- What is Management Accounting?

- What is Financial Accounting?

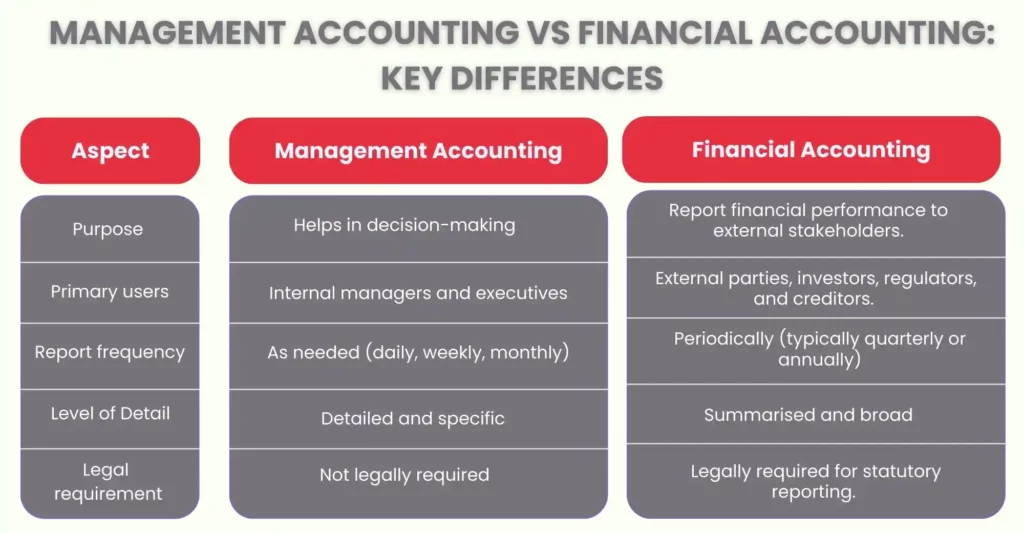

- Management Accounting vs Financial Accounting: Key Differences

- When to use Management Accounting?

- When to use financial accounting?

- Similarities between Management Accounting and Financial Accounting

- Pros and Cons of Management Accounting and Financial Accounting

- Frequently Asked Questions

- Conclusion

Accounting is the basis for well-informed decision-making in the commercial and financial sectors. However, did you know that there are several varieties of accounting, each with a unique function? The two most basic subfields are management accounting vs financial accounting. Both may sound similar, but they serve different purposes, adhere to different regulations, and prioritize distinct results.

Management accounting focuses on internal business operations. It aids managers and decision-makers in budgeting, trend forecasting, strategic decision-making, and understanding everyday financial operations. It is adaptable, progressive, and tailored to a company’s unique requirements at any time. Whereas, the financial accounting goal is to prepare accurate financial statements that reflect the company’s financial health.

Both forms of accounting use financial data, but they have quite different purposes and objectives. Knowing these differences not only makes it easier to select the best course of action for a given business requirement, but it also demonstrates how both fields complement one another to offer a comprehensive view of a company’s financial health. In this guide, we’ll explore the differences between management accounting vs financial accounting, explain when to use each, and help you determine which one your business needs.

What is Management Accounting?

The primary goal of management accounting is to supply internal data to support decision-making to company executives. In contrast to financial accounting, which is intended for external stakeholders, management accounting facilitates resource allocation, performance analysis, forecasting, and budgeting. Its primary goal is to provide management with the data they need to make plans and increase operational effectiveness

Objectives of Management Accounting

Decision Making: One of the primary goals and motivations of management accounting is decision-making. Managers calculate the profit and loss of various projects using financial data. This helps in assessing an organization’s overall performance and pinpointing areas in need of development. To facilitate decision-making, management accounting employs a variety of methods, including costing, economics, and statistics.

Financial Reporting: The preparation and presentation of financial statements that accurately depict the organisation’s cash flows and financial performance is another primary goal of management accounting. The balance sheet, income statement, cash flow statement, and statement of retained earnings are some examples of these statements.

Planning: One of the fundamental purposes of management accounting is planning, which primarily focuses on establishing objectives and the steps necessary to reach them. Additionally, managerial accounting makes predictions that tend to place the company in favorable positions both in the short and long term by utilising historical data and market patterns.

Controlling business operations: Monitoring performance and facilitating necessary changes to maximise efficiency are key components of controlling corporate operations. It uses tools like variance and financial control. analysis to identify inefficient areas with the goal of improvement and transformation. Another way to increase efficiency is through cost control.

Understanding Financial Information: A primary goal of management accounting is to convert complex financial data into a form that is easy to understand. The conversion of complex financial accounts into concise and understandable financial statements can only be accomplished through management accounting. It assists management in making decisions that are best for the company.

What is Financial Accounting?

The creation of financial reports, including cash flow, balance, and income statements, is a component of financial accounting. External stakeholders, including creditors, investors, and regulatory agencies, are the main audience for these reports.

Presenting a consistent, accurate image of a business’s financial health is the aim of financial accounting, which also makes sure that outside parties have access to trustworthy information for making decisions. Established frameworks like IFRS (International Financial Reporting Standards) must be followed in UK financial accounting.

Objectives of Financial Accounting

Systematic Recording of Financial Transactions: Maintaining a thorough, accurate, and timely record of every financial transaction a company undertakes is the goal of financial accounting. In addition to offering a solid foundation for creating financial statements and carrying out audits, this helps guarantee accountability and openness.

Assessing the Financial Position: Financial accounting helps determine the stability and health of a company’s finances by providing a snapshot of its financial position at a specific moment in time through the Balance Sheet, which displays the company’s assets, liabilities, and equity, or the owners’ remaining stake.

Ensuring Statutory and Regulatory Compliance: Financial accounting prepares accounts in line with recognised accounting standards like GAAP or IFRS, ensuring that companies meet their legal and regulatory requirements. This adherence lowers legal risks and boosts investor trust.

Supporting Audit and Internal Controls: Maintaining accurate financial records facilitates external audits, which further confirm the integrity and correctness of the financial data, and support internal controls. This improves company governance and fosters trust among stakeholders.

Management Accounting vs Financial Accounting: Key Differences

Even though both are vital to a business’s financial stability, their duties, reporting requirements, and accounting theories are very different. Essentially, management accounting is like internal notes and strategies to improve future grades, whereas financial accounting is like an investor’s report card. Both are necessary for a business to be profitable.

Any firm must comprehend these differences, whether they relate to accrual versus cash basis accounting or the roles and responsibilities of each.

Financial accountant: Primarily concerned with documenting and disclosing the business’s financial transactions. In addition to helping with tax, pensions, auditing, and other financial matters, they make sure that income statements comply with requirements. Their work is mostly done in the past, giving external stakeholders a precise financial history.

Management accountant: They play a more proactive role, utilising both present and emerging trends to support decision-making. They may be in charge of a group of accountants, compile financial statements and reports, and supervise payroll and bookkeeping systems. They are essential for creating budgets, analysing variances, and projecting future expenditures.

When to use Management Accounting?

When making internal business decisions, management accounting works best. It’s perfect for tasks like financial goal-setting, performance evaluation, budgeting, trend forecasting, cost control, and strategic initiative planning. Management accounting services provide the comprehensive, real-time data required to effectively inform choices about whether to introduce a new product or enter a new market, improve operations, or reduce costs.

When to use financial accounting?

Through financial accounting, external parties get a report of the company’s financial performance. Therefore, it is mandatory to prepare standardised financial statements for creditors, investors, regulators, and tax authorities, such as the cash flow statement, balance sheet, and income statement. For a clear, consistent, and legally compliant picture of your company’s financial health over a certain period, use financial accounting.

Similarities between Management Accounting and Financial Accounting

There are some similarities between financial accounting and management accounting, despite their distinct functions. Here are some significant parallels:

Use of Financial Data: Both depend on the company’s financial data, including revenue, costs, assets, and liabilities.

Support Business Decision-Making: Both internal management accounting and external financial accounting help make better decisions.

Record-Keeping: To guarantee financial accuracy and responsibility, both require methodical record-keeping.

Emphasis on Performance: Although for various audiences and in various situations, each category examines financial performance.

Interconnectedness: To conduct an in-depth internal analysis, management accounting frequently consults financial accounting reports.

Pros and Cons of Management Accounting and Financial Accounting

Management Accounting

Pros:

- Helps Make Decisions Internally: provides thorough insights to support strategic planning, forecasting, and budgeting.

- Customised reports: Reports can be customised to satisfy particular internal requirements.

- Real-Time Data: For prompt decision-making, current information is frequently used.

- Prioritise Efficiency: Assists in locating areas for cost reduction and enhancing operational effectiveness.

Cons:

- Absence of a Standardised Format: Reports that don’t follow a standard format may be inconsistent.

- Not Legally Required: Some businesses might not use it as much because it’s optional.

- May Involve Estimates: Depends on potentially erroneous forecasts and assumptions.

Financial Accounting

Pros:

- Standardised and Regulated: Dependability and consistency are guaranteed by rigorous regulations (such as GAAP or IFRS).

- Beneficial for External Stakeholders: Crucial for regulators, tax authorities, lenders, and investors.

- Historical Accuracy: Pays attention to the exact financial records of previous performance.

Cons:

- Ineffective for Internal Decisions: Not as useful for daily operational planning.

- Rigid Format: Detailed internal analysis and flexibility may be hindered by the standardised format.

- Time Lag: Frequently pertains to past facts that might not accurately represent the state of affairs now.

Frequently Asked Questions

Are Management and Financial Accounting Related?

Yes, both management and financial accounting provide insightful financial data, but management accounting provides in-depth data for internal operations and strategy, while financial accounting is mostly used for external compliance.

Who makes use of the data from each kind of accounting?

- Management Accounting: Internal users – company managers and executives.

- Financial Accounting: External users – shareholders, creditors, regulators, and the public.

What are the goals of Management Accounting and Financial Accounting?

Management accounting is used to support strategic planning and streamline internal processes. Financial Accounting: To give external users a fair and accurate picture of the financial situation.

How does management accounting improve internal decision-making?

- Provides real-time, tailored financial data for quick and informed decisions.

- Enhances budgeting, forecasting, and cost control, helping managers adjust strategies promptly.

What are the common challenges in implementing financial accounting?

- Navigating complex regulatory standards (e.g., GAAP, IFRS).

- Ensuring data accuracy and seamless system integration amid limited resources.

Can a management accountant switch to financial accounting?

Yes, a management accountant can transition into a financial accountant role. To do so, they should gain knowledge in external reporting standards (like GAAP or IFRS) through targeted training or courses, and gain practical experience in financial reporting and regulatory compliance. Certifications in financial accounting or additional education can also facilitate a smooth transition.

Conclusion

Both management accounting and financial accounting play essential roles in a business, their goals, target audiences, formats, and areas of emphasis are very different. Management accounting is internally focused, offering forward-looking insights for planning and operational control. In contrast, financial accounting is externally focused, presenting historical financial data in a structured format to meet regulatory and investor needs.

Businesses must comprehend these differences to make sure they are fulfilling their external reporting requirements and efficiently managing internal operations. Both types of accounting work well together and are essential to any organisation’s overall performance and openness.