- What is a Personal Tax Account?

- How to Access Your Personal Tax Account

- Planned Changes to Personal Tax Accounts (Subject to HMRC Confirmation)

- How to Set Up Your Personal Tax Account (Step-by-Step)

- What You Can Do with a Personal Tax Account?

- Safety and Security with your Personal Tax Account

- How can CoxHinkins assist with a Personal Tax Account?

- Frequently Asked Questions

- Conclusion

Managing your UK tax affairs online has become simpler and more efficient with the HMRC Personal Tax Account (PTA). Whether you are employed, self-employed, or receiving a pension, your PTA offers a secure, centralized platform to view, manage, and update your tax information anytime, anywhere.

This guide covers everything you need to know about the Personal Tax Account, including the latest changes, how to set it up step-by-step, its key features, and why it’s essential for staying compliant and in control of your taxes.

What is a Personal Tax Account?

A Personal Tax Account is a secure online service provided by HM Revenue & Customs (HMRC) that allows individuals in the UK to view and manage their personal tax information in one place.

Your HMRC Personal Tax Account lets you:

- Check your tax code and Income Tax estimate

- View income and tax paid for previous years

- Claim tax refunds

- Manage tax credits, Child Benefit, and Marriage Allowance

- Check your National Insurance record and State Pension forecast

- Update your personal details online

The service is available 24/7 and works in a similar way to online banking, allowing you to manage your tax affairs without calling or writing to HMRC.

How to Access Your Personal Tax Account

You can access your Personal Tax Account through the official HMRC website or via the HMRC app.

To sign in, you’ll need:

- A Government Gateway user ID and password

- Two-step verification (code sent to your phone or email)

If you don’t already have a Government Gateway account, you can create one during the sign-in process by verifying your identity using documents such as your National Insurance number, passport, or a recent payslip.

Planned Changes to Personal Tax Accounts (Subject to HMRC Confirmation)

HMRC has announced plans to further expand digital tax services over the coming years. These changes are intended to simplify reporting and improve online access, although some features may be introduced gradually.

Planned updates may include:

- A new digital reporting service for certain side incomes

- Changes to interest rates on late tax payments

- Temporary limitations on online submissions for specific income types

As HMRC guidance may change, taxpayers should always refer to official HMRC updates or seek professional advice where necessary.

How to Set Up Your Personal Tax Account (Step-by-Step)

Setting up a personal tax account in 2025 is a secure and straightforward way to manage your tax affairs efficiently. This guide, based on trusted official procedures, walks you through the process step by step.

Step 1: Visit the Official HMRC Website

Go to www.gov.uk/personal-tax-account.

Step 2: Create a Government Gateway Account

Click “Sign In” and then “Create sign-in details.” Enter your email address, create a password, and set up a recovery word.

Step 3: Verify Your Identity

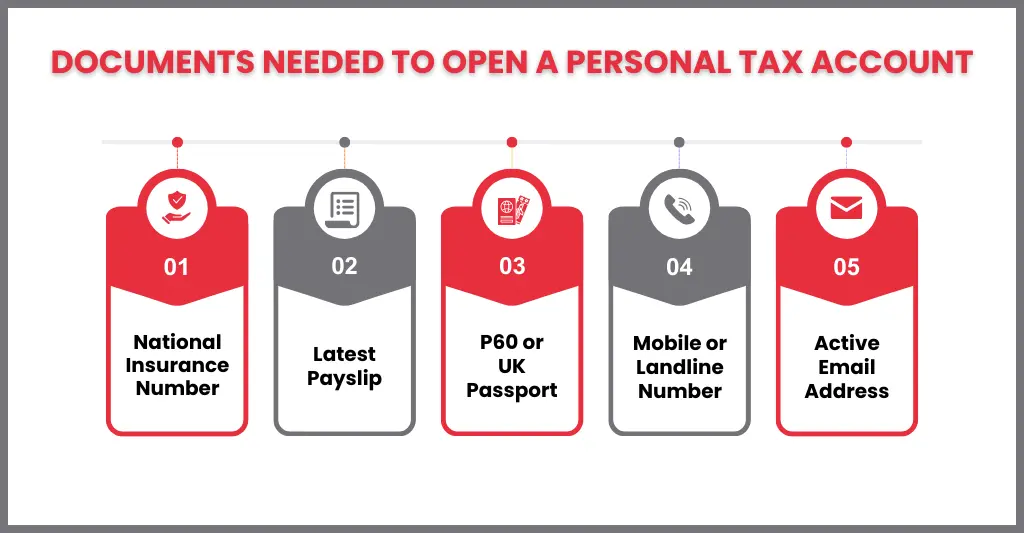

HMRC will ask for information to confirm your identity. You’ll need:

- Your National Insurance Number

- A recent payslip, P60, or valid UK passport

- Your current mobile or landline number (for two-step verification)

- An active email address

Step 4: Set Up Two-Step Verification

- Choose to receive a security code by text or phone call.

- Enter the code to confirm your identity.

Step 5: Complete Registration

- Answer security questions based on your documents.

- Once verified, your PTA is ready!

Step 6: Log In Anytime

- Use your Government Gateway User ID and password at www.gov.uk/personal-tax-account.

Tip: For official HMRC guidance, see HMRC’s PTA page.

Documents Required for Opening Personal Tax Account

- National Insurance Number (mentioned on your payslip)

- Latest payslip

- Recent P60 form OR UK passport (that should be in date)

- Your current mobile number or landline number for two-step verification security.

- Current active email address for the account.

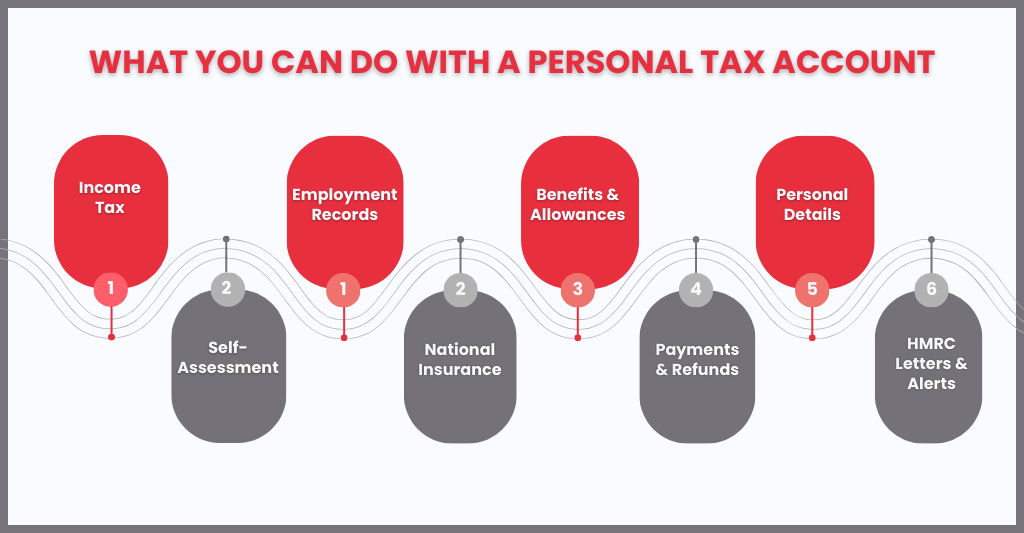

What You Can Do with a Personal Tax Account?

Your Personal Tax Account is your digital tax hub. Here’s what you can do:

Income Tax

- Check your tax code and see how much tax you’re paying.

- View your income tax estimate for the current and previous years.

Self-Assessment

- Register for self-assessment if you’re self-employed or have other untaxed income.

- File your self-assessment tax return online and track its status.

Employment Records

- Check and update your employment details (jobs, employers, PAYE tax codes).

- Access and print P60s and P45s for your records.

National Insurance

- View your National Insurance number and contribution history.

- Check your state pension forecast and see if you have any gaps in your NI record.

Benefits and Allowances

- Manage Child Benefit: View your claim, update details, or stop your claim.

- Manage Tax Credits and Marriage Allowance: Update claims, report changes, or renew tax credits.

Payments and Refunds

- Check if you’re due a tax refund or need to make a payment.

- Set up and manage direct debits for tax payments.

Personal Details

- Update your name, address, or contact details directly with HMRC.

Correspondence and Documents

- Access digital copies of tax documents and HMRC letters.

- Download forms and keep a digital record of your interactions.

Alerts and Reminders

- Receive notifications about deadlines, refunds, or changes to your account.

Safety and Security with your Personal Tax Account

Your PTA is protected by:

- Unique User ID and Password

- Two-Step Verification (security code sent to your device)

- HMRC Firewalls and Encryption: Your data is encrypted and monitored for unauthorized access.

Your Responsibilities:

- Log out after each session.

- Keep your login details private and secure.

- Never share your password or security codes.

Tips for Using Your PTA Effectively

- Regularly check your tax code to ensure it’s correct.

- Keep digital copies of all tax documents.

- Use alerts and reminders to meet deadlines.

- For side-hustles earning between £1,001 and £2,999, prepare to use HMRC’s new digital reporting service launching late 2025.

- If you have complex tax affairs or need help, consult a qualified tax professional.

How can CoxHinkins assist with a Personal Tax Account?

Taxes are something you should always complete correctly. It could be time to speak with a reputable tax expert if you’re unclear of how a personal tax account could help you, or if you’re just having trouble with any of the services mentioned above, such as employment records, benefits, and self-assessment returns.

CoxHinkins has years of expertise guiding people and companies toward successful and economical tax compliance. Our Accountants can assist with a wide range of tasks, including year-end accounting and filing your self-assessment tax return.

Frequently Asked Questions

Can I file all my tax returns through the PTA?

Most individual income tax and self-assessment returns can be filed online, but some complex returns or income types may require alternative methods

What if I forget my Government Gateway User ID?

If you forget your Government Gateway user ID, you can recover it on the HMRC sign-in page by entering the email address you used to register. HMRC will send your user ID to your email.

If you no longer have access to that email, you may need to re-verify your identity or contact HMRC support.

How can I pay my tax bill through the Personal Tax Account?

You can view your tax balance and make payments directly through your PTA using various payment options, including direct debit, bank transfer, or debit/credit card. Setting up direct debits helps ensure timely payments and avoid interest or penalties.

Is my data safe in the Personal Tax Account?

HMRC protects your data with encryption, firewalls, and two-step verification. You should also log out after each session and never share your login details or security codes to maintain account security.

Conclusion

A Personal Tax Account is the easiest and safest way to manage your tax affairs online. With instant access to your records, the ability to update details, and secure communication with HMRC, you’re always in control. Set up your PTA today for a smarter, stress-free tax experience.

Disclaimer: Kindly note this blog provides general information and should not be considered financial advice. We recommend consulting a qualified financial advisor for personalised guidance. We are not responsible for any actions taken based on this content.