals with both simple and complex tax concerns. Their services frequently include tax planning advice and aid with HMRC questions, making them ideal for high-income earners or individuals with several income streams.

The Tax Owl

The Tax Owl offers low-cost Self-Assessment tax return services, which are popular among first-time filers, sole traders, and landlords. The service focuses on precise submission and straightforward communication, with pricing designed to be reasonable.

Initor global

Initor is a company that specialises in outsourced self-assessment tax return preparation, primarily supporting UK accounting practices and businesses with high volume of returns. Initor Global is most known for its scalable delivery model, strong data security standards, and compliance with UK tax regulations. It is particularly suitable for firms or individuals managing multiple returns or seeking professional outsourcing support rather than direct-to-consumer tax software.

How to File Your Self-Assessment Tax Return with These Providers

- Share your details: Begin by entering basic personal information, income sources, and HMRC login credentials using the provider’s secure portal or onboarding form.

- Upload income and expense records: Submit invoices, bank statements, rental revenue data, and expense records so that the accountant can accurately evaluate your figures.

- Tax review and calculations: To ensure accuracy and tax efficiency, the supplier verifies your information, calculates your tax bill, and determines any permissible expenses or reliefs.

- Approval before submission: Before submitting the completed Self-Assessment tax return to HMRC, you check it, ask any queries you may have, and approve it.

- HMRC submission and ongoing support: Once approved, the provider submits your return with HMRC and stays accessible to assist you if HMRC has any follow-up inquiries.

Common Mistakes to Avoid When Filing Self-Assessment Tax Returns

- Missing HMRC deadlines: Filing late means missing HMRC’s 31 January deadline to submit your Self-Assessment tax return. HMRC issues an automatic £100 penalty purely for late submission, even if you owe no tax or are due a refund. The penalty is for missing the filing deadline, not for unpaid tax. Further penalties apply if the delay continues.

- Incorrect income reporting: One of the most frequent reasons for HMRC inquiries is the failure to report additional income, such as dividends, rental income, or freelance work.

- Claiming ineligible expenses: If personal or non-allowable costs are claimed, HMRC may make changes, impose penalties, or conduct additional investigation.

- Poor record keeping: Incomplete paperwork, unclear bank data, or missing invoices might cause filing delays and raise the possibility of mistakes.

- Not checking the return before submission: Always carefully check the return before submitting it because even small errors in numbers or personal information might lead to needless problems.

FAQs: Frequently Asked Questions

Can I change my self-assessment tax return once it has been filed?

If you find a mistake after submitting your Self-Assessment tax return, you can correct it online within a year after the deadline is over.

Does self-assessment require an accountant?

Hiring an accountant is not legally mandatory. But you can seek expert assistance to lower mistakes, find tax breaks, and confidently handle HMRC compliance.

Is it safe to file for a self-assessment online?

Yes, trustworthy companies employ encryption and secure portals to safeguard your information when you electronically submit your return to HMRC.

Conclusion

In this blog, we have understood about how to choose the best self-assessment tax return service provider. What are the benefits of working with a service provider? Self-assessment tax returns don’t have to be difficult or stressful to file. If you feel filing a self-assessment tax return is a tough task you can take the help of an experienced service provider mentioned in this blog.

It will surely help you to avoid frequent errors and penalties and make sure your return is accurate, and timely by working with the right service provider. Selecting a trustworthy supplier can save time, lower risk, and provide you with peace of mind. In 2026 and beyond, the above mentioned companies provide reliable choices to assist you in confidently managing your self-assessment.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.