- What Are Allowable Business Expenses Under HMRC Rules?

- Complete List of Common Allowable Business Expenses for Limited Companies

- Mixed-Use Expenses: How to Split Personal and Business Costs Correctly

- Claiming Capital Allowances on Larger Business Purchases

- Simplified vs Detailed Expense Claims: Which Method Applies to Limited Companies?

- Record-Keeping Rules: Receipts, Evidence, and HMRC Compliance

- Can You Claim Business Expenses Without Receipts? What HMRC Allows

- Step-by-Step: How to Claim Business Expenses for Your Limited Company

- How Far Back Can You Claim Business Expenses in the UK?

- Common Mistakes Directors Make When Claiming Limited Company Expenses

- HMRC-Approved Business Expenses Checklist

- FAQs: Frequently Asked Questions

- Conclusion

Struggling with claiming business expenses in UK? Many limited company directors overpay £2,500+ in tax each year by missing HMRC allowances. A single mix-up, like blending personal and business costs, leads to rejected claims, fines, or audits

Following Autumn Budget 2025, corporation tax is 19% for profits under £50k, 25% above £250k (sliding scale between). You can claim costs that are entirely for business purposes. Examples include office rent, employee salaries and employer NI contributions, business travel at 45p per mile, accountant fees, marketing for your website, and accounting software. For mixed home use, apportion fairly, for instance, 50% of broadband, and retain receipts for 6 years.

This guide provides clear lists of allowable and non-allowable expenses, advice on splitting shared costs, capital allowance rules, record-keeping essentials, a step-by-step claiming process, common mistakes to avoid, and FAQs. Claim confidently and reduce your tax liability without HMRC issues.

What Are Allowable Business Expenses Under HMRC Rules?

Allowable business expenses are costs your limited company incurs wholly and exclusively for trade purposes, per HMRC’s Corporation Tax rules (BIM37000). They directly reduce your taxable profits before the 19% corporation tax applies. But they must pass strict tests and you need solid records.

Allowable business expenses for a limited company must meet certain standards, according to HMRC. Simply said, the costs must be directly tied to running the firm. Here is how HMRC defines and applies the rules.

- Wholly and exclusively for business use: Spend must be 100% work-related.

- Necessary for running the company: The expenditure should be necessary to operate, manage, or expand the firm, not unnecessary personal spending.

- Directly linked to business activity: Expenses must be clearly related to the company’s work, services, or operations. No personal expenses should be included in it.

- No private benefit to directors or employees: If an expense delivers a personal benefit, it may be classified as a benefit in kind and taxed accordingly.

- Proper records must be kept: If HMRC requires evidence, each claim must be supported by receipts, invoices, and clear descriptions.

- Claimed through the company accounts: Allowable expenses reduce your company’s taxable profits before corporate taxes are determined.

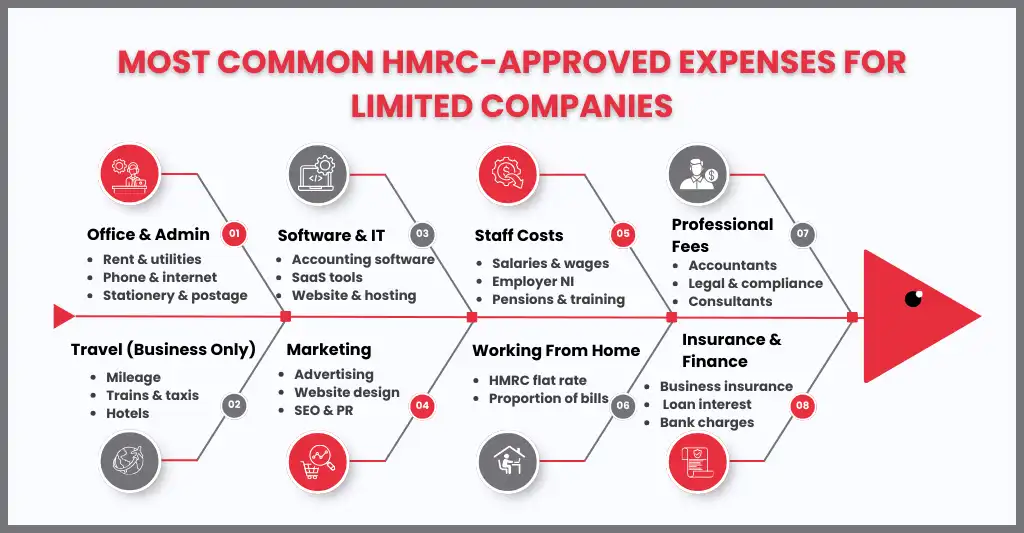

Complete List of Common Allowable Business Expenses for Limited Companies

HMRC permits Ltd companies to claim a wide range of costs as long as they are incurred solely for business purposes. The following is a realistic list of the most typically authorised business expenses for limited liability corporations, organised for clarity.

Office & Administration Costs

- Office rent and service charges

- Utilities (electricity, gas, water for business premises)

- Internet and business telephone costs

- Office supplies and stationery

- Postage, printing, and courier charges

Software, IT & Subscriptions

- Accounting software (e.g. bookkeeping and payroll systems)

- Business-related software licences and SaaS tools

- Cloud storage and cybersecurity services

- Website hosting, domains, and maintenance costs

Staff & Employment Costs

- Employee salaries and wages

- Employer National Insurance contributions

- Pension contributions

- Recruitment and training costs

- Staff uniforms and protective clothing

Professional & Legal Fees

- Accountant and bookkeeper fees

- Legal and compliance costs

- Business consultancy and advisory fees

- Company formation and secretarial services

Travel & Transport (Business Only)

- Business mileage (at HMRC-approved rates)

- Public transport, taxis, and parking for business journeys

- Hotel accommodation for work-related trips

- Vehicle running costs (if the car is owned by the company)

Marketing & Advertising

- Website design and development

- Online and offline advertising

- Branding, design, and content creation

- PR, SEO, and digital marketing services

Working From Home (Directors)

- HMRC-approved home office allowance

- Proportion of household costs (where applicable)

Insurance & Finance Costs

- Professional indemnity insurance

- Employers’ and public liability insurance

- Business loan interest and bank charges

Other Allowable Costs

- Business-related memberships and subscriptions

- Health and safety expenses

- Trade journals and industry publications

Claiming these charges appropriately has the potential to substantially decrease your company’s taxable profits. However, HMRC may restrict or challenge expenses for personal use or questionable business rationale, so good records and clear explanations are vital

Mixed-Use Expenses: How to Split Personal and Business Costs Correctly

Mixed-use expenses are those that are used both for work and for personal reasons. HMRC enables limited corporations to claim certain expenses, but only the commercial portion. One of the most common reasons expense claims are challenged is that they are not completed correctly.

Here’s how to handle mixed-use expenses correctly and stay compliant:

Claim only the business-related percentage

- You must determine a reasonable and justifiable division between commercial and personal use. HMRC does not tolerate estimations without a strong foundation.

Use a consistent and logical method

- The split should be calculated in the same manner each month or year.

Common mixed-use expenses HMRC reviews closely

- Mobile phones used for work and personal calls

- Home broadband and utilities

- Working from home costs

- Vehicles used for both business and private travel

Working from home (Ltd company directors)

- Claim the HMRC flat rate allowance, or

- Allocate household bills like energy, heating, and council tax based on business use.

Keep evidence to support the split

- Call logs, mileage data, usage estimations, and floor-space calculations should be saved in case HMRC requests justification.

Avoid claiming personal costs through the company

- Expenses that provide significant personal advantage may be rejected or classified as benefits in kind, resulting in higher tax and national insurance.

Claiming Capital Allowances on Larger Business Purchases

HMRC requires limited corporations to claim expenditures for major company acquisitions as capital allowances rather than day-to-day expenses.

What counts as a capital purchase?

Assets that are expected to be used in the business for more than one year, such as:

- Computers, laptops, and office equipment

- Machinery and tools

- Company vehicles (with specific rules)

- Fixtures and fittings

Annual Investment Allowance (AIA): Most plant and machinery is eligible for the AIA, which allows limited companies to claim 100% of the cost in the year of purchase, up to the HMRC yearly limit.

Mixed-use assets: If an asset is utilised partially for personal purposes, capital allowances must be limited to the business-use portion solely.

Special rules for company cars: Cars are treated differently and are usually not eligible for AIA. The allowance varies based on the vehicle’s CO₂ emissions, limiting the amount claimed annually.

Keep clear asset records: Invoices, purchase dates, and business-use rationale should be kept to back up the claim.

Simplified vs Detailed Expense Claims: Which Method Applies to Limited Companies?

Limited corporations can claim expenditures using either simplified or comprehensive expense claims, although the regulations are stricter than for sole traders

Simplified expenses (limited use for Ltd companies)

HMRC allows simplified expenses mainly for:

- Working from home (flat rate allowance)

- Business mileage using HMRC-approved rates

What simplified expenses do NOT cover

Ltd companies cannot use simplified expenses for:

- Rent or mortgage interest

- Council tax

- General household bills beyond the approved home-working rate

Detailed expense claims

Required for most other costs, including:

- Office expenses and utilities

- Equipment and software

- Professional fees and subscriptions

- Travel and accommodation

Evidence requirements

- Detailed claims must be supported by invoices and receipts showing the business purpose.

Choosing the right method

- Most Ltd companies use a mix of both, applying simplified rates where HMRC permits and detailed claims everywhere else.

Record-Keeping Rules: Receipts, Evidence, and HMRC Compliance

Accurate record-keeping is required when claiming business costs for a limited corporation. HMRC demands detailed proof to back up every claim, and poor recordkeeping is one of the most common reasons expenses are denied.

- Keep all receipts and invoices: Every expense should be accompanied by a legitimate receipt or invoice that specifies the supplier, date, amount, and business reason.

- Digital records are acceptable: HMRC accepts scanned or digital copies, as long as they are clear, comprehensive, and easily accessible.

- Maintain mileage and usage logs: Business mileage, home working, and mixed-use expenses must be documented with consistent records or calculations.

- Explain the business purpose: Include comments clarifying how travel, meals, and mixed-use charges relate to business activity.

- Retention period matters: Records must be retained for a minimum of six years in case HMRC demands evidence during a review or investigation.

- Accuracy protects against penalties: Incomplete or absent records might result in prohibited expenses, fines, and interest, even if the expense was valid.

Can You Claim Business Expenses Without Receipts? What HMRC Allows

HMRC expects receipts for the majority of business expense claims, but there are few exceptions where claims may be granted without them, provided the charges are fair and adequately documented.

- Receipts are the standard requirement: HMRC’s default position is clear: cost claims should be supported by receipts or invoices whenever possible.

- Small or incidental expenses: Minor expenses may be accepted without a receipt provided they are uncommon, acceptable, and clearly business-related.

- Mileage claims are an exception: Business miles can be claimed using HMRC’s approved rates even without fuel receipts, as long as precise mileage logs are kept.

- Bank statements alone are not enough: A payment transaction does not replace a receipt; without adequate documentation, HMRC may deny the expense.

- Higher risk of HMRC challenge: Claims made without receipts are more likely to be questioned and denied during an investigation.

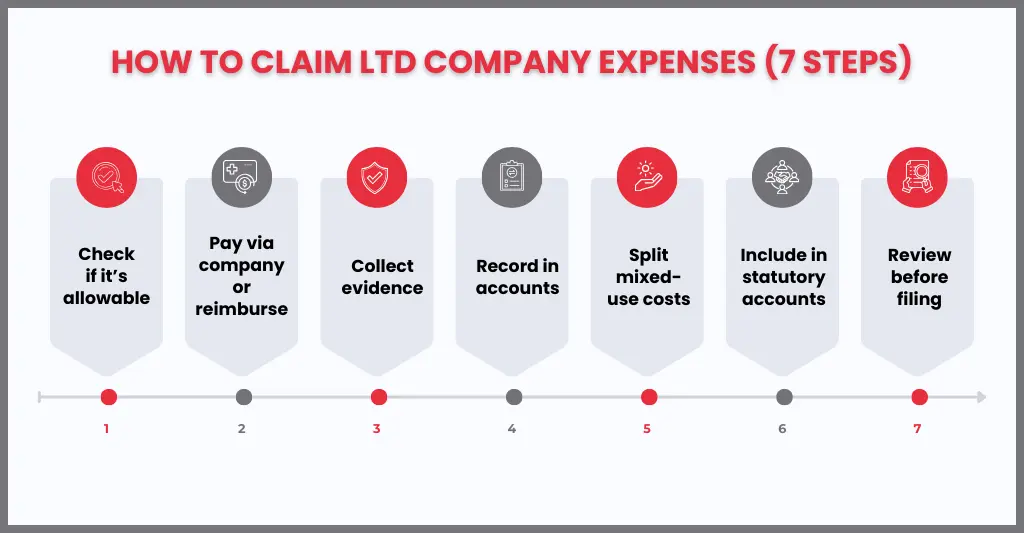

Step-by-Step: How to Claim Business Expenses for Your Limited Company

Claiming business costs for a limited company is more than just lowering taxes; it is also about doing it effectively and legally. Here’s a more detailed and practical explanation of how the process works.

Confirm the expense is allowable: Before claiming anything, ensure that the cost was expended solely for company purposes. If there is a personal benefit, HMRC may restrict or deny the claim. Mixed-use expenses can only be claimed for the business portion.

Pay the expense the right way:

Expenses can be paid: Directly from the company’s bank account,

- Individually by a director or employee and then compensated by the firm

- Personal payments should always be reimbursed on time and accurately recorded.

Collect and store evidence: Keep invoices, receipts, mileage logs, and supporting notes that clearly demonstrate why the spending is necessary for the firm. Digital copies are permitted provided they are clear and full.

Record the expense in your accounts: Enter the expense into your accounting software’s appropriate category (e.g., travel, software, professional fees). Accurate categorisation is critical for reporting and tax purposes.

Apportion mixed-use expenses correctly: Calculate a fair and consistent split for expenses that are both personal and business-related, such as home working, mobile phones, and vehicles. Only the business portion should be reflected in the company accounts.

Include expenses in statutory accounts: Allowable expenses diminish your company’s profit before corporate taxes are applied. Incorrect or unsubstantiated claims may be removed during HMRC reviews or checks.

Review claims before submission: Before filing accounts and a corporate tax return, ensure that all costs are reasonable, supported by documentation, and HMRC-compliant.

How Far Back Can You Claim Business Expenses in the UK?

HMRC enables limited corporations to claim business expenditures retrospectively, but only under certain time limitations and circumstances.

- Before your company started trading: Certain pre-trading expenses incurred in the seven years prior to trade can be claimed, as long as they were entirely for the purpose of establishing the business.

- After the company started trading: Once trading begins, costs must be claimed in the appropriate accounting period. If a cost is missed, it can usually be fixed in the next set of accounts or by filing an amended return.

- Amending corporation tax returns: A corporation’s tax return can usually be revised within 12 months of the filing date, allowing missed expenses to be included.

- Records must still exist: Even when claiming in the past, appropriate receipts, invoices, and evidence are required.

- No blanket backdated claims: Expenses from previous years cannot be claimed randomly without necessary accounting adjustments or HMRC permission.

Common Mistakes Directors Make When Claiming Limited Company Expenses

Even experienced directors may make mistakes when claiming expenditures through a Limited business. Many of these blunders result in HMRC challenges, and are completely avoidable.

- Claiming personal expenses as business costs: Everyday goods like groceries, clothing, and family travel are frequently processed inaccurately by the corporation.

- Ignoring the “wholly and exclusively” rule: Expenses for both personal and corporate use are claimed in full rather than being properly allocated.

- Incorrect treatment of director expenses: Reimbursing directors without sufficient documentation or consent may result in compliance difficulties.

- Poor or missing receipts: Claiming expenses without acceptable evidence is one of HMRC’s quickest ways to reject costs.

- Misclassifying capital purchases: Large assets are improperly reported as day-to-day expenses rather than capital allowances.

- Forgetting about benefits in kind: Personal benefits granted by the firm are not accurately reported, resulting in increased tax and NIC liabilities.

- Overclaiming home working costs: Using misleading percentages or claiming residential expenses without a valid business reason.

- Forgetting about benefits in kind: Personal benefits granted by the firm are not accurately reported, resulting in increased tax and NIC liabilities.

HMRC-Approved Business Expenses Checklist

Use this checklist to rapidly assess if a business expense is likely to be allowed under HMRC guidelines for a limited company.

- Wholly and exclusively for business use: The expense is necessary for the company’s operations and provides no personal gain.

- Clearly linked to business activity: There is a direct relationship between cost and the company’s operations, services, or revenue generating.

- Proper evidence available: Valid receipts, invoices, mileage logs, or usage records are kept.

- Correctly categorised in accounts: The expense is reported in the appropriate accounting category.

- Director and staff expenses documented: Reimbursements are evidence-based and appropriately approved.

- Included in the correct accounting period: Expenses are claimed in the appropriate year or properly adjusted if missed.

- Retained for HMRC review: Records are stored securely for at least six years

FAQs: Frequently Asked Questions

Do I need receipts for all business expenses?

HMRC expects receipts for the majority of its expenses. Mileage claims and simplified working-from-home allowances are two examples of limited exclusions. Claims submitted without receipts are more likely to be disputed.

Are meal and entertainment charges allowable?

Business meals during work-related travel may be allowed. Client entertainment, on the other hand, is not tax deductible for corporate tax purposes, despite the fact that it must be reported in the records.

How far back can I file a claim for business expenses?

Pre-trading expenses may be claimed up to seven years before trading begins. Missed expenses for trading periods can be added through updated accounts or tax returns, subject to HMRC deadlines.

Conclusion

Claiming business costs for your limited company is one of the simplest methods to lower your tax bill, but only if done correctly. HMRC’s regulations are straightforward, but they are frequently misunderstood, and little errors can easily turn valid claims into compliance concerns.

Directors can stay compliant while taking full use of available reliefs by understanding what constitutes an allowed expense, effectively handling mixed-use costs, maintaining excellent records, and following the right claiming process. The goal is to strike a balance: claim what you’re entitled to without pushing personal costs through the company or relying on guessing.

If you are unsure if an expense is allowable or how it should be handled, seeking professional advice early on can save you time, money, and unnecessary HMRC attention later. When expenses are accurately claimed, they become a powerful tool rather than a risk for your limited company.