- What are Service Charge Accounts?

- What Should be Included in Service Charge Accounts?

- Why is Yearly Year-End Service Charge Preparation Essential for Smooth Accounting?

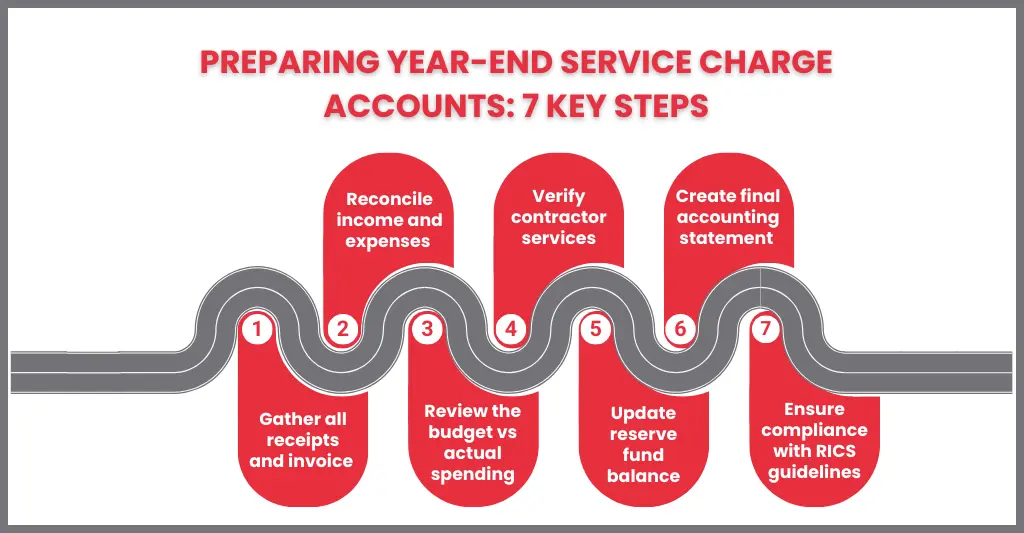

- Key Steps in Preparing for Year-end Accounts

- Best Practices for Transparent and Efficient Service Charge Management

- Understanding Year-End Service Charge Adjustments and Your Rights as a Leaseholder

- Common Pitfalls to Avoid During the Year-end Process

- How CoxHinkins can help you file Service Charge Year-end Accounts?

- Frequently Asked Questions

- Conclusion

The service charge is the quiet system that maintains everything in order behind every well-functioning residential building. It plays a crucial role in year-end service charge accounting, supporting the tiny but essential services that inhabitants depend on daily, such as the cleaners who arrive before sunrise, the maintenance team that fixes what breaks, and the insurance that protects the property

All of these dynamic components come together at an important moment as the year is about to end. A year’s worth of activity must be converted into visible service charge accounts by block managers, landlords, and real estate brokers. Additionally, even while the process can feel burdened by papers, deadlines, and compliance regulations all at once. It is also a strong chance to prove reliability and build trust in how the building is being managed and how service charge funds are being used.

This guide ensures that your service charge accounts are correct, clear, and submitted on time by guiding you through the year-end phase.

What are Service Charge Accounts?

The yearly statements, known as service charge accounts, record the expenditures of the money collected from leaseholders for service charges. They help maintain openness between landlords, managing agents, and leaseholders by outlining all revenue and expenses for the building, including maintenance, utilities, insurance, cleaning, and repairs.

What Should be Included in Service Charge Accounts?

Service charge accounts should provide a clear breakdown of all money collected and spent during the year. Typically, they include:

- Opening and closing balances

- Total service charge income received

- A detailed list of all expenses (cleaning, repairs, insurance, utilities, maintenance)

- Reserve or sinking fund contributions and movements

- Comparison of budgeted vs actual costs

- Any surplus or deficit for the year

These elements give leaseholders full visibility of how their service charge funds have been managed.

Why is Yearly Year-End Service Charge Preparation Essential for Smooth Accounting?

Preparing year-end service charges guarantees precise recording, reconciliation, and reporting of all revenue and expenses. It assists property brokers, landlords, and block managers in providing transparent, compliant accounts that tenants can rely on. In addition to lowering mistakes and preventing disagreements, proper year-end planning facilitates budget planning for the following year and maintains efficient financial management.

Key Steps in Preparing for Year-end Accounts

Accurate record-keeping and sound organisation are necessary for preparing service charge year-end accounts. Key actions consist of:

- Gather all of the receipts and invoices for the entire accounting period.

- To make sure every transaction is accurately documented, reconcile income and expenses.

- Examine the budget and actual spending to find and explain the differences.

- Verify that services were provided as billed by looking through contractor contracts and maintenance documents.

- Contributions and withdrawals should be updated in reserve or sinking fund balances.

- Create the final accounting statement that displays revenue, expenses, and any surplus or deficit.

- Before providing accounting to leaseholders, make sure that the Royal Institution of Chartered Surveyors (RICS) and lease criteria are met.

These procedures assist you in appropriately closing the year and maintaining honesty with all parties involved.

Best Practices for Transparent and Efficient Service Charge Management

Clear communication, precise financial tracking, and robust compliance are the cornerstones of effective service charge management. Block managers, landlords, and real estate brokers can preserve confidence and ensure seamless year-end accounting by adhering to these best practices:

- Keep detailed and organised records: Keep all contracts, invoices, receipts, and maintenance reports organised. A well-structured record lowers the possibility of missing or inaccurate information and speeds up year-end reconciliation.

- Communicate regularly with leaseholders: Provide information on scheduled maintenance, ongoing repairs, and budget use. Leaseholders are better able to understand how their contributions are being used when there is clear communication.

- Review budgets throughout the year: Track spending in comparison to planned expenses to spot irregularities early. Frequent reviews enable you to modify plans if expenses alter and avoid surprises at year’s end.

- Follow RICS and Lease Compliance: The RICS Service Charge Residential Management Code should serve as a guide. Maintaining your accounts compliant and increasing transparency are two benefits of making sure your procedures follow UK regulations.

- Monitor Contractor Performance: Keep track of whether services are provided at the agreed-upon price, on schedule, and in accordance with the specifications. Accurate reporting and value for money are ensured by strong contractor control.

- Maintain Healthy Reserve or Sinking Funds: Make contributions to pay for ongoing maintenance, including structural improvements, lift servicing, and roof repairs. Reserves that are well-managed lessen leaseholders’ unexpected financial burdens.

- Conduct Periodic Internal Checks: Quarterly or mid-year reviews make the year-end procedure much more seamless, help find issues early, and keep accounts current.

Understanding Year-End Service Charge Adjustments and Your Rights as a Leaseholder

At the end of the year, the building’s actual operating costs are compared with the expected service fees that tenants have paid. This may result in a surplus (where expenses were less than anticipated) or a deficit (where expenses were more).

Surplus: Depending on the conditions of the lease, any excess may be put into the reserve fund, credited to the accounts of the leaseholders, or carried forward to lower future service fees.

Deficit: In the case of a deficit, leaseholders might be required to pay more to make up the difference. The managing agent or landlord must provide a detailed explanation for why the expenses went above budget.

Your Rights as a Leaseholder

Leaseholders have important protections under UK law, including:

- The right to view a breakdown of the expenditures of service charge funds.

- The ability to obtain invoices, receipts, and supporting documentation.

- The ability to use the First-tier Tribunal (Property Chamber) to contest unjustified charges.

- Section 20 grants the right to consultation for significant projects that exceed the legal threshold.

- The right to get accounting prepared in accordance with the lease’s conditions and RICS guidelines.

Leaseholders can keep informed, spot irregularities early, and make sure service charges are reasonable, fair, and transparent by being aware of these rights.

Common Pitfalls to Avoid During the Year-end Process

If important measures are missed, year-end service charge planning could face difficulties. Understanding these typical problems promotes more accurate and seamless accounting:

- Missing or Disorganised Documentation: Contracts, maintenance records, invoices, and receipts are frequently lost or improperly documented. Delays, mistakes, and unfinished accounts result from this.

- Not Reconciling Accounts Regularly: The risk of inconsistent numbers, inaccurate balances, and unexplained deviations rises when reconciliations are postponed until year’s end.

- Overlooking Lease Requirements: Specific guidelines for managing service charges are outlined in each lease. Disputes or non-compliance may arise from disregarding these terms.

- Poor Contractor Oversight: When generating final accounts, failing to confirm if services were provided as billed might result in needless expenses and difficulties.

- Inadequate Reserve Fund Planning: Leaseholders may experience unexpected economic difficulties in the future if reserve or sinking fund contributions are not examined and modified.

- Lack of Clear Communication with Leaseholders: Once the accounts are given, miscommunications and disagreements may arise due to delays, unclear explanations, or missing updates.

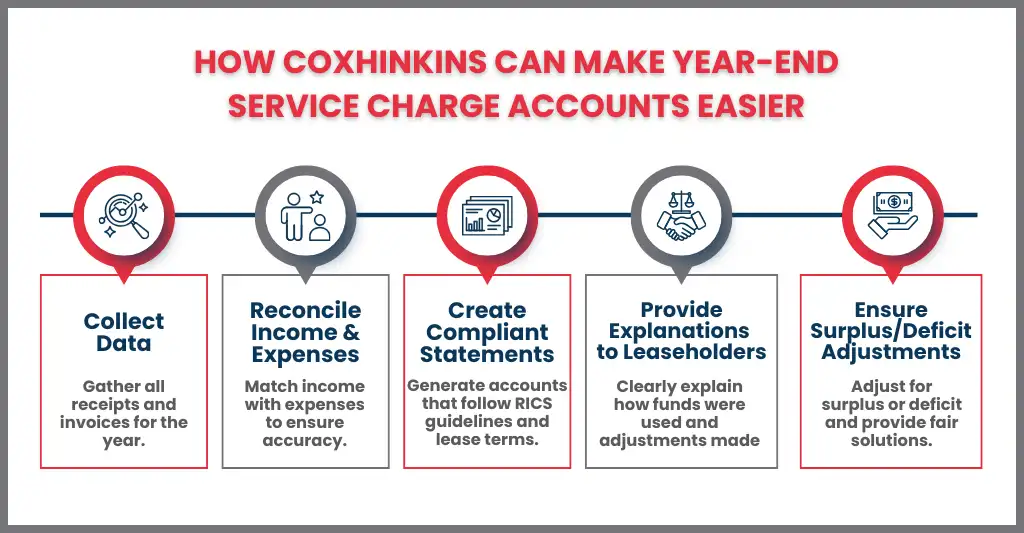

How CoxHinkins can help you file Service Charge Year-end Accounts?

The year-end service charge procedure is made easy, precise, and completely compliant by Cox Hinkins. In order to compile comprehensive year-end accounts, our staff collaborates closely with block managers, landlords, and real estate brokers. This includes obtaining data, balancing income and expenses, and creating concise statements that adhere to RICS guidelines and UK lease terms. We help you explain to leaseholders how their service charge contributions have been utilised by providing a detailed breakdown of all expenses. To make sure nothing is overlooked and all legal requirements are fulfilled, every account undergoes thorough compliance and accuracy checks. We also help with surplus or deficit adjustments, assisting you with shortages, credits, and the necessary next actions.

Frequently Asked Questions

What are service charge accounts?

Service charge accounts are yearly reports that detail how the funds received from tenants have been used for maintenance and management. They consist of revenue, expenses, reserves, and any excess or shortfall.

What would happen if there were a deficit or surplus?

Depending on the terms of the lease, a surplus could be added to the reserve fund, credited to leaseholders, or carried over to the following year. When there is a deficit, leaseholders typically have to contribute more to make up the difference.

Why is transparency in service charge accounts necessary?

Maintaining confidence between managing agents, landlords, and leaseholders is facilitated by transparency. Clear reporting guarantees that everyone is aware of how service charge money is being spent, minimises uncertainty, and avoids disagreements.

Conclusion

Creating year-end service fee accounts is crucial to encourage financial clarity, trust, and openness in any residential block. It goes beyond just a regulatory requirement. Block managers, landlords, and property brokers can transform what frequently seems like a difficult activity into a seamless, well-structured process with well-organised records, prompt reconciliations, and a clear understanding of lease requirements. By steering clear of typical dangers and adhering to best practices, you can guarantee the building’s long-term financial stability in addition to producing accurate records and fostering leaseholder confidence.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.