- What Does Claiming VAT Back Actually Mean?

- When Can You Claim VAT Back?

- Why Is Reclaiming VAT Important for Businesses?

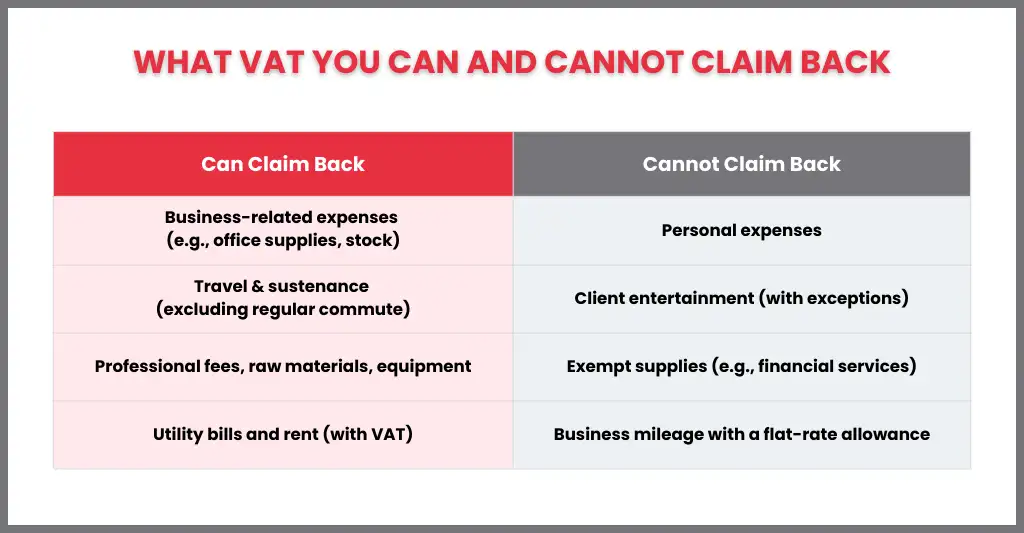

- What VAT You Can and Cannot Claim Back?

- How Far Can You Claim VAT Back?

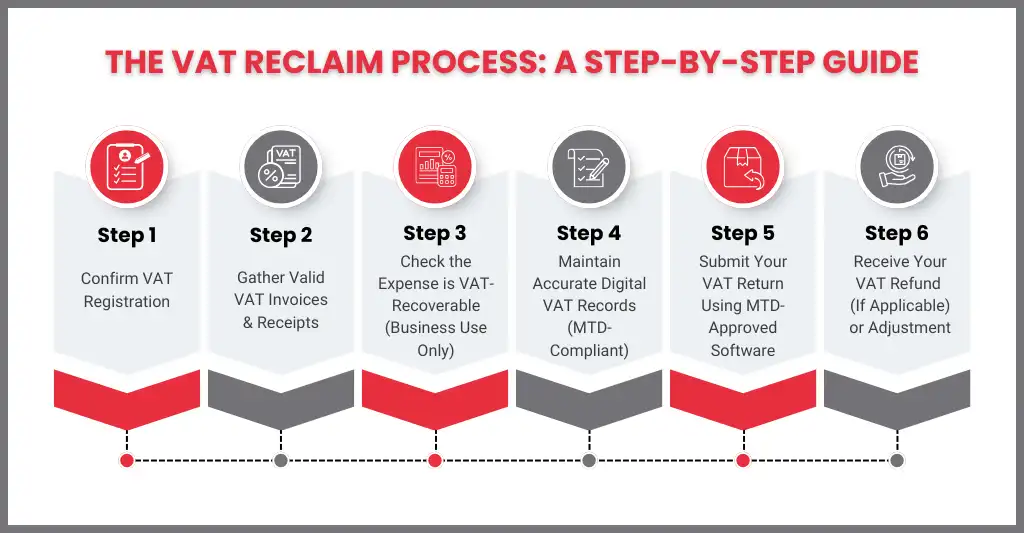

- How to Claim VAT Back in Practice (Step-by-Step)?

- HMRC and MTD Requirements When Claiming VAT Back

- Common Mistakes to Avoid When Claiming VAT Back

- When Should You Get Help with Claiming VAT Back?

- Frequently Asked Questions

- Conclusion

Claiming VAT back in the UK is a good advantage for businesses to boost cash flow, but errors are widespread, and HMRC inspection is very strict. The criteria for reclaiming VAT are detailed and frequently misunderstood, from determining who is eligible to do so to knowing which expenses qualify and how far back you may go. Businesses who reclaim VAT wrongly face delays, penalties, or rejected claims, but those that do it correctly can recover significant amounts of money.

This blog explains how to claim VAT back in the UK in easy, practical terms. We will understand the essential rules, reclaim limits, allowable expenses, and HMRC criteria you must follow to stay compliant. Whether you own a small business, a growing firm, or are a VAT-registered professional, this blog will teach you how to correctly recover VAT, avoid frequent mistakes, and deal with HMRC with confidence.

What Does Claiming VAT Back Actually Mean?

Claiming VAT back means reclaiming the VAT that your VAT-registered business has paid on qualified business costs from HMRC. When you file your VAT return, you compare the VAT you paid on purchases (input VAT) to the VAT you charged consumers (output VAT).

If input VAT is more than output VAT, HMRC will reimburse the difference. VAT can only be reclaimed for eligible business expenses that are backed by legitimate VAT invoices and sufficient records.

When Can You Claim VAT Back?

If your business is VAT-registered and the expenses are for taxable business activities, you can claim VAT back. VAT is normally reclaimed when you submit your VAT return, which might be quarterly or annual depending on your scheme.

You may also claim VAT:

- On business purchases made after VAT registration

- On certain costs incurred before registration (within HMRC time limits)

- When you hold a valid VAT invoice or receipt

VAT cannot be reclaimed on exempt supplies, personal expenses, or in cases where HMRC rules specifically prohibit recovery.

Want to know how to register for VAT? Read our detailed guide: How to Register for VAT

Why Is Reclaiming VAT Important for Businesses?

Reclaiming VAT enables businesses to get money back that is already spent on legitimate business expenses. It enhances cash flow and overall profitability of the business. Without reclaiming VAT, costs are essentially higher, which can lower margins and limit expansion.

Accurate VAT reclaims also help businesses stay HMRC-compliant, decrease the risk of fines, and ensure financial records reflect the exact cost of operations. For many UK businesses, prompt VAT recovery can significantly improve working capital and cash management.

What VAT You Can and Cannot Claim Back?

You can claim VAT back on:

- Goods and services purchased only for business usage

- Office expenses, equipment, and professional fees

- Travel and sustenance (without regular commute)

- Stock and Raw Materials

- Utility bills and rent (with VAT)

You cannot usually claim VAT back on:

- Personal or non-business expenses.

- Client entertainment (with some exclusions)

- Exempt Supplies

- Business mileage with a flat rate allowance

- Purchases made without a valid VAT invoice.

Only VAT that is directly related to taxable business activity and meets HMRC paperwork requirements can be recovered.

How Far Can You Claim VAT Back?

HMRC permits reclaiming VAT on costs within 4 years from the end of the relevant VAT period’s due date (for post-registration input tax errors) or 4 years from the period end (overpaid output tax). Pre-registration:

- Up to four years for assets you still possess (such as equipment or stock).

- Up to six months for services received prior to registration.

All claims require valid VAT invoices and proof of taxable business use. Claims exceeding these time limits or lacking proper evidence will be rejected.

How to Claim VAT Back in Practice (Step-by-Step)?

- Make sure your business is VAT-registered: VAT can only be reclaimed once your business has been formally registered with HMRC. Any VAT incurred prior to registration can only be claimed if it is within HMRC’s pre-registration time constraints.

- Gather valid VAT invoices and receipts: Before claiming for VAT it is mandatory that you maintain every receipt and invoice. HMRC demands sufficient evidence for every VAT reclaim. The invoices you have submitted must contain the supplier’s VAT number, invoice date, VAT amount, and information on the goods or services purchased. VAT cannot be reclaimed in the absence of valid invoices.

- Confirm the expense is VAT-recoverable: Check that all costs are directly related to your taxable company activity. VAT cannot be reclaimed on personal expenses, exempt supplies, or restricted items like most client entertainment.

- Record VAT accurately in your accounts: In order to comply with Making Tax Digital criteria, input VAT (VAT paid) and output VAT (VAT charged) must be appropriately recorded and maintained in digital form.

- Submit your VAT return to HMRC: When filing your VAT return, mention both the total input VAT you are recovering and the output VAT you owe. Returns are typically submitted quarterly with MTD-compatible software.

- Receive your VAT refund or adjustment: If you have paid more VAT than you have charged, HMRC will reimburse the difference to your bank. If not, it is deducted from your VAT responsibility.

HMRC and MTD Requirements When Claiming VAT Back

HMRC expects firms to comply with Making Tax Digital (MTD) for VAT. This indicates:

- VAT records must be maintained online.

- VAT returns must be submitted using MTD compliant software.

- Manual submissions through the previous HMRC portal are no longer accepted.

- There must be digital links between records and VAT returns.

Failure to follow MTD regulations can lead to rejected returns, penalties, or delayed refunds. When claiming VAT, you must use compliant software and keep clear digital records.

Common Mistakes to Avoid When Claiming VAT Back

Claiming VAT back will increase your bank balance to some extent, but minor mistakes frequently result in rejected claims, delays, or penalties. Here are the most common errors UK companies should avoid:

- Reclaiming VAT without a valid VAT invoice: You must have a valid VAT invoice including the supplier’s VAT number, invoice date, and VAT amount. Bank statements or pro forma invoices are insufficient.

- Claiming VAT on non-allowable expenses: Most corporate entertainment, personal expenses, and some company transportation costs are either limited or not reclaimable at all.

- Reclaiming VAT before VAT registration: According to HMRC’s rule VAT can only be reclaimed after registration, with the exception of some pre-registration fees that meet HMRC requirements.

- Mixing personal and business expenses: Claiming VAT on costs that are partly or entirely personal is not acceptable to HMRC and can result in investigations.

- Using the wrong VAT scheme: Businesses on the Flat Rate Scheme users cannot reclaim input VAT on most purchases (except capital assets >£2,000); VAT is accounted via flat percentage on turnover only.

- Incorrect VAT calculations: Even minor calculation errors can result in differences between your records and your VAT return.

- Poor record-keeping under Making Tax Digital (MTD): HMRC expects you to maintain proper digital records and use good compatible software. Otherwise, VAT claims may be invalidated due to manual errors or missing digital links.

- Missing VAT return deadlines: If you want to get a refund on time don’t forget the deadlines. Late VAT returns can cause refunds to be delayed and may incur surcharges or penalties.

When Should You Get Help with Claiming VAT Back?

Many businesses handle routine VAT reclaims on their own, but there are some cases when professional assistance can save time, decrease risk, and prevent costly mistakes. Consider obtaining help claiming VAT back if:

- Your VAT position is complex: When dealing with partial exemption, mixed commercial and personal use, imports/exports, or cross-border VAT, errors are easy to make without specialised understanding.

- You’re newly VAT registered: First-time VAT registration sometimes generates concerns regarding pre-registration fees, proper VAT handling, and establishing compliance records from the start.

- You’re unsure what VAT is reclaimable: If you are unsure about prohibited expenses (such as vehicles, entertainment, or home-office charges), seek professional assistance to avoid filing incorrect claims.

- You use a specific VAT scheme: Businesses using the Flat Rate Scheme, Cash Accounting Scheme, or Annual Accounting Scheme frequently have the reclamation limitations that must be carefully managed.

- HMRC has queried or rejected a VAT claim: If you have received an HMRC enquiry, assessment, or delayed return, experienced accountants can help you reply effectively and avoid further investigation.

- VAT refunds are material to your cash flow: When VAT reclaims account for a major portion of your working capital, accurate and timely submissions become vital to corporate stability.

- You are struggling with MTD Compliance: If digital record-keeping, VAT software, or digital links are causing difficulties, get assistance to ensure your VAT returns fulfill HMRC’s MTD criteria.

Frequently Asked Questions

How Can I Claim VAT Back Efficiently?

You can claim VAT back efficiently by preserving valid VAT invoices, digitally recording all expenses using MTD-compliant software, ensuring that costs are VAT-recoverable, and filing accurate VAT returns on time.

Can I Claim VAT Back on International Purchases?

Yes, you can claim VAT back on certain international purchases, but only if the UK VAT was correctly charged and the expense is related to your taxable business activity. Import VAT can also be reclaimed if you have the necessary customs and VAT documentation.

Can I claim VAT back as a sole trader?

Yes, a single trader can claim VAT back if they are VAT-registered and the expenses are primarily for taxable business activities, as evidenced by legitimate VAT invoices.

How much VAT can I claim back?

You can reclaim the VAT you paid on qualified business costs. The amount depends on your purchases and VAT return information. VAT can be reclaimed on products and services used for taxable business activity, with the exception of personal or non-business expenses.

Can I reclaim VAT without an invoice?

No, VAT cannot be reclaimed without a proper invoice. HMRC demands a VAT invoice that includes the supplier’s VAT number, invoice date, and amount paid.

Can charities claim back VAT?

Yes, charities can claim VAT back on certain purchases, but only if they are VAT-registered and the expenses are directly tied to their charity activity. Charities may also seek for VAT exemption or refunds through specific schemes, such as the VAT Refund Scheme for Charities

Conclusion

Claiming VAT back in the UK can be a really effective way to give your cash flow a much-needed boost, but only if you get it right, and stick to HMRC’s rules and regulations. It all comes down to knowing what VAT you can actually get back, having all your legitimate invoices in order, not missing out on time limits – and also making sure you’re up to speed on Making Tax Digital. Mess any of these up, and you could end up with rejected claims, delays or even the threat of fines.

You just need to be clear with the process and accurate paperwork. But if you are doing complex deals, have a specific VAT arrangement in place or rely heavily on getting your VAT back, it’s probably worth bringing in the experts. Not only can they help you avoid trouble, but also save time and money by cutting down on the risk of mistakes and delays.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.